What salary increase do employees receive on average per year? Is the average pay rise changing over time?

These questions are always top of mind for People and Reward Leaders planning their next compensation review.

Fair and competitive compensation is key to hiring and retaining the talent the business needs to thrive, and your talent competitors are suddenly granting 8% average pay rises, suddenly your salaries might seem a lot less attractive – which means your budget plans might need to shift gear.

So, to help, let’s take a look at the latest data on average salary increases – from Ravio’s 2026 Compensation Trends report.

The average salary increase in 2026

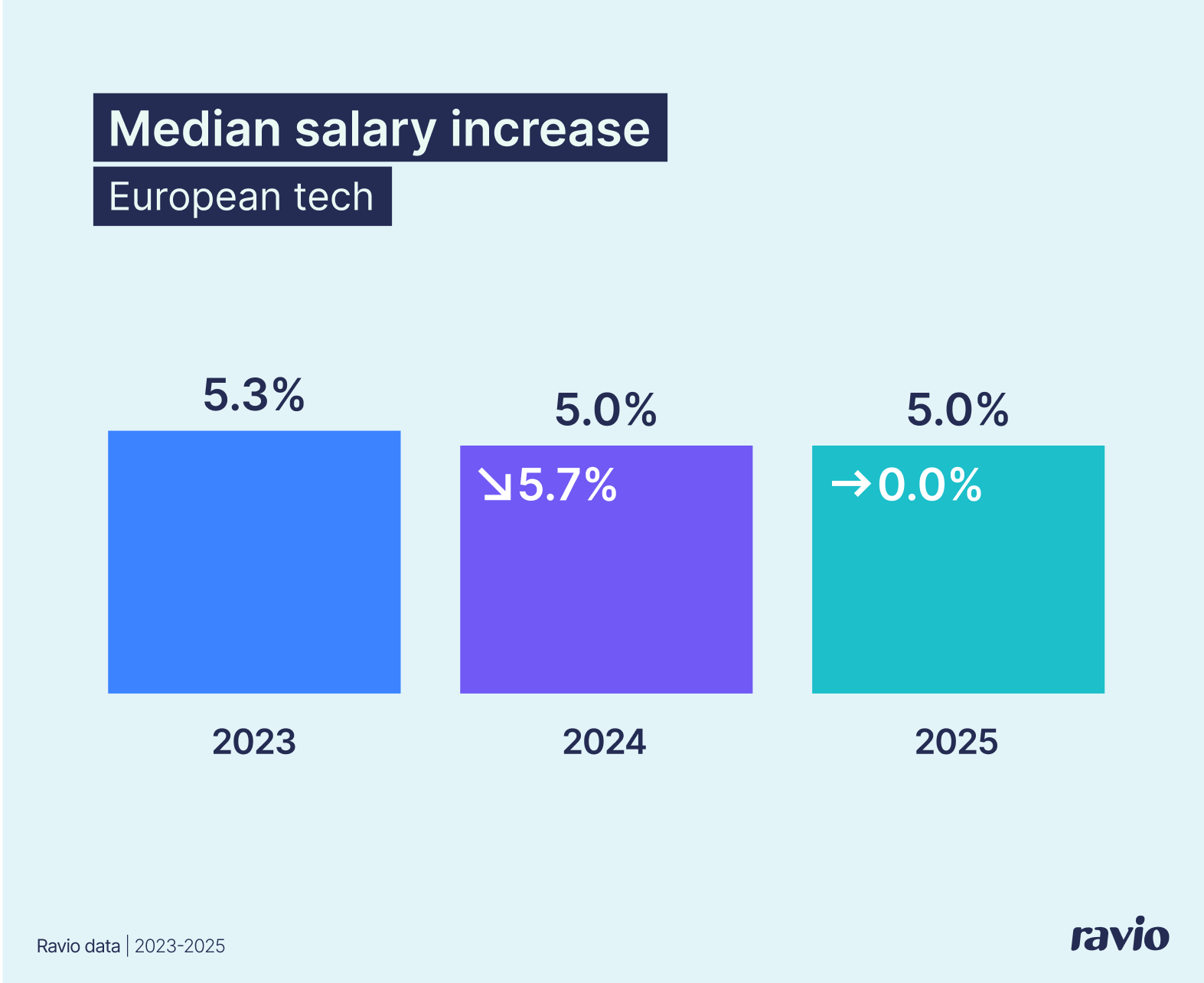

The average salary increase is 5.0%.

