- 1. Reliable benchmarking data reduces financial risk and employee turnover

- 2. It’s impossible to get a like-for-like comparison with crowdsourced salary data

- 3. Sample size and data confidence is an unknown with crowdsourced salary data

- 4. It isn’t just data, it’s bringing structure to our compensation approach too

- 5. Industry-leading companies rely on salary benchmarking data

- 6. Incoming pay equity legislation will require more structure and transparency

Getting buy-in from senior leadership to purchase compensation benchmarking data isn't always simple.

We hear regularly from People and Reward Leaders who know they need access to reliable salary benchmarking tools to make consistent, competitive, and fair decisions around compensation – but can't get their founder, CEO, or CFO to give that all-important budget approval.

It's usually the case that senior leaders see compensation benchmarking data as an unnecessary expense, rather than a strategic investment.

After all, can't we just keep using free sources like Glassdoor or LinkedIn job ads?

Alistair Fraser, founder of Justly, has come up against this challenge many times in his career in Rewards – so much so that it's one of the many questions covered in his own salary benchmarking guide.

We asked Alistair his best advice on communicating the value of compensation benchmarking data as an essential investment in talent retention, employee engagement, industry competitiveness and pay equity legislation.

His key arguments are:

- Reliable benchmarking data reduces financial risk and employee turnover

- It’s extremely challenging to get a like-for-like comparison with free, user-reported salary data

- Sample size and data confidence is an unknown with free, user-reported salary data

- It isn’t just buying data, it’s bringing structure to our compensation approach

- Industry-leading companies rely on salary benchmarking data

- Incoming pay equity legislation will require more structure and transparency

Ultimately, investing in reliable benchmarking data is about building trust, confidence, and credibility, ensuring pay decisions are fair, competitive, and grounded in reality.

Let’s take a closer look.

1. Reliable benchmarking data reduces financial risk and employee turnover

One of the biggest objections People and Reward leaders face from CEOs and founders is the cost of compensation benchmarking data. Many leaders see it as an unnecessary expense, rather than a strategic investment.

As a result, CEOs and founders are reluctant to pay for benchmarking data – preferring to send their People and Reward leaders to crowdsource that information for free.

The inaccuracies of crowdsourced salary data can pose serious financial risks to companies – especially early-stage startups who are just finding their feet and must be more cost-conscious.

Of course, expense management and financial risk is a top priority for CEOs and CFOs, so this can be a powerful message when trying to get buy-in from senior leaders to purchase benchmarking data.

To tackle this problem, People and Reward leaders must communicate the financial risks of using crowdsourced salary data and demonstrate the ROI of investing in salary benchmarking data from a reliable compensation benchmarking company.

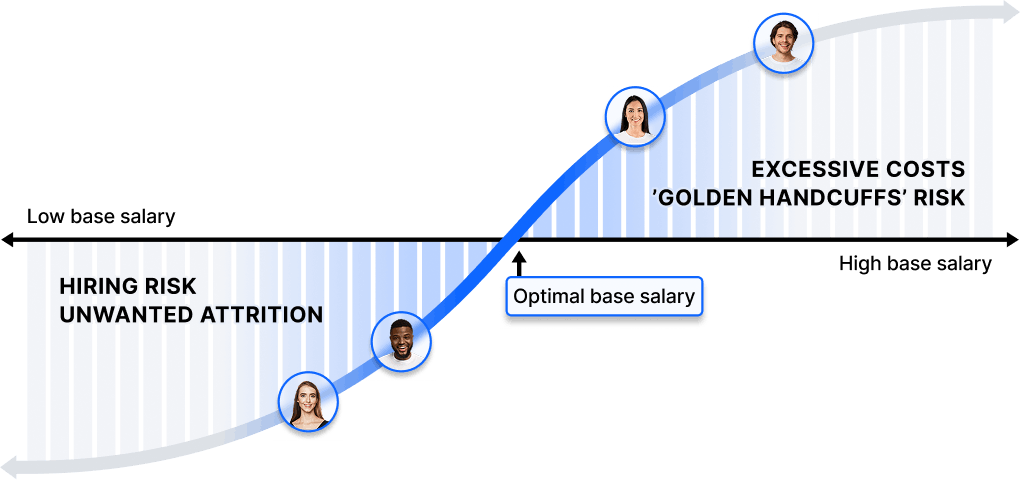

The main financial risks lie in organisations paying under or over the market rate when using data that’s unverified and submitted by users who might be at a different level, role, and location to the one you’re seeking a benchmark for.

