What are Europe’s tech start ups prioritising for 2024 in terms of people and headcount?

Well, in this year’s difficult economic landscape – persistent inflation, a lack of VC funding, an almost-closed IPO window – start ups have shifted focus from rapid hiring and ‘growth at all costs’ towards team stability through a focus on improving retention and slow and steady growth.

This is a sensible approach. As we all know, recruiting is expensive, so making employee retention a priority is much needed to achieve that stability and keep costs down.

But, to achieve those improved retention rates in a time of heightened living costs, it’s vital that companies avoid salary stagnation for their employees. And with pay increases and promotion rates actually down this year, this is extra important.

Start ups that recognise this, and budget to enable salary reviews and career development to be a priority in 2024, can win on employee retention.

Let’s take a closer look at the data behind these trends – all extracted from Ravio’s Compensation Trends 2024 report – and explore how start ups plan to improve employee retention during an economic downturn.

Ravio's Compensation Trends 2024 Report

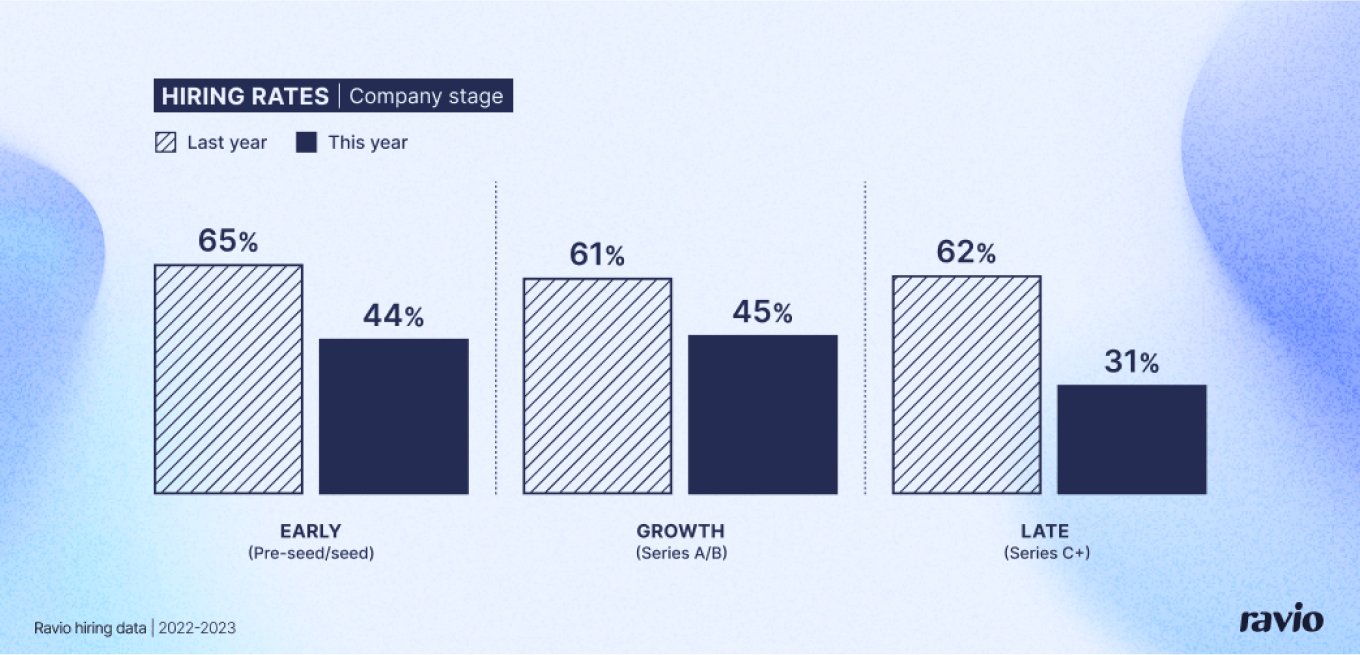

Hiring is down by up to 50% as start ups prioritise stability over expansion

The talent war and hiring frenzy of the past couple of years have given way to a much more cautious approach to hiring in 2023.

Across Europe as a whole, the new hire rate has decreased from 60% last year to 37% this year.

Larger, late stage companies (series C+) have cut hiring the most, with the hiring rate half what it was this time last year. This is likely because the difficult VC investment environment and almost-closed IPO window has hit these later stage companies the hardest.

