- What are salary surveys?

- 6 ways to use salary survey data

- How to access salary survey data

- How reliable are salary surveys for compensation decisions?

- Popular salary survey providers

- How to turn salary survey data into usable benchmarks?

- Alternatives to traditional salary survey providers

- Salary surveys vs real-time compensation benchmarks

- To wrap up: Should you use salary surveys for compensation benchmarking?

- FAQs

Salary surveys are one of the most widely used tools for compensation benchmarking. But while they’re often treated as a reliable source of market pay data, the reality is far more nuanced.

This guide breaks down how salary surveys actually work, what data they provide, where they fall short, and when they’re useful. You’ll also learn how teams turn survey data into usable benchmarks – and which alternatives exist for fast-moving tech companies.

If you’re making pay decisions and want clarity, not assumptions, this guide is for you.

What are salary surveys?

Salary surveys are the traditional method for collecting compensation data from large enterprises across different industries, levels, and regions.

Conducted by large global HR consultancies like Mercer and Radford, salary surveys give People and HR teams the market pay data they need to understand how companies generally pay for specific roles, seniority levels, and industries.

You can either purchase the data as a full dataset or a custom peer-group report, tailored to specific locations, industries, or company sizes.

Salary survey data is often delivered in spreadsheets. However, most consultancies today offer salary survey software to make it easier to view and analyse market data.

What data is included in a salary survey?

The exact data a salary survey gives you depends on the provider, but it typically includes:

- Base salary range

- Variable pay

- Total compensation (including benefits, equity, and bonuses)

You get compensation data across multiple target percentiles and per job role and job level, depending on the provider’s job catalogue and level framework.

Who contributes data to salary surveys?

Traditional compensation surveys rely on a give-to-get model where participants must manually submit their employee compensation data, usually once or twice a year, to access the dataset.

Because this process requires significant time and resources, contribution is dominated by large enterprises rather than smaller, fast-growing companies.

For instance, participation from global organisations in legacy industries like manufacturing, oil and gas, pharmaceuticals, and financial services is common, so you’ll often see industry-specific surveys for these types of companies.

How often are salary surveys updated?

Most global salary surveys update once or twice a year, with the specifics depending on the provider.

Given their large-scale nature, collecting and validating survey data takes months. So by the time the results reach you, it's often long after the data was captured – making it more of a snapshot in time than fresh market insights.

Who are salary surveys ideal for?

Salary surveys are especially useful for:

- Large, established companies with well-defined job roles

- Organisations that need broad, industry-wide compensation data

- Teams with the resources to participate in surveys and navigate large datasets.

What to look for in a salary survey?

When selecting a salary survey, make sure you review the following:

- Survey data coverage: What particular industries, region(s), and cities does it cover? Is the market pay data from peers of your company size, revenue range, and structure?

- Compensation data scope: What data is included: base salary, variable pay, equity compensation, and/or benefits?

- Data update frequency: How often does the survey data refresh? It’s generally either quarterly or annually when it comes to traditional providers.

- Data collection and validation methodology: Where do you need to submit your compensation data? And what methodology does the survey provider use to ensure aggregated data is accurate?

- Job role catalogue and level framework: Do the job roles align with your own internal framework? Do you feel confident you can accurately map your internal employees to the data?

- Customer support: Does the provider offer data submission and job mapping resources, and how easy to use are they? Are human representatives available during your work hours to support the submission levelling processes?

6 ways to use salary survey data

Salary survey data supports a range of compensation tasks, from benchmarking to band design, to help you make informed, competitive decisions. Here are the most common ways teams use them:

- Benchmark salaries. Compare your internal salary structures with the wider talent market to understand what fair and competitive pay looks like across roles.

- Plan market positioning strategy and model costs. Use salary survey data to understand how market competitive pay varies across different roles, levels, and target percentiles. This helps you decide how to position your company against the wider market for employee compensation, factoring in talent needs and financial sustainability of payroll costs.

- Plan location strategy. Use survey data across broad regions to understand how pay differs geographically. This helps you decide where to hire, how to budget for distributed teams, and how to set location-adjusted salary ranges.

- Create or adjust salary bands. Use market benchmarks to set or update salary band midpoints based on your target percentile and build structured, transparent pay ranges.

- Set pay for new roles. Use salary survey benchmarks to determine appropriate, market-aligned compensation when adding new positions.

