- Finance-led vs HR-led compensation review budgeting

- The pros and cons of Finance-led vs HR-led compensation budget planning

- How to collaborate effectively with finance on compensation budgets: 4 expert tips

- What is a typical budget for salary increases?

- How is the final salary increase budget typically divided per department?

- How much input do line managers typically have on how salary increase budget is divided?

An annual compensation budget has many crucial roles to play.

There's all the existing payroll obligations to maintain.

And then there's this year's compensation reviews to think about – where the budget needs to enable key objectives to me met.

That's objectives like fixing pay equity issues and salary band outliers to maintain fairness. Administering market adjustments to ensure compensation stays competitive against the market. Rewarding high performing employees to avoid attrition. Enabling employee progression with promotions or compensation adjustments to reflect growth. Keeping employee purchasing power consistent with inflation or cost of living (COLA) adjustments.

There’s a lot to consider.

But it’s often the case that People and Rewards Leaders are handed a compensation budget by the Finance team, without being consulted on all of these varying needs.

That can be frustrating, to say the least.

But there’s an alternative world where the People Team either lead the conversation on the budget needed to meet employee objectives, or collaborate closely with Finance colleagues on compensation budget planning.

In this article we’ll take a closer look at how to determine a compensation review budget – including expert advice on finance-led and HR-led approaches and how to collaborate effectively with finance team colleagues for a smooth execution.

Subscribe to our newsletter for the monthly insights from Ravio's compensation dataset and network of Rewards experts

Finance-led vs HR-led compensation review budgeting

The three scenarios for compensation review budget planning is for the process to be led by the Finance team, by the HR team, or by the Executive team (as a top-down mandate) – we'll focus on the Finance vs HR process here.

Finance-led compensation review budgets

In a finance-lead process, the finance team defines a set amount of budget which can be made available for the compensation review, before involving the People Team. In some cases, C-level executives will define the budget with a top-down approach and hand this to Finance to manage.

HR-led compensation review budgets

With HR-led compensation review budgeting (and compensation budgeting overall), the People Team aims to get on the front foot and lead the budget conversation – calculating the budget required to meet objectives and taking this to the finance team and leadership stakeholders for alignment.

In this scenario, the process goes something like this:

- Stakeholder alignment on compensation review approach to ensure upfront agreement on which factors will be included in the compensation review – rewarding high performance, matching market benchmark changes, matching inflation increases, promotions, fixing inconsistencies and inequities – and the company’s approach to those factors, informed by the overall compensation philosophy. The Head of Finance or CFO should be included in this alignment.

- Internal data analysis to determine any compensation adjustments needed to fix inconsistencies e.g. salary band outliers, or inequities e.g. a large gender pay gap in a certain team.

- External data analysis to understand inflation or cost of living impacts if applicable, and to determine market adjustments needed to ensure employee compensation remains competitive against market benchmarks – typically done by refreshing salary bands using up-to-date benchmarking data from a real-time tool like Ravio.

- Budget forecasting to determine the amount required to meet the agreed compensation review needs, often with scenario modelling to enable you to put forward a couple of different options for budget requirements – using the outcomes of the data analysis as well as the rationale for rewarding performance e.g. the top 10% of performers will receive a 5% merit increase or cash bonus.

- Stakeholder sign off on the budget forecast: discussion, alignment, and approval of the planned budget, including both leadership stakeholders and finance team.

- Budget rollout: the performance / compensation review takes place and the budget is divided to meet team or employee needs.

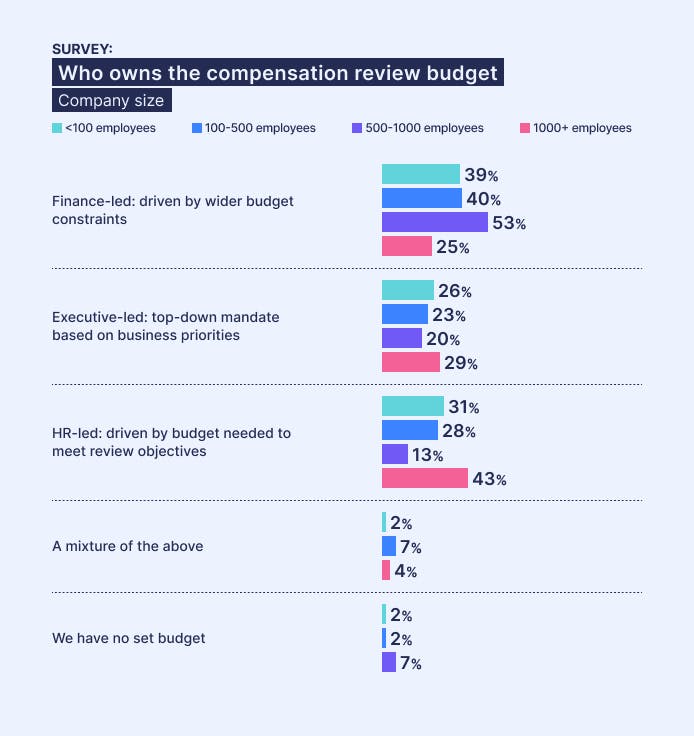

Does Finance or HR typically own compensation budget planning?