Paying over the market rate leads to excessive payroll costs, which is already one of the most costly expenses for a business. It can also lead to a ‘golden handcuffs’ scenario wherein the role is so well-paying that the employee feels obliged to stay, even if they would truly prefer to explore a different role.

On the other hand, if companies use data that is under market rate then the time to hire for new roles may be greatly increased while also failing to attract qualified candidates.

Plus, underpaying employees means the company may quickly lose top employees to better-paying roles – increasing attrition rates and financial costs to re-hire and re-train employees.

In fact, the average cost of hiring employees in the UK is around £40,000. In comparison, pricing for a salary benchmarking tool like Ravio is around £5,000 per year for a 100-person company.

For Alistair, it’s a no-brainer.

“I see CEOs not wanting to pay £6-7k for some really solid, objective data that’s going to allow them to compare apples to apples and gives them a high degree of certainty around what the market is paying.”

“The cost of replacing headcount should be, from an ROI perspective at least, enough for leadership to see the value of accurate benchmarking data.”

“A one-time annual fee, just to give that certainty and build trust and credibility that the numbers haven’t been plucked out of thin air, is a drop in the ocean compared to what it would cost to replace an employee who leaves citing pay as a reason.”

💡 The importance of choosing a well-aligned compensation benchmarking data provider

It’s also worth noting that there can also be costs to using the wrong compensation benchmarking data provider (as opposed to using free, user-reported salary data).

Providers typically have differing geographical focus, which can impact the benchmarks. For instance, both Ravio and Pave are salary benchmarking data providers, but whereas Ravio’s strength is Europe, Pave’s is the US. Pave, therefore, has much less data confidence for benchmarking data in Europe – evident in the below example of Software Engineers in London.

2. It’s impossible to get a like-for-like comparison with crowdsourced salary data

“I'd say 50% of founders don’t want their team to pay for a benchmarking provider because they believe you can crowdsource that information. It's a common opinion that you can use secondary sources like LinkedIn and Glassdoor,” says Alistair Fraser, Founder of Justly.

Crowdsourced salary data is free to use, so it’s understandably tempting. But that isn’t the only reason CEOs and founders choose to use them: they also believe they can get the same quality results, too.

This often comes from a lack of understanding of the value of reliable salary benchmarking data – and the difference between this and crowdsourced salary data.

Secondary data sources are based on user-reported data.