This is the median pay rise that employees received in the last 12 months (October 2024 to October 2025) within their existing job role (i.e. from in-role pay adjustments, but not promotions).

Salary increases have stayed consistent this year – the average pay rise in 2024 was also 5.0%, a slight decline from the average pay rise in 2023 at 5.3%. Overall, this suggests a period of economic stability in Europe.

"Budgeting for pay reviews has been static at 4-5% over the last 2-3 years. We only see higher budgets when companies discover they've fallen behind competitors, but there's been little appetite for catch-up spending recently. I don't expect this to change until the economy improves and the talent market heats up again."

Founder of Darwin Total Rewards

Will all employees receive a pay rise in 2025?

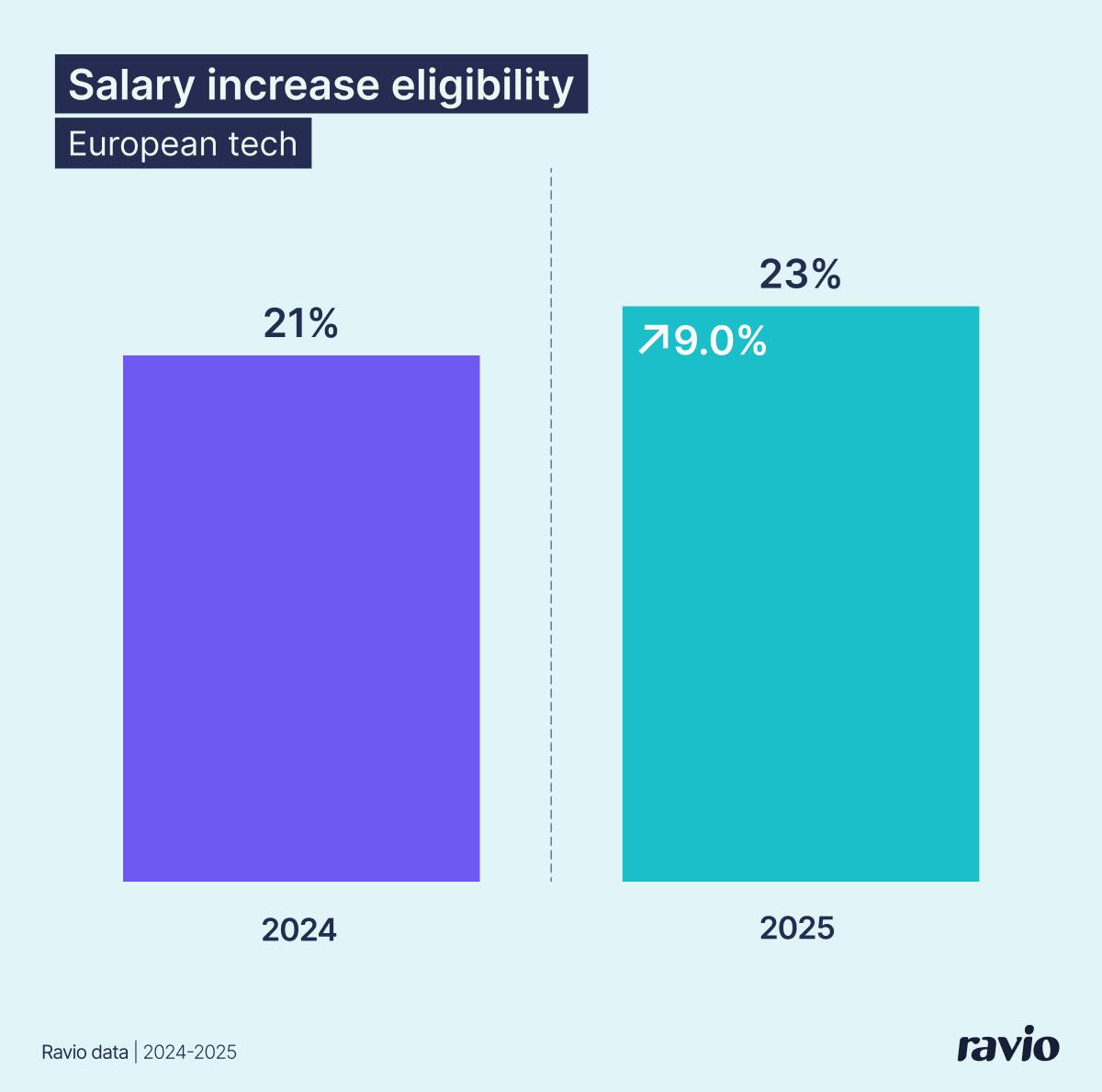

Whilst the average pay rise is 5.0% in 2025 (Ravio data, October 2025), this only accounts for employees who do receive a pay increase – and not every employee does receive one.

23% of employees received a salary increase in the past year (October 2024 to October 2025) – up slightly from 21% in the previous year.

It’s important to note that this reflects only in-role salary increases, so there’s an additional group of employees who received a promotion and will have therefore gained a promotion-based increase (see below).

Those employees receiving no in-role increase and no promotion increase pose a risk given that market competitive salaries continue to rise. Companies maintaining salary freezes for the majority of their workforce may find their compensation becoming uncompetitive, particularly for those who have been in role for multiple years without adjustment.

"When only a small share of employees receive salary increases while market medians continue to rise, companies may be intentionally or unintentionally setting up future retention challenges, especially if external opportunities improve. It's difficult to say whether this reflects a new discipline, an overcorrection from past cycles, or a targeted strategy to reward select individuals over others."

VP of People at HV Capital

How does the average salary increase in 2025 vary across Europe?