Our research on how companies typically approach compensation reviews found that the most common approach is a finance-led budget.

However, it does vary significantly: in 38% of companies Finance teams drive compensation review budgets, with leadership-led budgets coming second at 31%, and HR-led budgets at 25%.

When we analyse responses by company size, the proportion of HR-led budgets remains broadly consistent, but there are large fluctuations between finance-led and executive-led.

As companies grow, the proportion of finance-led budgets increases, until it reaches 53% at the 500-1000 employee range. At the same time, executive-led pay review budgets become significantly less common (13% vs 31% overall), likely as budgets are delegated as the company grows.

But, interestingly, once companies reach 1000+ employees, leadership control over compensation budgets increases to become the most common approach, with 43% of companies – the highest of any company size.

Perhaps at this size, compensation becomes a strategic workforce tool requiring executive direction, and potentially even board or remuneration committee oversight too.

💡Ownership of the compensation budget can also fluctuate from year to year

The budget available for compensation reviews often varies from year to year, and is closely related to the success of the business.

Payroll is a significant cost for employers, so if there’s a difficult year where budgets are tight, it’s common for the need for efficiency to be reflected in the salary increase budget.

In this scenario, it’s also more likely that there will be tighter reins on all budget decisions – so even if normally the salary increase budget is HR-led, in a tough year it’s likely to become much more finance-led (or even executive team led).

As with many elements of the role, People Teams will need to be prepared to flex and adapt to changing environments in terms of how they collaborate with finance and leadership colleagues on the budget for salary increases, as well as how that budget is spent – in a year where there’s less budget, People Teams will need to think creatively about how to reward and retain employees when salary increases aren’t an option.

The pros and cons of Finance-led vs HR-led compensation budget planning

There are pros and cons to each approach – something that Ravio’s Chief People Officer, Vaso Parisinou, discussed with Zalando’s Senior Rewards Partner, Olga Flegontova, during a recent webinar on the topic of compensation reviews.

Vaso highlighted that when Finance leads the conversation it means that the compensation budget is much more “stable” because “compensation adjustment costs have been closely aligned to overall budget forecasts and big picture company goals”.

However, Olga points out that this stability can also turn into a “quite rigid process, which loses sight of talent needs”. This is because Finance Teams don’t have all of the nuanced information about what the compensation review budget needs to achieve. As Vaso puts it: “It can mean that HR’s role is sidelined, which can be very painful to manage given the impact of salary increase budgets on the lives of every single employee.”

On the other hand, for Vaso an HR-led approach gives People and Reward Leaders a “seat at the table” for strategic discussions, and ensures that the budget is set “based on actual employee objectives, even to the level of enabling custom adjustments based on really specific talent needs.”

But, just like Finance lacks vital expertise on employee needs, HR lacks vital expertise on financial parameters – with Olga highlighting that the HR-led approach always “comes with the challenge of keeping budgets aligned with overall financial goals, and avoiding overspending on the compensation review.”

Plus, Vaso’s experience is that, without the right stakeholder alignment, it’s common for the budget to be “derailed by last minute changes by finance or leadership stakeholders which are outside of HR control.”

Collaborative ownership between Finance and HR

Lucia Nikolaou is highly experienced with managing compensation budgets, having advised leadership and led People Teams in several tech startups and scaleups, both as an in-house People Leader and now as a strategic consultant partner through CompanionHub.

When we spoke to Lucia on the topic of budget planning, she highlighted that a third option of a “hybrid approach” is “becoming increasingly common, especially in more mature organisations or those transitioning toward a more strategic HR function.

“In this hybrid approach, Finance and HR collaborate from the outset. Finance might set initial parameters based on broader business goals, company health metrics, and targets, but HR plays a key role in shaping the specific needs, using data on market benchmarks, internal equity, and retention risks to influence the budget.”

It’s the best of both worlds, because, as Lucia puts it: “it combines financial discipline with people-focused insights, leading to more balanced and effective outcomes.”

But there’s a catch.

The hybrid approach is collaborative by nature, so it “requires strong relationships and ongoing communication between HR and Finance”. Unfortunately that “isn’t always easy to establish, particularly in organisations where HR is still viewed as a cost center rather than a strategic partner.”

📊 High performing teams are more likely to have a collaborative approach to compensation budgets

Ravio's research on compensation reviews found that companies with the highest performing compensation review processes (those who achieve a 4-5 out of 5 against their success metrics) are much less likely to have leadership-led budgets (20% vs 31% overall) and are twice as likely to collaborate across teams (10% vs 5% overall).

This reiterates Lucia's advice that the most successful compensation reviews actually come from collaborative budget-setting rather than top-down mandates.

