Your offer just got rejected. Again.

The candidate was perfect – experienced, aligned with your values, genuinely excited about the role. But when it came to compensation, the conversation was over.

Or maybe it's the opposite problem.

Your payroll has ballooned beyond what the business can sustain, but you're not entirely sure where you're overpaying or why. You just know something feels off.

Without salary benchmarking, you're flying blind on compensation decisions.

You don't know if you're competitive enough to win the talent you need, or if you're burning budget unnecessarily. And you can't confidently answer when an employee asks why they're paid what they're paid, or when a founder questions whether payroll costs make sense.

In this guide, we'll cover what salary benchmarking is, why it's essential for effective compensation management, and walk through a step-by-step process for implementing best practice salary benchmarking in your organisation.

What is salary benchmarking?

Salary benchmarking is the process of analysing market data to understand what other companies pay for specific job roles, levels, and locations.

This involves gathering salary benchmarking data from benchmarking tools, salary surveys, or other market sources, filtered by relevant factors like industry and company size.

The goal is to establish a market reference point that informs your internal compensation decisions – helping you set fair, competitive, and financially sustainable pay for your team.

You might also see salary benchmarking referred to as compensation benchmarking, rewards benchmarking, or remuneration benchmarking. The only difference is that, whereas ‘salary benchmarking’ refers specifically to data for base salaries ‘compensation benchmarking’ or ‘rewards benchmarking’ may encompass data for other elements of total compensation too, like equity benchmarks or benefits benchmarks.

Subscribe to our newsletter for monthly insights from Ravio's compensation dataset and network of Rewards experts 📩

Why is salary benchmarking important?

The purpose of salary benchmarking is to provide the foundation for fair, competitive, and financially sustainable compensation decisions – without it, you're making critical pay decisions without knowing whether they'll actually work.

Here’s a full breakdown of the benefits of salary benchmarking:

1. Salary benchmarking underpins your whole compensation strategy

Your compensation philosophy should define how you want to position against the market.

Will you lead the market by paying at the 75th percentile to attract top talent? Meet the market at the 50th percentile for competitive but sustainable pay? Or lag the market but offset with strong equity or benefits?

There's no right or wrong answer – it depends on your company's goals, values, and financial position. But you can't execute any of these strategies without knowing what the market actually is.

Salary benchmarking gives you the reference point to make strategic, defensible, market-informed decisions that align with your business reality.

💡 Understanding target percentiles in salary benchmarking

Target percentiles show where you want to position your pay relative to the market.

When you benchmark a role, the data shows you what companies at different points in the market are paying, for instance:

- 25th percentile: 25% of companies pay less, 75% pay more. This represents below-market pay, often used when offsetting with strong equity or benefits.

- 50th percentile (market median): Half of companies pay less, half pay more. This is considered market-rate pay and the most common target for competitive compensation.

- 75th percentile: 75% of companies pay less, 25% pay more. This represents above-market pay, often used for critical roles or to lead the market on base salary.

2. You can't attract or retain talent without salary benchmarking

Fair and competitive pay consistently ranks as a leading factor in both hiring and retention.

In fact, our recent Compensation Trends report found that 61% of companies cite cash compensation as the main challenge to retaining talent.

Without salary benchmarking, you're guessing whether your offers will land or whether your existing employees are flight risks. You might lose great candidates because your offer came in below market, or watch high performers leave once they realise they're underpaid.

3. Salary benchmarking keeps payroll costs sustainable

Payroll typically accounts for around 70% of operating expenses. So whilst competitive pay is vital for your talent plans, it’s also vital to ensure those decisions are financially sustainable.

Salary benchmarking helps you strike that balance – understanding what overpaying against the market looks like. Without benchmarks, it's easy to make finger-in-the-air decisions that lead to straining budgets unnecessarily.

4. Salary benchmarking enables accurate headcount planning

Market benchmarks let you forecast realistic salary ranges for new positions or office locations – crucial for runway planning and securing leadership buy-in on hiring plans.

With payroll as a major portion of employee costs, salary benchmarking gives you the visibility to plan headcount expansions confidently, knowing what it will cost to build the team you need to meet business goals.

5. Salary benchmarking supports pay equity and compliance

Pay transparency regulations are tightening globally – like the EU Pay Transparency Directive, taking effect in 2026, which will require all employers with European-based employees to demonstrate fair, equitable pay practices.

