Let’s say an employee accepts a job offer to join your company.

They stay with the company for five years and consistently perform highly during that time, building up their skillset and taking on additional responsibilities – even being promoted into a new role at a higher level.

Would you expect their salary to remain the same as when they were first hired?

Probably not.

It’s likely the employee’s salary would gradually increase over their tenure with the company, via annual salary increases to reflect market changes, salary raises related to performance, and pay increases at the point of promotion to ensure a competitive salary for their new role and level.

When it comes to equity compensation, there’s more of a divide.

Some startups decide only to offer new hire equity grants: equity compensation given to a new employee as part of their total compensation package to join the company.

Others also offer equity refresh grants: additional equity granted to an employee who has already received a new hire equity grant at the start of their employment – typically done as an employee retention strategy.

Is it actually worth setting up an equity refresh programme for your startup? And if so, what’s the best approach to take? That’s what we’ll cover in this article.

What is an equity refresh grant?

An equity refresh grant is additional equity granted to an employee who has already received a new hire equity grant at the start of their employment

Let’s break that down a little further.

Many startups offer equity compensation to employees as part of their overall total compensation package when they join the company, giving them a small ownership stake in the company.

This is known as a new hire equity grant – equity granted to the employee when they are first hired and join the team.

For some companies, this is where equity compensation starts and ends. Employees receive a certain amount of equity at the time of hiring, and that’s that.

However, some companies also decide to offer additional equity to employees during their tenure at the company, on top of what was agreed in their initial new hire equity grant – this is known as an equity refresh grant.

There are a few different approaches that companies tend to take when it comes to designing an equity refresh programme, which we’ll go into in the next section of this article.

But first, why do some companies choose to offer equity refresh grants?

Subscribe to our newsletter for a monthly treasure trove of insights from Ravio's compensation dataset and network of Rewards experts, to help you navigate a career in compensation 📩

What are the benefits of offering equity refresh grants?

Typically, a big incentive for offering equity compensation is employee loyalty.

Equity compensation typically comes with a set vesting period, over which time ownership is gradually transferred from company to employee, giving incentive for the employee to stick around for that length of time. Plus, as the equity increases in value over time if the company is successful, equity compensation also acts as an extrinsic motivator for the employee to be engaged in the company’s success and perform highly.

Given that equity compensation can be such a strong driver of employee retention and motivation generally, it makes sense that companies choose to build on this via offering additional equity throughout an employee’s tenure.

Within this overall bucket of employee retention and motivation, a few more specific reasons for offering equity refresh grants are:

- To reflect the employee’s progression over their tenure. The amount of equity compensation offered to an employee typically varies depending on their role and job level, just like with salaries. Therefore, if an employee’s progresses during their tenure at the company, taking on new responsibilities or even being promoted to the next level, then it may be necessary to increase their equity compensation commensurately to ensure it remains fair and competitive.

- To reflect market changes in equity compensation benchmarks. Similarly, what a competitive equity compensation package looks like can fluctuate within the market as startup compensation trends change, or the economic situation shifts (e.g. a highly competitive job market may force typical equity compensation packages to increase). It may, therefore, be necessary to offer additional equity in order to bring that initial new hire grant back in line with the market.

- To recognise and reward high performance. Some companies offer salary increases and/or bonuses based on performance, as a way to recognise, reward, and retain top performers – equity compensation can also be used in the same way, offering additional equity in the company as a performance incentive. It’s relatively common in established, public companies for annual equity refreshers to be tied to performance – and much less likely in startups and scaleups.

- To avoid employees leaving as soon as equity vests. If a company has a four year vesting period as standard for employee equity compensation, then it’s entirely possible that employees will stick around until year four to maximise their equity, and then leave the company because their incentive to stick around has gone. Granting additional equity, with a new or extended vesting period, extends that incentive.

💡 How does job level impact equity compensation?

Typically, the equity compensation offered to an employee increases with job level – the more senior a role, the more equity they are granted.

In fact, some companies only offer equity compensation to certain job levels e.g. management and above or C-level executives only.

Ravio’s data shows that in the UK, for instance, 10% of companies only offer equity compensation to founders and leadership.

➡️ Learn more about typical equity compensation structures in the Complete Guide to Equity Compensation for Startups

What are the different approaches to designing an equity refresh programme?

When it comes to equity compensation, there isn’t much best practice out there – different companies take lots of different approaches to offering equity to employees.

The same is true of equity refresh grants, you’ll likely come across lots of different founders and people leaders who are taking very different approaches.

What is right for your company will come down to what aligns with your overall compensation philosophy and the goals for offering equity compensation to employees.

A few of the most common approaches to designing an equity refresh programme are:

- Time-based equity refresh grants

- Performance-based equity refresh grants

- Promotion-based equity refresh grants

It’s also common to do a combination of some or all of the above approaches.