Extract from Ravio's Compensation Trends 2024 Report

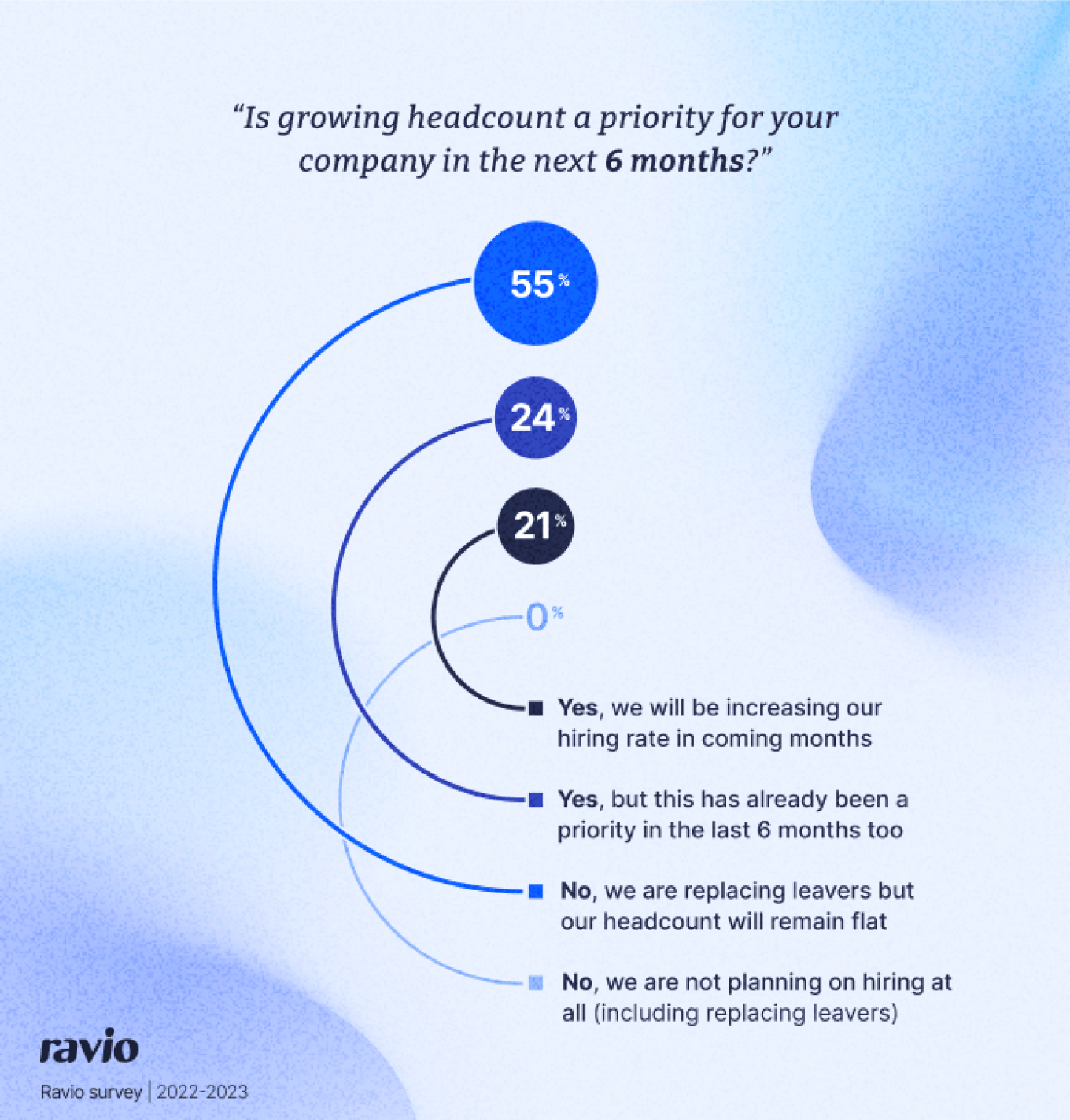

In terms of plans for next year, only 21% of companies will actively increase headcount in the next 6 months, whereas 55% of companies plan to keep headcount flat, replacing leavers but not introducing any new roles.

Extract from Ravio's Compensation Trends 2024 Report

When asked why this is the case, there were three recurring themes:

- A desire to ‘stabilise’ the existing team before the next stage of headcount growth

- A focus on ‘slow and steady growth’ rather than continuous hiring

- A need to ‘manage costs’ more closely in the ‘difficult economic environment’.

