- Quick recap: What Radford offers

- Radford compensation management pros and cons

- Radford vs top compensation management alternatives: Side-by-side comparison (2026)

- 11 best Radford alternatives for compensation management in 2026

- How to choose the best Radford alternative for your needs?

- So is Radford still the best compensation benchmarking option?

- FAQs

Despite its longstanding brand reputation, Radford’s compensation data is often outdated by the time it reaches you — a key reason many companies look for Radford alternatives.

Manual survey submissions, part of Radford’s give-to-get model, also add extra work to your plate and increase the risk of human error, leading to inaccurate insights.

Then there’s the eyebrow-raising cost per dataset (especially if you need multiple locations) and the additional spend on separate tools to manage other compensation processes.

No wonder you’re exploring Radford alternatives.

To help, we reviewed the market to find the best Radford alternatives in 2026 — comparing 11 compensation management providers side-by-side with Radford.

Whether you’re choosing your first benchmarking provider, switching from Radford, or looking to supplement its data, you’ll see how each provider stacks up in data coverage and compensation management features so you can select one that best fits your organisational needs.

Quick recap: What Radford offers

Radford is the HR arm of the global consultancy firm Aon. It’s a consultancy firm first, and a compensation management software provider second — offering three main services:

- Compensation consulting

Since Radford is primarily a consultancy, its experts help companies design and implement strategic HR and compensation projects across 6 key areas:

- Executive compensation

- Employee rewards

- Sales compensation

- Corporate governance

- Equity compensation

- Private company compensation (i.e. support for companies on the road to IPO)

- Benchmarking data

Radford sells salary survey datasets, a compilation of compensation data (base salary, equity, variable pay, and benefits) gathered by Radford through a large-scale survey, typically conducted once per year.

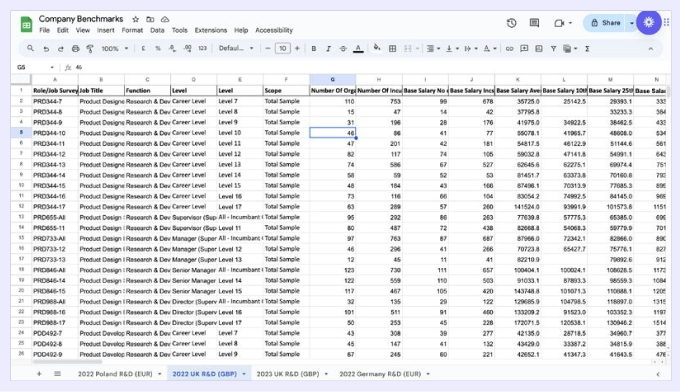

Historically, the data has been delivered in the form of spreadsheets like this one:

Today though, you can also view and analyse data in their online software, The Radford Platform, which gives you access to benchmarking data and job architecture and levelling results.

- Market practice studies

Radford’s compensation database also includes ‘market practice studies’. Like salary surveys, these are findings from Radford surveys on global companies’ reward practices — helping People Teams shape their approach across different areas.

Radford currently has 6 live market practice studies on the following areas of reward:

- Salary increase and employee turnover

- Short- and long-term incentives

- Intern, new graduate, and pay administration

- Employee experience and paid time off

- Sales incentives and car policy

- Severance and change-in-control.

Radford compensation management pros and cons

Whilst Radford has a strong reputation and offers broad data from the world’s largest organisations, the annual nature of its salary surveys means the benchmarking data is already outdated by the time it reaches you.

Below, we break down the key pros and cons of using Radford for compensation management in detail:

Radford pros

As of 2025, Radford has a 4-star G2 rating (based on four reviews).

The main benefits of using Radford for compensation management are:

- Brand trust and credibility. Radford is a well-known, respected brand with long-standing credibility among corporate HR teams for its support in compensation management. This can make it easier to secure senior stakeholder approval for Radford over alternative providers.

- Large dataset. Radford collects compensation data from some of the world’s largest corporations, giving its benchmarking datasets broad coverage across countries, job roles, and job levels. However, if your organisation has a streamlined structure, much of the data is often irrelevant, making the dataset harder to use.

- Data and consultancy. Owing to its traditional consultancy model, Radford offers personalised support for strategic HR projects, alongside compensation data and management products — a plus for companies looking to implement or improve processes.

Radford cons

The main downsides of using Radford for compensation management are:

- High cost of Radford data and projects. Radford’s brand reputation and work with the world’s largest companies allow it to charge very high rates for compensation data and projects. Costs can quickly grow with add-ons like custom peer groups or separate datasets for each location — even if you have only a few employees there.

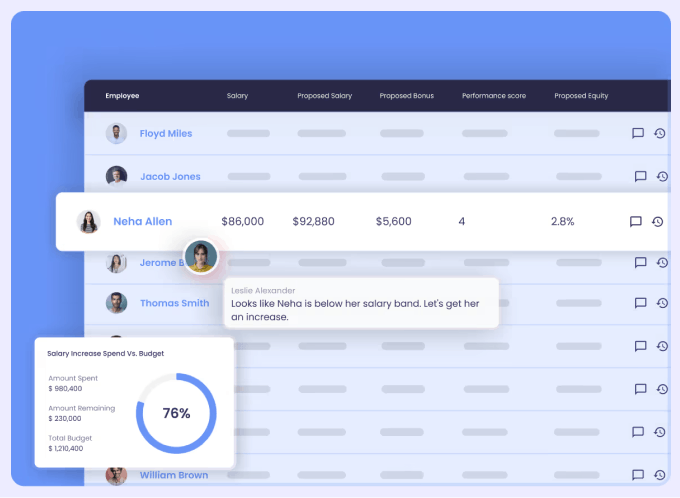

- Limited compensation management features. As a compensation management solution, Radford lacks key features like salary bands, pay equity analysis, and compensation review planning (e.g., budgeting scenarios). Whilst one-off consultancy projects may cover some gaps, this approach doesn’t meet the ongoing software needs of most teams.