There’s also the question of which employees are eligible for equity refresh grants. It might be a scheme for all employees, or it may be only for certain departments or levels of seniority, depending on your overall approach to equity compensation and/or employee retention priorities.

Time-based equity refresh grants

A time-based approach to equity refresh grants means that there are pre-determined points in time at which additional equity will be offered to existing employees.

This ensures a predictable, consistent schedule for granting equity to employees – making it easier to manage and easier to communicate to employees.

Within this, two common structures would be:

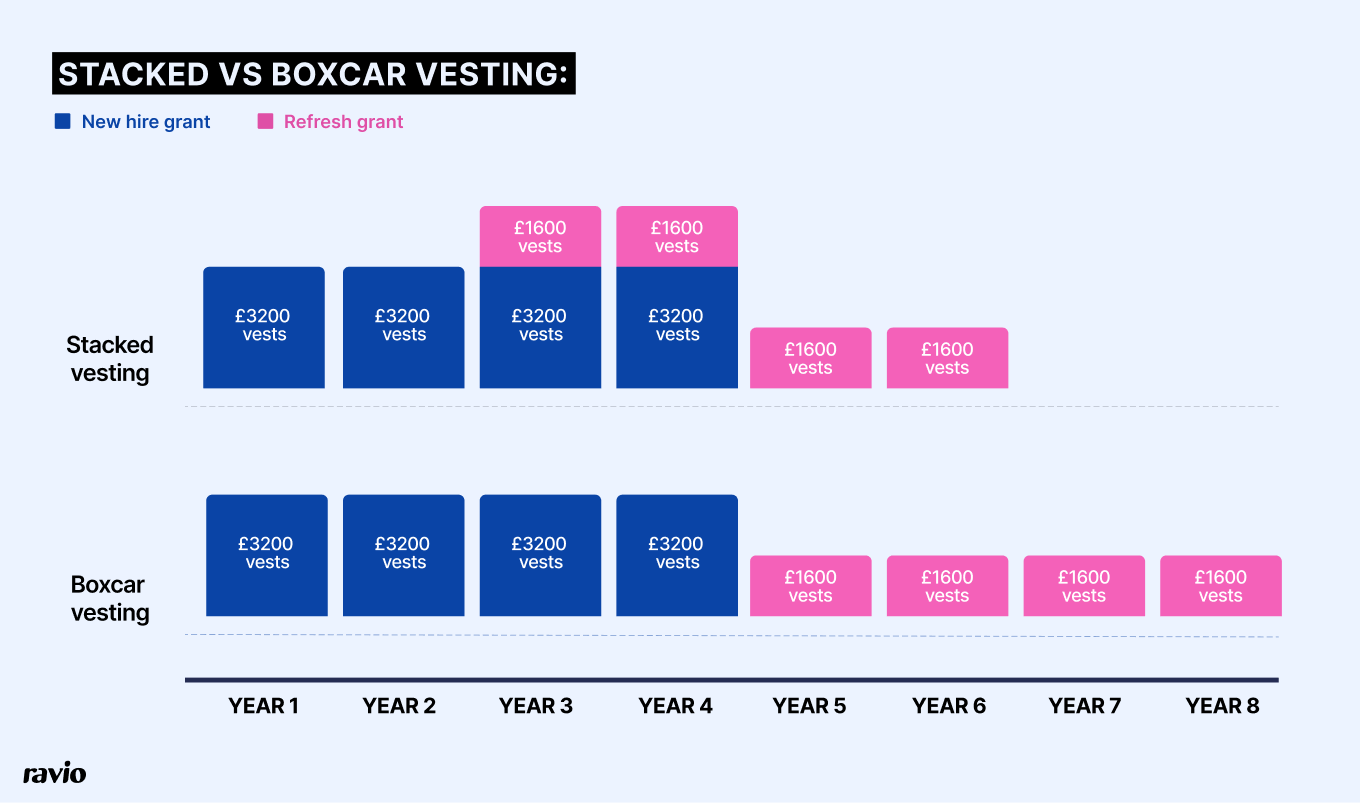

- Equity refresh grant at the end of new hire grant vesting period. As we’ve seen, it’s possible for there to be a drop-off in employee engagement at the end of the vesting period for their initial new hire equity grant. Therefore, some companies will decide to offer employees additional equity on top of their new hire grant at certain points within that initial vesting period e.g. after 50-75% of the new hire grant has vested, to give an incentive for them to continue to stay with the company and contribute to its success. One standard approach is the ‘boxcar approach’ wherein an equity refresh grant is granted at year 2 or 3 of employment, but will not start vesting until after the employee’s new hire grant is fully vested, avoiding overlapping vesting periods.