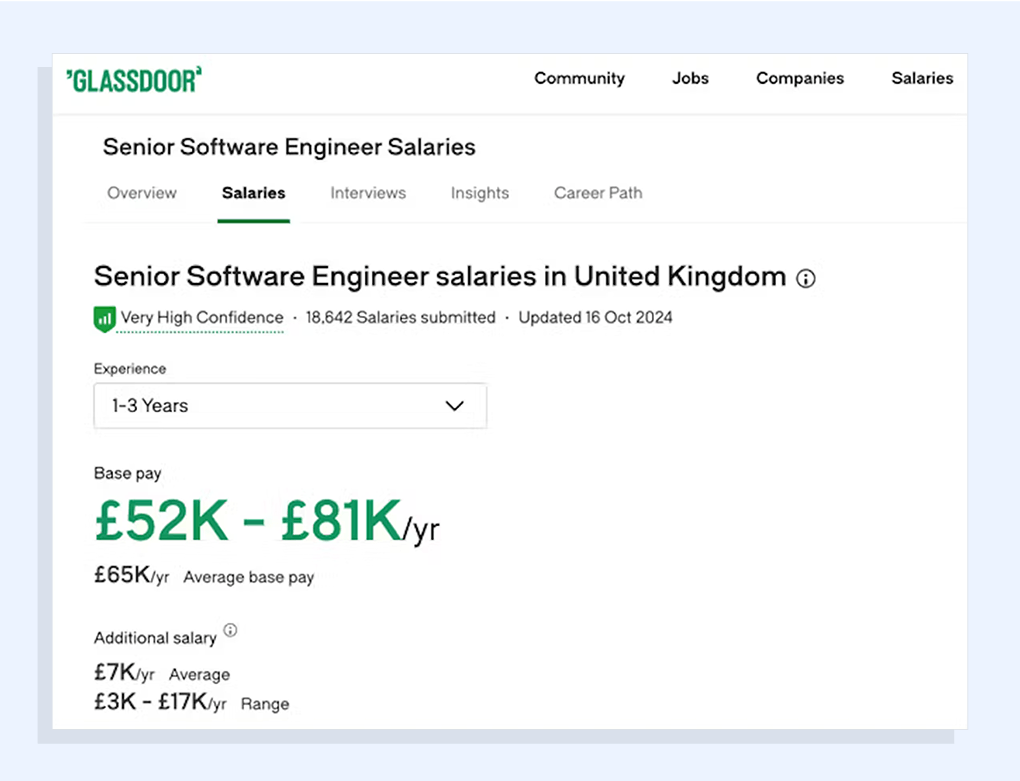

For instance, Glassdoor asks employees to submit their salary, and use this self-reported data to produce ‘average’ salaries for each role. With LinkedIn or other job boards, companies will often list the salary range for a role within the advert which is free to use.

However, because the salary information is self-reported of this, there is no way of verifying the benchmarking data is accurate, up-to-date, or even correct.