How to collaborate effectively with finance on compensation budgets: 4 expert tips

Lucia Nikolaou shared four vital considerations for developing effective collaboration between Finance and HR with us, based on her 10+ years of experience:

- Understand the historical context

- Build a trusted relationship over time

- Develop a shared perspective and process.

- Bring valuable insights and expertise to the table

Tip 1: Understand the historical context

When she works with companies where compensation budgets are currently Finance-led, Lucia’s first step is always to “understand the historical context behind the company’s budgeting practices”.

The most common context is that there has been a lack of capacity within the HR team to handle budget planning, or a lack of capability which has led to budgeting issues previously.

In this scenario, Finance becomes the natural lead.

But the reality is that “Finance probably doesn’t want to own the compensation review budget, and is unlikely to refuse an offer for help from HR”. Finance Teams have responsibility for overall company costs and budgets which gives them a lot to juggle already. Plus, they don’t have the knowledge or expertise to be able to confidently make decisions about compensation review costs, so input from HR teams on this is hugely beneficial for them. “It’s rare that they love budgeting so much that they want sole responsibility for all elements of it!”

Having this information to hand “surfaces opportunities to make changes that will benefit everyone” which “helps to frame the approach” in terms of broaching the topic effectively with Finance colleagues.

It’s also important to note that if there is a capability issue at hand, then an HR-led collaboration may simply not be possible – less mature HR teams (common in startups) will struggle to take the lead and own the budget planning progress.

“You have to recognise that it isn’t always a Finance issue, and getting the historical context helps with that. I learnt the hard way from years of refining and improving compensation review processes at startups in the early stage of my career that you really need a high level of understanding to plan budgets successfully and represent that budget to the C-level.”

Tip 2: Build a trusted relationship over time

It takes time to build a trusted relationship, and if you wait until budget season to start that relationship, it’s too late.

Lucia suggests reaching out to Finance colleagues as early as possible – at the start of a new role, or when first considering what improvements could be made to the budget process.

“Reach out to introduce yourself. Then make an effort to build regular communication touchpoints – both formal check-ins and informal opportunities to ask questions, support with data enquiries, or collaborate on projects. The aim is to create a foundation for trust and collaboration long before budget planning begins.”

One piece of advice from Lucia to build trust is to “speak the same language” as the Finance Leader.

That means listening to them and understanding their role and processes, and then using that information to inform how you communicate with Finance colleagues.

In Lucia’s experience, data is key to this: “Most of the time that means numbers! Any metric you can get comfortable with using in conversation will bring you one step closer to the heart of your Finance Leader.”

Tip 3: Develop a shared process

Once those regular communication touchpoints are established, speak with the Finance Leader about the compensation budgeting process as early as possible – “ask them how their budgeting process works, and work with them to create a framework for how you can collaborate with them for the compensation review budget.”

It’s vital to include alignment with overall business goals and budgets as the starting point for that framework.

As Lucia puts it: “HR and Finance need to work from a shared understanding of the company’s priorities – whether the business is preparing for a challenging financial year, investing heavily in new products, or optimising for leaner operations.”

Having this alignment first ensures that you can build a realistic budget plan for the compensation review which aligns with strategic priorities – which means no surprises later in terms of stakeholder alignment or budget constraints.

From the HR side, it’s also important to provide as much information as possible on the process and timeline for the compensation review.

Finance and HR will then need to work together to agree guidelines on how compensation adjustments will be determined (performance, market competitiveness, internal pay equity, etc.) and how the final budget is distributed amongst departments to decide final compensation adjustments per employee, and a communication plan for who will share what, and when.

Tip 4: Bring valuable insights and expertise to the table

Understanding compensation and its role in attracting and retaining employees to ensure business success is crucial when setting the budget for salary increases, but Finance Teams don’t inherently have this knowledge.

Through bringing this information to the table, HR teams offer real expertise in compensation budget planning, ensuring accurate forecasting and impactful outcomes.

Making your Finance Leader aware of the value that you can add to the process sets collaboration off to a great start – especially since, as we saw in tip 1, budgeting is rarely anyone’s favourite task!

For Lucia, “data insights are your strongest tools” to bring to the table. Her advice is to first ensure compensation data is “accurate and comprehensive, tracking both cash and equity components in one system”.

Then “tie that data to meaningful KPIs, using metrics like employee turnover, performance trends, and the financial impact of compensation decisions to translate HR needs into business terms.”

In terms of setting the budget for salary increases, People Leaders can support the collaboration by preparing budget scenarios based on the employee needs that the compensation review needs to fulfil.

“Present multiple options (minimum budget, ideal budget, maximum budget) and show how these levels would support different outcomes,” Lucia says, “to give your Finance Leader clear options and advocate for meaningful investment in people, whilst also demonstrating that you understand the need for budget constraints.”