- Annual equity refresh grant. Some companies view equity refreshers in the same way as an annual salary increase, giving a standard increase each year across all employees. This can help to keep equity compensation competitive against the market for existing employees.

For instance, fintech company Wealthfront opt for a time-based equity refresh programme wherein employees receive a new hire equity grant when they first join the company, and then receive an equity refresh grant of 25% the size of their new hire grant every year after their second year of employment.

Performance-based equity refresh grants

With a performance-based equity refresh programme, additional equity compensation will be given to high performing employees, in the same way that bonuses or salary raises may be allocated based on performance.

This is typically done as part of the company’s standard performance review cycle, and is therefore most commonly done on an annual cadence, and may include employees needing to meet pre-agreed goals or objectives.

For instance, Gitlab has an annual equity refresh grant cycle which runs as part of their annual compensation review process. All employees that have been with Gitlab for at least six months are eligible, and grants are awarded based on talent and performance criteria.

💡How to bring equity compensation into your performance review process with ease

For companies that do choose a performance-based approach to equity refresh grants, it’s important to have clarity on what criteria needs to be met in order to be eligible for an equity refresh grant and how employees will be evaluated against this criteria.

We’d recommend streamlining this process with a performance management system like Factorial (one of our trusted partners at Ravio) to easily build a data-driven, objective performance review process, as well ensuring that employees have full visibility into the process too to improve engagement.

Promotion-based equity refresh grants

With a promotion-based equity refresh programme, additional equity compensation is granted to employees when they are promoted into a new role and job level.