- Static compensation data that is always behind the market. Radford’s annual survey model means benchmarking datasets are months out of date by the time you receive them. You then need to wait another year (and pay again) for the next update.

- Complex job role and level taxonomies. Radford’s datasets span hundreds of roles and levels, making them time-consuming and manual to align with your company’s structure. This breadth comes from Radford compiling data from the world’s largest companies across many industries and locations — its technology compensation survey alone covers 899 roles, for example.

- Manual and time-intensive compensation data submissions. Completing Radford’s manual survey submissions is time-consuming and complex, with the process increasing the risk of errors. And because access is based on a give-to-get model, you must submit your organisation’s compensation data to receive the dataset.

- Hard to use online platform. Radford specialises in consultancy, not software. So even though it’s now possible to receive their benchmarking datasets in a platform instead of a spreadsheet, users report that it is unintuitive and difficult to use.

Radford vs top compensation management alternatives: Side-by-side comparison (2026)

You can choose from two broad Radford salary benchmarking alternatives:

- Traditional consultancies

- Real-time benchmarking software

This table gives you a quick comparative overview of all the Radford alternatives with a detailed review in the next section.

Compensation management software feature | Radford | Ravio | Payscale | Pave | Assemble | Lattice | Compa | Barley | Aeqium | Companalyst | Mercer, / WTW/ Korn Ferry |

|---|---|---|---|---|---|---|---|---|---|---|---|

Salary benchmarking data | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No | Yes | Yes |

Equity benchmarking data | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No | Yes | Yes |

Variable pay benchmarking data | Yes | Yes | Yes | Yes | No | Yes | No | Yes | No | Yes | Yes |

Benefits benchmarking data | Yes | Yes | Yes | Yes | No | Yes | No | Yes | No | Yes | Yes |

Talent market trends data | Yes | Yes | Yes | Yes | No | No | Yes | No | No | No | No |

Job architecture and levelling | Yes | Yes | No | Yes | Yes | No | No | No | No | No | Yes |

Salary bands | No | Yes | No | Yes | Yes | Yes | No | Yes | Yes | Yes | No |

Pay equity analysis | No | Yes | No | Yes | Yes | No | No | Yes | Yes | Yes | No |

Compensation review | No | No | No | Yes | Yes | Yes | No | Yes | Yes | Yes | No |

Consultancy services | Yes | No | Yes | No | No | No | No | No | No | No | Yes |

Geographic focus | Global | Global | US | Global (strongest for US & Canada) | US | N/a | US | N/a | N/a | US | Global |

11 best Radford alternatives for compensation management in 2026

Here are 11 of the strongest Radford alternatives, a mix of real-time benchmarking platforms, survey aggregators, and traditional consultancies.