Lucia highlighted four key pieces to prepare ahead of kicking off salary increase budget discussions:

- Compensation benchmarks. Use tools like Ravio that offer real-time salary benchmarking data to identify any significant market shifts that need to be taken into account during the compensation review. Then map this data against current salary bands (again, Ravio’s salary band tool can help to visualise this) to highlight where market adjustments are needed.

- Talent mapping. Use data from previous performance reviews to map key talent and highlight any top talent who is at risk of attrition.

- Internal pay equity. Identify any existing pay inequities and inconsistencies that need to be addressed to maintain fairness, through conducting a pay equity analysis.

- Financial projections. This one will need to come from the Finance Team (as well as C-level stakeholders), but it’s vital to understand financial projections and any business priorities that may influence budget constraints.

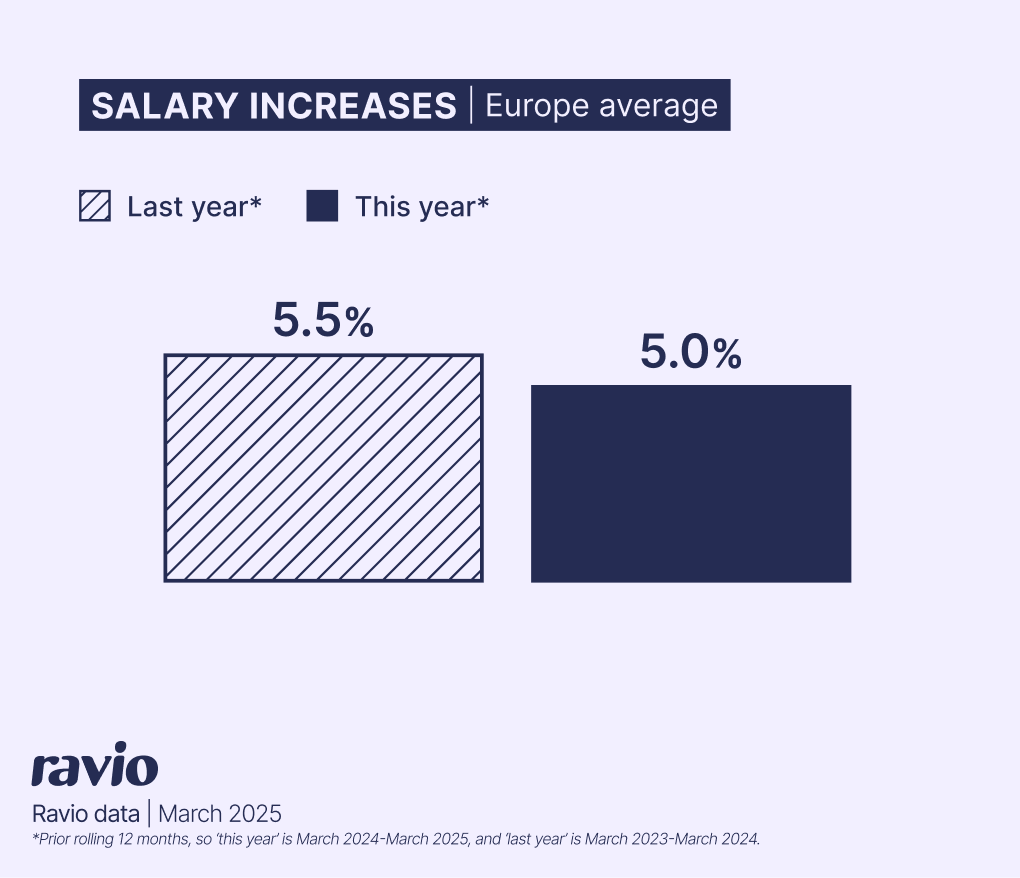

What is a typical budget for salary increases?

Many companies plan their compensation review budget based on a percentage of existing payroll costs – and understanding how much companies typically increase their payroll by at compensation review can be helpful context.

From Ravio's market trends data, we can see that the average annual salary increase globally is 5.0% (average over 2024-5) – that’s non-promotion, so it covers compensation adjustments for market alignment, rewarding performance, fixing inconsistencies, and inflation raises.

This means that companies should expect at least a 5% increase in payroll costs from each merit cycle – plus any additional factors relevant to the individual company, like typical promotion rate or upcoming projects like changes to employee benefits, and so on.

This is also a slight decrease from last year (average over 2023-4) when the average salary increase per person was 5.8% – so we might expect compensation review budgets to be a little slimmer this year than previously.

