- How to access salary benchmarking data

- Option 1: Real-time salary benchmarking tools

- Option 2: Salary survey data from HR consultancies

- Option 3: Employee-reported salary data

- The best salary benchmarking tools for 2026

- How to select a salary benchmarking tool

- Why is Ravio the best salary benchmarking tool on the market?

- FAQs:

Because accurate, up-to-date salary benchmarking data is critical for offering fair, market-competitive pay, choosing the right data source is essential.

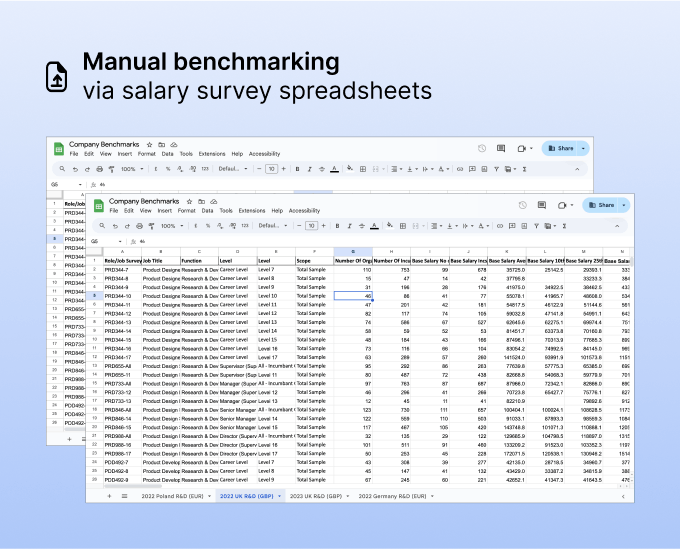

Historically, annual salary surveys from consultancies like Radford were the default source for this data. But their manual data access and submission processes made them both hard to use and prone to inaccuracies.

Then there’s benchmarking data from employee-reported salary platforms like Glassdoor or Michael Page. But those, too, offer highly unreliable data that’s unfit for effective compensation planning.

This is where salary benchmarking tools come in.

Salary benchmarking tools like Ravio are specifically designed to solve these problems, with reliable, relevant, real-time compensation data — hosted in a user-friendly platform.

So in this guide, we’ll help you:

- Compare the pros and cons of salary benchmarking data options

- Review the best compensation benchmarking software in 2026

- Understand how to find the right salary benchmarking tool for your company.

How to access salary benchmarking data

There are three main data sources that People and Reward Leaders rely on for salary benchmarking, and some are (much) more reliable than the others:

- Real-time salary benchmarking tools

- Salary surveys from HR consultancies

- Employee-reported data and job adverts

Here’s a brief overview of how these sources compare with a detailed breakdown of each factor below:

Salary surveys e.g. Radford | User-reported data e.g. Glassdoor | Real-time salary benchmarking tools e.g. Ravio | |

|---|---|---|---|

Salary benchmarking data delivery | Benchmarks delivered in a spreadsheet. Some providers offer data online, but limited software capabilities. | Salary range via job adverts or online salary checker tools. | External benchmarks and internal salary data accessible 24/7 via a software platform. |

Salary benchmarking data recency | Point-in-time salary data gathered via salary surveys conducted annually. | Unknown for job adverts. Average from all submissions for Glassdoor. | Real-time salary data, constantly updated via HRIS integrations. |

Salary benchmarking data accuracy and reliability | Risk of human error due to manual salary survey submissions. | Highly unreliable due to lack of context and verification. | Highly accurate, no risk of human error due to integrations that pull salary data directly from HRIS integrations. |

Salary benchmarking data pool relevance | Broad global data pool, but skewed to large legacy organisations. | A data pool of one for job adverts, and an amalgamation of unknown companies for Glassdoor. | Typically targeted data pools e.g.Ravio and Pave both offer global data but Ravio is strongest in Europe and Pave in the US. |

Job role and level mapping | Manual mapping and a highly complex job library with thousands of job roles and levels to contend with. | Basic descriptions of the job role and level only, no mapping. | Automated job mapping against the provider’s framework, ensuring like-for-like comparisons. |

Compensation management software capabilities | Piecemeal solution: salary survey data, standalone tools e.g. salary bands, consultancy projects. | None. | Typically offer additional compensation tools, powered by the benchmarking data. |

Option 1: Real-time salary benchmarking tools

Having up-to-date salary benchmarking data is essential to ensure your employees’ pay stays fair and competitive — especially given how fast-paced the talent market is in 2026. That’s why real-time benchmarking platforms aren’t just an ‘option’ but, rather, the smart choice.

Dedicated, software-first compensation benchmarking companies like Ravio gather employee salary data directly from the source by integrating with company HRIS systems — automatically updating benchmarks to reflect any changes and ensuring real-time alignment with market changes.

Pros

- Always up-to-date. Because salary benchmarking tools integrate with your HRIS system, they automatically reflect any new hires or salary changes in your benchmarks — keeping them up-to-date.

- Fewer errors and more accuracy. Salary compensation tools automatically pull data directly from your HRIS, eliminating the need for manual work and, therefore, reducing the risk of human error in your benchmarking process.

- Highly relevant to your company. Most platforms offer filters like location, industry, headcount, and company stage — allowing you to benchmark against peers that actually match your organisation .

Note: Different providers have varying coverage for different industries, geographic regions, and company sizes, so it's vital to confirm the data matches your company's needs before committing. See if Ravio covers your roles, regions, or sector.

- Easy comparison of internal and external data. Compensation benchmarking tools often combine external salary benchmarks with your internal employee data — making it simple to compare existing salaries or bands to the live market and adjust accordingly, all within the platform.