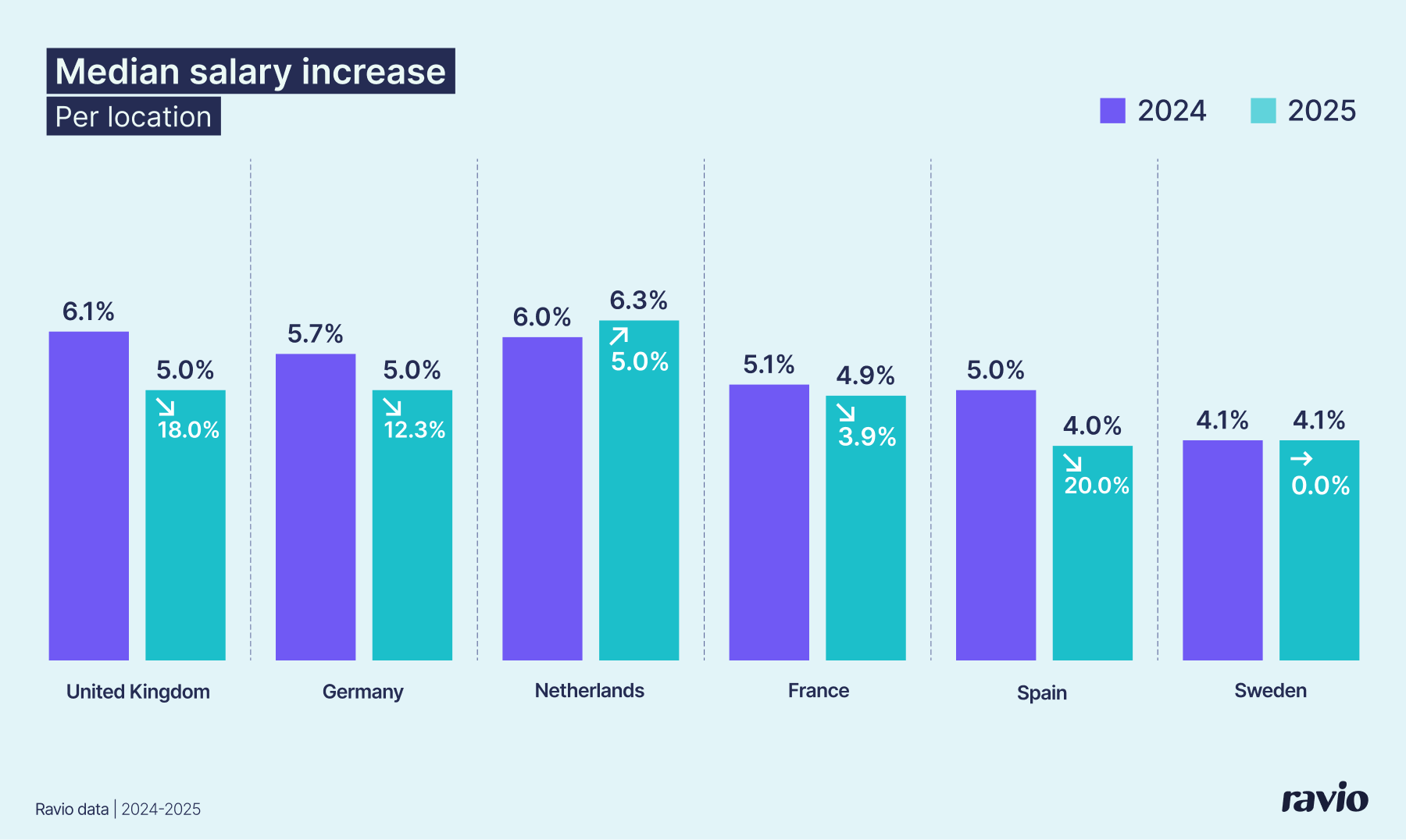

Here’s the overview of average salary increases across Europe in 2025:

- UK average pay rise in 2025: 5.0%

- Germany average pay rise in 2025: 5.0%

- Netherlands average pay rise in 2025: 6.3%

- France average pay rise in 2025: 4.9%

- Spain average pay rise in 2025: 4.0%

- Sweden average pay rise in 2025: 4.1%

Ravio’s data shows that most European markets saw salary increases cool in 2025, with the UK and Spain experiencing the steepest declines (-18% and -20% respectively). Spain now offers the lowest increases at 4.0%.

Sweden’s average pay rise remained the same this year, but is still the lowest across the European market. Given Sweden’s salaries have overall seen growth, this suggests that this is driven by higher salaries for new hires rather than increases for existing employees – which could lead to salary compression issues.

The Netherlands stands out as the only market where average salary increases actually grew in 2025, rising from 6.0% to 6.3%.

"While 5% increases are working well for Western Europe, companies can't apply one rate across all markets. In Eastern Europe we're seeing 6-8% increases, sometimes double that in markets like Ukraine where inflation remains very high. Each location operates independently with its own economy and expectations – benchmark them separately and distribute your budget fairly across these differences."