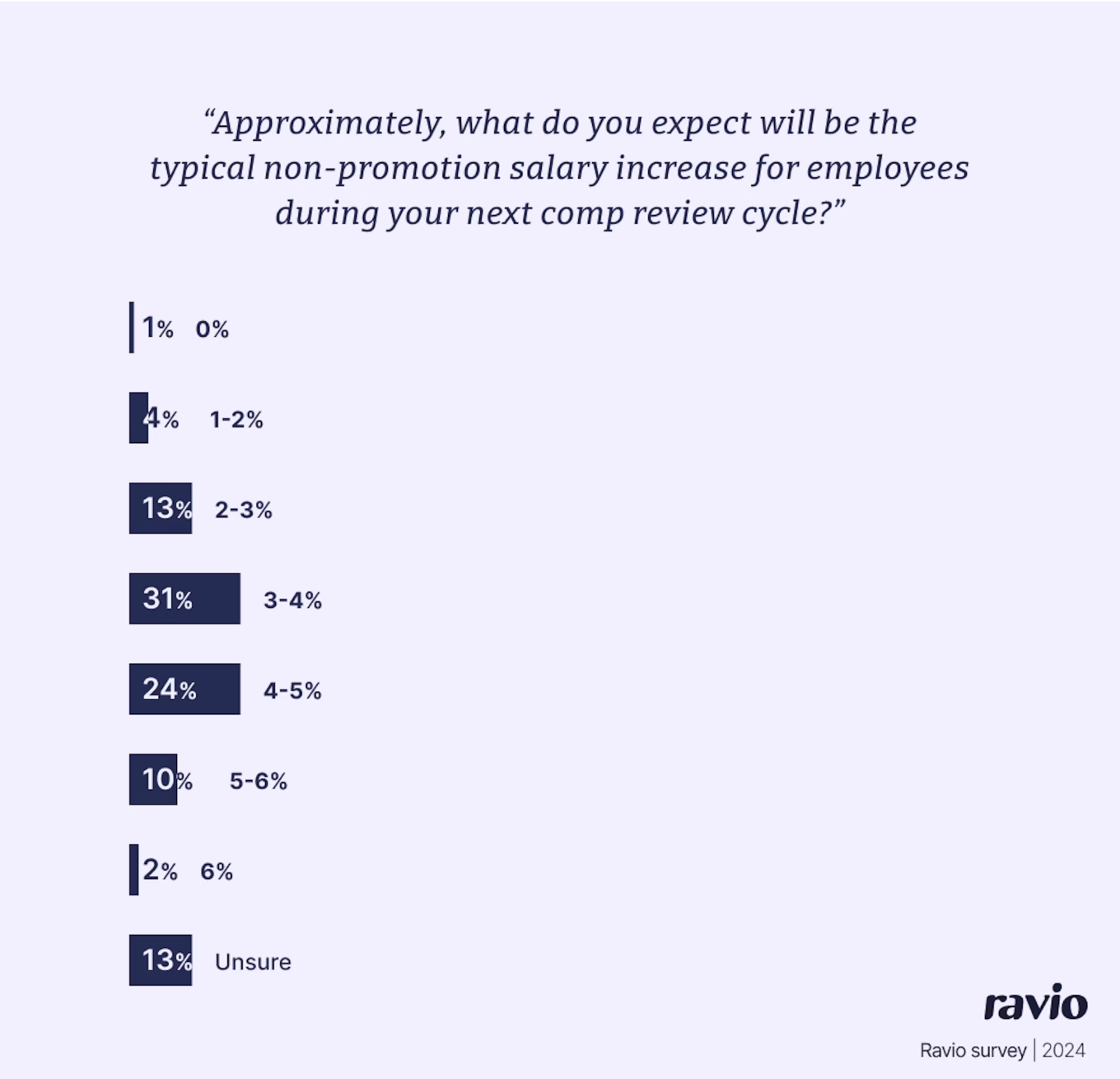

This also aligns with our latest survey of People and Reward Leaders for our Compensation Trends report. We asked about expectations for salary increases at the next merit cycle in 2025, and 55% of companies answered with a planned salary increase of 3-5%.

Of course, there are variances within this average.