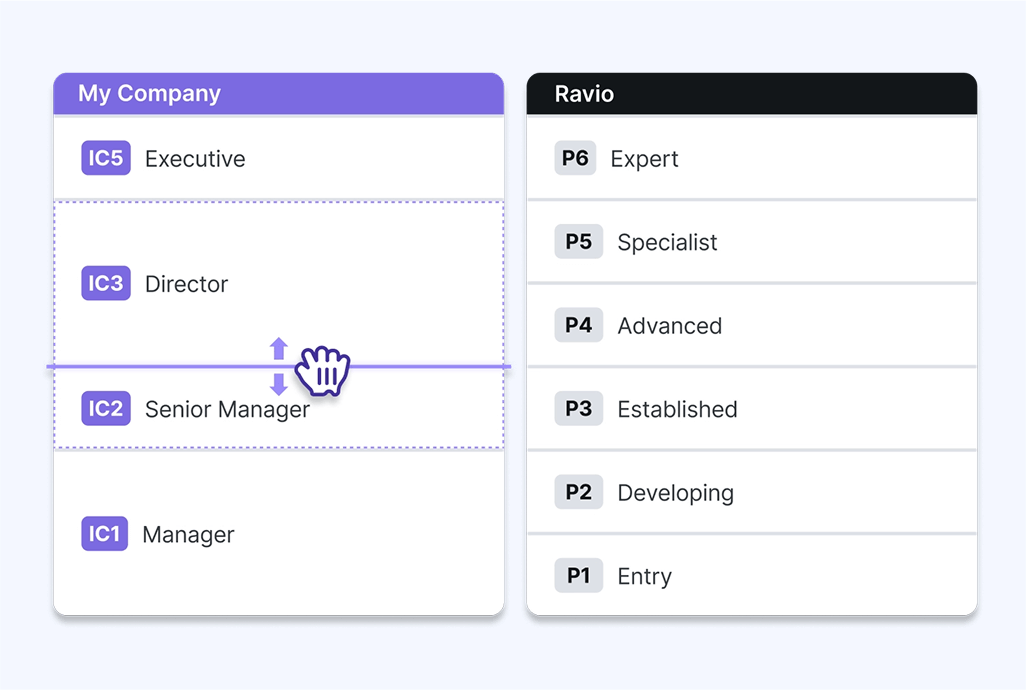

- Consistent, automated role mapping. Most tools automatically map your employees to platform-specific job levels and roles. This ensures you get consistent, like-for-like benchmarks without needing to do the heavy lifting. (Each provider does this differently, so always check how it works.)

- Access benchmarks instantly. Once you’re onboarded (usually in days), you can access live salary benchmarks at any time — no waiting for survey cycles. Most platforms also let you invite hiring managers or other stakeholders to view the data directly.

- Easy-to-use interface. Benchmarking tools replace clunky spreadsheets with clean, intuitive interfaces so People Teams can browse, filter, and share data without digging through tabs.

- Additional compensation tools included. Beyond benchmarking, salary compensation platforms often come with additional features such as building salary bands, analysing pay equity, or running a pay review — making it easier to use the salary data effectively.

Cons

- Legacy survey providers still hold a strong reputation. Established consultancies like Radford and Mercer have large (though broad) datasets and trusted brands, making leadership buy-in easier. Unlike real-time salary benchmarking tools, they also offer consultancy services — valuable for some organisations depending on their needs.

- Choosing the right tool is crucial. Platforms vary by region, industry, and role coverage, as well as data relevance and usability. Evaluate your shortlisted platforms' data sources, update frequency, and user experience to find the best fit for your company (more on this below).

Option 2: Salary survey data from HR consultancies

Several HR consultancies run large-scale salary surveys by inviting companies to submit their employee compensation data. That data is then aggregated and packaged into benchmarks you can purchase.

Common salary survey providers include:

- Radford

- Mercer

- Willis Towers Watson

- Korn Ferry

- Culpepper

- Salary.com

- Empsight

- Altura

- Brightmine (including XpertHR, Cendex)

Today, there are also several HRIS tools which partner with Mercer Comptryx to provide static third-party salary survey data (HiBob, Lattice, Leapsome) – but the issues remain the same.

They’re credible but slow. And since surveys are typically run once or twice a year, the data is often months old by the time you receive it.

Pros

- Credibility and easy leadership buy-in. Consultancies putting together salary surveys are traditionally well-known in the HR space and often seen as trusted sources, which can help you with budget approvals.

- Established data pool with broad participation. Longstanding pool of survey participants gives these providers access to vast datasets across multiple geographies and industries.

Cons

- Outdated salary data. Salary surveys run once or twice a year, taking consultancies months to collect, aggregate, and deliver requested datasets. This makes salary survey data basically a snapshot from a few months ago — and one that takes months before it’s refreshed again.

- Error-prone data due to manual submissions. Salary surveys rely on companies submitting employee compensation data manually. Not only is this a time-consuming process for People Teams, it also exposes the data to human error, reducing its accuracy.

- Hard to compare with relevant companies. Most survey data is based on a broad data pool, often skewing toward large, global enterprise companies like manufacturing and oil and gas. This makes the insights irrelevant to fast-moving companies like high-growth tech scale-ups.

Note: It’s usually possible to purchase an industry-specific (or specific peer group) cut of the data at an additional cost. But that results in a much smaller data pool, reducing reliability.

- Difficult to use. Survey results usually come in dense spreadsheets with poor UX — unless you pay for portals like The Radford Data & Analytics Platform or Brightmine’s portal. But since these platforms are built by consultancies as secondary products, their clunky interfaces often feel just as outdated and hard to use.

- No way to compare to your internal salaries. Salary surveys require you to manually match benchmarks to your internal salaries (often in highly complex spreadsheets) — something modern platforms do automatically.

- Inaccurate job matching. Salary surveys work on a give-to-get model, meaning organisations submit their data based on predefined job roles and levels. Because it’s all manual, errors and inconsistencies are pretty much unavoidable. Plus, with so many roles and levels involved, People Teams often struggle to match survey categories to their internal job frameworks.