- Run annual compensation reviews. Use data during yearly review cycles to check whether market rates for any job roles have changed, and if so, by how much. This way, you can reflect the new range and adjust salaries so pay remains competitive.

Why is salary survey data rarely used alone

As you’ve seen above, salary survey data is immensely useful in making compensation decisions, from creating salary bands to adjusting pay during annual reviews. However, these decisions require current, relevant market data to get right – an area where traditional salary surveys fall short.

Essentially, salary surveys run on long manual data collection cycles, meaning the data reflects pay levels from months earlier rather than what companies are offering today. And because market conditions shift quickly – especially in competitive or fast-moving talent markets – this lag makes it harder to rely on traditional surveys alone as your only source of truth.

Not to mention, the lengthy submission process also introduces challenges. Between manually extracting, formatting, and inputting data – and aligning it with the survey provider’s job and level frameworks – there’s plenty of room for human error.

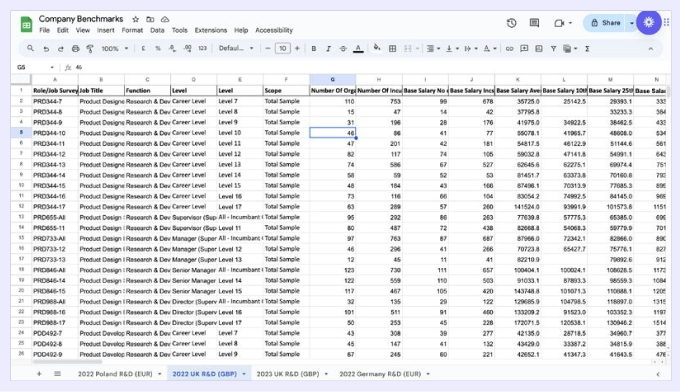

Example salary survey output: Salary survey data delivered in spreadsheets that you need to manually map against your internal roles

Any unintentional data entry mistakes, like misclassifying a role or mistyping a number, can skew the dataset and impact quality.

This is why fast-growing tech teams don’t use survey data alone. Instead, they pair it with real-time benchmarks from modern benchmarking software providers to stay on top of market trends and improve compensation decision-making accuracy.

How to access salary survey data

There are three leading ways to access salary survey data, depending on how much detail you need and whether you have the resources to contribute your own compensation information:

Option 1: Participate in salary surveys

Participation typically follows quarterly or annual submission cycles, where you provide detailed, up-to-date data on your job titles, levels, base pay, variable pay, and benefits – all organised according to the provider’s predefined job catalogue.

These formats are often rigid, with specific templates and rules to follow so the provider can standardise input across all participants. Once submissions are complete, the survey provider then aggregates all data – making it available for purchase for participants.

Option 2: Buy salary survey access

Some providers, like Willis Towers Watson (WTW), allow you to purchase salary survey data without having to participate in the salary survey. However, there are only limited datasets accessible without directly participating in surveys.

Option 3: Use third-party platforms

Some HR platforms provide access to salary survey data through partnerships with survey providers. For example, HR tool, HiBob, offers Mercer data with its compensation module, delivering data as a PDF – without requiring you to participate directly in the survey.

You can also access survey data through providers that aggregate multiple salary surveys, such as Payscale.

How reliable are salary surveys for compensation decisions?

Salary surveys are helpful for high-level, point-in-time comparisons, especially for large, established roles and industries. However, they’re less reliable for fast-moving or competitive markets because the data is typically updated infrequently, relies on manual submissions, and may not reflect current pay trends or niche roles accurately.

Here’s more on the strengths and limitations of salary surveys:

Advantages of salary surveys

- Trusted, recognisable sources. Because salary surveys come from well-known HR consultancies like Mercer, Radford, and Willis Towers Watson, they carry strong credibility with executives, making it easier to secure internal buy-in for compensation decisions.

- Broad market coverage. Salary surveys collect data from some of the world’s largest corporations, offering wide benchmarks across functions, seniority levels, and regions – useful for making compensation decisions that require a global view.

- Consultancy services available. Because global consulting firms conduct these surveys, organisations can also tap into their advisory and implementation services for compensation planning and broader organisational strategy.

Limitations of salary surveys

- Outdated market data. Salary surveys run on long collection cycles that reportedly refresh quarterly or annually, so the data reflects pay levels from months earlier. In fast-moving talent markets, this makes it harder to offer competitive, up-to-date salaries.