1. Ravio

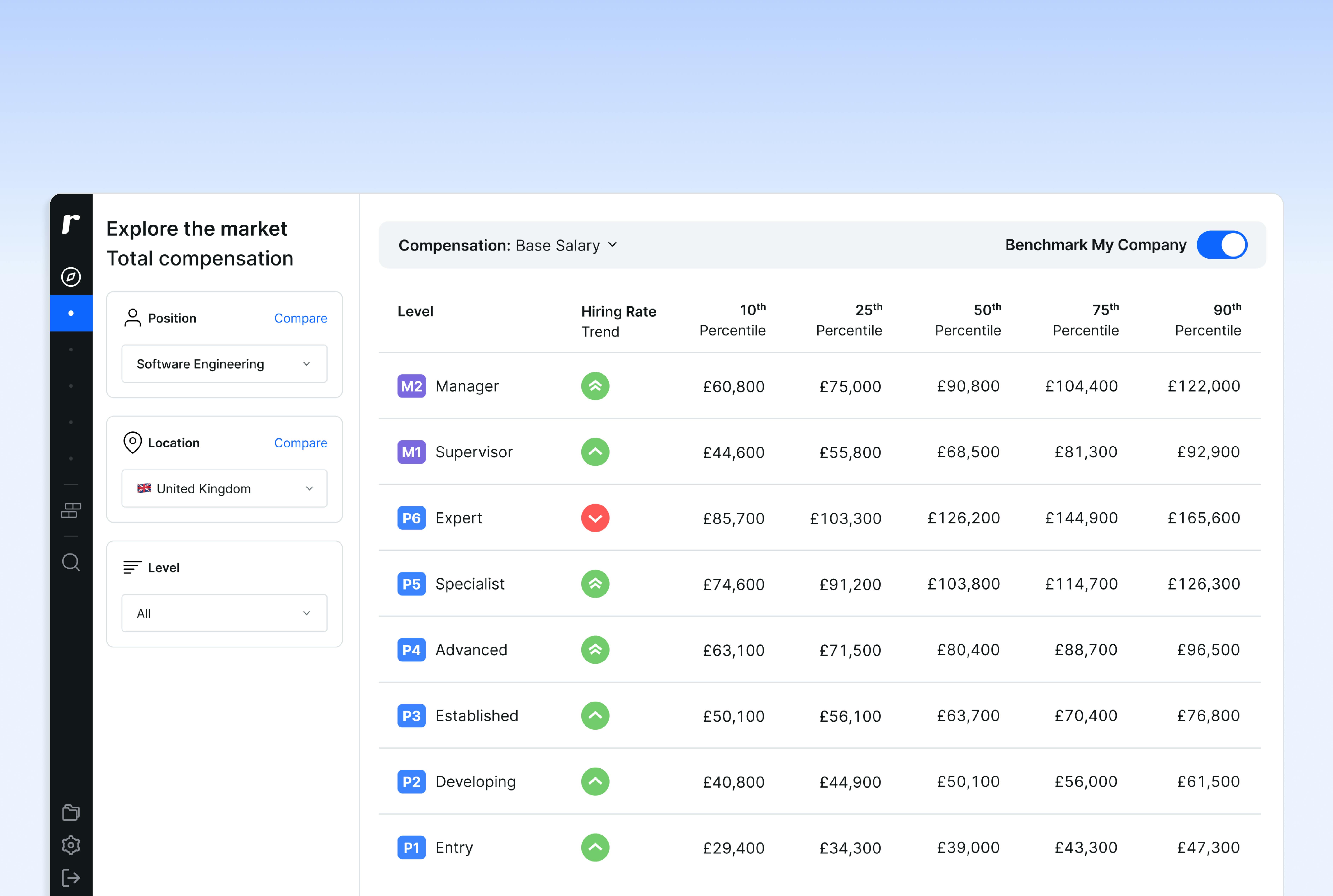

Ravio is a compensation management platform powered by reliable and real-time benchmarking data.

Ravio offers real-time compensation data and built-in compensation management — covering salary bands and pay equity — making it ideal for high-growth tech companies, particularly those with a strong presence in Europe.

Key features:

- Access global benchmarking data with a deep European market data focus. Get reliable compensation data from over 1,400 companies contributing to Ravio’s compensation database, with benchmarks available for over 50 countries and 100+ roles.

- Instantly access real-time total rewards benchmarks and market trends. View base salary, equity, variable pay, and benefits updated continuously via Human Resource Information System (HRIS) integrations, with global coverage and insights on salary increases, attrition rates, and other market shifts.

- Compare relevant roles with advanced filtering and job levelling. Use filters for industry (e.g. fintech salaries vs overall tech), company size, stage, and location to focus only on relevant data. As you onboard, your job roles are mapped to Ravio’s level framework to ensure consistent and accurate analysis across all benchmarks.

- Control data access and ensure security. Define, set, and control what colleagues (e.g., hiring managers) can see, with all information aggregated, anonymised, and encrypted. Ravio is also fully GDPR and SOC 2 compliant.

- Create, manage, and share salary bands internally. Build new salary bands or import existing ones to visualise, edit, compare to market benchmarks, and identify outliers. Run budgeting scenarios and share tailored views with managers, talent teams, or employees to maintain transparency and control.

- Automatically analyse and address pay equity gaps. Instantly visualise and identify gender pay gaps and women representation concerns, compare against market benchmarks, estimate remediation costs, and share progress via custom reports.

Radford vs Ravio:

Unlike Radford, a consultancy first and a compensation data provider second, Ravio is a modern real-time compensation management platform that pairs total rewards benchmarks with tools to build salary bands, analyse pay equity, and run end-to-end compensation reviews.

Key differences include:

- Data sources and freshness: Radford’s annual salary surveys rely on manual company submissions, meaning data is prone to error and often months out of date. Ravio pulls compensation data directly from company HRIS systems — eliminating human error and ensuring benchmarks are accurate, reflective of the current market.

- Data relevance: Radford’s large-enterprise focus means customers must sift through irrelevant data, with no filtering options. Ravio lets you filter by location, industry, company size, and stage, and maps your job levels to its framework during onboarding for true like-for-like comparisons.

- Compensation management features: Radford provides only static benchmarking data, while Ravio combines total rewards benchmarking with salary bands, and pay equity analysis, in a single system.

- Pricing: Radford charges upwards of £10,000 ($13,000 for survey datasets or consultancy projects. Ravio’s pricing, on the other hand, depends on your company size, selected modules, and market data needs. Roughly for a 500-person company, for example, pricing starts at £5,000 per year and includes real-time benchmarking data and selected compensation management features in one platform. You can always try out Ravio with 3 free benchmarks to see if our data is right for you.

- Ease of use: Radford’s platform is unintuitive compared to Ravio’s modern, intuitive interface, which users describe as ‘easy-to-use’, ‘user-friendly’, ‘intuitive’, and ‘easy to interpret’.

- Consultancy support: The only downside to Ravio versus Radford is that it doesn’t offer in-house consultancy projects as Radford does. However, Ravio customers get a dedicated customer success manager, ongoing educational workshops, and access to a partner network of compensation consultants with discounted rates for additional project work.

“Access to Ravio's live market data with amazing visualisations means no more headaches from delayed data sets or having to age compensation data, which has been a real friction point for us in the past.

VP of People at Mollie

2. Payscale

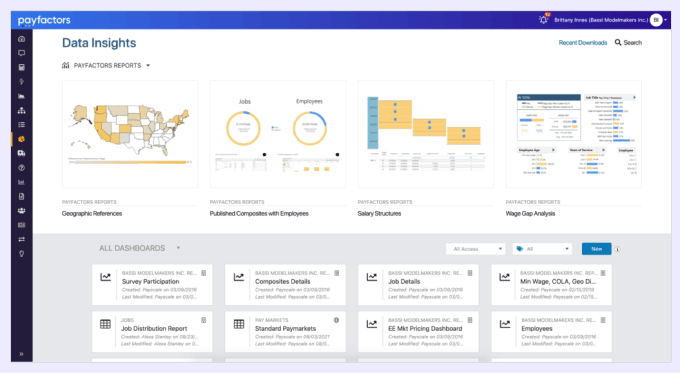

Payscale combines consulting services and aggregated benchmarking data with modern compensation management software — making it ideal for companies looking to consolidate multiple data sources and manage complex survey participation requirements in one platform.

Key features:

- Choose from three purpose-built products. Marketpay aggregates third-party survey data from providers like Radford and Mercer — pairing it with data analysis and survey participation management. Payfactors offers end-to-end compensation management combining benchmarking, salary band creation, pay equity analysis, and survey management. Lastly, Compensation Planning facilitates collaboration with line managers on compensation review and communicating salary adjustments to employees.