Option 3: Employee-reported salary data

There are two main ways companies can access employee-reported salary data:

- Crowdsourced salary info from sites like Glassdoor

- Salary ranges listed by other companies in job adverts on platforms like Indeed

Let’s break them down:

Glassdoor and other self-reported salary sources

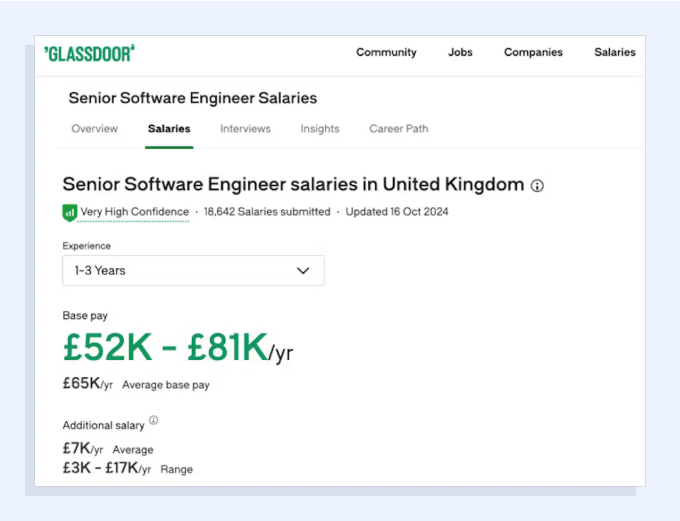

Glassdoor collects salary data directly from users who anonymously submit their job title, salary, location, and other details. This data is then aggregated to produce the Glassdoor salary index that provides a salary range per role.

Other industry-specific sources also exist. For example, content marketing community, Superpath, publishes an annual salary report for content marketers via a survey.

While these tools are primarily built for individuals to assess their own compensation, some People and Reward teams still turn to them when formal data sources aren’t available for niche or emerging roles.

Glassdoor's salary index

Salary benchmarking with job adverts on LinkedIn and Indeed

Many companies now include salary ranges on their job postings — especially with the rise of pay transparency regulations like the EU Pay Transparency Directive.

Some teams manually review these listings on LinkedIn or Indeed to gauge market rates.

Job adverts on LinkedIn

Job boards like Michael Page, Reed, and Indeed also aggregate data from job adverts into free salary checker tools.

Michael Page's salary benchmarking tool

Pros

- Free and easy to access. Anyone can set up a free account and browse these platforms.

- Helpful when there’s no budget or buy-in. For teams that don’t have stakeholder support for salary benchmarking tools (yet), user-reported salary sources can feel like an accessible starting point.

Cons

For Glassdoor salary benchmarking:

- Unverified and inconsistent self-reported data. Anyone can submit salary information and there’s no verification. Even when submissions are honest, the way they’re reported varies. For example, some sales execs share base salary, others add their On-Target Earnings (OTE) too.

- Outdated averages. Glassdoor uses simple averages (not a best practice for benchmarking, since outliers skew results), and includes salaries from many years ago with no date filters — so the “current” rate may be anything but.

- No way to filter by company type or size. Glassdoor’s data pool spans all industries and company sizes, but there’s no way to filter for your specific company profile — making accurate, like-for-like comparisons difficult.

For job advert data:

- Small sample size. Most teams manually review a handful of roles, which isn’t statistically useful or representative of the market.

- Large salary ranges that span multiple levels. Many job ads list broad ranges (e.g. $50k–$90k) because they’re open to hiring at different levels — from junior to senior. That makes it hard to benchmark compensation for a specific job level.

- No context behind the numbers. Compensation structures vary across companies in how they balance base pay, equity, benefits, and bonus. Job adverts don’t give this context and without it, it’s hard to understand what a salary range actually reflects.

![“[Using Glassdoor] created frustrations with line managers. They didn’t trust the data, which made it difficult for us to discuss what people’s pay should be. Were we paying the right amount to people, or

were we way off in the market?” - Maartje Koopman, Head of People and Culture at Tiqets](https://images.prismic.io/ravio/Z1cmxJbqstJ98O_Y_MaartjeKoopmanTiqets%E2%80%93quoteonGlassdoor.png?auto=format,compress)

The best salary benchmarking tools for 2026

Because they continuously update benchmarks with real-time employee data and market insights, salary benchmarking tools provide the most accurate and up-to-date salary information.

That said, there are several benchmarking software providers you can choose from — each with different strengths, features, and global vs regional data coverage.

Let’s review them next:

1. Ravio

Best for high-growth tech companies (especially those with a large presence in Europe).

Key features:

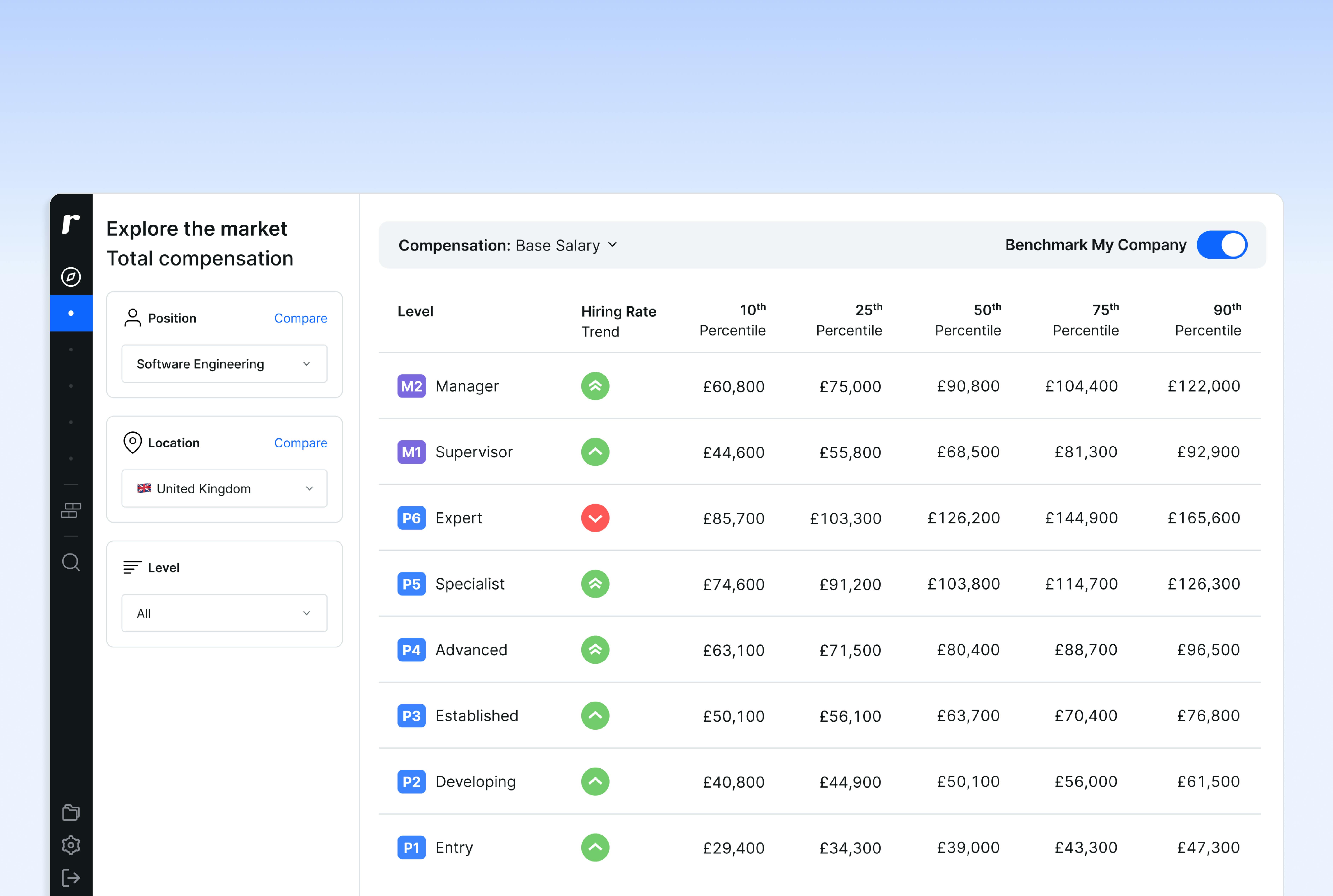

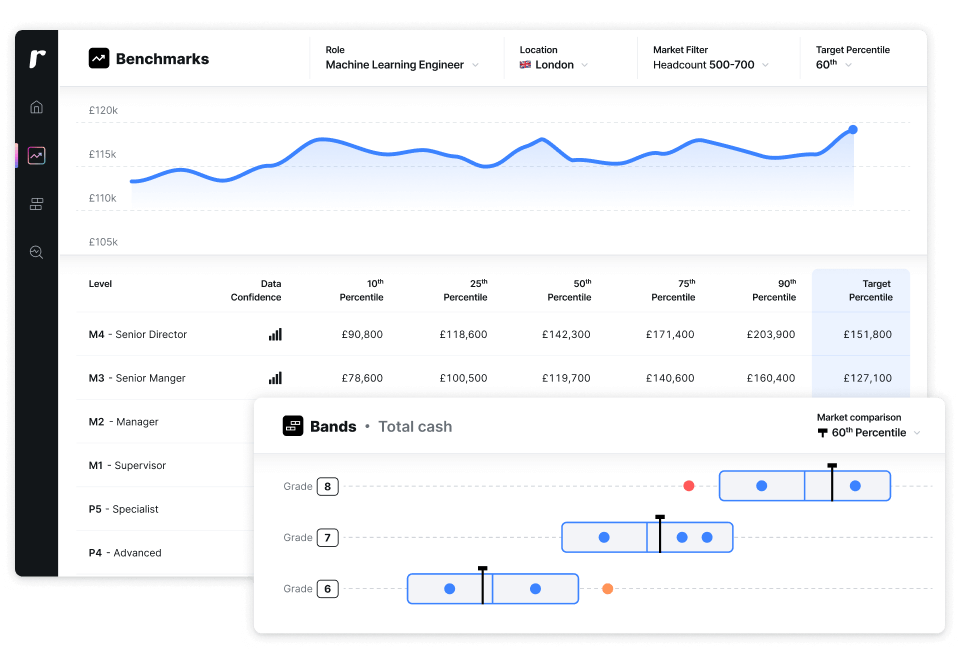

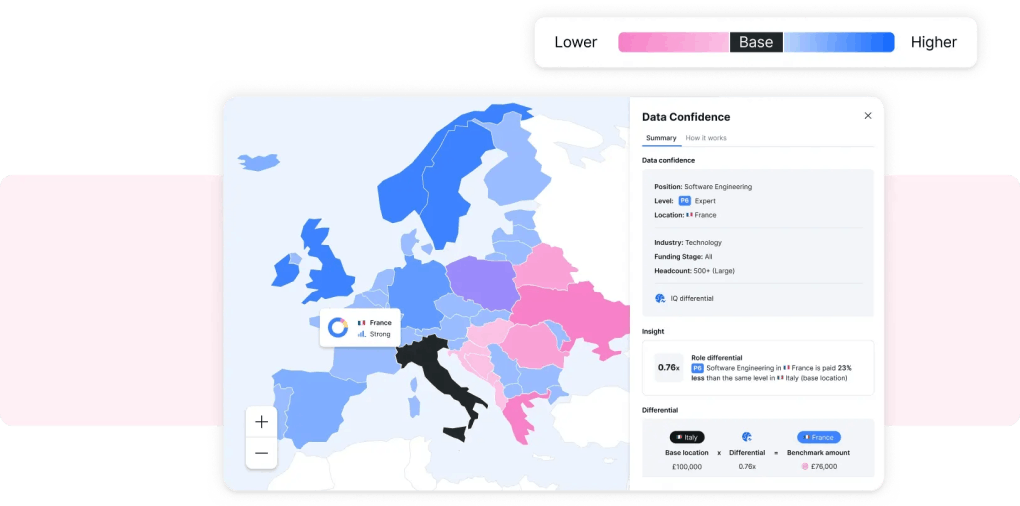

- Compensation data from over 1,400 companies contributing to Ravio’s compensation database, with benchmarks available for over 50 countries and 100+ roles.