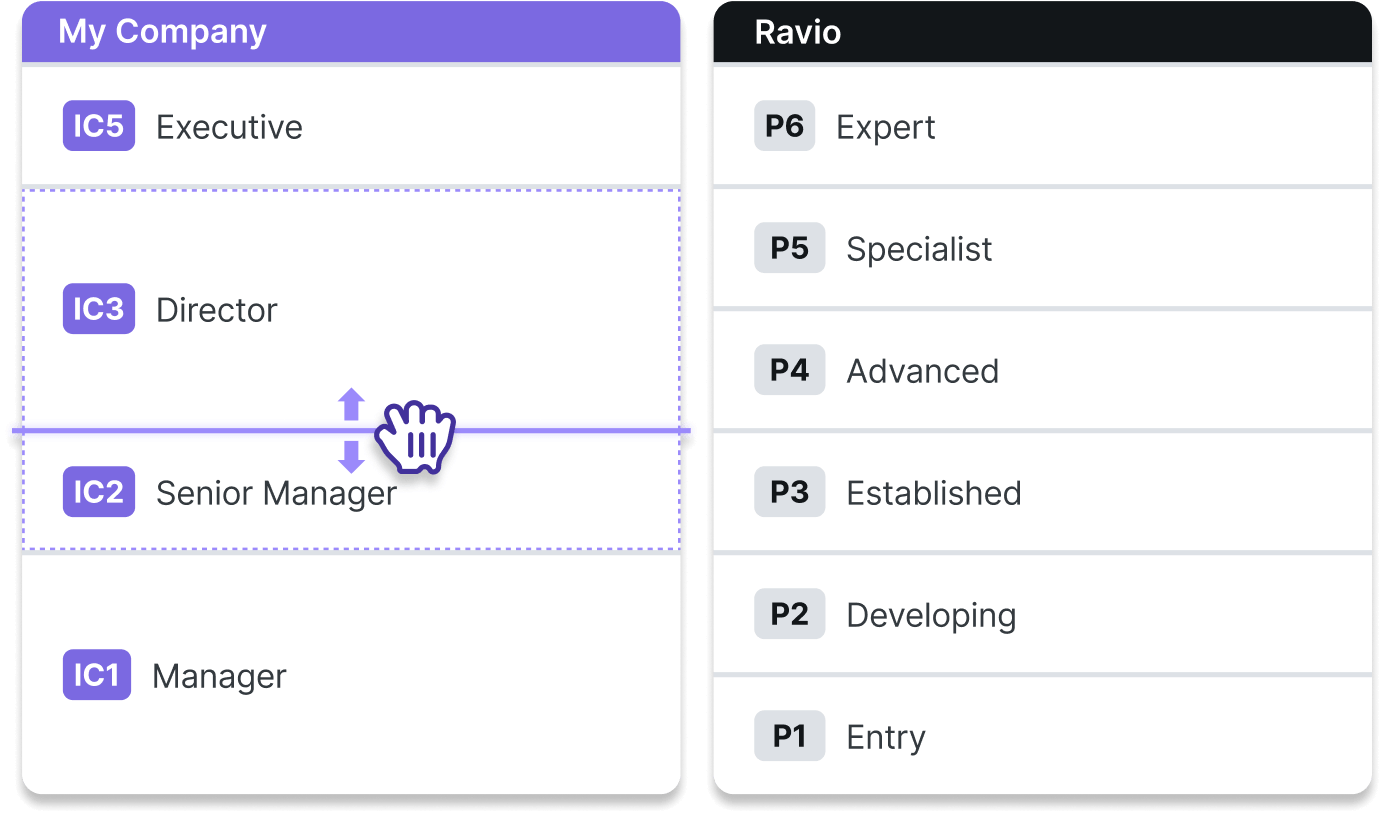

Plus, user submissions make accurate job levelling a major issue. Job titles and organisation structures can vary significantly, and there’s no way of knowing the context of a user’s submission, making direct comparisons impossible.

In the below Glassdoor example, we can see that Software Engineer salaries in London range from £45,000-£76,000 per year. Despite a high number of salaries being submitted, there’s no way to verify that input is accurate or what level of seniority this range reflects. Organisations also level employees differently, making it impossible to know if it’s an accurate comparison to your levelling framework.

“By using crowdsourced benchmarking data, you’re taking a big bet on whether job titles mean the same thing across different organisations,” says Alistair.

To compare apples to apples, People and Reward leaders would need to read the job descriptions of every submission and manually map it back to their own levelling framework – a task that is almost impossible to avoid misinterpretation and takes a huge amount of time.

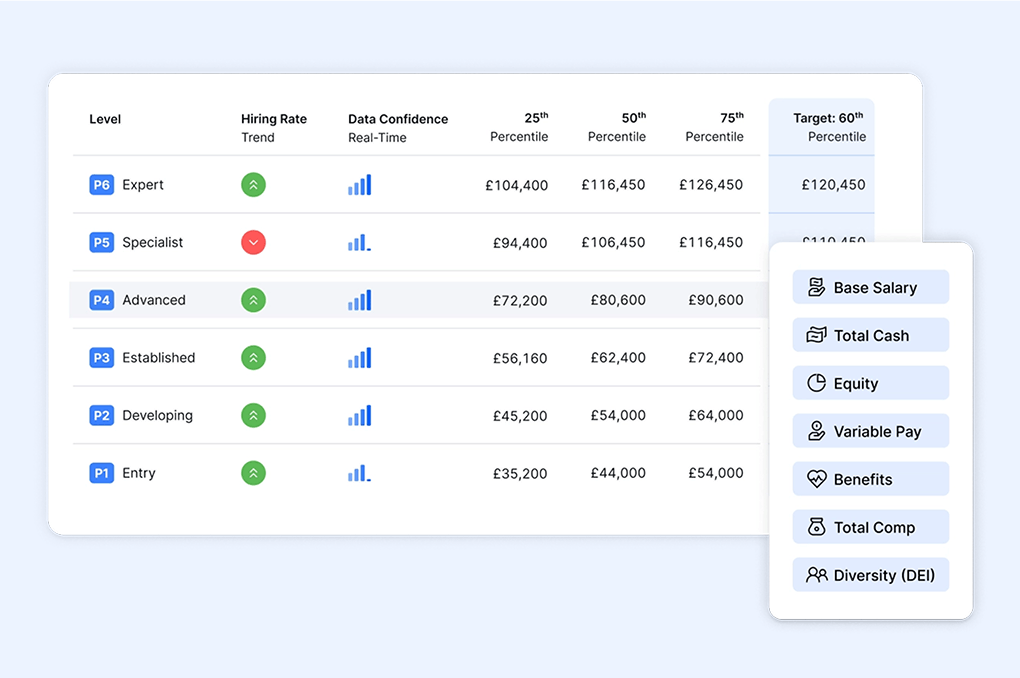

“The benefit of using a primary source like Ravio is that you’re able to map to the levelling criteria and all the companies that are using Ravio use that same criteria as well,” explains Alistair.