Senior Compensation Manager at Bolt and Co-founder of Cohorts

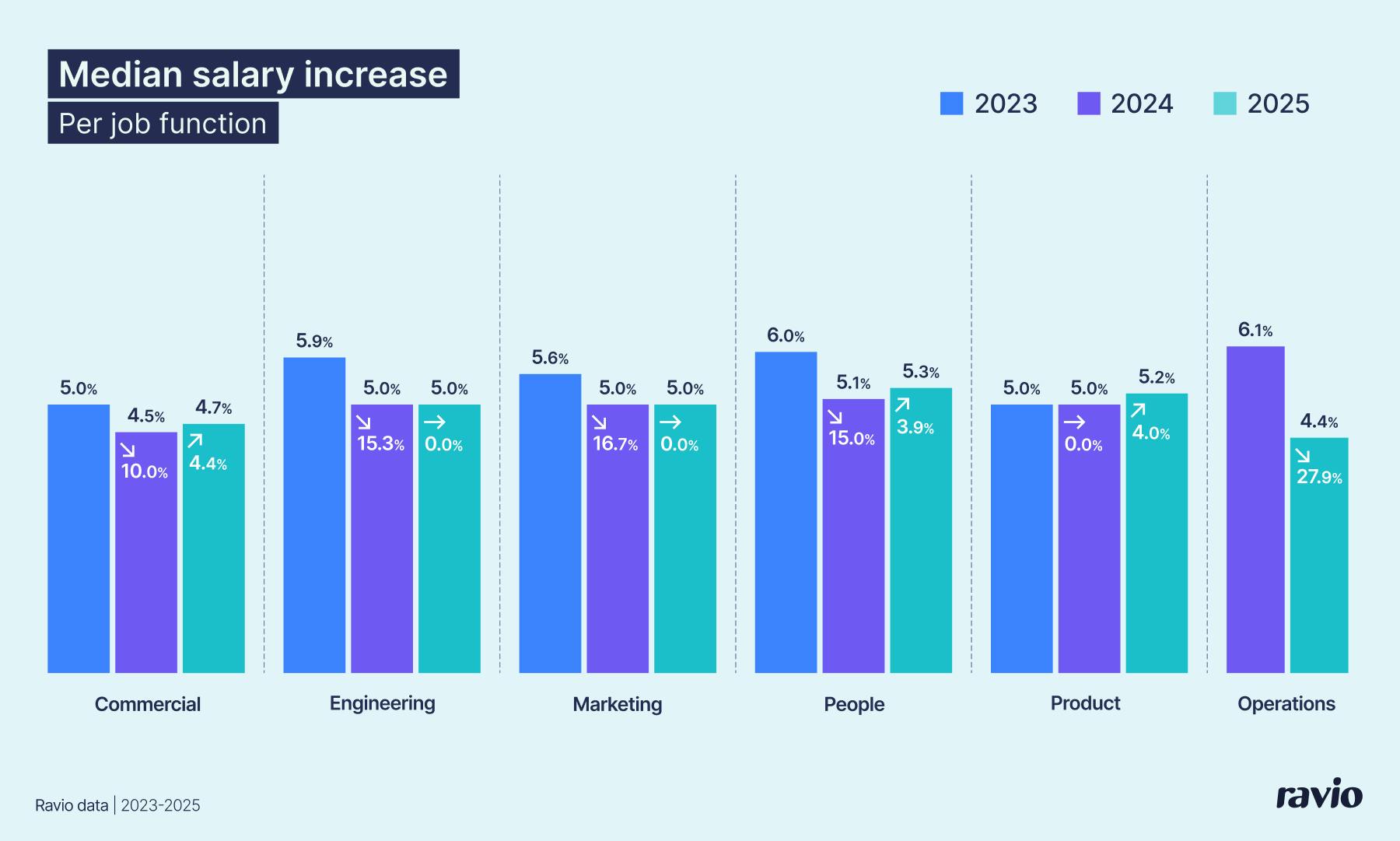

How does the average salary increase in 2025 vary across job functions?

Looking at Ravio’s Compensation Trends report data on median salary increases per job function, we see consistency – with most clustering around 5.0% as the typical annual salary increase.

Engineering, Marketing, and Product all maintained exactly 5.0% median increases, while People (5.3%) and Commercial (4.7%) showed only minor variations.