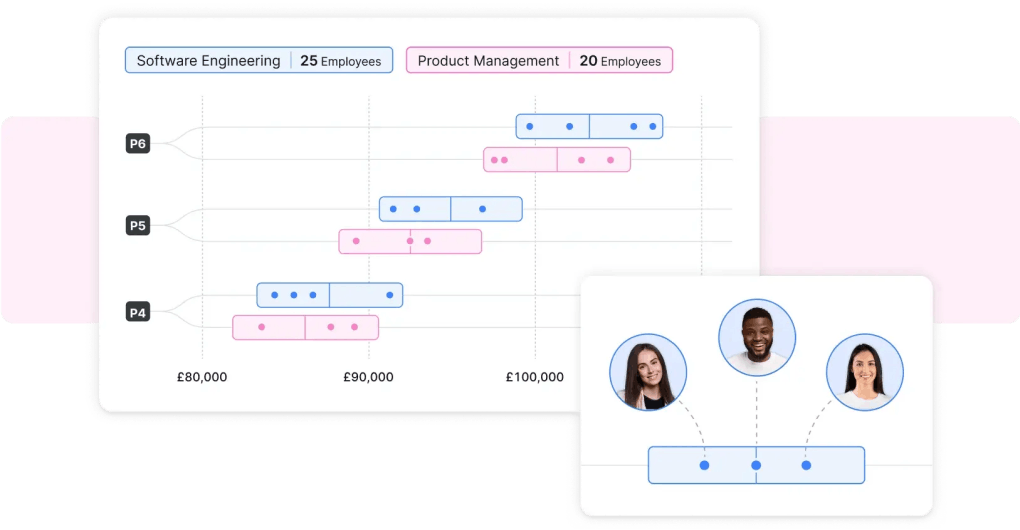

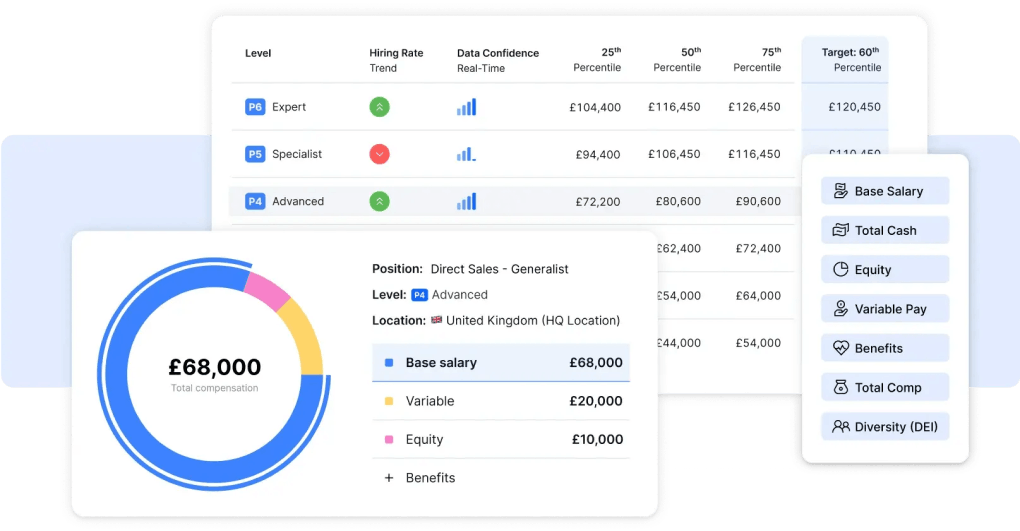

- Real-time salary and total rewards benchmarking covering base salary, variable pay, equity, and employee benefits.

- Verified data reviewed by data scientists for accuracy and consistency across industries and roles.

- Advanced filters for location, industry (e.g. fintech salaries vs overall tech), headcount, company size, and funding stage to ensure relevant benchmarking pools.

- Automated job matching to Ravio’s level framework for consistent, like-for-like comparisons.

- Compensation management features including salary bands, and pay equity analysis.

- Easy to use, with secure integrations to 100+ HRIS systems.

Compared to other modern salary benchmarking tools, Ravio offers the optimal mix of reliable data, comprehensive compensation management tooling, user-friendly technology, and expert support on hand to help — you can also find a detailed breakdown below.

2. Pave

Ideal for US-based tech startups and enterprises needing high-quality compensation data in the US, Canada, and the UK.

Key features:

- Real-time salary benchmarking data via give-to-get model.

- Covers base salary, equity, and variable pay (note: limited equity/bonus data outside core markets).

- AI-defined job levels (by track, family, and number).

- End-to-end compensation planning tools with built-in budgeting, forecasting, and approval workflows.

- Clean UI with integrations to 18 HRIS systems.

Unlike Ravio, Pave sources 67% of its data from US and Canadian companies, and only 14% from European organisations — making it less ideal for US-based enterprises or European companies hiring globally.

3. Figures

Ideal for mid-sized European companies looking for compensation data aligned with EU Pay Transparency Directive compliance.

Key features:

- Salary benchmarks via HRIS integrations, Excel uploads, and Mercer partnership data.

- Daily data collection with monthly benchmark updates. Third-party Mercer survey data is updated quarterly.