3. Sample size and data confidence is an unknown with crowdsourced salary data

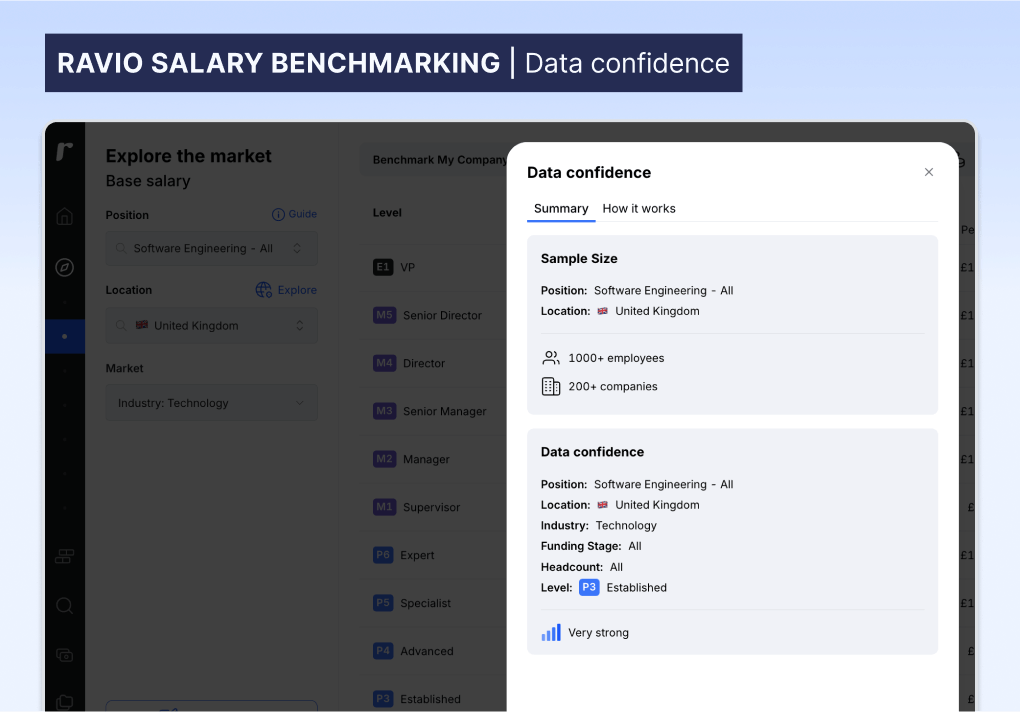

One of the most important aspects of compensation benchmarking data is to ensure a solid sample size behind the benchmarks you’re looking at. This is why traditional salary survey providers like Radford still remain popular, because they have amassed large datasets behind their benchmarks.

With free, crowdsourced salary data, the sample sizes can be really small – driven only by a handful of relevant job adverts or user submissions. This makes it an untrustworthy representation of the market.

For Alistair, this is one of the most important elements to make clear when talking to leaders about salary benchmarking tools – especially if they are reluctant to invest money.

“CEOs who are really data-driven will want to know sample size in order to understand the confidence in the data,” explains Alistair. “If you’re showing data with low confidence and holes in it, you know they will switch off.”

So, when communicating the importance of salary benchmarking data to senior leaders, be proactive in addressing sample size, peer group composition, and data credibility. Walk them through dataset filters and sample sizes to show how it applies to the company’s specific needs.

For example, in the Ravio platform, it’s easy to identify the data confidence and sample size for each individual benchmark.

4. It isn’t just data, it’s bringing structure to our compensation approach too

Traditionally, buying compensation benchmarking data meant buying a one-off excel spreadsheet from a consultancy like Radford or Mercer, filled with the data from their annual salary survey.