- Risk of data inaccuracy. Because companies must manually extract, format, and submit detailed compensation data, human error is inevitable. Minor data input errors by even a small segment of the participants can skew the benchmarks you rely on for pay decisions.

- Peer groups that don’t match your reality. Surveys typically draw from large enterprises in legacy industries and public company data, resulting in broad peer groups that don’t reflect the size, stage, or hiring market of startups, scaleups, or private companies.

- Inconsistent job mapping that undermines benchmarking accuracy. Participants must map their roles and internal salary bands to external benchmarks, which is another time-consuming process that introduces room for error and is especially difficult with complex job levels, hybrid roles, or non-standard titles.

- Challenging to use survey data. While valuable, the sheer volume of salary survey data can make it challenging for People and Rewards teams to quickly find the specific insights they need, slowing down compensation decision-making.

- Limited compensation analysis software. Traditional salary survey providers are consultancies first and tech platforms second. Their tools mainly help with viewing data, but they don’t offer the ongoing compensation management capabilities – such as salary band creation, budgeting, or pay equity checks – that modern teams need day to day.

Dig deeper: The pros and cons of salary surveys

Popular salary survey providers

Companies have plenty of choices when it comes to salary survey providers – from Culpepper and Salary.com to Empsight, Altura, and Brightmine (previously XpertHR and Cendex). Here’s a closer look at four of these salary survey providers:

1. Radford

Radford is the HR arm of global consultancy firm Aon, offering:

- Compensation data, including base salary, equity, variable pay, and benefits. It also publishes market practice studies – findings from their surveys on global companies’ reward practices – covering areas such as salary increases, incentives, pay administration, employee experience, paid time off, and severance.

- Compensation design and implementation consulting across executive compensation, employee rewards, equity compensation, sales compensation, and more.

- Software tool, The Radford Platform, that allows access to compensation data, job architecture, and levelling results.

Who is Radford salary data ideal for? Global organisations, especially those needing deep expertise in executive pay, equity, or pre-IPO compensation.

2. Korn Ferry

Korn Ferry is a global consulting firm that helps organisations hire, engage, and retain talent, and sells salary survey data:

- Compensation data from 32,000 companies across 150+ countries to give you salary and benefits data.

- Organisational strategy and talent development consulting. Korn Ferry also advises companies on retaining employees and improving sales effectiveness.

- Software tool, Korn Ferry Pay, to access survey data and let you compare compensation and benefits across roles, peer groups, and countries.

Who is Korn Ferry salary data ideal for? Large enterprises and multinational organisations, particularly those in regulated industries such as finance, pharmaceuticals, and manufacturing.

3. Mercer

Mercer is a global HR consultancy that helps enterprises design and implement strategic compensation practices. It offers:

- Survey datasets include Mercer’s flagship annual global survey, the Total Remuneration Survey (TRS), industry-specific surveys, employee-specific data, and studies on trending workplace topics.

- Consulting services covering total rewards strategy, employee benefits, pension schemes, and job evaluation.

- Software tools, Mercer WIN® (Workforce Intelligence Network) for accessing purchased survey data and Mercer Comptryx, Mercer’s salary benchmarking software that’s based on a give-to-get submission model and gives you quarterly market updates.

Who is Mercer salary data ideal for? Large enterprises and multinational organisations in regulated industries such as banking, pharmaceuticals, and manufacturing.

4. Willis Towers Watson

Willis Towers Watson is also a global organisational consultancy that offers the following for large, multinational enterprises:

- Survey datasets covering general industry, regional, and industry-specific salary surveys, sourcing insights from 32 million employees across 11,000 organisations in more than 130 countries.

- Organisational strategy and design services and executive advising across executive compensation, pensions consulting, risk advisory, organisational change, leadership strategy, and employee experience.

- Software tools, Compensation Software and Embark to access and analyse survey data and support the survey submission process.

Who is WTW salary data ideal for? Global enterprises looking for broad coverage in core markets like the US and UK.

How to turn salary survey data into usable benchmarks?

Traditional salary survey providers typically give you raw compensation data – the responses to their salary survey collected, aggregated, and shared with you.

But raw data isn’t instantly usable for making pay decisions.

Firstly, you need to feel confident that:

- The data has been checked and verified to ensure there are no skewing outliers

- The sample size is robust enough for the data to be a statistically valid benchmark

- The data has been mapped consistently to the same job titles and levels, to ensure the benchmark reflects like-for-like comparisons across the participating companies.