This uniformity could suggest companies are taking more centralised approaches to salary increases, moving away from function-specific strategies.

The one outlier is Operations, which saw a steep 28% decline. This likely reflects the evolving nature of operations roles – with routine tasks increasingly able to be automated or outsourced, while strategic operations work is often being brought within other functions like Product (‘Product Ops’) or Engineering (‘Engineering Ops’).

“Lessons learned from years of tech layoffs, in combination with seeing lean teams at AI-first startups achieve incredible results, is leading founders to challenge themselves to think differently. It used to be formulaic: seed round meant hire X roles, Series A meant hire Y roles. Now founders are asking themselves how to get further along the scaling journey with fewer people. It’s no surprise that lower level operational and support roles are the ones being deprioritised as companies automate many workflows.”

Talent Director at Atomico

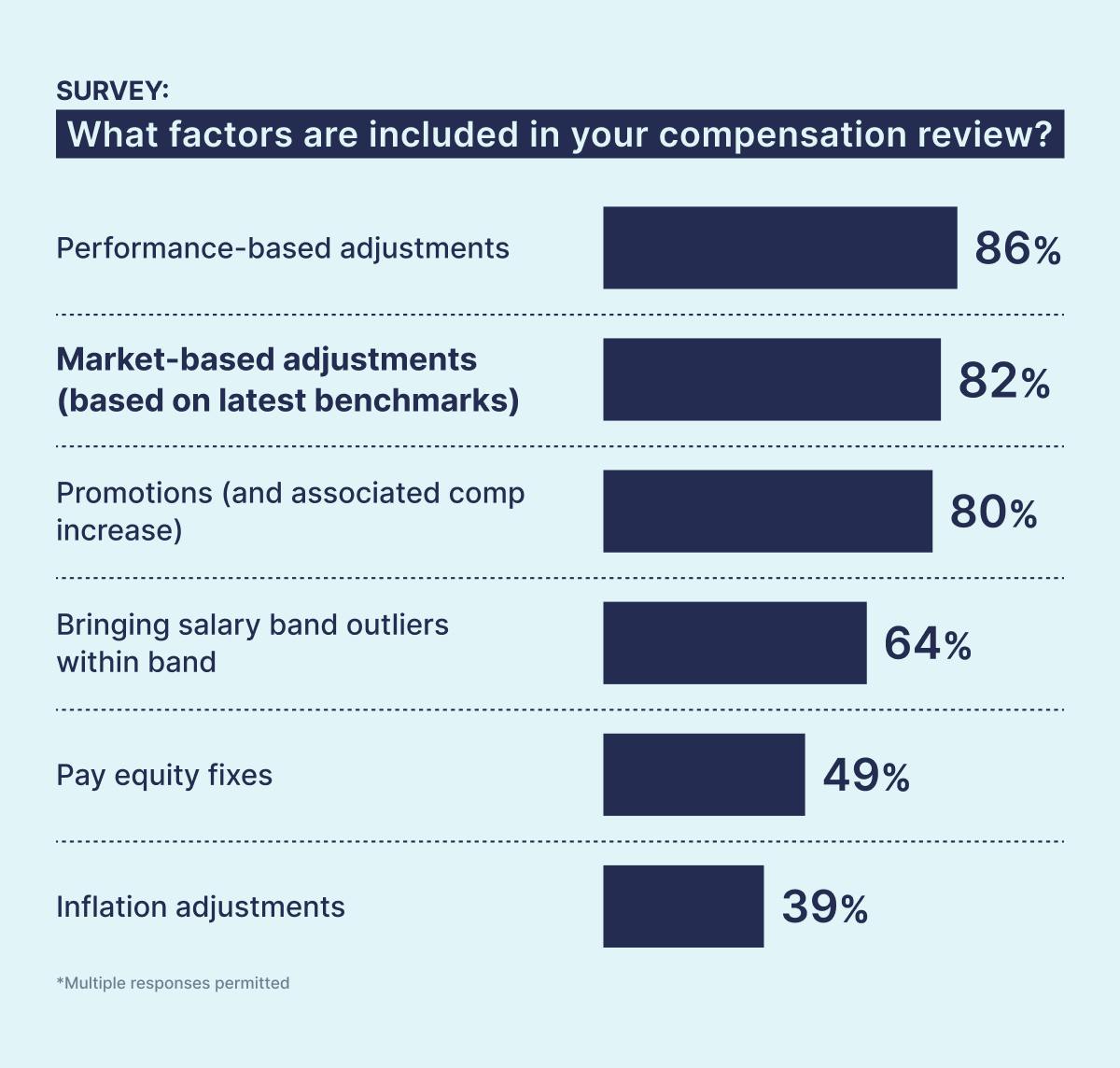

How do companies decide what salary increase to give their employees?

Companies use many factors to determine the salary increase that their team will receive.

Budget is one important factor which often limits the size of salary increase available to team members. Beyond this, the most important factors are:

- Performance-based adjustments. 86% of companies (Ravio pay review survey, August 2025) factor performance into their salary increases – with the size of the salary increase varying per employee based on their performance rating.

- Market adjustments. 82% of companies factor market adjustments into their salary increases, reflecting changes in market rates per role and location to ensure that employee pay remains fair, competitive, and in line with the company’s compensation philosophy.

- Pay equity fixes.49% of companies use salary increases to address any inconsistencies or pay gaps within their company – so employees who are underpaid compared to their peers who perform work of equal value will receive a higher than average pay increase.

