- EU Pay Transparency Directive readiness checklist

- 1. How to prepare for increased pay transparency for existing employees

- 2. How to prepare for increased pay transparency for job applicants

- 3. How to prepare for new gender pay gap reporting requirements under the EU Pay Transparency Directive

- Build your company's pay transparency checklist

Across Europe, countries are currently in the process of transposing the EU Pay Transparency Directive into their national laws ready for roll out by June 2026.

Once in place, the legislation will mean big changes to pay transparency and gender pay gap reporting practices for most EU employers.

For most companies there’s a lot of work to be done to ensure compliance – so, in this article we'll walk through the implications for employers across three key areas:

- Pay transparency for existing employees

- Pay transparency for job applicants

- Gender pay gap reporting

Plus, we've put all of the key steps into a handy pay transparency checklist – just make your own copy, and then you can tailor it and use it for your company's needs.

EU Pay Transparency Directive readiness checklist

1. How to prepare for increased pay transparency for existing employees

The central focus of the EU Pay Transparency Directive is to close the gender pay gap by increasing pay transparency – shining a light on cases and causes of pay discrimination (i.e. unjustified differences in pay for employees performing equal work or work of equal value) and pushing employers to address those causes.

To achieve this, the legislation introduces new pay transparency rulings for employees.

Two key things will become mandatory when the roll out of the EU Pay Transparency Directive is completed in 2026, with regards to existing employees:

- Pay and career progression transparency. Employers must make pay levels and career progression pathways easily accessible for employees.

- Employee right to pay information. Employees have the right to information on the pay level of employees doing equal work or work of equal value to them, and employers must make them aware of this. Employees also cannot be banned from discussing salaries with colleagues.

Effectively, this means that employers need to get much better at communicating their compensation approach to employees – including enabling line managers to explain why individuals are paid the way they are, and what they need to do to increase that level of pay.

Which means that, first and foremost, you need to make sure you have a clear and logical compensation approach.

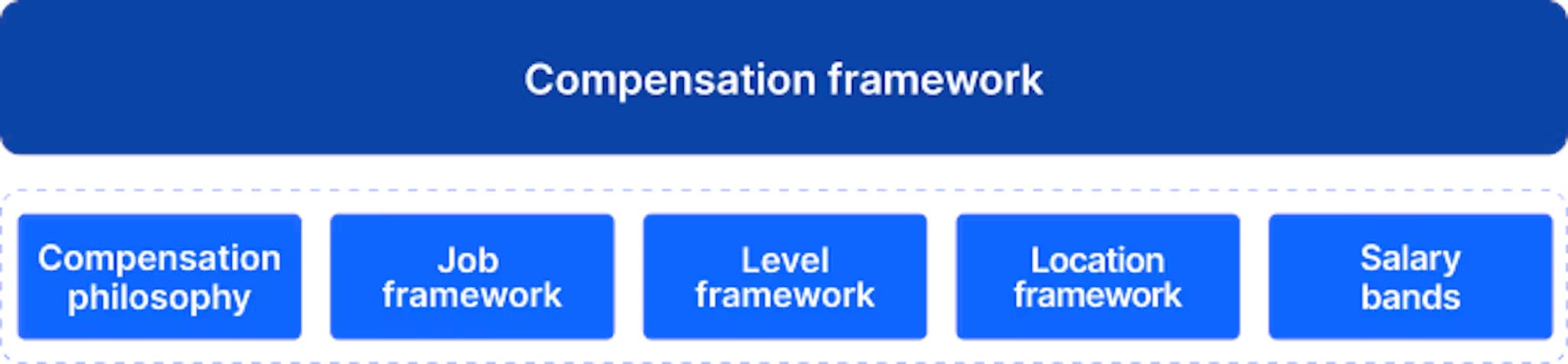

If you don’t already have a robust compensation framework, now’s the time to do that.

The crucial pieces of the puzzle are:

- Compensation philosophy. The guiding principles that explain why the company approaches compensation in the way that it does, which is vital for the clear and transparent communication about compensation with employees that the new pay transparency laws call for.

- Level framework. The level framework outlines the different career tracks within a company’s structure (typically Professional/IC, Management, Executive), the hierarchy of job positions i.e. job levels within each of these tracks, and the definition for each job level (e.g. responsibility, impact, scope). Pay naturally varies depending on the level of seniority of a role, and the job levels also outline the possible career and pay progression pathways within a company, so a clear level framework is a crucial building block for a robust compensation framework. This also makes communicating the different pay levels to employees much easier.