- Covers base salary and variable pay benchmarks (no equity data included).

- Advanced filters including industry, headcount, location, and funding stage.

- AI-powered data modeling to fill gaps in smaller markets.

- Prebuilt salary band templates for companies building their first compensation framework with granular role breakdowns and visible datapoint counts per benchmark — ideal for small teams starting from scratch.

Compared to Ravio, Figures doesn't offer benchmarking data across the total compensation package. Data coverage is limited to base salary and variable pay, with no equity or benefits benchmarking.

Companies requiring broader data coverage may need to purchase additional access to Mercer's third-party survey data.

4. Compa

Ideal for US enterprises that need an offers-based benchmarking tool to supplement traditional salary surveys — especially in tech, life sciences, and retail.

Key features:

- Real-time compensation benchmarks, including new hire data sourced from job offers via ATS integrations.

- Bi-weekly syncs keep benchmarks current, based on real hiring activity.

- AI-powered recommendations for comp adjustments and offer guidance.

- Built-in workflows for offer approvals and recruiter collaboration.

- Skills-based analysis for hard-to-price, specialised roles.

Unlike Ravio, Pave, and Figures, Compa focuses solely on offers-based benchmarking and market intelligence — not full compensation management.

Salary bands, comp review, and pay equity features are also limited.

As a result, Compa doesn’t support the compensation workflows needed to scale efficiently. You’ll still need to run compensation reviews and manage salary bands manually — often in spreadsheets.

5. CompUp

Ideal for India-based startups, mid-market companies, and service firms running structured compensation reviews or merit cycles.

Key features:

- Real-time compensation benchmarks via automated HR/payroll integrations in India.

- Live market data sourced from 250+ Indian startups contributing active data.

- Peer-basket filters to benchmark against Indian startups by stage, size, and industry (no advanced segmentation by custom cohorts or funding stage).

- Simulate budgets, tie pay to performance ratings, and run automated merit cycles without spreadsheets.

- Route pay decisions through proper approval chains and generate Total Rewards Statements to communicate employees’ salary, bonus, and benefits

Unlike Ravio and other salary benchmarking tools, CompUp’s benchmarks are tailored exclusively to the Indian startup ecosystem.

It’s a strong fit for Indian startups running structured reviews. But its limited industry scope means benchmarks can be unreliable for niche, senior, or globally distributed roles.

6. Carta Total Comp

Ideal for VC-backed, US-based private companies already using Carta’s cap table platform to manage ownership and equity.

Key features:

- Real-time salary and equity benchmarks sourced from Carta’s proprietary dataset of private-market companies.

- 100+ HRIS integrations to automatically sync compensation, job level, and employee data.

- Integrated cap table data to track and forecast ownership, vesting schedules, and share allotments.

- Scenario planning tools to model equity dilution, ownership impact, and compensation runway.

- Structured workflows to plan, model, and approve salary and equity offers — with full audit support.

- Clean UI and simple plug-and-play setup if you’re already using Carta.

Carta is primarily a cap table management platform, so equity benchmarking is its strength, while salary data is less robust. And because it works only with privately held startups, its benchmarks aren’t relevant for public companies.

Compared to Pave’s broader US market coverage, Carta’s focus is only on companies already using its platform — offering tighter integration between compensation planning and real-time ownership data.

But like Pave, Carta’s global benchmarks, while available, aren’t as robust in European or international markets, making Ravio a stronger choice for teams hiring globally.

7. Assemble (acquired by Deel)

Best for US-based companies looking for a benchmarking platform that can incorporate multiple sources, especially biotech firms.

Key features:

- Specialised biotech and life sciences compensation datasets alongside Carta’s proprietary private-market data.

- Import and combine compensation data from multiple sources via manual uploads and mapping.

- Customised workflows for compensation planning and approvals.

- HRIS and Carta’s Cap Table integrations.

- Comprehensive compensation features including salary bands, structured compensation reviews, and offer letter generation.

Unlike other salary benchmarking tools covered so far, Assemble does not collect pay data directly from customers. Instead, it relies on manual data uploads and mapping, requiring users to manage and combine multiple compensation datasets themselves.

While this approach offers flexibility for companies looking to incorporate diverse data sources, including specialised biotech datasets, it also means more manual work compared to platforms like Ravio that automatically embed proprietary benchmark data.

8. Compensation IQ by Qlearsite

Best for public sector organisations, charities, and nonprofit entities across Europe with a strong presence in the UK.

Key features:

- Combines data from manual uploads, third-party partnership with Mercer, and salary ranges shared in job postings via its partnership with Lightcast (no owned proprietary data).

- HRIS integrations to compare your internal salaries with the external data (not to build a real-time dataset).

- AI-powered automated job mapping to standardise benchmarking.

- Customisable dashboards highlighting compensation metrics, trends, and areas of concern.

- User-friendly interface designed for quick access.

Compared to Ravio’s real-time benchmarking data for tech companies, Compensation IQ relies on third-party Mercer data from infrequent salary surveys.

It also pulls from self-reported sources like Glassdoor, which are unverified, inconsistent, and can be skewed by outdated data or missing context such as company size, type, or how pay is structured — making the data irrelevant to tech companies.

In addition to these leading compensation benchmarking tools, there are also other HR platforms that offer third-party compensation benchmarking data. These include:

- Lattice

- HiBob

- Leapsome

- Barley

- Comprehensive

- Zendesk

With all these options, how can you decide which is right for your company? Let’s show you how next.

Note: All information shared in this guide is based on the most up-to-date information available at the time of publication — sourced from websites of all companies included and third-party platforms like G2.

How to select a salary benchmarking tool

Look for the following factors when evaluating a salary benchmarking software for your company:

Up-to-date data for market-aligned compensation decisions

Prioritise salary benchmarking tools that own their compensation dataset and refresh benchmarks regularly — ideally through live integrations with your HRIS, ATS, or cap table systems. That way, you’re acting on what’s happening now, not six months ago.