Salary benchmarking provides an objective foundation for compensation decisions, reducing the guesswork and bias that often influence pay and enabling you to build defensible and equitable compensation structures.

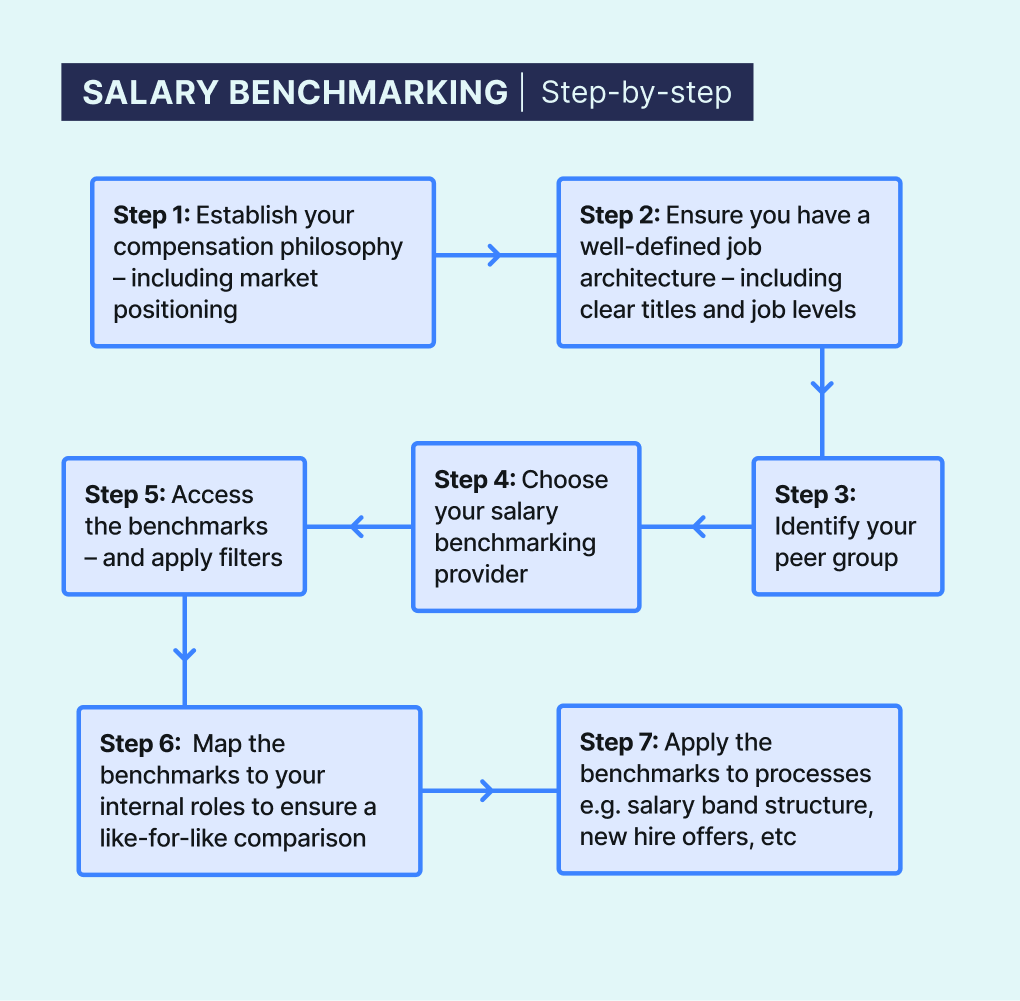

How to a conduct salary benchmarking process: Step-by-step guide

Without a clear process, compensation benchmarking becomes a box-ticking exercise that doesn't actually solve the problems you're facing. You're still losing candidates to better offers, still fielding uncomfortable questions about fairness, still wondering if you're spending payroll budget wisely.

Here's how to approach it systematically – from defining your philosophy to applying the benchmarks in practice.

Step 1: Establish your compensation philosophy

Before you start benchmarking, you need clarity on how you'll use market data – not just which percentile to target, but why.

In relation to market benchmarks, your compensation philosophy should address:

Market positioning. Will you lead the market (75th percentile), meet it (50th percentile), or lag behind? This might differ by function, location, or seniority level, depending on your talent priorities and how difficult it is to attract and retain certain talent. And remember that financial sustainability is an important factor here.

