Deciding what vesting schedule to offer for your equity compensation is a bit of a juggling act.

For the company, a longer vesting period and cliff with less frequent vesting intervals is optimal when thinking about an employee retention strategy, because there is financial incentive for the employee to stick around longer and realise the value of their equity.

But, the opposite is true for the employee.

For them, a shorter vesting period and cliff with more frequent vesting means they’re able to more quickly realise the financial value of their equity grant and are less likely to leave equity compensation on the table if they end up leaving the company – so this kind of schedule can be much more attractive when trying to secure top talent onto the team.

So how do other companies approach vesting schedules? Let’s find out.

💡 A quick refresher: how does vesting work again?

In equity compensation, vesting is the legal process of transferring ownership of shares from company to the employee.

Typically, vesting takes place gradually over a pre-determined period of time (the vesting period), incentivising employees to stay with the company until they have gained the full benefit of their equity compensation.

Within that period of time, shares will vest at regular points (the vesting frequency), typically monthly, quarterly, or annually. And there’s also typically a cliff, a period of time which must pass before the shares start to vest.

For more like this, go to the Complete Guide to Equity Compensation for Startups ➡️

What is the most common vesting schedule for European startups?

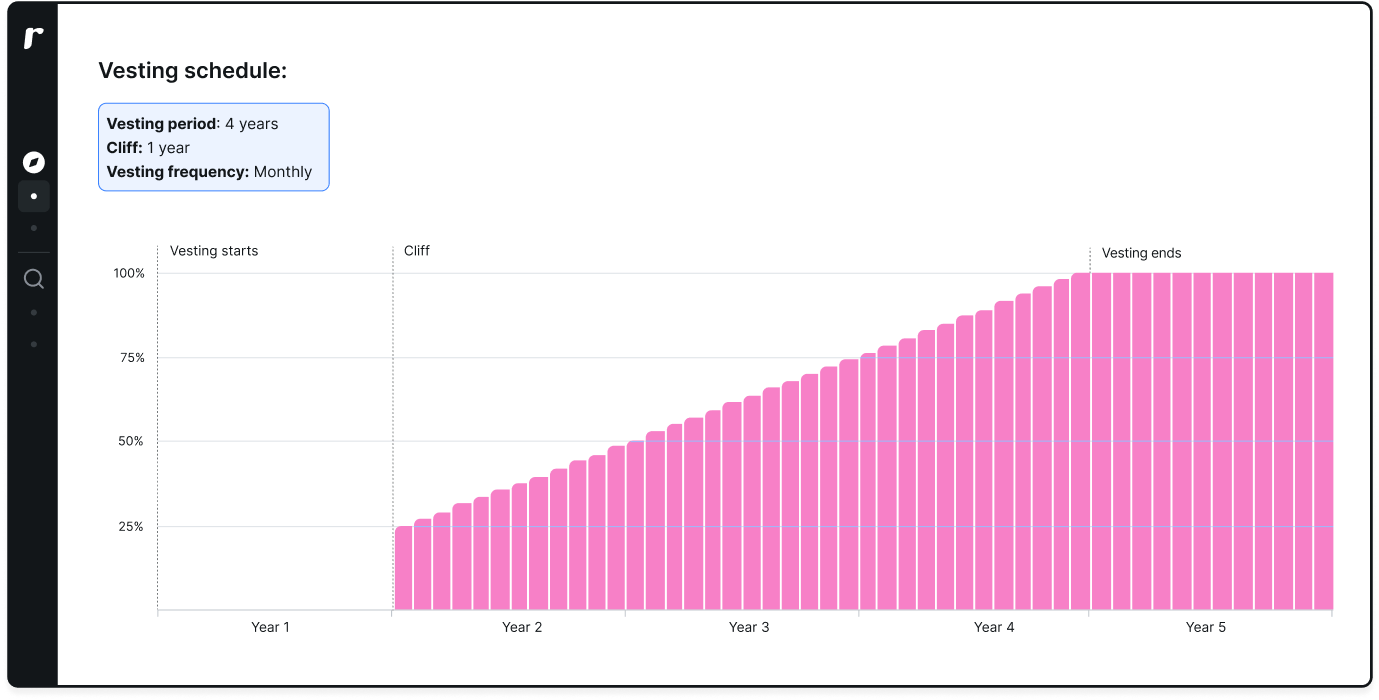

Looking at Ravio’s equity benchmarking data for the European tech industry, we can see that the most common vesting schedule for new hire equity grants is as follows:

- Vesting period: 4 years

- Vesting frequency: monthly

- Cliff: 1 year

A whopping 62% of companies in our dataset opt for this 4 year vesting period with a 1 year cliff and monthly vesting – so it’s the most popular schedule by far.