In fact, in fast-moving markets, stale benchmarks can mean misaligned pay ranges — risking candidate drop-off or costly overcompensation. People and Rewards teams, therefore, need fresh, current data to adjust pay bands, make offers, and justify decisions with confidence.

Also, be mindful of certain HR platforms that rely on third-party salary data. These often source insights from salary surveys run by consultancies like Mercer. While credible, this data is usually outdated by the time it reaches you.

Accurate data to justify pay, retain talent, and close gaps

Look for a HRIS- or ATS-integrated salary benchmarking platform to get accurate benchmarks from real employee data, not old surveys or user-reported data.

This level of precision matters when you’re spotting pay gaps, adjusting salary bands, or defending offers to leadership. It’s also key to building trust in your compensation process.

So to ensure benchmark accuracy, evaluate each tool for:

- How it verifies and models its data

- How it aggregates data to produce the benchmarks you see in their platform

- How it handles missing data points (for example, via AI modelling or location differentials)

Internal vs. external benchmarking to identify pay gaps and inconsistencies

The ideal salary benchmarking software should make it easy for you to compare internal compensation data like your current employee salaries or salary bands with real-time market benchmarks.

This internal vs. external view helps surface issues like salary band outliers, salary compression, or pay inequity. In turn, it allows you to make timely, competitive adjustments so you can stay aligned with market competitive rates.

Strong data protection to meet compliance and reduce risk

Select a salary compensation software that has SOC 2 Type 2 certification and also has GDPR policies in place for European data.

This protects all your sensitive employee salary data that the software accesses through its integrations with your HR system for accurate benchmarking.

Benchmarks based on companies like yours — by region, size, and role

When evaluating salary benchmarking tools, check where their dataset is strongest.

For example, both Ravio and Pave offer global salary benchmarking data. But while Ravio leads in European markets, Pave has deeper coverage in the US and Canada.

Relevant data — by industry, location, company size, and role type — ensures you’re benchmarking against companies you actually compete with, helping you stay competitive in attracting and retaining top talent.

Bonus: Look for software that offers multiple filtering options so you can tailor comparisons with companies in the same industry, with the same HQ location, or at a similar stage of growth.

Total rewards data, not just salary, to make fair, competitive offers

Choose a salary benchmarking tool that doesn’t just give you base salary benchmarks but the total compensation picture, including variable pay, equity compensation, and employee benefits.

You need this broader view to make fair, competitive offers — even more if you’re in a market where equity or benefits play a big role in attracting top talent.

Keep in mind, not all salary compensation software offer this. Figures, for instance, focuses only on salary and variable pay, while Ravio includes equity and benefits benchmarks too.

Accurate, easy job matching for cleaner, comparable benchmarks

Ideally, choose a salary benchmarking tool that automatically maps your internal roles to job benchmarks during onboarding.

This helps your team match job titles and levels to the right benchmarks — without manual guesswork or spreadsheet wrangling.

Automatic job mapping also saves hours and ensures your compensation comparisons stay accurate and consistent, even as your organisation grows.

Easy-to-use platform that cuts manual effort and saves you time

Choose a salary benchmarking tool with a simple, intuitive interface so you’re not wasting time figuring out how to pull data, compare benchmarks, or share results with stakeholders.

Not sure how usable a tool really is? Explore their website for product videos or book a demo to see the platform in action.

Some platforms also offer free trials so you can test them yourself — like Ravio offers 3 free benchmarks from their entire global dataset. Lastly, always check G2 reviews to see how intuitive other users find your shortlisted software to be.

Flexible user permissions for secure, role-based access and collaboration

Go with a salary benchmarking tool that lets you control who sees what — whether it’s HR, leadership, line managers, or employees.

This is especially useful when managers need to make new hire salary offers or review raises. And if you’re aiming for more pay transparency, tools that allow employees to view their own total rewards can help you communicate clearly and consistently.

Additional compensation management features to streamline your workflow

Finally, it helps to choose a salary benchmarking tool that lets you do more than just view data. For instance, build salary bands or report on pay equity.

These are things you’d need to do anyway once you have benchmarking data so managing it all in one platform saves time and reduces tool-switching.

Why is Ravio the best salary benchmarking tool on the market?

Ravio checks off all of the boxes for what makes a great salary benchmarking tool discussed above. Here’s an overview:

| Ravio's salary benchmarking tool |

|---|---|

Up-to-date benchmarks | Yes |

Accurate benchmarks | Yes |

Robust data security measures | Yes |

Relevant data pool | Yes |

Total rewards benchmarks | Yes |

Accurate job matching | Yes |

Intuitive platform | Yes |

Flexible user permissions | Yes |

Compensation tools | Yes |

Here’s the full details on Ravio as a salary benchmarking tool – and if you'd like to see the platform in more detail, get in touch:

- Up-to-date benchmarks. Secure integrations with over 100 HRIS tools makes onboarding quick and easy, and ensures Ravio’s compensation benchmarking database is always accurate and up-to-date.

- Accurate benchmarks. All data is checked and verified by Ravio’s team of data scientists and benchmarking experts to ensure a high degree of accuracy and consistency in terms of how data is labelled and interpreted across companies.