💡 Market positioning examples:

- Ravio. We pay competitively to attract and retain the talent we need to grow, but we also factor in financial sustainability to ensure we are a responsible employer with longevity in mind. We target a higher percentile for technical roles than for commercial, to reflect the highly competitive market for tech talent.

- Buffer. Targets the 70th-90th percentile and benchmarks all roles against San Francisco salaries (known for being among the highest in tech), making their compensation competitive and aligning with one of their compensation principles of 'generous' compensation.

Total rewards mix. What makes up your compensation offering beyond base salary? For example, some early-stage startups pay below market on base salary but offset with generous equity compensation. If you offer equity, variable pay, or strong benefits, you'll need benchmarks for those too.

Location approach. Will you use location-specific benchmarks for each market (location-based pay), apply multipliers from a central location (hybrid approach), or pay everyone based on one standard location regardless of where they work (location-agnostic pay)?

💡 Location pay examples:

- Ravio – location-based pay. London-based employees (who attend mandatory in-office days) are benchmarked using London data. UK-based remote workers are benchmarked using UK-wide data rather than London-specific rates. Global remote workers are benchmarked using data for their country of employment.

- Buffer – cost of living multiplier. San Francisco acts as a base location to ensure highly competitive pay globally. High cost of living locations (Zurich, New York, London, Los Angeles) receive 100% of base benchmark. All other locations have a 90% multiplier applied.

- TestGorilla – location-agnostic pay. All roles are benchmarked against 'Europe', which is seen as a "mini version of the world" due to the variance in pay across different European countries, making it a reasonable proxy for global variance.

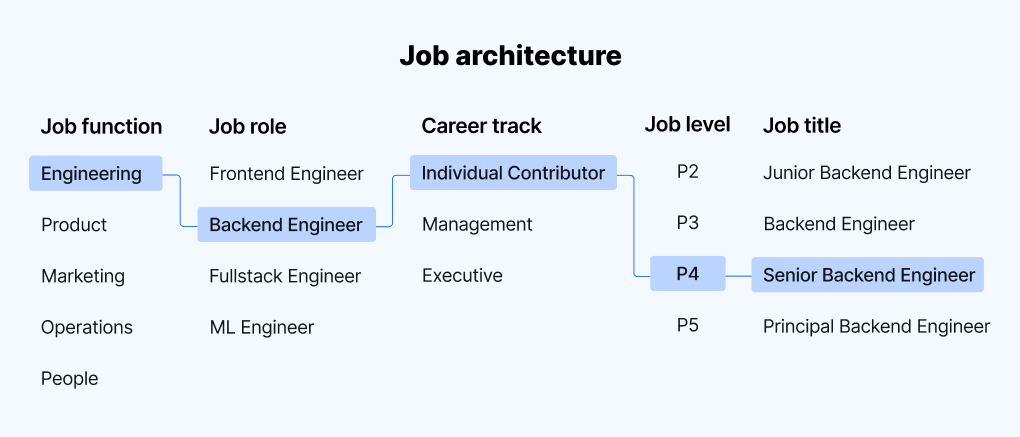

Step 2: Ensure you have a well-defined job architecture

Accurate benchmarking starts with a clear, standardised job architecture. Without it, you can't reliably match your internal roles to external benchmarks.

Your job architecture should include:

- Consistent job titles that reflect actual work, avoiding job title inflation

- Clear job families that group similar roles (e.g. Engineering, Marketing, Sales)

- Defined job levels that distinguish junior from senior contributions

- Role descriptions that outline scope, responsibilities, and impact.

This foundation ensures that when you benchmark a ‘Senior Software Engineer’, you're able to compare like-for-like between your team and the market benchmarks, because you have that clarity on how you define that role internally.

"No one experiences any joy doing a salary benchmarking exercise for a 500-person organisation that has 500 unique job titles. The overriding principles when creating or updating your job architecture are to eliminate ambiguity and to build for scale."

Chief People Officer at Ravio

Step 3: Identify your peer group

That typically means a peer group that reflects your:

You need to benchmark against the companies you actually compete with for talent to ensure it helps you hire and retain the talent you need.

- Industry: SaaS companies and manufacturing firms have very different compensation structures.

- Location(s): cost of labour and local talent markets drive significant variance, so you’ll need benchmarks specific to those locations.