In terms of alternatives, the next most common options are to have a vesting frequency of annually (9% of companies) or quarterly (9% of companies), but still with the same 4 year vesting period and 1 year cliff.

Why is the 4 year vesting period so popular?

It’s clear that a 4 year vesting period with a 1 year cliff is the norm.

Why is that?

Well, the best guess is that it dates back to the 1980s and 90s.

The 1980s saw the Tax Reform Act of 1986 in the US, under Ronald Reagan, which (amongst other things) made it mandatory for full vesting of employee equity to occur within 5-7 years of the equity grant. In this context, a 4 year vesting schedule was a competitive move, offering quicker than mandatory vesting.

Then, in the dotcom boom era of the 1990s and early 2000s startups were exiting quickly, with the typical time from founding to exiting around 4-5 years – so it made sense for founders to be on a similar schedule for their equity vesting.

Through this, a 4 year vesting period became the market standard.

And sticking with that market standard vesting period can make it easier for potential employees to understand the meaning and value of their equity compensation – given that equity can be a very confusing topic area. So, it makes sense that most companies would simply opt for the market standard, rather than going off-piste and leaving candidates wondering why the offer is different to offers they’ve received elsewhere.

Plus, a 4 year vesting period does seem a reasonably sensible length of time if your priority in offering equity compensation is employee loyalty and retention – which is typical in the tech industry, where a high employee turnover has long been a difficulty.

In our 2024 compensation trends report, we highlighted that the median tenure for employees in European tech startups is 1 year and 9 months. A 4 year vesting period, therefore, extends enough beyond that typical tenure to offer a clear financial incentive for employees to stay with the company a little longer than they otherwise might, without extending so far beyond the median tenure that it feels like an unreachable goal to access the full value of the equity grant and therefore loses its incentive.

It’s also common for companies to offer additional equity refresh grants to further incentivise employees to stay after their initial 4 year vesting period has come to a close, so that retention benefit can be continued for longer too.

And, of course, the standard 1 year cliff is there to ensure that company ownership is not diluted with equity granted to mis-hires and poor fits, who will typically leave their role before the year mark and, therefore, before any of their equity has vested.

Subscribe to our newsletter for a monthly treasure trove of insights from Ravio's compensation dataset and network of Rewards experts, to help you navigate a career in compensation 📩

Is the 4 year vesting period on its way out?

There are alternatives out there to the 4 year vesting period, which could become more popular. Here we'll take a look at a few of those – but, our data currently shows no sign of the 4 year vesting period becoming any less standard, so take these with a pinch of salt.

Eliminating the cliff to attract talent

In recent years the tech industry has faced talent wars, with rapid hiring and headcount growth goals in a tough talent market. Winning talent became a huge priority, with a need to ensure every job offer was as competitive as possible to avoid losing out on new hires.

With this, there has been some shifting towards equity compensation as a strategy for talent acquisition.

Some of the big names of the tech world like Doordash, Coinbase, Lyft, Stripe, Meta, and so on have implemented substantially shorter vesting periods and/or cliffs as a way to make their total compensation packages even more competitive – in some cases removing the cliff entirely.

Increasing vesting periods to reward employee loyalty

At the same time, some startups are going the other direction and finding ways to give greater weighting to employees who stay for longer.

Given that typical employee tenures have significantly declined in recent decades (gone are the days of a ‘job-for-life!), this seems pretty counterintuitive – today’s employees don’t seem to be swayed by incentives that try to lock them into a role.

A more interesting approach would be for startups to grant annual equity refresh grants in the same way that many large, public companies are doing, instead of only refreshing equity at the very end of someone’s vesting period – to add smaller, but more regular incentives to stick around for an extra year.

Back-loaded vesting schedules

One approach which is becoming more common is back-loaded vesting.

