Gone are the days when compensation was just about base salary. Today, compensation management is a strategic tool that helps companies attract, retain, and engage top talent. But as European tech companies brace for a “tech winter” marked by hiring freezes, tighter budgets, and cautious spending, the role of a compensation expert and reward leader has become more complex than ever.

That’s why Ravio recently hosted an interactive webinar, diving into some of the most pressing challenges in the compensation review process and exploring other compensation levers to pull.

Vaso Parisinou, Ravio’s Chief People Officer and Zalando’s Senior Reward Partner, Olga Flegontova, shared valuable insights on the latest compensation trends across European tech, smart budget planning for pay reviews, and the balance between performance-based and market-based pay.

💡If you missed it, here’s a recap of the discussion – or you can watch the full recording on Ravio’s YouTube channel.

Section 1: European tech braces for a “tech winter”

The discussion kicked off with an overview of compensation trends across European tech, taken from Ravio’s Compensation Trends report.

Vaso Parisinou, Chief People Officer at Ravio, walked the audience through a high-level summary of salary increases, hiring rates, and attrition trends – which were, for the most part, all down from last year. It signals a cautious approach from European tech companies, especially at growth stage companies where a lack of funding is being felt hardest.

“Now, given the worldwide uncertainty, businesses are taking more of a cautious approach when thinking about expanding headcount, especially in tech companies. Overall, it’s setting a different pace for the coming year.”

- Vaso Parisinou, Chief People Officer, Ravio

Olga Flegontova agreed that hiring freezes and restrained recruitment have become more common, leading to what she called a “tech winter.”

Companies are responding by balancing competitive salaries with tighter budgets, even as employees look for more financial support to counter rising living costs.

“Employers are seeking more support during these turbulent times of high inflation. Attrition rates are down, and this gives companies a chance to catch their breath in the constant race for the top talent, and evaluate efficiency of the rewards programs.”

Section 2: Different approaches to budgeting

Next, Vaso Parisinou introduced two primary budgeting approaches that companies are adopting: finance-led and HR-led.

Finance-led budgeting often emphasises alignment with financial forecasts and business goals, offering stability and predictability, but it can feel restrictive, especially when responding to talent needs in real time. In contrast, HR-led budgeting allows for more flexibility, enabling adjustments based on specific retention and engagement goals. However, this approach can sometimes lead to cost overruns if not closely aligned with overall financial objectives.

“Successful budgeting is about partnership. Each of us has a unique way of managing the resources, managing the process, and managing the stakeholders. But each approach comes with its own advantages and challenges.”

- Vaso Parisinou, Chief People Officer, Ravio

Olga shared how companies are finding ways to bridge these two methods, stressing the importance of early communication between HR and finance to align on priorities and ensure a shared understanding. By balancing finance-led rigour with HR’s adaptability, companies can set realistic budgets that achieve both business objectives and employee satisfaction.

“HR led budgeting helps address specific talents needed in real time, so we are much more flexible. However, the challenge with a HR-led approach is keeping it aligned with the broader financial goals and to avoid overspending. Striking this balance usually means combining and blending both approaches.”