- Company size and stage: a 50-person Series A startup and a 5,000-person public company operate in different talent markets. Headcount, revenue, and funding stage all matter.

Defining this upfront ensures your benchmarks reflect reality – not an averaged-out view of "all companies everywhere" that doesn't actually match who you're hiring against.

Step 4: Choose your salary benchmarking provider

There are several ways to access salary benchmarks, and they vary widely in reliability, recency, and ease of use.

- Real-time compensation benchmarking tools (e.g. Ravio) integrate directly with HRIS systems to pull live employee compensation data which is then turned into benchmarks, ensuring up-to-date benchmarks at all times. These tools typically include features like automated role mapping, filters for peer groups, and additional compensation management capabilities like salary band tools. They're fastest to access and most accurate, but regional and industry coverage varies by provider – Ravio, for instance, is best-fit for tech/tech-enabled companies with significant headcount in Europe.

- Traditional salary surveys (e.g. Radford, Mercer, Willis Towers Watson) collect data through annual or biannual surveys where companies manually submit employee compensation information. The result is a broad dataset, but that is often months old by the time it's delivered, and prone to error due to the manual submission process. Surveys work well for large enterprises in broad industries with a fully-fleshed Rewards team, but can feel less relevant for fast-moving tech companies.

- User-reported sources (e.g. Glassdoor, Indeed job adverts, ChatGPT) are free and easy to access but highly unreliable. The data is unverified, often outdated, and lacks context about company size, role scope, or compensation philosophy – making it unfit for serious compensation planning.

When evaluating compensation data providers, focus on three key factors:

- Relevant. Does the provider cover your roles, locations, and peer companies? Can you filter the data to match your context?

- Reliable. How is the data collected and verified? What's the sample size and confidence level for each benchmark?

- Real-time. How often is the data refreshed? Are you working with current market rates or last year's snapshot?

For a detailed comparison of salary benchmarking providers, see our guides on the best salary benchmarking tools and evaluating compensation data providers.

“Access to Ravio’s live market data means no more headaches from delayed data sets or having to age compensation data, which has been a real friction point for us in the past. Ravio offers real-time data with amazing visualisations making it the easiest and most user-friendly benchmarking tool we use.”

VP People, Mollie

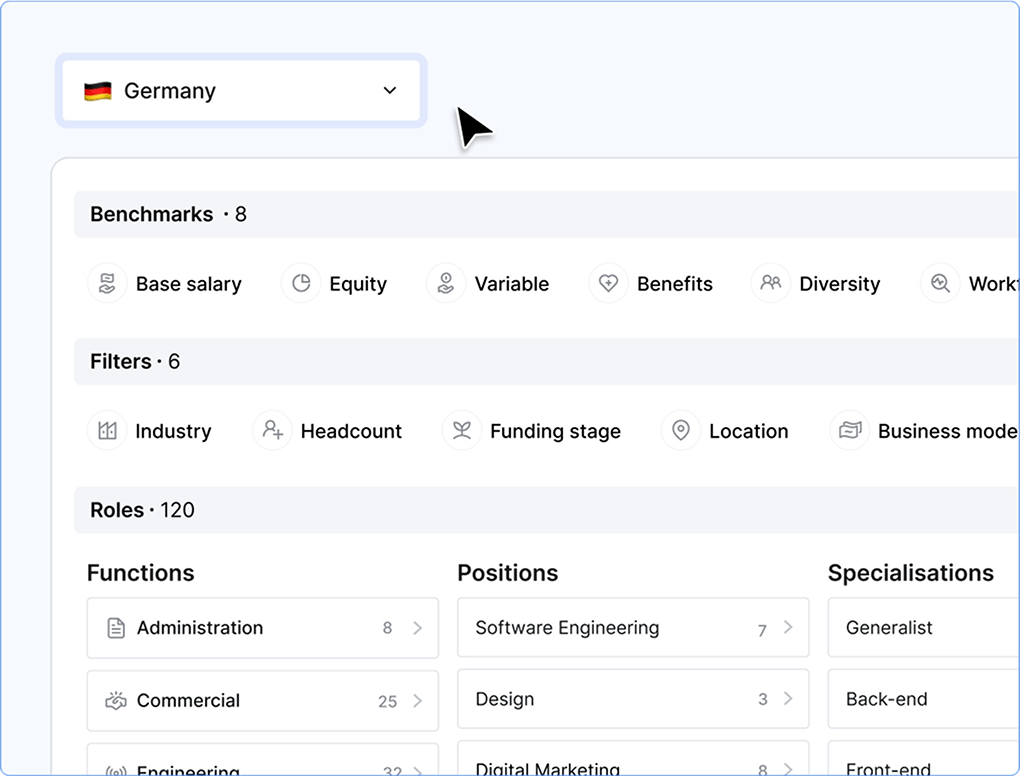

Step 5: Access the data and apply filters

Once you've chosen a provider, access the benchmarks and filter them to match your peer group.