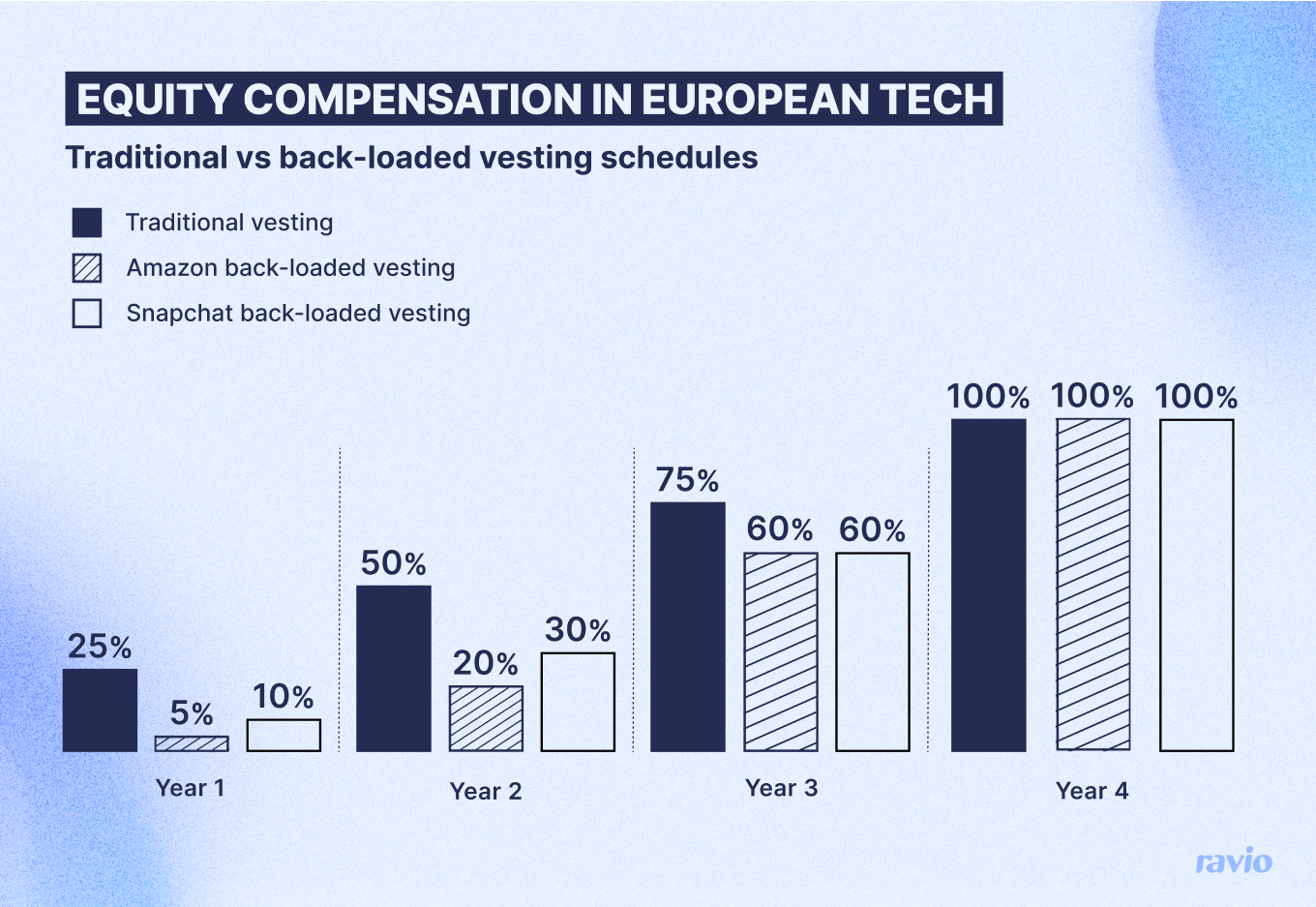

In a typical 4 year vesting period 25% of the grant would vest at the end of each year. With a back-loaded schedule it’s staggered, so only a small amount of equity would vest in the first years, with most of the equity vesting towards the end of the vesting period.

Amazon take this approach, with 5% vesting in the first year, 15% in the second, and 40% in the third and fourth years.

And so do Snapchat, where it’s a 10%, 20%, 30%, 40% staggered release over the 4 year vesting period.