Given how strenuous this work is, converting the voluminous raw data into benchmarks is a statistical exercise that a provider is responsible for doing using a trusted methodology – but there’s little information on how traditional salary survey providers validate data and turn it into a statistically robust benchmark.

So it’s a question worth asking a provider when you evaluate them.

Then, secondly, you also need to be able to seamlessly map the salary benchmarks you’re provided against the internal reality of your company – the job titles, roles, and levels that you actually use.

If you aren’t able to accurately match up your ‘Lead Engineer’ with the benchmark that best reflects that employee’s role scope and seniority level, then the benchmarks won’t give you the reference point you need.

So the question now is, how can you turn salary survey data into usable compensation benchmarks?

You either put in the manual work that goes into sifting through, mapping, validating, and making sense of all that overwhelming pool of data, or you upload the data into modern benchmarking software to access usable benchmarks.

Here’s how both options work:

1. Manually map survey data to internal job architecture

This involves taking all the salary survey data, whether accessible via an online platform or a PDF, and manually mapping it to your job titles, levels, and functions.

Besides being time-consuming, this process still relies on raw salary data – not statistically validated benchmarks – which limits accuracy.

And because HR and Rewards teams can’t independently validate or standardise that data at scale, manual mapping often introduces inconsistencies, especially when roles don’t neatly match predefined survey categories.

As a result, while manual mapping makes survey data usable, it doesn’t make it reliably accurate for compensation decisions.

2. Combine salary survey data with a real-time benchmarking provider

This involves uploading your salary survey data to a real-time benchmarking software provider to improve benchmark usability and context.

While this doesn’t turn your raw salary survey data into usable benchmarks in itself, it lets you combine salary survey data you’ve mapped with benchmarks from a real-time provider so you can:

- Compare the two datasets for different roles side by side (for example, pay data for a prompt engineer in Romania, according to Mercer’s salary survey and Ravio’s real-time benchmarks).

- Apply different datasets to different groups of people (for instance, use Mercer data for US employees and Ravio benchmarks for employees in Europe).

For this though, you’ll need a provider that lets you add and use additional datasets. Ravio, for instance, lets you upload your salary survey data into the platform so you can easily – compare reliable benchmarks across roles, levels, or locations.

This approach gives HR and Reward teams a more well-rounded view of compensation levels – without having to do manual work and getting reliable benchmarks.

Bolt takes the same approach by pairing salary survey data with Ravio to build more reliable and relevant benchmarks, which helps them make faster compensation decisions and stay ahead of market trends with real-time benchmarks.

“Because most providers also have their own job levelling and job families structure, it’s a huge effort to then convert ours to theirs. It requires keeping up with all the changes they might have implemented during a year. [But] for someone to take that task away is a huge benefit.”

Senior Compensation Manager at Bolt

Alternatives to traditional salary survey providers

1. Real-time compensation benchmarking software

Modern benchmarking software integrates with companies’ HR systems to give you continuously updated compensation benchmarks in real-time.

Depending on the provider you select, these tech-first benchmarking solutions either offer AI-led job mapping or have human teams that map your job roles during onboarding.

Several providers also apply consistent data validation and cleaning methodologies to give you reliable benchmarks.

Pros:

- Offer up-to-date, reliable benchmarks that reflect current market movements

- Reduce the need for manual job mapping and spreadsheet-based analysis

- Data is easier to filter and compare benchmarks across roles, levels, and locations

Cons:

- Limited coverage for multinational corporations compared to large survey providers

- Requires system integrations or ongoing data sharing (but once set, this isn’t a limitation).

2. Compensation survey aggregators

Compensation benchmarking aggregators combine data from multiple salary surveys into a single platform, giving you a consolidated view of compensation data rather than relying on one provider’s dataset.

Some aggregators, like Payscale, also offer tools that support salary survey participation, helping simplify data submission.

Pros:

- Access to compensation data from multiple survey sources in one place

- Survey participation tools can reduce the manual effort involved in survey submissions.

Cons:

- They rely on traditional salary survey data, with the same limitations around data freshness, update cycles, and relevance

- Data still requires manual job mapping, adding effort and limiting benchmark reliability.

3. User-reported salary data sources

User-reported salary data comes from publicly available sources, including:

- Employee-reported pay on company review sites like Glassdoor

- Salary ranges listed in job adverts on platforms such as LinkedIn or Indeed

- ChatGPT-sourced data based on unreliable, publicly available sources.