If you're using a traditional salary survey, you might need to purchase specific peer-group reports to cover the locations and industries you need.

If you're using a real-time benchmarking platform, most tools let you filter by location, industry, company size, and funding stage – making it quick to narrow down to your actual talent competitors.

Apply filters that match your compensation philosophy and peer group from Step 3. For instance, if you're a 200-person Series B SaaS company hiring in London, filter for:

- Location: London or UK

- Industry: SaaS or tech

- Company size: 100-500 employees

- Stage: Series A/B

“[Before Ravio] it was very difficult for us to compare ourselves with the right sectors, organisations, and competitors as we are a tech scale-up. We have so many developer positions – like different engineering types and product roles – so we needed data for tech scale-ups, versus large corporate organisations.”

Head of People & Culture, Tiqets

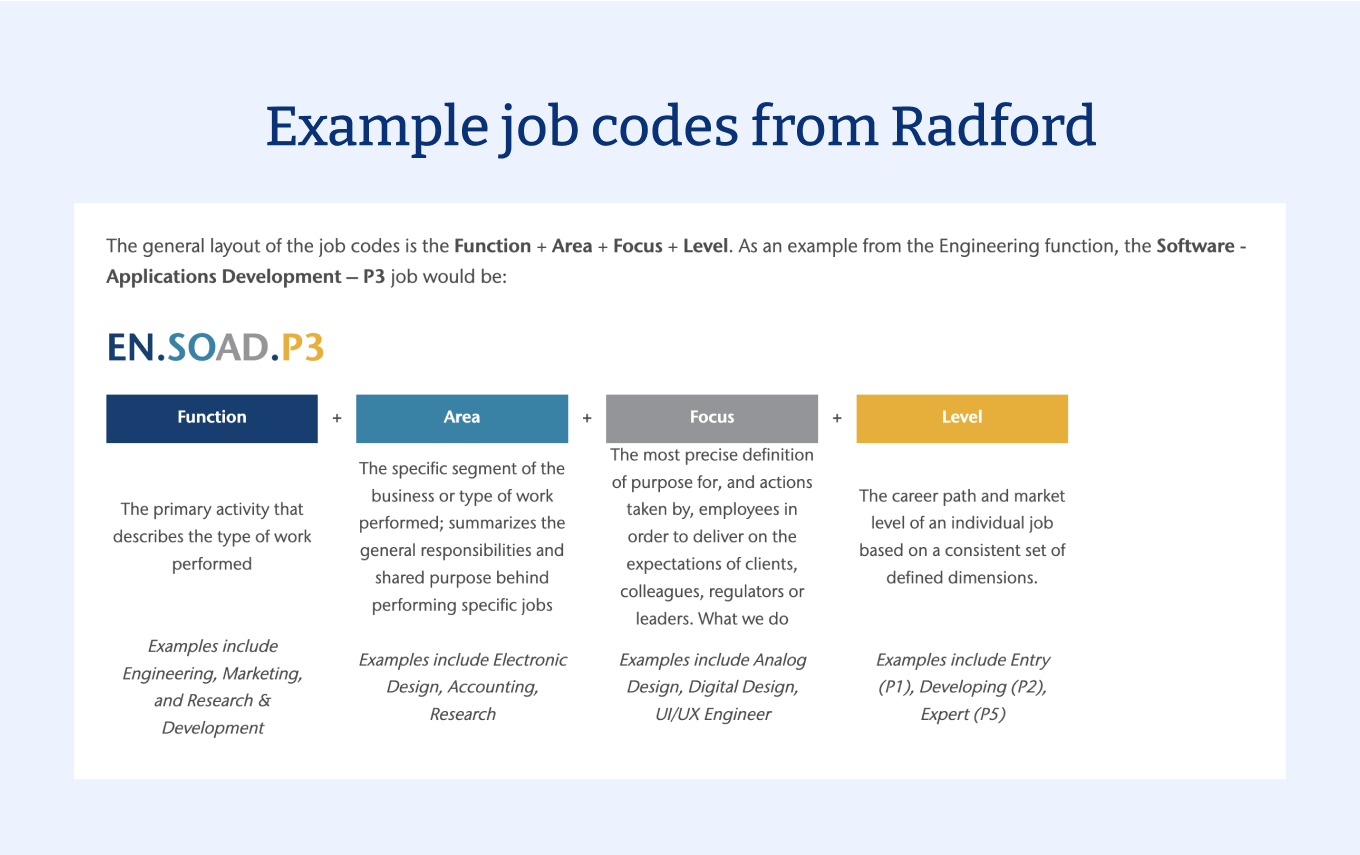

Step 6: Map benchmarks to your internal roles

Mapping benchmarks to your internal roles is often the hardest and most time-consuming part of salary benchmarking, but it’s also the most important part.

Different companies use different job titles, level frameworks, and role descriptions, and so do different compensation benchmarking providers – so to benchmark accurately, you need to match your internal structure to the provider's taxonomy.

With traditional salary surveys, this is entirely manual.

Survey providers use predefined job catalogues with hundreds (sometimes thousands) of unique roles and levels. Radford's tech survey, for instance, includes 899 unique job titles.

You'll need to read through descriptions, interpret how they match your roles, and map everything yourself – a process that can take days or weeks for larger organisations.

With modern benchmarking platforms, mapping is typically automated or semi-automated.

Some providers use AI to suggest matches, others have dedicated teams that handle mapping for you during onboarding.

Ravio, for example, has a dedicated team of Benchmarking Operations experts who map each of your employees to our role library and level framework, ensuring consistency. If you already have an internal level framework, we create a correlation table showing exactly how your levels align with ours.

Ravio correlation table, showing how a user's job levels are mapped against the Ravio level framework

Either way, accuracy here is critical for salary benchmarking to be effective.

If you map a "Head of Engineering" role to the wrong benchmark – say, to CTO data instead of Director of Engineering – your pay decisions will be off from the start.