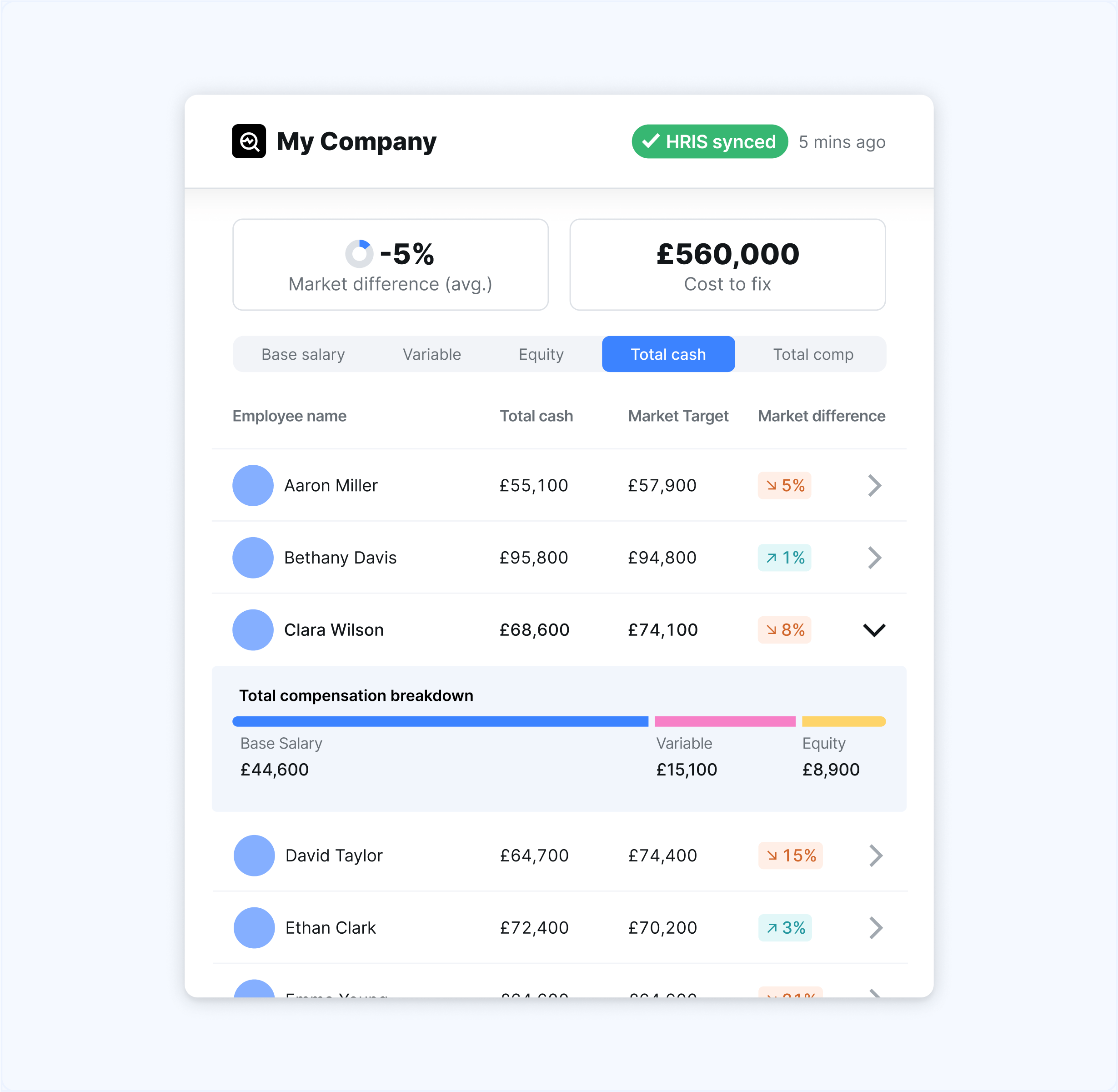

- Comparison of benchmarking data with internal salary data. Ravio's platform enables you to view compensation benchmarking data as standalone data — but it also makes it easy to compare those benchmarks with existing employee compensation to see where they fall against the market. Plus, Ravio's salary bands tool lets you build salary bands using the benchmarking data, or refresh existing salary bands to bring them in line with the market.

- Relevant data pool. Over 1,400 companies contribute to Ravio’s compensation database, with benchmarks available for over 50 countries and over 100 roles, ensuring high data confidence for all benchmarks. Plus, filters are always available for location, industry, headcount, company size, and funding stage, to ensure a relevant data pool to compare against.

- Total rewards benchmarks. Ravio’s total compensation benchmarking data covers base salary, variable pay, equity compensation, and employee benefits.

- Robust security measures. Employee data is fully anonymised, and is kept safe and secure at all times through rigorous privacy and security protocols — including GDPR compliance and SOC 2 Type 2 certification. Ravio’s data is hosted in Europe.

- Accurate and straightforward job matching. Ravio automatically matches your internal job levels with the Ravio level framework to ensure a like-for-like comparison and if you don’t have levels yet, Ravio’s team will map your individual employees to the Ravio level framework.

- Intuitive and easy-to-use platform. Ravio has a G2 rating of 4.7, and users regularly comment that the platform is ‘user-friendly’ and ‘intuitive’.

- Flexible user permissions. Ravio includes the ability to add users to your Ravio account with varying levels of permissions. Plus, you can also share benchmarks and salary bands outside of the platform to help with stakeholder management and employee communication.

- Additional compensation management features. Ravio isn’t just a salary benchmarking tool, it’s an end-to-end compensation management platform – with the ability to use the benchmarking data as the foundation for building salary bands, analysing pay equity, and more.

FAQs:

What is the best salary benchmarking tool?

The best salary benchmarking tool meets your organisational needs — integrating with your HRIS systems and offering real-time salary and total rewards data. It should also offer strong data coverage tailored to your needs, whether that’s regional benchmarks or global market data, depending on your team’s structure and hiring footprint.

What to look for in a salary benchmarking tool?

Check how the tool collects and verifies data, and whether its coverage best fits your needs (regional vs global). Ensure it integrates with your HRIS system, is intuitive for team-wide adoption, and offers strong security standards — SOC 2 Type 2 certification and GDPR compliance for European data.

How to select a salary benchmarking tool

Choose an HRIS-integrated salary benchmarking tool that offers real-time compensation data across salary, equity, and benefits. Ensure it also supports automatic job matching, strong data security, and advanced filters by company size, region, and industry. Don’t forget to evaluate ease of use to ensure smooth implementation for your team.