- Aggregate multiple compensation data sources in one platform. Access third-party surveys (e.g., Radford, Mercer), employer-reported HRIS data, and employee-reported data — available in Payfactors and as standalone dataset purchases.

- Streamline traditional survey participation and management. Use MarketPay’s templates and workflows to simplify submitting data to survey providers like Radford.

- Access compensation consultancy services. Work with Payscale’s experts on initiatives like job matching or benchmarking implementation.

Radford vs Payscale:

Payscale combines third-party benchmarking data, consultancy services, and modern compensation management software — offering a broader but more complex product mix than Radford’s in-house annual surveys and consultancy services.

Key differences include:

- Data sources and freshness: Payscale aggregates salary survey data from multiple traditional providers like Radford, as well as employee-submitted data, giving you broader data coverage than Radford’s single-survey model. As with Radford and other traditional survey providers though, this means the data is outdated and prone to errors from manual data collection. And because employee-submitted data is often inconsistent and inaccurate, it’s also an unreliable source.

- Platform scope: Payscale offers a broad range of options — standalone benchmarking datasets, consultancy services, and compensation management software. For companies seeking consultancy support alongside modern compensation management software, Payscale can be an integrated solution versus Radford’s consultancy services paired with an outdated, limited platform.

- Compensation management features: Payscale’s Marketpay gives you end-to-end compensation management capabilities, versus Radford’s platform, which supports basic data analysis.

- Pricing: Payscale offers three plans with additional options to separately purchase Marketpay to access its compensation management features. Because there’s no published pricing, it’s hard to draw parallels between Radford and Payscale’s costs.

- Ease of use: Payscale users frequently describe the platform as “smooth and easy to use” and “straightforward,” compared to Radford platform’s unintuitive interface.

Key features:

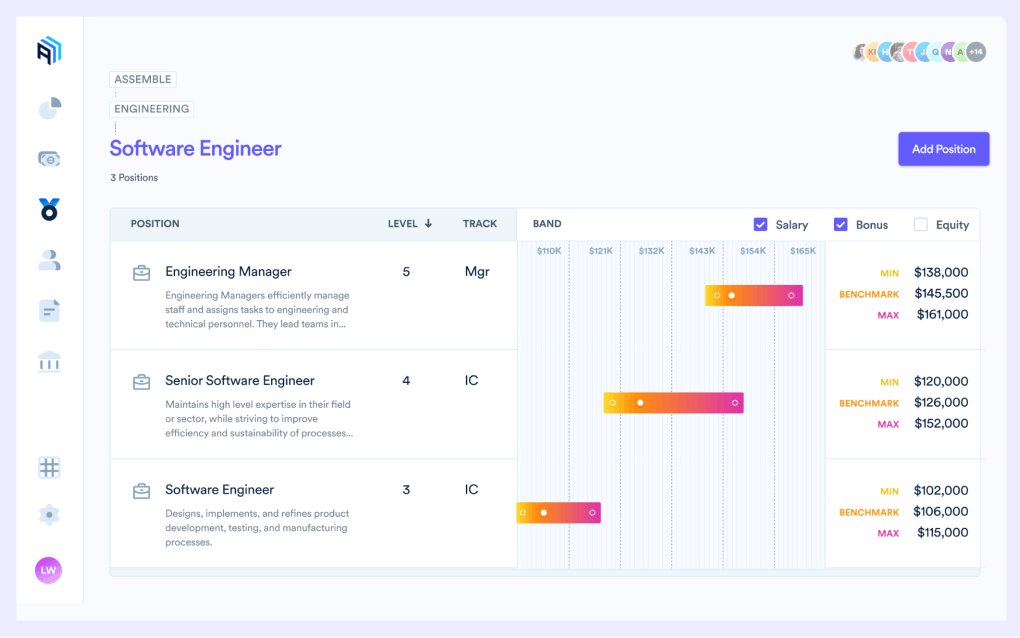

- Access third-party job offer benchmarking data. Assemble integrates with the US-based equity management platform Carta to give you equity compensation benchmarking for private companies. (Note: Salary benchmarking data is less mature in Carta as it’s relatively new to the space.)

- Plan, manage, and analyse compensation plans in one place. Build salary bands aligned with your job architecture and location-based pay strategy, compare to market benchmarking data, forecast adjustment costs, and assess your organisation’s ‘compensation health.’

- Improve pay transparency with an employee portal. Customise offer letters and give employees visibility into their total rewards package.

Radford vs Assemble

Assemble delivers an end-to-end compensation platform sourcing benchmarks via a private company equity provider, Carta, while Radford offers annual surveys for selling compensation data.

Key differences include:

- Data sources: Assemble sources benchmarks via an integration with Carta that excels in equity compensation benchmarking with a focus on privately held startups. But Carta is still relatively new to salary benchmarking — with only 40,000 datapoints compared to 450,000+ from dedicated compensation benchmarking companies like Ravio. In contrast, Radford’s salary benchmarks come from its annual surveys, offering broader coverage but with the same survey-model limitations.

- Platform scope: Assemble offers an end-to-end compensation solution, whereas Radford provides consultancy services and benchmarking data without any built-in management tools.

- Benchmark relevance: Assemble is primarily used by US-based biotech companies. It’s building its own dataset, “Compgrid,” but that will only cover biotech-specific benchmarks. Radford, in contrast, offers global coverage across legacy industries.

- Pricing: Assemble does not publish pricing information, making direct cost comparisons to Radford difficult.

- Ease of use: Users describe Assemble as “user-friendly” and “intuitive,” while Radford’s platform is often considered unintuitive and over-complicated.