It’s also vital to document your mapping decisions. Again, if you use a tool like Ravio, this will all be saved for you within the platform – but if you opt for a salary survey provider, you’ll need to manually keep notes yourself for future reference.

Step 7: Apply benchmarks to compensation decisions

With accurate, filtered benchmarks mapped to your roles, you can now use them to guide real compensation decisions, bringing them into processes like:

- Build or refresh salary bands. Use your target percentile (from your compensation philosophy) as the midpoint for each band, then set a range (typically ±15-20%) to reflect progression within a level. This creates structure for hiring decisions and internal pay progression.

- Make market adjustments. Compare your existing employee salaries to the benchmarks. Where are you falling behind? Which roles or locations need immediate adjustment to stay competitive? Prioritise changes for retention-critical roles or areas where you're significantly below market.

- Design competitive new hire offers. When hiring, place candidates within the appropriate band based on their experience and skills relative to the level. Benchmarks give you confidence that offers are both competitive and fair relative to the rest of your team.

- Inform retention decisions. If a valued employee receives an external offer, benchmarks help you evaluate whether to counter – and if so, by how much – based on current market rates for their role.

- Refresh regularly. The talent market is constantly moving, so salary benchmarking should be a regular process – with bands refreshed and market adjustments made to reflect any shifts, and keep employees aligned to your compensation philosophy. Most companies revisit benchmarks at least annually as part of their compensation review process.

Salary benchmarking isn't a one-time exercise.

It's an ongoing practice that keeps your compensation competitive, defensible, and aligned with your business strategy as both your company and the talent market evolve.

Salary benchmarking example: How to benchmark a Software Engineer role

To see how salary benchmarking works in practice, let's walk through benchmarking a P3 Software Engineer role at a 200-person Series B SaaS company based in London.

Important caveat: This example shows how to benchmark a single role, but ideally you should benchmark your entire organisation to build consistent, company-wide salary structures – not benchmark roles one-by-one as you hire. Benchmarking individually can create inconsistencies in how different roles compare to one another, making it harder to maintain internal pay equity as you grow.