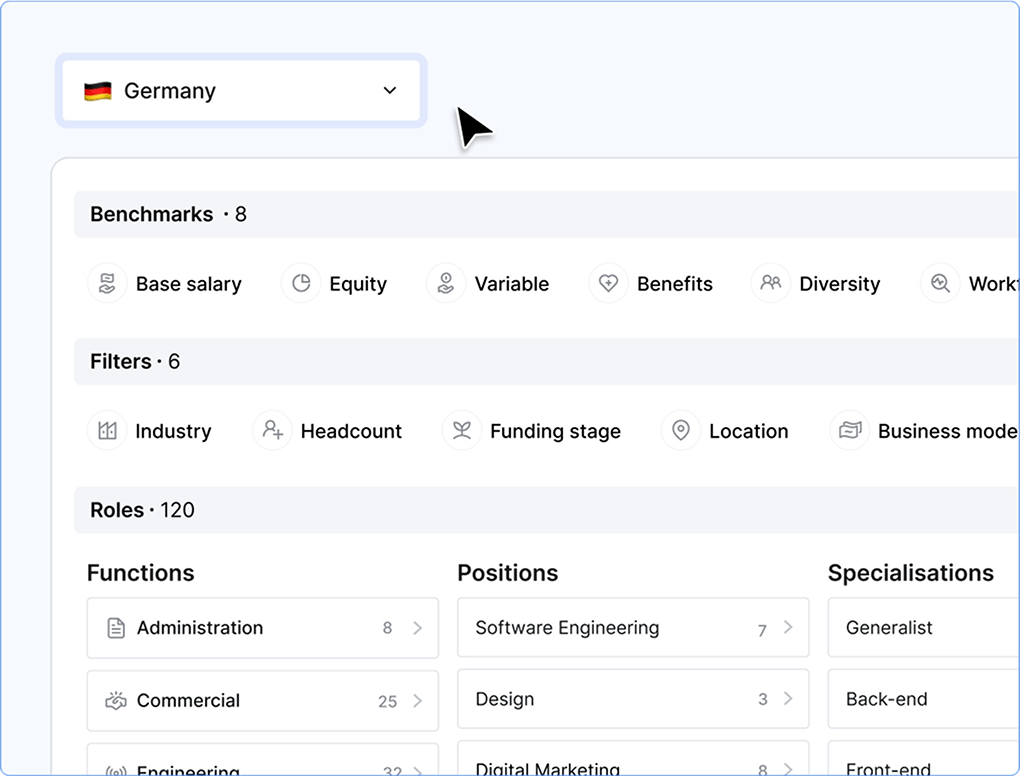

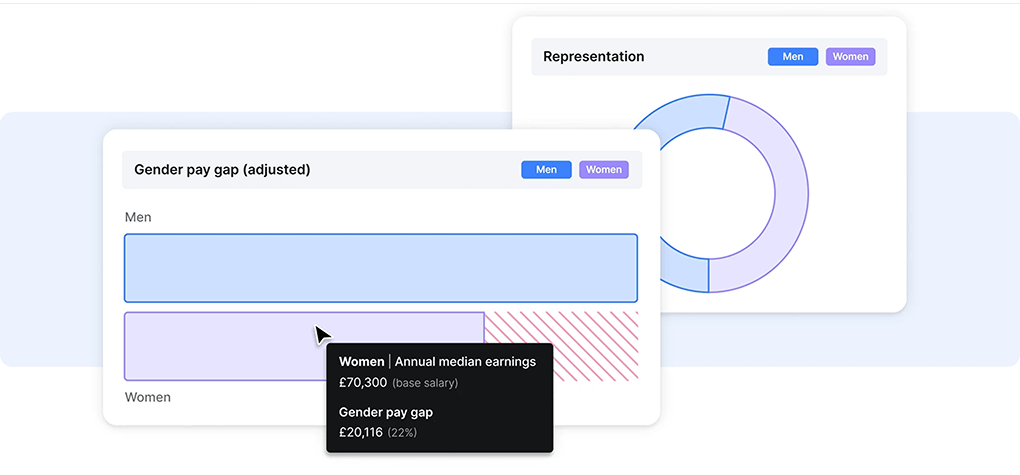

This isn’t the case anymore. Platforms like Ravio’s offer real-time salary data that can be accessed anytime, and that can be easily compared in-platform with your company’s employee salary data. Plus, Ravio also offers additional compensation management tools like the ability to build salary bands aligned with market data, analyse and address pay equity issues, manage equity compensation, and run a compensation review.