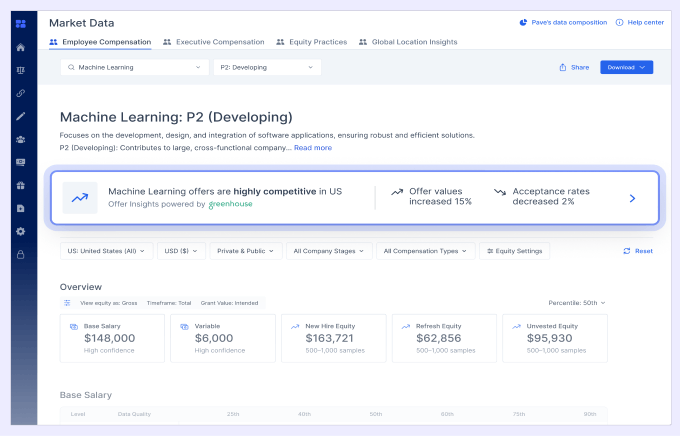

4. Pave

Pave is an end-to-end compensation management platform with real-time benchmarking via HRIS integrations — ideal for US-based tech startups and enterprises in the US and Canada.

Key features:

- Get high-quality compensation data in US and Canada. Pave sources 67% of its data from US and Canadian companies, and 14% from European organisations — making coverage strong for North American companies (but less ideal for US-based enterprises or European companies hiring globally).

- Access real-time salary benchmarking data and market data. Integrate Pave with your HRIS to deliver total rewards benchmarking data plus offer insights for early market signals. (Note: Equity/bonus data is limited outside core markets).

- Filter for relevant comparisons. Apply filters for company stage, location, and more with AI-defined job levels (by track, family, and number) available.

- Manage end-to-end compensation workflows. Create, analyse, and share salary bands, run merit cycles, and generate offer letters for new hires with Applicant Tracking System (ATS) integration.

Radford vs Pave:

Where Pave is a modern, US-focused platform that pairs live benchmarking with compensation management tools, Radford is a consultancy selling survey-based benchmarking data.

Key differences include:

- Data freshness: Pave connects to HRIS systems for live benchmarking and offer insights, keeping data current. Comparatively, Radford’s annual, manually submitted surveys are prone to error and often months out of date.

- Data coverage: Pave’s data is strongest for US roles; coverage is lighter outside the US. Radford gives you broad, global data.

- Benchmark relevance: Pave lets you filter by location, industry, company size, and stage to surface only relevant benchmarks. Radford’s large-enterprise focus leaves customers sifting through irrelevant roles with limited filtering

- Compensation management features: Pave bundles benchmarking with salary bands, pay equity, and review planning in one system, whereas Radford sells data and consulting.

- Pricing: Pave’s pricing isn’t public, but tiered packages are typically more cost-effective than Radford’s consultancy model, which runs in six figures.

- Ease of use: Pave users say its interface is “clean” and “easy to navigate,” but Radford platform is frequently described as unintuitive.

- Consultancy support: Pave doesn’t offer in-house consultancy projects; Radford does, which may suit organisations looking for one-off engagements.

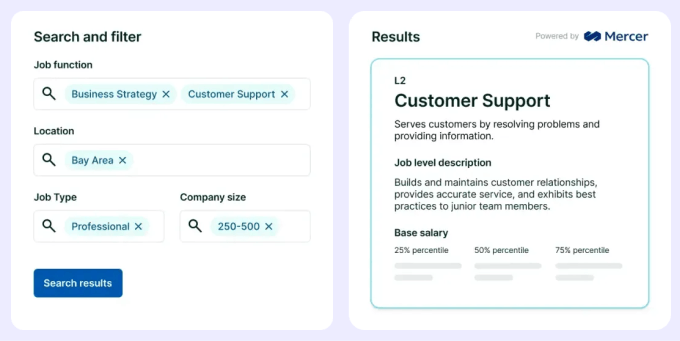

5. Lattice

Lattice is primarily a people management platform that has expanded to offer compensation benchmarking via Mercer, a Radford-like survey provider — ideal for mid-market teams that need basic total compensation coverage within a broader people platform.

Key features

- Access third-party compensation data via Mercer. Get data that’s comparable to Radford’s, as Mercer collects benchmarks from manually submitted, annual surveys.

- Build salary bands and manage merit cycles. Create, edit, and share bands, track budgets, and collaborate on adjustments.

- Unify data for a complete HR view. Combine Mercer benchmarks with employee performance data for comprehensive analysis; basic pay equity tools are included.

Radford vs Lattice:

Both Lattice and Radford give you salary benchmarking data — Lattice just offers it via a Mercer partnership, whereas, Radford offers proprietary survey data.

Key differences include:

- Data sources and freshness: Radford and Lattice both offer survey-based data (Radford’s own and Lattice’s via Mercer, a traditional consultancy providing survey data, similar to Radford). This means both their data comes with the same limitations — it's outdated, inaccurate, and often irrelevant to your organisation.

- Platform scope: Radford offers a wide breadth of consulting services across HR, whereas Lattice offers a full suite of HR tools, including performance reviews, employee engagement surveys, and compensation tools. So while both offer extensive solutions, their areas of focus vary — one leans on advising/strategy and the other on tooling.

- Compensation management features: Lattice offers more compensation management features than Radford but lacks the depth that other salary benchmarking tools like Ravio offer — as evidenced by Lattice’s reliance on third-party benchmarking data.

- Pricing: Lattice uses transparent per-seat pricing. $11 per seat/month for the HR platform, plus $6 per seat/month for compensation (with a $4,000 annual minimum). But Radford’s consultancy projects and survey access can each run into six figures.

- Ease of use: Lattice’s modern interface is an improvement over Radford’s dated platform, but users still report it as “not necessarily intuitive” and “limited in functionality.”