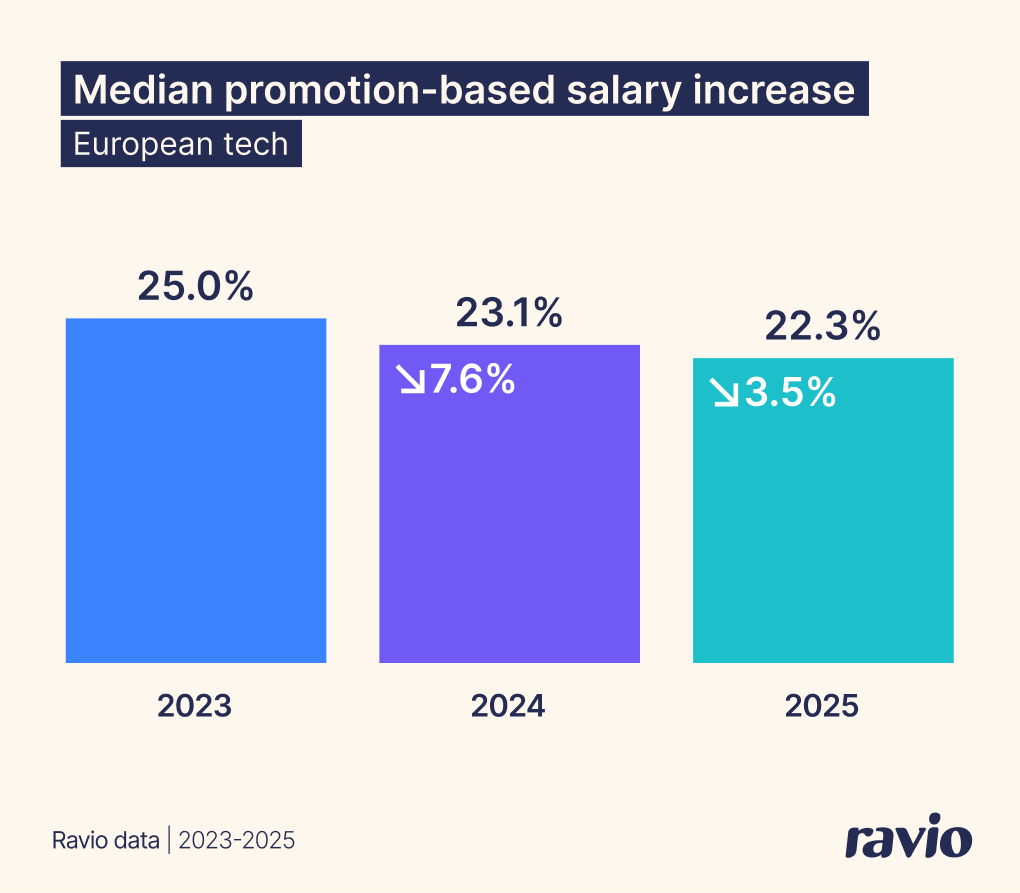

The average promotion-based pay increase in 2025

The average promotion-based salary increase in 2025 is 22.3% – this is the median pay increase an employee receives when they are promoted to the next job level for their role, usually a much more substantial pay increase than your typical annual in-role pay rise.

This continues a trend of promotion-based pay increases slightly declining in the last few years, with:

- 2024 average promotion-based pay increase: 23.1%

- 2023 average promotion-based pay increase: 25.0%

Promotion increase sizes vary significantly across European markets. France leads with 28% median promotion-based increases, whilst the UK offers the smallest promotion increases at 21%, with Sweden (22% promotion-based pay increase) also below the European average.

Interestingly, countries with higher promotion rates tend to offer smaller increases – the UK has the highest promotion rate (4.6%) but lowest increase (21%), while Germany shows the opposite pattern (2.5% promotion rate, 25% increase). This suggests different approaches: some markets promote more frequently with modest increases, while others promote employees more slowly but with more significant changes in base pay.

FAQs

What was the average pay rise in 2024?

The average pay rise in 2024 was 5.0% (Ravio data, Oct 2023-Oct 2024). This represented a slight decline from the 5.3% average pay rise recorded in 2023, but marked the beginning of a period of stability – with salary increases remaining at 5.0% in 2025 as well.

What was the average pay rise in 2023?

The average pay rise in 2023 was 5.3%, according to Ravio data. This marked a significant decline from 2022, when the average salary increase across European tech was 8.0% – reflecting the wider market correction after the pandemic-era tech boom.

What is a typical pay rise percentage?