Alistair explains that when he walks executives through a benchmarking platform – showing filters by location, role, and level – it immediately “clicks” for them. They can see how structured data makes decision-making easier.

“As soon as they see a grid and the fact that you can drill down using filters and then see the different levels, it seems to click,” says Alistair.

Instead of just presenting numbers in a deck or spreadsheet, it’s more effective to demo the benchmarking tool you’re evaluating, or share a structured data grid to make the value tangible with your CEO or leader. Let them see the differences between unstructured and structured benchmarking.

According to Alistair, it’s also particularly effective to showcase target percentiles at this stage too. CEOs and founders want to understand the cost of competitiveness – whether they need to target the 50th percentile to be market-aligned or whether they decide to target higher and be market-leading.

“Showcasing percentiles effectively demonstrates value to CEOs and reduces skepticism. Unlike crowdsourced data, which lacks percentile targeting, benchmarking platforms give CEOs and leaders the precision to align pay decisions with their desired market position.”

When communicating the value of investing in a compensation benchmarking platform, it’s also important to communicate how much time and effort it takes to locate and source these benchmarks from crowdsourced platforms.

“Oftentimes, CEOs will ask their team to find benchmarks through secondary sources without knowing how much legwork it takes. And when they get messy, inconsistent datasets back, it becomes obvious how unreliable these sources are,” says Alistair.

“By then, it’s too late. It’s taken the team a long time and you then have to go right back to the beginning; trying to shoehorn a benchmarking tool in quickly and start your job family mapping and levelling again.”

5. Industry-leading companies rely on salary benchmarking data

CEOs are often more likely to trust a benchmarking provider when they see that industry-leading companies are already using it. Recognisable brand logos can be a powerful trust signal that can help People and Reward leaders gain CEO buy-in.

According to Alistair, showcasing recognisable logos can reassure CEOs that a salary benchmarking tool operates at a reliable, industry-accepted standard.

“When big tech companies put their trust in a salary benchmarking provider, and you know they contribute to that particular dataset, that can be highly effective in building credibility,” says Alistair.

In many cases, even if a company does not have direct visibility into the dataset’s exact sample composition, just seeing the names of trusted brands associated with the provider can help eliminate skepticism – especially in industries or regions where companies are highly competitive and want to ensure they are benchmarking against relevant peers.

For People and Reward leaders, therefore, leveraging brand credibility should be a key part of the pitch to senior leadership. Instead of just discussing dataset size or data accuracy, show logos of trusted industry names to make the case more compelling.

![“[Using Glassdoor] created frustrations with line managers. They didn’t trust the data, which made it difficult for us to discuss what people’s pay should be. Were we paying the right

amount to people, or were we way off

in the market?” – Maartje Koopman, Head of People and Culture at Tiqets](https://images.prismic.io/ravio/Z63Gp5bqstJ9-j8A_MaartjeKoopmanTiqets%E2%80%93quoteonGlassdoor.png?auto=format,compress)

6. Incoming pay equity legislation will require more structure and transparency

Incoming pay transparency regulations like the EU Pay Transparency Directive will soon require organisations to ensure equal pay for equal work, including reporting on gender pay gaps, stricter hiring laws such as disclosing salary ranges to job candidates, and not being able to enquire about historical salaries in interviews.

It means that CEOs and founders who want to use free, unverified sources may not just face financial implications, but also more serious non-compliance consequences, too.

It’s crucial that People and Reward leaders demonstrate that inaccurate benchmarking doesn’t just impact hiring and retention, but it also puts the company’s compliance and reputation at risk.

Companies need a structured approach to compensation, including well-defined salary bands and job levels to ensure equal pay for equal work – something that is impossible to do using platforms like Glassdoor or LinkedIn to source salary data.

Plus, as part of the EU Pay Transparency Directive, organisations will soon have to share salary ranges with job candidates for new roles – increasing the reputational risk if their data isn't truly aligned to the market.

📊 Looking to switch to a reliable compensation benchmarking provider?

Explore the most comprehensive real-time total reward data set with 3 benchmarks for free, or if you’d like a full tour of the Ravio platform book a demo with one of our experts.