Lattice cons

- Broad HR provider with limited compensation management features. Whilst some companies may find benefit in the breadth of features offered by Lattice, it does mean that they have less in-depth expertise in compensation management – as made clear by their reliance on third-party benchmarking data from Mercer.

- Reliance on third-party compensation survey data. Lattice provides compensation benchmarking data through an integration with Mercer. Mercer is a traditional salary survey data provider, similar to Radford, and so has the same issue of relying on out-of-date data which is prone to error.

- Modern software but not always intuitive. Lattice is a modern software provider, which is a benefit compared to Radford. However, Lattice users report that the platform is ‘not necessarily intuitive’ and ‘limited in functionality’.

6. Compa

Compa (originally Compa Index) is an offers-based benchmarking tool — ideal for US enterprises in tech, life sciences, and retail that want to supplement traditional salary surveys with real-time offers data.

Key features:

- Get real-time offer and stock intelligence. Integrate with your HRIS and applicant tracking systems (ATS) to access offer-based salary and equity data. (Note: Compa focuses solely on job offer benchmarks, not full compensation management — salary bands, comp review, and pay equity features are limited.)

- Filter and track specific peer groups with AI insights. Narrow benchmarks to specific peer groups, get AI-driven recommendations for pay adjustments and offer guidance for competitive hiring.

- Streamline offers and recruiter collaboration. Use built-in workflows for offer approvals and skills-based analysis to price hard-to-fill or specialised roles.

Radford vs Compa:

Compared to Radford’s consultancy-led, survey-based benchmarking, Compa is a US-focused platform offering real-time offer data from ATS integrations though it lacks coverage for existing salaries and broader compensation management features.

Key differences include:

- Data sources and freshness: Compa pulls real-time insights from live offer data in ATS systems, giving you an up-to-date view of new-hire market trends — unlike Radford’s annual survey data. That said, offer data excludes existing employee salaries and is limited to high-volume roles that appear regularly in ATS systems, making it unreliable for accurate compensation benchmarking.

- Data coverage: Compa is still early stage with no public G2 reviews and a smaller dataset than Radford’s decades of accumulated benchmarks. Its US focus also means strong coverage for US roles only — limiting its value for companies hiring globally.

- Job levelling accuracy. Compa offers detailed role and level descriptions plus outlier detection to flag mismatches for more accurate benchmarking, whereas Radford provides no automated levelling or job matching support.

- Compensation management features: Compa focuses on ATS offer data with no additional compensation management features such as salary bands or pay equity analysis. Radford also only offers benchmarking data, but provides consultancy services separately.

- Pricing: Compa starts at ~£29,000 per year ($35,000 per year) for limited early-stage salary data with no public pricing available for the Compa Pro (all features) plan. Although not as costly as Radford (for its limited dataset), it is pricier than more mature compensation platforms that offer additional features.

- Ease of use: Founded by an ex-Mercer leader, Compa is built to overcome the downsides of old-school survey providers like Radford and Mercer. It’s designed for quick onboarding, letting you access benchmarking data in minutes instead of waiting on a yearly basis for Radford’s survey data.

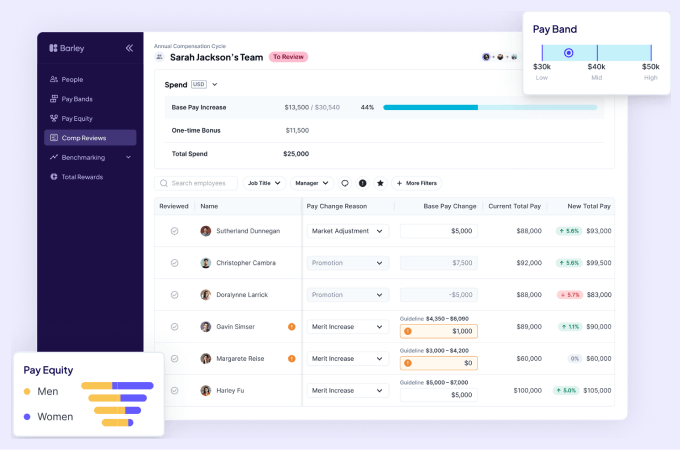

7. Barley

Barley is a compensation management platform using third-party benchmarking data from Mercer — ideal for small businesses in the US and Canada.

Key features:

- Access third-party compensation data. Barley partners with Mercer, a consultancy like Radford for salary benchmarking data, and also lets you import benchmarks from other providers.

- Plan and manage compensation reviews end-to-end. Build and edit salary bands, analyse pay equity gaps, set budgets, and run adjustments using a merit matrix approach.

- Collect candidate pay expectations to spot market shifts. Gather and report on salary expectations shared by job candidates as an additional source of pay trend data.

Radford vs Barley:

Where Radford is a consultancy offering annual salary survey data, Barley packages similar Mercer-sourced survey data into a modern, end-to-end compensation management platform.

Key differences include:

- Data sources and freshness: Barley’s benchmarking data comes from an integration with Mercer, which, like Radford, is a consultancy that relies on annual surveys prone to human error and outdated insights.

- Compensation management features: Barley combines third-party benchmarking with end-to-end compensation management features, while Radford sells static benchmarking data and consultancy services.

- Pricing: Barley doesn’t list pricing publicly but offers tiered packages based on features needed, with benchmarking and total rewards as add-ons. This likely makes it more cost-effective for companies seeking select features compared to Radford.

- Ease of use: Barley users share the platform is ‘intuitive’ and ‘easy to use’ — compared to Radford’s platform, which is known for being unintuitive and over-complicated.

8. Aeqium

Aequim is a compensation planning and management platform that relies on user-provided benchmarking data — ideal for companies that already have reliable compensation benchmarks and want tools to operationalise them.

Key features:

- Aggregate and use your own compensation data. Connect existing compensation datasets from surveys, industry databases, or other sources to power Aeqium’s planning workflows. (Note: Aeqium does not include any proprietary market data — users have to provide all benchmarks.)