A typical pay rise percentage is currently 5.0%, based on Ravio's compensation trends data. This represents the median in-role salary increase that employees receive during annual compensation reviews. However, the typical percentage varies by location – for instance, the Netherlands sees higher average increases at 6.3%, whilst Spain averages 4.0%.

What is the average yearly salary increase?

The average yearly salary increase across European tech is 5.0% (Ravio 2026 Compensation Trends report). However, it's important to note that not all employees receive a salary increase each year – only 23% of employees received an in-role pay rise in the past year, with an additional portion receiving promotion-based increases instead.

How much is a typical promotion salary increase?

A typical promotion salary increase is 22.3%, according to Ravio's 2026 Compensation Trends report. This is significantly higher than in-role salary increases (which average 5.0%), reflecting the jump in compensation that comes with moving to a higher job level. Promotion increases vary by location, with France offering the highest median increases at 28% and the UK the lowest at 21%.

Is a 4% pay rise good?

A 4% pay rise is slightly below the current European average of 5.0% (Ravio 2026 Compensation Trends report).

Whether it's "good" depends on context. Location is a factor, for instance – in Spain, where the average is 4.0%, it's competitive, whilst in the Netherlands (6.3% average) it would be below market.

It's also important to consider your role's market rate and performance: companies typically use salary increases to maintain market competitiveness and reward performance, so comparing your increase to both market averages and your own contribution provides a fuller picture.

What is considered a good pay rise?

A good pay rise is one that keeps your compensation competitive with current market rates for your role, level, and location, whilst recognising your performance and progression. According to Ravio’s 2026 Compensation Trends report, the median in-role salary increase across European tech is 5.0%, whilst promotion-based increases average 22.3%.