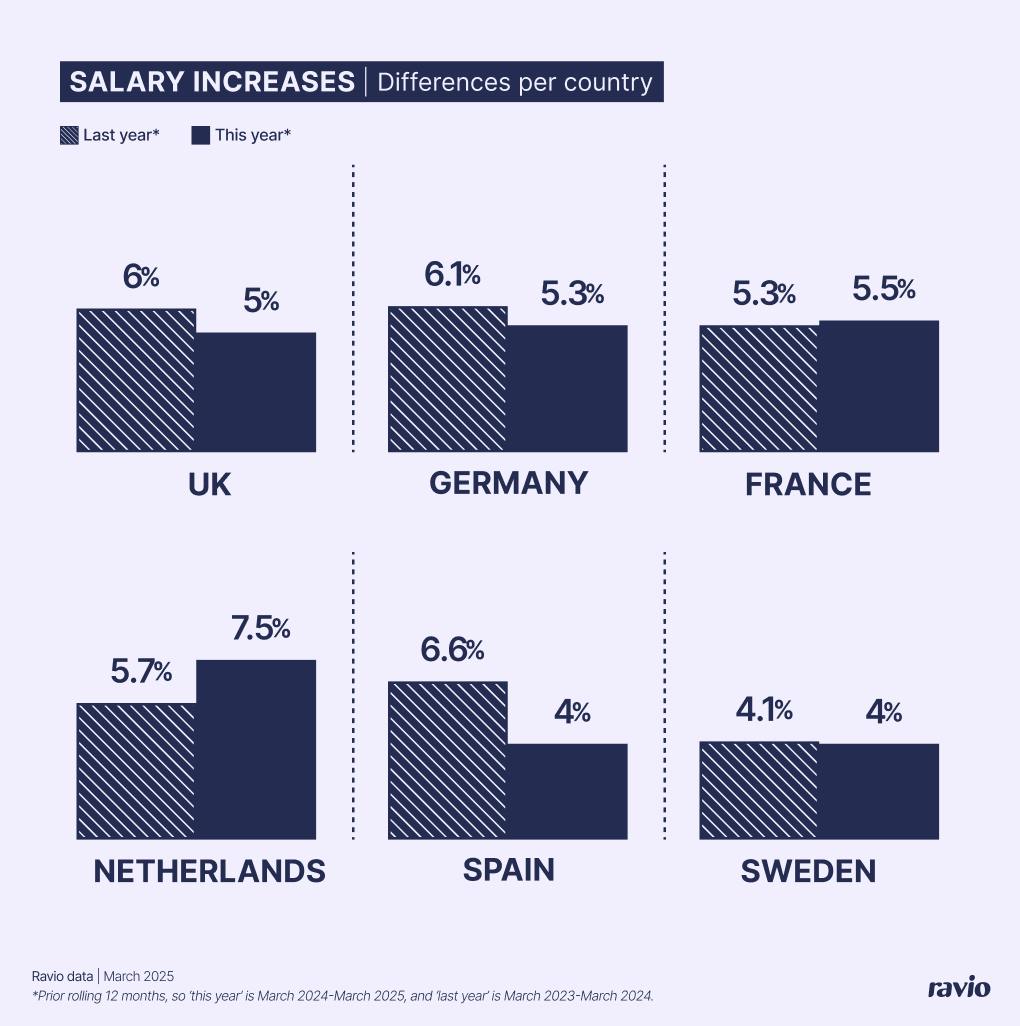

In terms of location, we can see from Ravio's data that across Europe, there are slightly different average salary increases.

The Netherlands has seen a particular shift this year, with the average salary increase for Dutch employees now at 7.5% for 2025 – an increase of 32% from last year – so companies with employees in the Netherlands might need a bigger compensation review budget this year.