- Manage full-cycle compensation planning. Create and update salary bands, model and approve compensation adjustments with manager guidance and scenarios, identify outliers, analyse pay equity, and generate custom reports.

- Provide interactive compensation transparency. Share interactive offer letters with new hires and give employees access to their total rewards statements through a self-serve portal.

Radford vs Aeqium:

While salary survey data is central to Radford’s offering, Aeqium is a compensation management platform that excludes benchmarking — relying on users to import their own data.

Key differences include:

- Data sources: Aeqium does not provide proprietary data — instead, it relies on customers to integrate external benchmarking sources they already use. Radford’s benchmarking data comes from its own annual salary surveys.

- Compensation management features: Aeqium offers a broad set of tools for managing compensation strategy, salary reviews, pay equity analysis, and related workflows. However, it lacks Radford’s core strengths: proprietary benchmarking data and consultancy services.

- Pricing: Aeqium doesn’t publish pricing, but offers tiered packages based on selected features. For companies sourcing benchmarking data separately, this setup can offer flexibility — but total costs will also depend on the price of external data providers you use. This can be more cost-effective than Radford for companies that already have benchmarking data in place.

- Ease of use: Aeqium’s users say it has a “great UX” and is “super intuitive,” in contrast to Radford’s platform, which users often describe as unintuitive and complex.

9. CompAnalyst by Salary.com

CompAnalyst is a compensation management platform by Salary.com that offers aggregated data from third-party compensation survey providers — ideal for US-based enterprises with complex compensation structures and the internal resources to manage implementation, rollouts, and training.

Key features:

- Access third-party survey data with AI-powered gap-filling. Benchmark using data from multiple compensation survey providers, fill gaps with AI insights, and manage survey participation in the platform.

- Manage compensation planning from setup to communication. Build and edit salary bands, identify pay equity issues, model performance-based increases, and create total compensation statements to share changes transparently.

- Forecast labour costs for headcount planning. Model and predict labour expenses to assess the financial impact of hiring, role changes, or restructuring.

Radford vs CompAnalyst:

Radford delivers global salary survey data and consultancy services. CompAnalyst combines aggregated survey data from multiple providers like Radford, with a full suite of compensation management tools.

Key differences include:

- Data sources and freshness: CompAnalyst aggregates compensation survey data from providers like Radford, Mercer, and Willis Towers Watson. While this gives you multiple sources in one platform (vs. a single provider with Radford), it still inherits the same limitations of traditional survey data — static, outdated, and prone to errors from manual collection.

- Benchmark relevance: CompAnalyst’s data coverage is strongest in the US, making it a good fit for large US-based companies — but less relevant for organisations with a global workforce. Radford, by contrast, provides broader international benchmarking data from legacy companies.

- Compensation management features: In addition to aggregated survey data, CompAnalyst offers an end-to-end compensation management platform. Radford, by contrast, focuses on selling static benchmarking data and consultancy services only.

- Pricing: CompAnalyst does not disclose pricing publicly. User reviews cite the product as expensive and note that contracts can be difficult to cancel once signed.

- Platform scope and ease of use: CompAnalyst’s multitude of compensation offerings lets you do so much that users say navigating the many modules can feel like “a bit of a maze.” In direct contrast, Radford’s platform swings the other way — limiting you to viewing and analysing data, while also being unintuitive.

10. Brightmine

Like Radford, Brightmine (formerly XpertHR and Cendex) is a consultancy conducting surveys to gather compensation data — but focused on the UK market, making it ideal for companies seeking UK-specific compensation benchmarks only.

Key features:

- Access UK-focused total rewards benchmarks and workplace insights. Get salary, variable pay, and benefits data, plus workplace insights like absences and performance management — either via Brightmine’s Compensation Planning portal or as raw survey data.

- Analyse and address pay equity gaps. Use Brightmine’s analytics tools to identify the root causes of pay disparities.

- Leverage consultancy support for HR and Rewards projects. Work with Brightmine’s consultants on initiatives ranging from compensation strategy to employment law compliance.

Radford vs Brightmine:

Both Radford and Brightmine are consultancy-led, survey-based providers — Radford’s salary benchmarks are global, while Brightmine’s are UK-focused.

Key differences include:

- Data source: Brightmine’s dataset is heavily UK-focused, with data from over 1.5 million employees across 26 functions. While this makes it highly relevant for UK-based companies, its limited tech-role coverage means it’s less useful for global tech companies. Radford, in contrast, provides broader global coverage.

- Compensation management features: Like Radford, Brightmine’s focus is on benchmarking data and consultancy projects rather than end-to-end compensation management. Neither offers the depth of compensation management tools found in other modern platforms like Ravio.

- Pricing: Brightmine’s pricing is custom, with no published estimates available, so there’s no way to know how the costs of Radford and Brightmine surveys compare.

- Ease of use: Both Radford and Brightmine are consultancies-first, with online platforms for accessing benchmarking data. Brightmine puts more emphasis on tooling, which could make it more user-friendly than Radford’s.

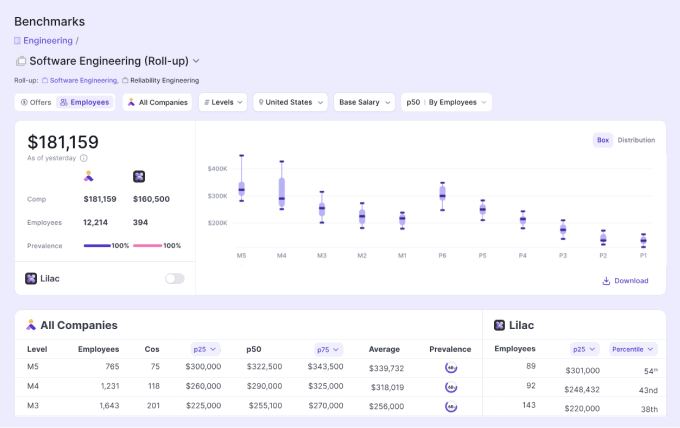

11. Alternative consultancy providers: Mercer, Willis Towers Watson, Korn Ferry

In addition to the compensation management software we’ve explored, there are also other Radford alternatives in the form of traditional HR consultancy providers.