While these sources are easy to access and often free, the data is self-reported and not validated or standardised, which limits their reliability for compensation decision-making.

Pros:

- Freely accessible or low-cost compared to traditional salary surveys

- Useful for high-level sense-checks or early-stage research.

Cons:

- Small or uneven sample sizes can skew results

- Self-reported data is not verified and is based on historical submissions, making it hard to assess current market shifts

- Job titles and levels are often inconsistent, making like-for-like comparisons difficult

- Salary ranges reflect broad averages with no clarity on role definitions, seniority, or outlier handling.

Salary surveys vs real-time compensation benchmarks

Based on the alternatives of traditional compensation survey companies above, it’s clear that real-time benchmarking tools are the strongest alternative for reliable pay data.

They easily overcome the shortcomings of salary survey data by automating job mapping and giving you continuously updated benchmarks that reflect current market conditions.

Here’s a quick comparison between traditional salary surveys and real-time benchmarking tools – with more details covered here:

Traditional salary surveys | Real-time salary benchmarking tools |

|---|---|

Out-of-date data. |

Real-time data from HRIS integration. |

Error-prone, time-consuming manual data submission. |

Data direct from source, no lengthy manual submissions. |

Broad, misaligned peer group, as data comes from multinational companies mainly. |

Deeper insights for fast-growing industries and niche locations with data filters available. |

Limited visibility into data validation, confidence levels, or outlier handling. |

Benchmarks generated using consistent validation and confidence thresholds (depending on the provider). |

Manual job matching. |

Job level mapping done for you. |

One-off data snapshot with no additional tools to analyse and use the data. |

Comprehensive compensation management functionality. |

To wrap up: Should you use salary surveys for compensation benchmarking?

Salary surveys still play a significant role in compensation planning – but they’re not the only universal solution anymore.

As for whether they’re right for you depends on your company’s size, structure, and how critical pay competitiveness is to your hiring strategy.

With that, salary surveys are a good fit if:

- You’re board-led, with stakeholders placing more trust in established, traditional providers

- You’re an enterprise-scale organisation looking for benchmarks from large, comparable corporations

- You’ve a dedicated internal compensation team with the time and expertise to access, interpret, and manage survey data.

But salary surveys are not the best fit for you if:

- You’re hiring frequently or scaling quickly, and need up-to-date market data

- Your compensation philosophy focuses on market-competitive or market-leading pay to attract and retain top talent

- You hire globally and need location-specific, real-time benchmarks rather than broad regional survey averages

- You’re a tech company that hires niche or emerging roles, especially in smaller or competitive talent markets

- Your compensation is equity-heavy or highly variable, making broad survey averages less representative.

In short, salary surveys can provide useful context, but on their own, they’re often too static and manual to use for modern, fast-moving organisations.

Teams that need reliable, current benchmarks typically look beyond surveys and combine survey data sources with real-time salary benchmarking software like Ravio to support more accurate compensation decisions.

FAQs

What is a salary survey for benchmarking?

A salary survey for benchmarking is a tool used to compare your company’s pay levels against the wider market. It collects compensation data from large organisations and aggregates it by role, level, and region. Companies use this data to understand typical pay ranges.

Are salary surveys worth the cost?

Salary surveys can be worth the cost for large, enterprise organisations that need broad, industry-wide benchmarks and have the resources to manage manual survey submissions and analysis. For fast-growing or tech-led teams that need up-to-date, role-specific benchmarks, the cost often outweighs the value unless surveys are combined with more current data sources.

Can startups use salary surveys?

Startups can use salary surveys, but they’re often not the best fit on their own. Surveys tend to give you market pay data from larger, established companies, not your peers. They also update infrequently, which can misalign with startup roles and fast-changing markets. Most startups use salary surveys only as background context, pairing them with more current, flexible benchmarking data.

Why do salary surveys lag reality?

Salary surveys lag reality because they rely on manual data submissions collected on quarterly or annual cycles. After data is gathered, it takes additional time to validate, aggregate, and publish the results. By the time the data reaches users, it often reflects pay levels from months earlier rather than current market conditions.

How do companies combine salary surveys and live data?

Many companies upload salary survey data into compensation management software that supports custom market imports. These tools accept Excel or CSV files, and some, like Ravio, let you automatically map job codes to internal roles so you can compare benchmarks across roles, levels, or locations.