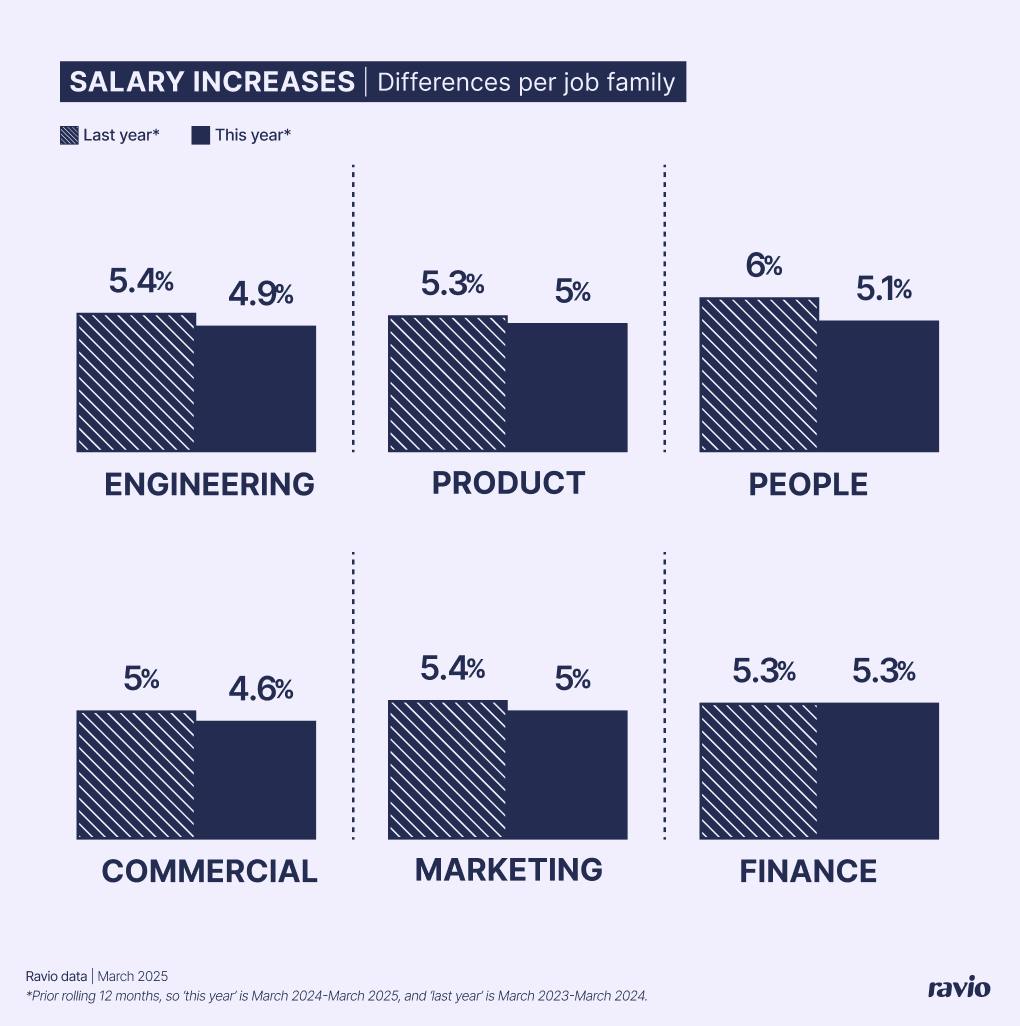

In terms of job function, Ravio's data also shows variances across different roles – though the variances are less significant than per location.

People teams have seen the biggest shift, with the average salary increase for employees in the People function having dropped from 6% last year to 5.1% this year.

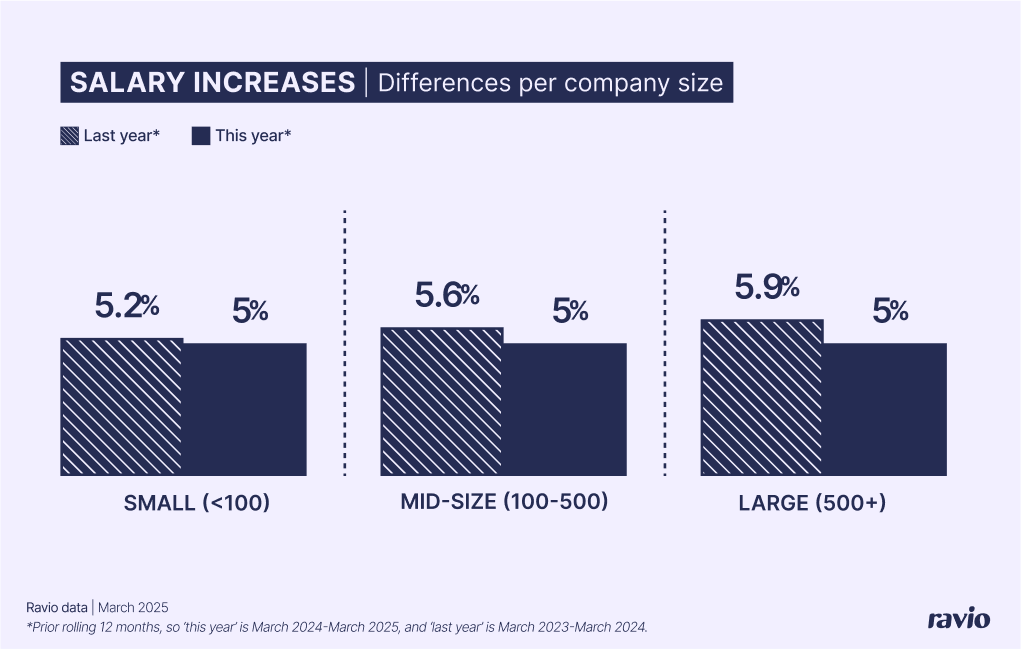

Finally, there are also variances depending on company size.

It might be expected that larger companies have more budget for compensation reviews, but in reality in 2025 companies of all sizes (measured by employee headcount) now have an average salary increase of 5% per employee – with this average having declined for medium and large companies.

This might reflect the difficult economic environment of recent years, with companies focusing on slow and sustainable growth and so keeping compensation budgets slightly lower.

This information provides the context needed to weigh up overall compensation needs compared to other business priorities, and for the HR team to start thinking about priority adjustments to make during the compensation review.

In Lucia’s experience, retaining top talent is always top of the list of priorities, especially when budgets are tight.

If retaining top talent takes up most of the available budget, People Teams may need to think creatively about ways to meet employee needs with a lower compensation review budget.

Lucia suggests:

- Phased salary increases spread across multiple merit cycles

- One-off adjustments using mechanisms like a performance bonus or equity refresh grant to reward performance without creating long-term payroll commitments

- Introduce an equity programme as a new incentive instead of salary increases

- Introduce a variable pay programme tied to future performance metrics e.g. a bonus pot available for all employees if X metric is achieved by Y time, or a profit-sharing opportunity dependent on business performance.

- Invest in individual growth through offering learning budgets, starting a mentoring programme, identifying opportunities for internal mobility, and so on.

Early communication is also crucial in this scenario to avoid disappointment – both with managers who might be expecting to be able to reward their team, and with employees who might be anticipating a pay rise.

Lucia suggests explaining the “bigger picture” context, both in terms of internal factors and external economic factors to help managers and employees to understand the rationale behind decisions.