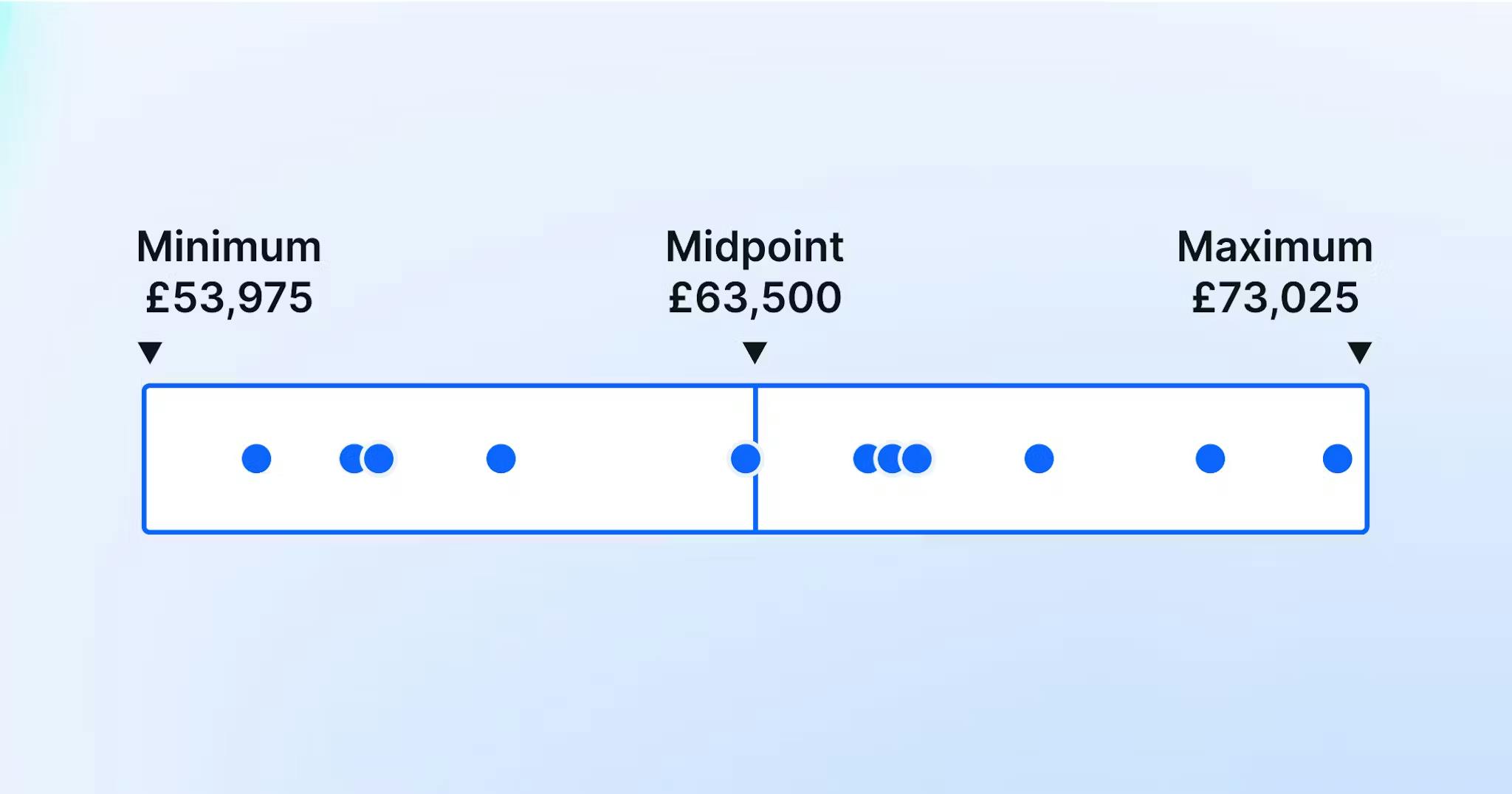

- Salary bands. Salary bands go hand-in-hand with the level framework. Salary bands should be created for each job level in the level framework to give a clearly defined structure for pay progression within an employee’s current role, as well as requirements for career progression to the next pay level. Reliable salary benchmarking data should be used to inform the salary band for each job role and job level, aligned to market-standard compensation. Again, with a well-defined and logical salary band structure that you feel confident in, the requirement to make pay levels and progression pathways clear for employees becomes a simple task.

Once you have that robust compensation framework in place, you’ll also need to make a plan for how you will ensure this information is easily accessible and regularly updated for employees.

If you already have all of these elements in place, it’s still worth checking the thinking and making any adjustments needed to ensure you’re happy to share the approach openly with employees.

💡 How are other companies implementing pay transparency with their employees?