- Olga Flegontova, Senior Rewards Partner, Zalando

Section 3: Pay-for-performance model versus market adjustment

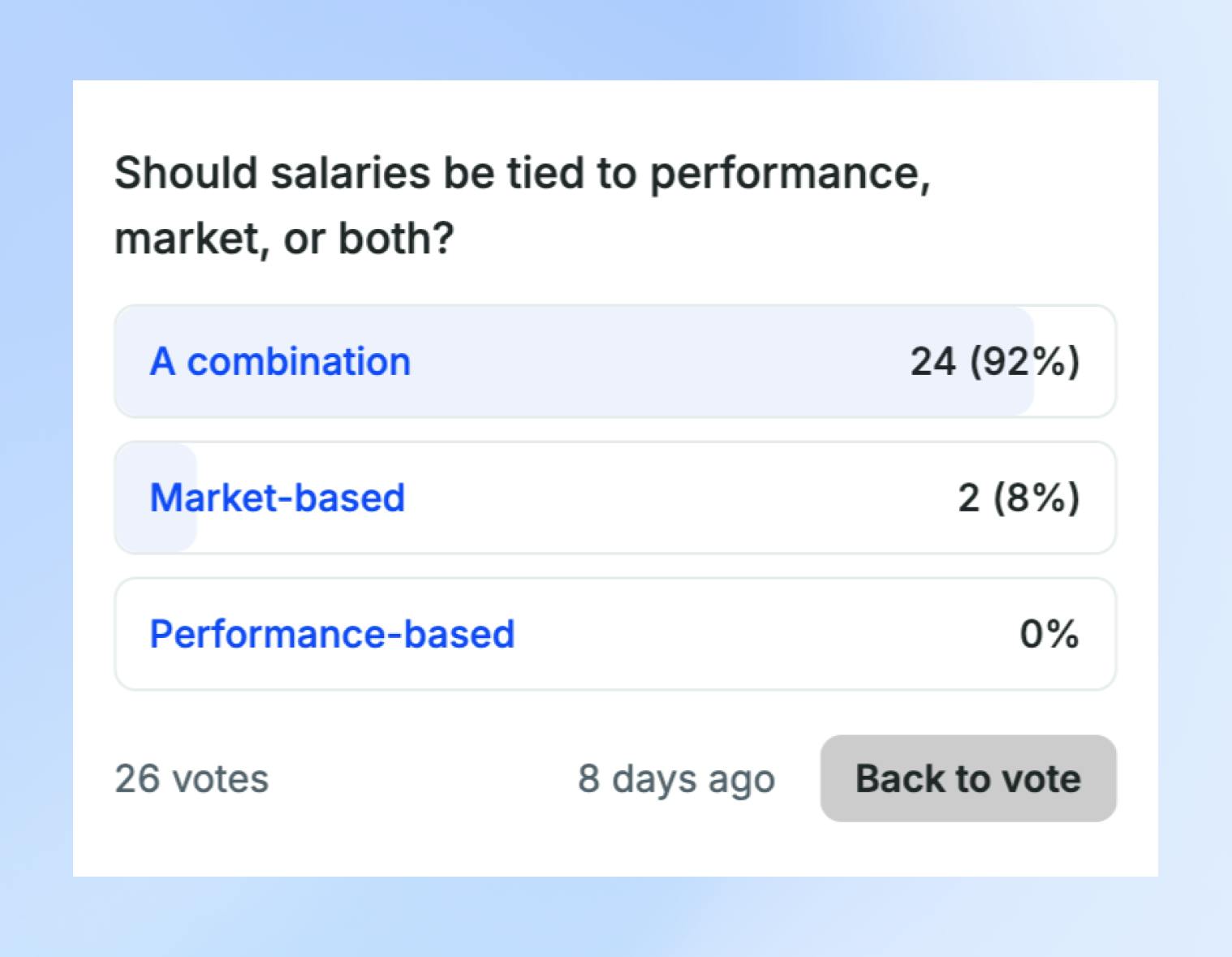

With tighter budgets and cautious spending, the topic of balancing market adjustments with rewarding individual achievements took centre stage.

Market-based adjustments ensure salaries stay competitive and align with industry standards but can overlook individual performance, potentially leaving high performers feeling undervalued. Performance-based pay rewards top performers directly but can be difficult to apply fairly across an entire organisation.

💡 In a poll, 92% of webinar attendees favoured a combined approach that balances market benchmarks with performance-driven rewards.

Despite market-based adjustments being popular, Vaso Parisinou believes we are seeing a rebalancing across the two models.

But there is a challenge here: scaling this is really difficult. Inequities can appear across organisations organisation. What's more, companies who focus on performance-based adjustments may not always keep pace with market shifts, especially where there's very competitive fields.

“Market-based adjustments were all the rage a few years ago, but I actually think we're slowly seeing a rebalancing on the other side with much stronger performance based adjustments. Merit adjustments allow us to directly reward individual contributors, fostering a culture of real achievement."

Olga agreed, explaining that many companies are moving towards a blended model, using market data to set salary bands while also incorporating performance metrics to recognise individual contributions.

For Olga, a blended approach is ideal — using market data for salary band adjustments, coupled with performance metrics like attrition and new hire data. This combination allows companies to stay agile in a competitive market.

"Market-based adjustments need precise benchmarking, using structured data rather than anecdotal feedback, and require investment in both tools and skilled professionals. While they keep us competitive, they can sometimes overlook top performers, which impacts retention."

- Olga Flegontova, Senior Rewards Partner, Zalando

Section 4: The role of equity in total compensation

Equity has become a core component of total compensation, especially in tech. In this webinar, both speakers explained how equity incentives align employee interests with company success, offering long-term financial rewards and helping early-stage companies compete for talent.

“Equity itself is a powerful tool – it gives employees a real stake in the company, driving commitment and engagement, especially for those focused on growth. But to be effective, equity programs require a lot of enablement for both leaders and employees, especially in complex tax landscapes like Germany, where equity can sometimes sound very complicated.”

Olga added that while equity was traditionally reserved for executives, more European companies are offering it to employees at all levels. However, she emphasised that equity plans need to be tailored to each company’s size, maturity, and industry standards to be effective.

Section 5: Q&A

The final part of the webinar featured an engaging Q&A session, where attendees posed their top questions on compensation challenges.

Here’s a snapshot of some of the questions asked –

How much visibility should finance teams have into individual salaries and equity allocations to support precise budget planning?

The level of visibility finance teams have into individual salaries and equity allocations can depend on the company’s stage and size. In larger, more developed companies, finance often plans at a high level, so accessing individual salary details may not be necessary for all team members. However, in smaller companies, finance teams are more likely to have full visibility into individual salaries to support more granular budget planning. Generally, there will always be a few key roles in the finance team, such as payroll or FP&A (Financial Planning and Analysis), that have access to all salary and equity data, even if it's not available to everyone in the department.

How commonly do companies use a merit matrix as a default guideline in merit cycles, compared to using it as a flexible recommendation tool or not at all?

Using a merit matrix by default is more common than applying it purely as a recommendation tool. Larger companies often use the matrix consistently, while smaller companies may apply it more flexibly as a guideline. For organisations seeking flexibility, offering a range within the matrix and allowing managers to challenge recommendations through a defined process can ensure fairness and increase buy-in, helping the merit cycle feel balanced and participative.

At what stage do companies typically offer equity only to select roles instead of all employees?

There isn’t a straightforward progression from offering equity to everyone to only select roles – it varies widely by company and depends on factors like headcount and the potential dilution of equity. Some companies start by offering equity only to executives and then expand it to more employees as part of their engagement strategy. However, as companies grow, offering meaningful equity to all employees can become challenging due to administrative effort and the risk of providing small, less impactful allocations. In those cases, it may be more beneficial to focus equity grants on key roles and offer cash-based rewards to others.

Should equity grants be prorated for part-time employees compared to full-time employees?

Equity grants should generally be prorated for part-time employees to ensure fair and proportional compensation. However, companies need to check specific share option plan rules, as some require employees to work a minimum number of hours to qualify for equity grants.

As for employees on parental leave, common practice varies, but it’s often recommended to allow equity vesting to continue during leave, as it’s part of the reward package. Some companies, including Ravio, continue vesting share options during parental leave, recognizing it as part of the employee’s total compensation. However, practices may vary based on company policy and the specific terms of the equity program.