Plus, focusing on the “long-term goal of business stability” also aids understanding – highlighting that avoiding overspend now will support business success, which means “equity growth and the potential for bigger raises and progression opportunities in future once business and economic performance has improved”.

How is the final salary increase budget typically divided per department?

Ravio's compensation review research found that there’s no clear consensus when it comes to allocating compensation budgets across departments.

Overall, 31% of companies don't split by department at all, 26% use an egalitarian approach based on each team’s percentage of payroll, while others base decisions on performance needs (16%), or a mix of approaches (20%).

Small companies overwhelmingly don’t divide their budget by department (44% vs 31% overall), reflecting simpler organisational structures where a centralised approach for all employees may make more operational sense than a per team approach.

The 500-1000 employee group are much more likely to use an egalitarian model where each department gets a budget equal to a percentage of their payroll (47% vs 26% overall) – suggesting a heightened focus on structure and fairness at this point of scaling a business.

Large companies (1000+) are more likely to use mixed approaches (39%) using mixed approaches, perhaps reflecting the reality that with numerous departments and global locations, a one-size-fits-all approach becomes impractical.

How much input do line managers typically have on how salary increase budget is divided?

For many companies, managers play a large role from this point onwards, through manager discretion on the final compensation adjustment granted to each employee – which can be done in a few different ways, for instance:

- Full manager discretion: the Rewards Leader splits the total salary increase budget up between teams, and it’s then up to each team manager to divide their team budget up between employees.

- People Team recommendation: the Rewards Leader makes a recommendation to managers on the salary increase an employee should receive, which the manager then approves or adjusts.

- A combination of the two: the Rewards Leader might define a set salary increase that an employee must receive to account for market adjustments or pay inequity issues, but the manager then has discretion on additional salary increase based on performance rating.

And some companies keep ownership squarely with the People Team – they will determine the final compensation adjustment that each employee will receive based on all factors and provide this to line managers with the rationale behind the decision.

Ravio's compensation review research found that the most common approach (41% of companies) is for HR/Rewards teams to define the recommended adjustment for each employee, with managers then able to suggest changes to the recommendation to fit team needs.

This approach strikes a balance between systematic fairness and managerial insight.

Further, where managers have input, 58% of companies require justification for changes and 65% have a final stage of Reward team approval – again ensuring there are guardrails in place to maintain overall consistency and equity. Given increasing pay equity regulations, every company should be enforcing such safeguards to prevent bias creeping into compensation decisions.

A collaborative approach is particularly popular at larger organisations where 62% of 500-1000 employee companies and 58% of 1000+ companies use this model.

On the other hand, smaller companies favour more centralised control. 21% keep end-to-end control with Reward teams (vs 16% overall), and 6% give leadership teams full control (vs 3% overall) – likely reflecting the ability to manage compensation decisions centrally with smaller teams.

Mid-size companies (500-1000 employees) are most likely to give managers full budget control, with 31% allowing managers end-to-end discretion over their team's adjustments.

“Manager discretion is the ‘art’ side of the art and science of compensation review decisions, and it’s an important factor. Managers have context that Reward teams don’t, and retaining that discretionary element enables ownership over the process and how it is communicated with employees. Of course, that discretion should always be guided by the People Team to support line managers with the decisions and with managing the budget available.”

Total Rewards Consultant at Darwin Consulting

Examples: How companies use different levels of manager discretion

CrowdBuilding: HR team maintains full control (100 HC)

As a 15-person startup with a flat hierarchy, CrowdBuilding's HR Lead maintains end-to-end control over all compensation decisions. With no traditional management structure, centralised control brings structure, consistency, and fairness to how compensation and employee progression are managed.

Storyblok: Guided flexibility through merit ranges (100-500 HC)

Storyblok's Reward team defines a recommended range for salary increases based on market competitiveness and performance ratings (e.g. 4-4.8%increase for exceeding expectations). Managers then choose where each employee sits within that range based on individual context. This gives managers meaningful flexibility to retain the talent they need, whilst maintaining systematic fairness through performance-based guardrails and market competitiveness.

Skyscanner: Systematic process with challenge rights (1000+ HC)

Skyscanner uses an automated process where the Reward team controls compensation decisions based on performance ratings, experience, and peer comparisons. Managers can challenge specific recommendations but have limited discretion to override the systematic approach. This ensures fairness and consistency across their large global workforce whilst preventing bias from affecting compensation decisions.

Showpad: Team leads own outcomes with phased enablement (100-500 HC)

Showpad's Reward team evaluates market data, pay equity, and performance inputs and provides this information to team leads, who have full control over compensation decisions for their teams – with final review by CEO and Director of Total Rewards. Currently this is limited to VPs and Directors, with the capability being systematically built across management layers over time, aiming to eventually have people managers owning the process. This phased approach ensures decisionmaking quality through strong understanding, whilst building toward line manager ownership by the people with the best context on individual employee needs.