Define your parameters in line with your compensation philosophy

Establish the key details:

- Role: Software Engineer

- Level: P3 (established Individual Contributor)

- Location: London, UK

- Company context: 200 employees, Series B, tech sector

- Compensation philosophy: Target 75th percentile for engineering roles, adjust salaries based on employee location.

Access and filter the salary benchmarking data

In your chosen salary benchmarking platform, filter the data to match your peer group:

- Location: London

- Industry: Tech/SaaS

- Company size: 100-500 employees

- Job level: P3

Review the results

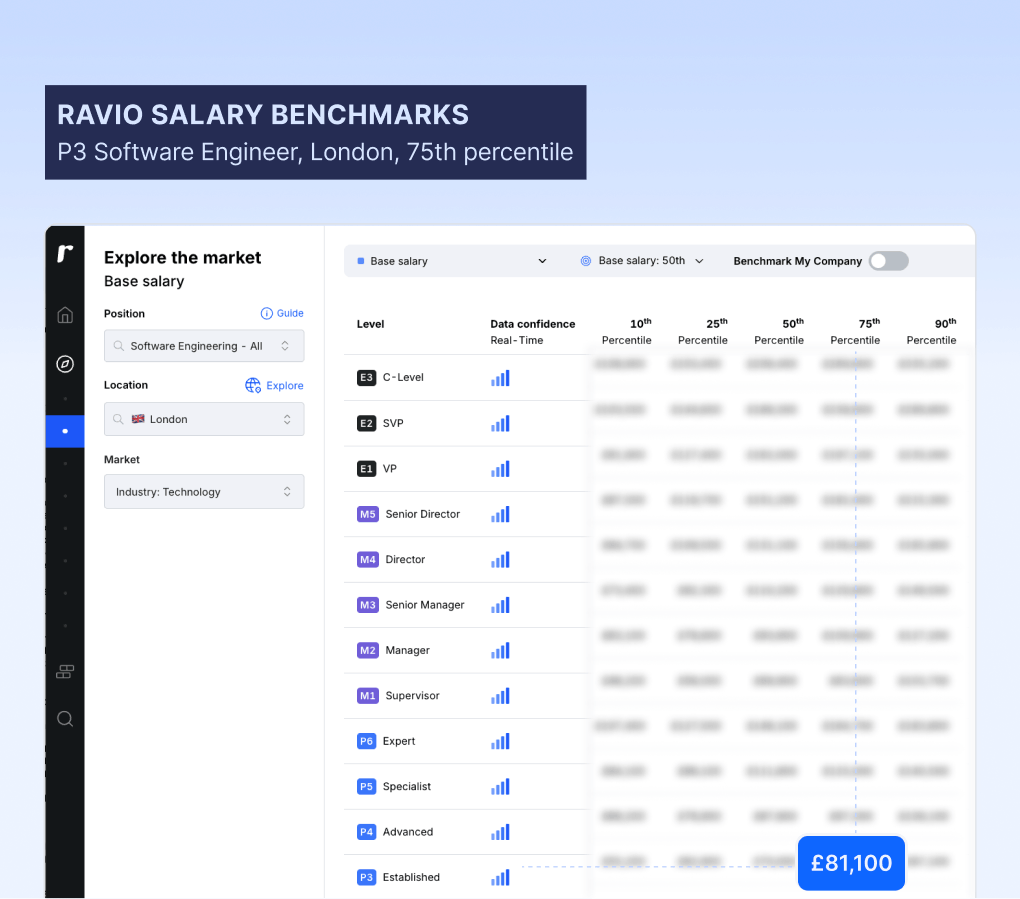

For a P3 Software Engineer in London with these filters applied, Ravio's data shows:

- 25th percentile: £65,800

- 50th percentile (median): £72,600

- 75th percentile: £81,100

Based on your 75th percentile target, your market reference point for the role is: £81,100.