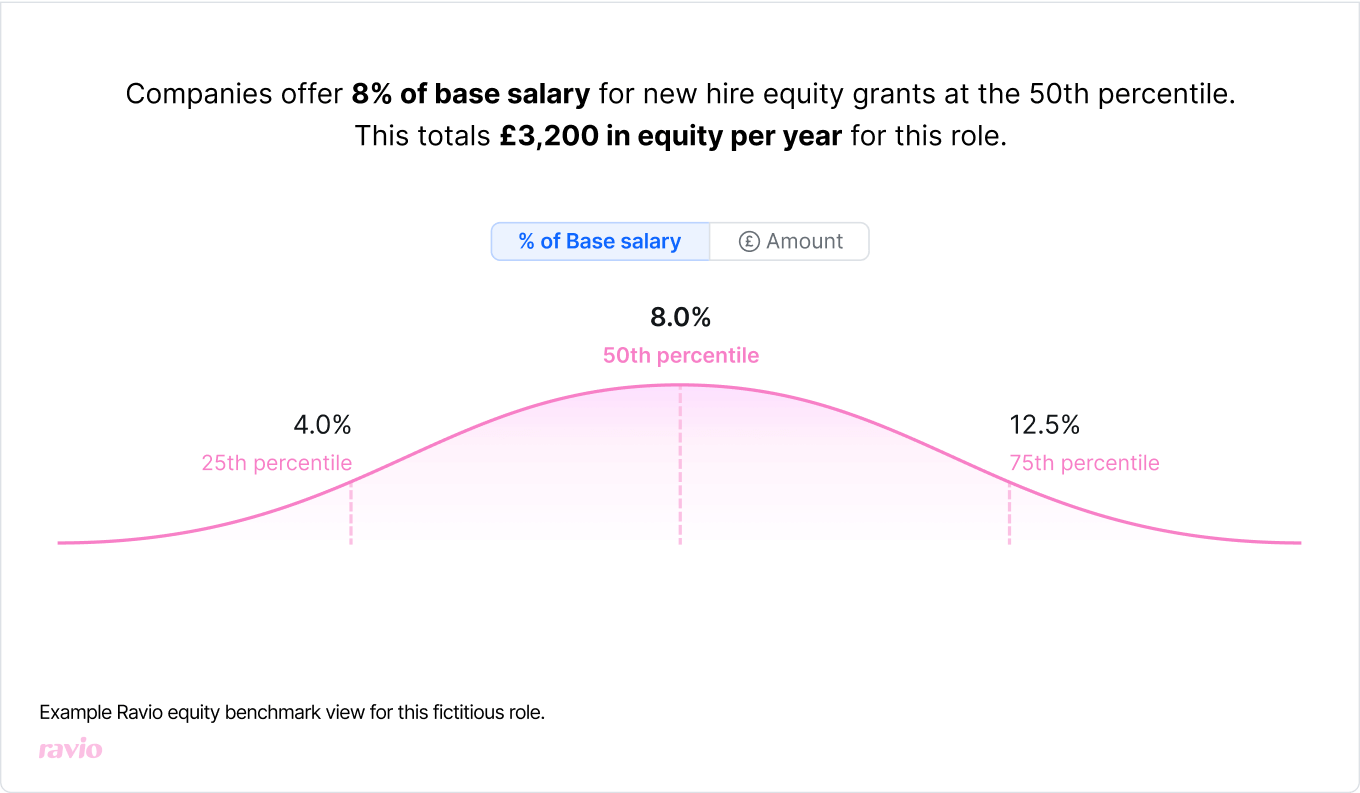

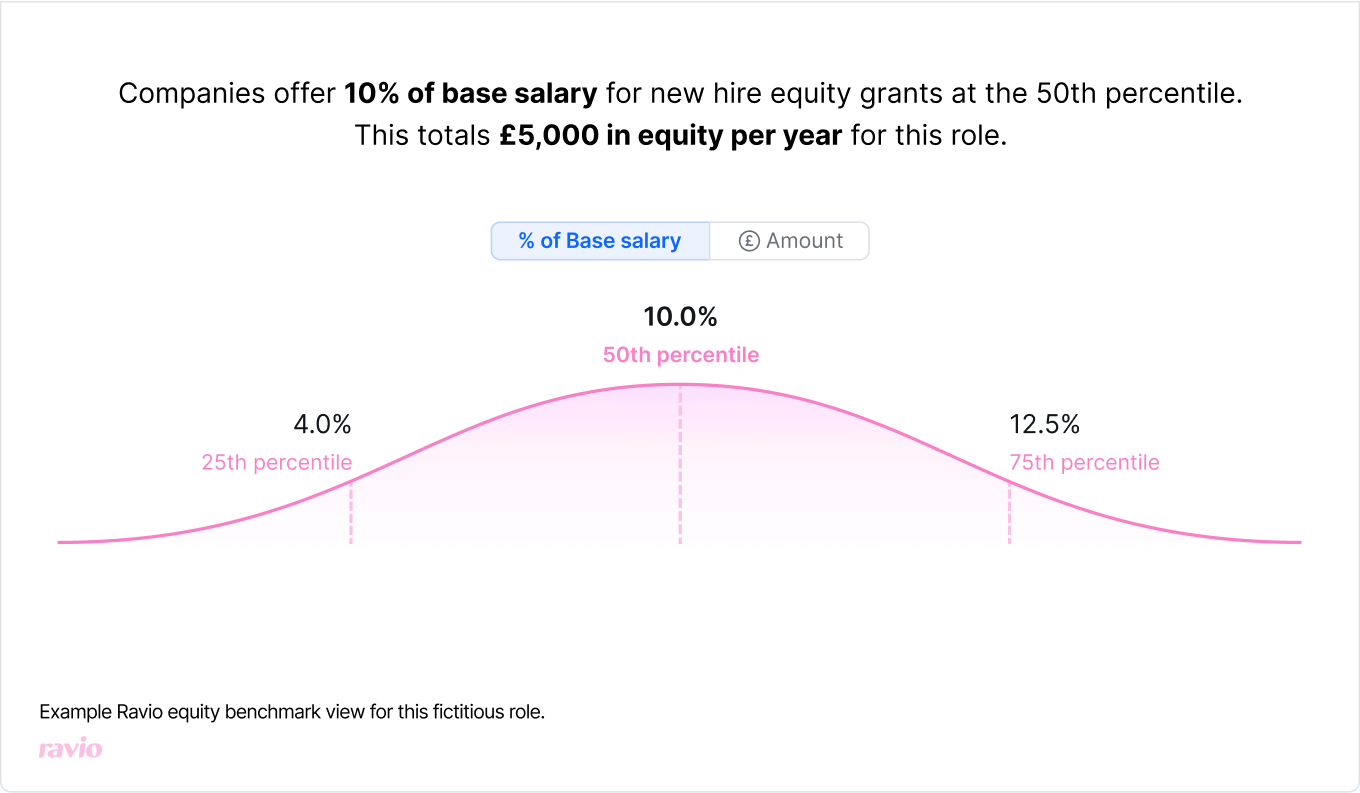

Typically, this means using equity benchmarks like Ravio’s to understand what a competitive new hire equity grant looks like for the employee’s new job position, and then increasing the total value of their equity compensation to match the market rate.

So, for instance, an employee might have initially received a new hire equity grant of 8% of their base salary of £40,000 when they first joined the company – meaning a total equity grant value of £3,200 (likely granted over a four year vesting period).

If they are then promoted to the next level within the company’s levelling framework, equity benchmarking data might show that for their new level it’s typical to offer 10% of base salary as equity, and the new base salary might be £50,000.

If the employee was joining the company in this role, then, they would be offered a total equity grant value of £5,000.

So, at the point of promotion you might grant them an additional £1,800 in equity to make up the difference – though bearing in mind that the actual value of the equity may also have changed in the time the employee has been with the company, if the company’s valuation has changed.