Here's a few examples of different approaches that companies are taking when it comes to transparent pay practices:

- Typeform have rolled out transparent salary bands internally, so that employees have access to the salary range for each job level within their own job family.

- Checkly have implemented a standardised salary formula with clear documentation on how this works for the team – and a public pay calculator for job candidates too.

- Buffer are well-known for their fully open approach, wherein all employee salaries are shared publicly through Buffer's website.

2. How to prepare for increased pay transparency for job applicants

The pay transparency rulings extend to prospective employees as well as existing employees, with the key changes being:

- Salary ranges for new job positions must be made accessible for candidates before they are called to an interview.

- Gender neutral language must be used in job adverts and descriptions.

- Candidates must not be asked about their salary history during interviews.

- Employment contracts must not include a pay secrecy clause because employees have the right to discuss salaries (this also applies to existing contracts, which may need to be amended).

Therefore, an important step for employers preparing for the EU Pay Transparency Directive by 2026 is to check current hiring practices and ensure that documents and processes are in line with these changes.

The ruling on exposing salary ranges for new job positions is particularly important and is causing a stir in the People Leader community.

In terms of steps to take in preparation, this links us back to the previous section on ensuring you have a robust compensation framework that you’re happy to share openly with employees, because this ruling means that you also need to be comfortable for your pay approach to be shared publicly via job adverts.

One particular issue to be aware of with new employees is salary compression – when new hires are brought in at a higher salary than existing employees who perform equal work or work of equal value.

This might occur because companies aren’t performing regular, robust compensation reviews to ensure that all employee compensation packages remain fair and competitive with the market. Or it might be that pay and career progression pathways and practices aren’t working correctly for existing employees. Or it might be that a decision is made to offer a higher salary for a candidate in order to secure them for the role, particularly if you’re struggling to fill the position.

All of these causes come down to a lack of consistency and fairness in compensation practices, which is why having a well-defined and logical compensation framework is absolutely crucial when preparing for new pay transparency laws.

“It’s natural for a large and high-impact change in the law to seem overwhelming. The trick is to break it down into manageable steps. A sensible place to start would be to recognise that this will need input from many stakeholders, including in HR / people, payroll, benefits, finance and legal. So we recommend assembling a cross-functional working group as a starting point.”

Legal director at Lewis Silkin

3. How to prepare for new gender pay gap reporting requirements under the EU Pay Transparency Directive

One of the key implications of the EU Pay Transparency Directive is that it will introduce gender pay gap reporting requirements for employers which are much stricter than those currently in place by individual EU member states.

In brief, the rulings mean that companies with 100+ employees will be required to report their:

- Mean and median gender pay gap for base salary

- Proportion of men and women receiving variable pay

- Mean and median gender pay gap for variable pay

- Proportion of men and women in quartile pay bands i.e. lower pay, lower middle, middle upper, upper.

Companies that have a gender pay gap of more than 5% in any of these areas, and does not fix this within 6 months, will be required to conduct a ‘joint pay assessment’ – a much deeper analysis into the root causes of the gender pay gap and an action plan for addressing these causes, produced in collaboration with employee representatives.

Therefore, another crucial step for employers preparing for the EU Pay Transparency Directive is to gather the employee compensation data you need and calculate the existing gender pay gap (across the above criteria) within your company.

Once you have this information, if your gender pay gap is above 5% in any category you’ll need to start digging deeper into the data to understand why there are pay differences based on gender and put actions in place to close the gender pay gap.

Based on our analysis of pay equity across Europe, some of the most prevalent causes that companies will need to address are:

- Women are underrepresented in the workforce, and especially in senior positions

- The gender pay gap is already present at the point of hiring – meaning companies need to particularly look at their hiring and salary negotiation process

- Some job functions perform much worse for pay equity than others, with Software Engineering having the highest adjusted gender pay gap across the European tech industry

- Women still bear disproportionate caregiving responsibilities, and time off work for childcare systematically stunts the progression of women to more senior (and more highly paid) roles.

Build your company's pay transparency checklist

To make things easier as you prepare your company for new pay transparency legislation, we've put together a (free) pay transparency checklist.

All you need to do is:

- Make your own copy of the checklist, so that you can edit and tailor it to your heart's content

- Complete the checklist in each tab – ticking any items that your company has already completed

- Head to the 'results' tab for your personalised pay transparency checklist, with each item your company still needs to complete to be fully prepared for pay transparency laws

- Make edits to the spreadsheet to help you project manage the work needed, such as including "due dates" for when each item will be completed, as well as owners and action items

- As you work through those items, go back and tick them off the checklist, until you reach 100% readiness.

If you aren't sure how to approach an action, there's helpful content included throughout.