Software Engineering salary benchmarks shown in Ravio's platform

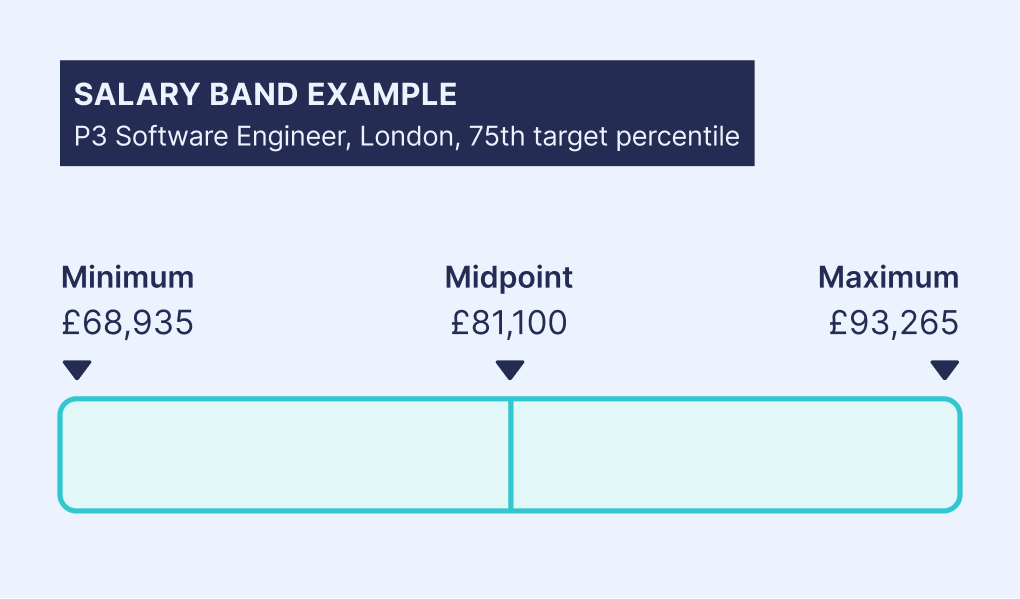

Apply to your salary structure

Rather than paying this exact figure to every P3 Software Engineer you hire, use this as the foundation of your compensation structures.

A typical approach is to use the market benchmark at your target percentile as the midpoint of your salary band.

So for this example, with a typical ±15% salary range, your P3 Software Engineer band would be:

- Minimum: £68,935

- Midpoint: £81,100

- Maximum: £93,265 (for someone excelling at this level, close to promotion)

When making a new hire, you'd place them within this band based on their experience and skills relative to P3 expectations – perhaps £73,000 (0.90 compa ratio) for someone with 2 years' experience, or £88,000 (1.09 compa ratio) for someone who's been performing at this level for several years.

Step 5: Refresh regularly

Check this benchmark again at your next compensation review (typically annually, or more frequently for competitive roles) to ensure the band stays aligned with market movement.

FAQs

What does salary benchmarking mean?

Salary benchmarking means analysing market data to understand what other companies pay for specific roles, levels, and locations. It provides a market reference point to inform fair, competitive compensation decisions.

How does salary benchmarking work?

Benchmarking works by comparing your internal roles against external market data, filtered by relevant factors like location, industry, and company size. You then use those benchmarks to guide salary decisions, build salary bands, and ensure competitive pay.

What is the purpose of salary benchmarking?

The purpose of salary benchmarking is to ensure compensation is fair, competitive, and financially sustainable. It helps you attract and retain talent, manage payroll costs effectively, and make defensible pay decisions aligned with market reality.

What are the benefits of salary benchmarking?

Salary benchmarking helps you design competitive compensation strategies, attract and retain top talent, keep payroll costs sustainable, support accurate headcount planning, and ensure pay equity compliance. It provides the foundation for confident, data-driven pay decisions.

What is global salary benchmarking?

Global salary benchmarking compares compensation across multiple countries and regions, accounting for differences in cost of living, local talent markets, and regional pay practices. It's essential for companies with distributed or international teams to ensure locally competitive pay.

Where to benchmark salaries?

You can benchmark salaries through real-time compensation platforms like Ravio, traditional salary surveys from providers like Radford or Mercer, or employee-reported sources like Glassdoor (though these are unreliable). The best source depends on your company context, but you should evaluate based on whether the provider offers relevant data for your roles and locations, updates the benchmarks regularly to reflect the live market, and ensures reliable, verified benchmarks through a robust methodology.

What is the best salary benchmarking tool?

The best salary benchmarking tool provides relevant data for your roles and locations, updates in real-time, and offers reliable, verified benchmarks. Ravio is ideal for European tech companies because it offers the strongest coverage across Europe with real-time data from 1,500+ companies, sample size and data confidence indicators, automated role mapping, and comprehensive compensation management features beyond just benchmarking.