The three main consultancy provider Radford alternatives are:

All of them offer essentially the same services as Radford – compensation consultancy for the design and implementation of strategic projects, and benchmarking data via compensation surveys (delivered through spreadsheets or online platforms e.g. Korn Ferry Pay).

They, therefore, also have very similar upsides (brand trust, large global dataset, consultancy services) and limitations (inaccurate and outdated data, complex taxonomies, expensive, limited features) to Radford.

*All information in this article is based on the most up-to-date information available at the time of publication, sourced from the websites of all companies included.

How to choose the best Radford alternative for your needs?

When choosing an alternative to Radford compensation, consider the following internal factors:

- Team size and complexity. How large is your HR/Rewards team, and how many stakeholders will need access? Match the tool’s permissions and workflows to your team’s structure.

- Geographic footprint. Are you benchmarking for one country, multiple regions, or globally distributed teams? Choose a provider with data strength in your target regions.

- Hiring speed, scale, and role types. Are you filling niche senior roles or hiring in volume? Select a platform that can handle your pace and role diversity.

- Compensation program maturity. Do you already have salary bands and review processes in place, or are you starting from scratch? Look for tools that fit your stage.

- Budget. What can you allocate to accessing and managing compensation data? Balance the cost of data reliability, coverage, and platform features against expected ROI.

- Internal compensation expertise. Can your team interpret raw survey data, or will you need consultancy support? Either way, select a provider with proactive customer support and automated job mapping to reduce manual work on your plate.

- Current benchmarking data sources. Are you using surveys already? Decide whether to integrate them in a benchmarking tool for vast coverage, replace them entirely, or pair using a traditional survey provider with a real-time benchmarking tool like Bolt did.

- Integration readiness. Is your HRIS clean and up to date? Does it integrate with the software you’re reviewing? Confirm compatibility before shortlisting.

Once you’ve evaluated your organisational needs, consider the following external factors:

- Data provider’s market coverage and reputation. How established is the vendor in your target regions or industries? Do other companies in your sector trust their data? Look for customer references in your sector.

- Update frequency of benchmarks. Is the data refreshed quarterly, monthly, or in real time? How does that compare to Radford’s cadence? Compare cadence against your hiring and review cycles.

- Vendor stability and roadmap. Is the provider financially stable and investing in product development? Are they introducing new features that align with your future needs?

- Customer support quality. How responsive and knowledgeable is their team? Do they offer dedicated account managers or compensation consultants?

- Compliance track record. Is the provider GDPR/SOC 2 certified? Review their data privacy processes and incident response.

- Ease of switching. How easy will it be to import/export your data if you change tools in the future?

So is Radford still the best compensation benchmarking option?

In most cases today, Radford is no longer the best choice for compensation benchmarking and management.

While it’s a trusted brand that many stakeholders know, its survey data can be inaccurate, heavily manual to manage, and outdated by the time it reaches you. Not to mention, it barely offers any built-in compensation management tools to put all the benchmarking data to use.

Today, Radford alternatives like Ravio and other providers make up for traditional salary survey data shortcomings — offering accurate, up-to-date benchmarks combined with full compensation management platforms.

💡Why not combine Radford and Ravio for the strongest data coverage

Traditional salary survey providers like Radford have been a trusted salary data source for a long time and so have built up a large and broad set of data.

But, as we've seen, they tend to lag behind the market – the nature of salary surveys means that it takes a while to compile survey responses and turn them into benchmarking data – which can especially be a challenge for tech companies who need to stay on top of market trends and emerging roles.

Real-time providers like Ravio provide a solution to this.

It's therefore becoming common for companies to use multiple salary data providers to validate the data, and ensure up-to-date data is available as and when it's needed.

Plus, different providers have different focuses in terms of locations, industries, company sizes, and so on. A traditional HR consultancy like Radford will have strong data for legacy industries and large enterprises, whereas a tool like Ravio is much stronger for the tech industry.l

That's exactly why Bolt chose to add Ravio as a salary data source, on top of their existing salary survey provider.

FAQs

How much does the Radford survey cost?

Although Radford doesn’t publish its survey pricing, users report Radford survey costs go upwards of £10,000 (over $13,000), with each country adding an additional layer of cost.

What is the best salary benchmarking tool?

The best salary benchmarking tool meets your organisational needs — integrating with your HRIS systems and offering real-time salary and total rewards data. It should also offer strong data coverage tailored to your needs, whether that’s regional benchmarks or global market data, depending on your team’s structure and hiring footprint.

What are the disadvantages of salary surveys?

Because salary surveys are typically updated only once or twice a year and rely on manual submissions, their data is often outdated and prone to human error. They also tend to source information from large, legacy companies that may not match your size, stage, or region — making them a risky foundation for high-stakes compensation decisions in today’s fast-moving talent market.

Is Radford part of Aon?

Yes, Radford is the HR arm of Aon, a global consultancy firm. Aon offers three main compensation management services: compensation consulting, benchmarking data based on annual salary surveys, and market practice studies.

What is the alternative to Radford?

Ravio, Pave, and Assemble are strong real-time benchmarking alternatives to Radford. Other options include consultancy providers like Mercer, Willis Towers Watson, and Korn Ferry, as well as platforms like Aeqium and Payscale that aggregate data from multiple salary survey providers.