In essence, retaining experienced employees means that companies can continue to improve their offering and win new customers at a consistent level of growth, without the costs associated with hiring.

With hiring taking a backseat, retaining existing talent is paramount – and that means avoiding salary stagnation

In order to keep headcount flat and achieve that company stability, 78% of companies are making improving employee retention a core priority for the next 6 months.

Competitive compensation is key to this.

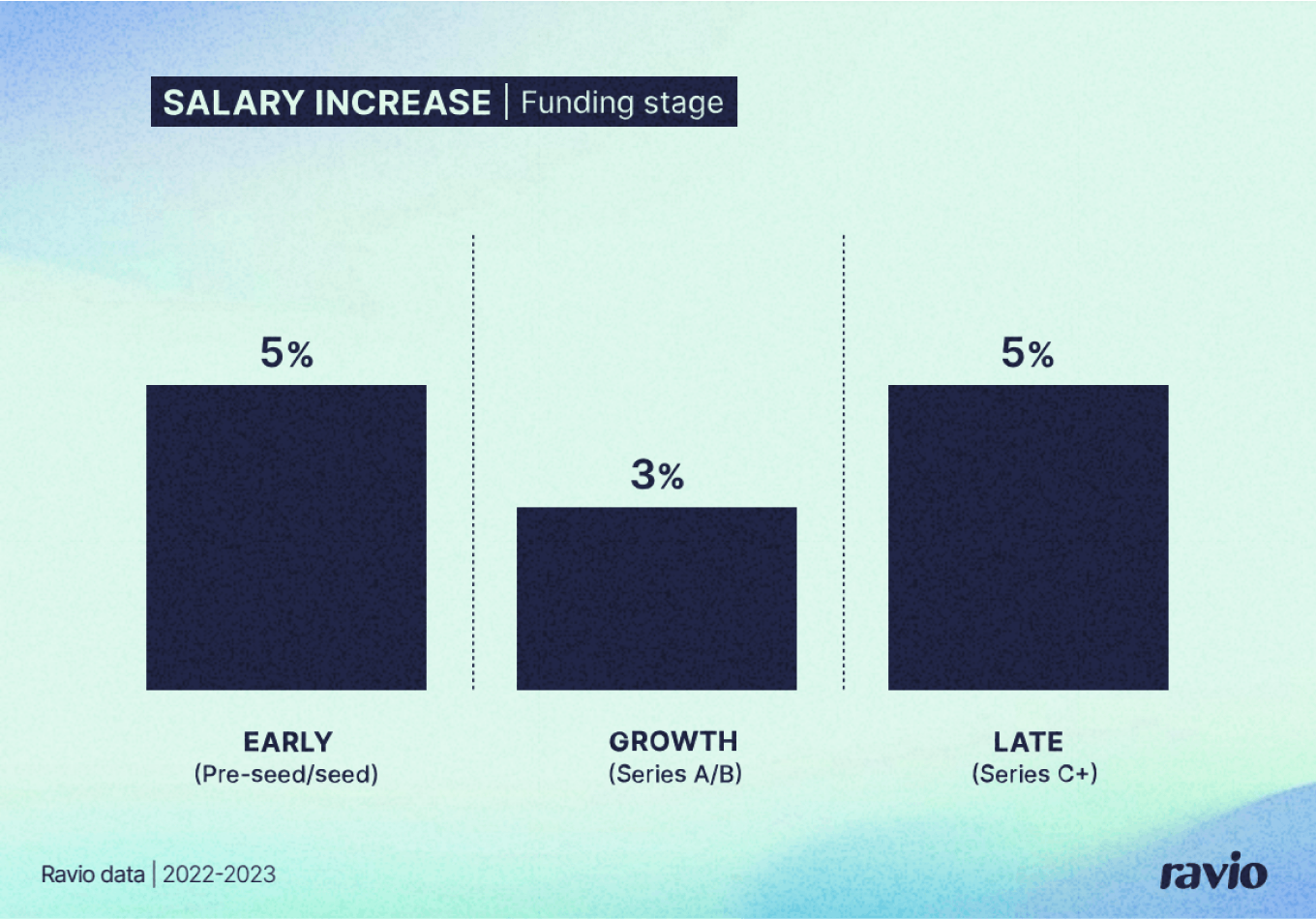

Given that pay increases and promotion rates have actually declined in 2023, whilst inflation remains high (4.9% across Europe as of September 2023), it’s likely that employees are hoping to increase their earnings next year to help their pay check stretch further.

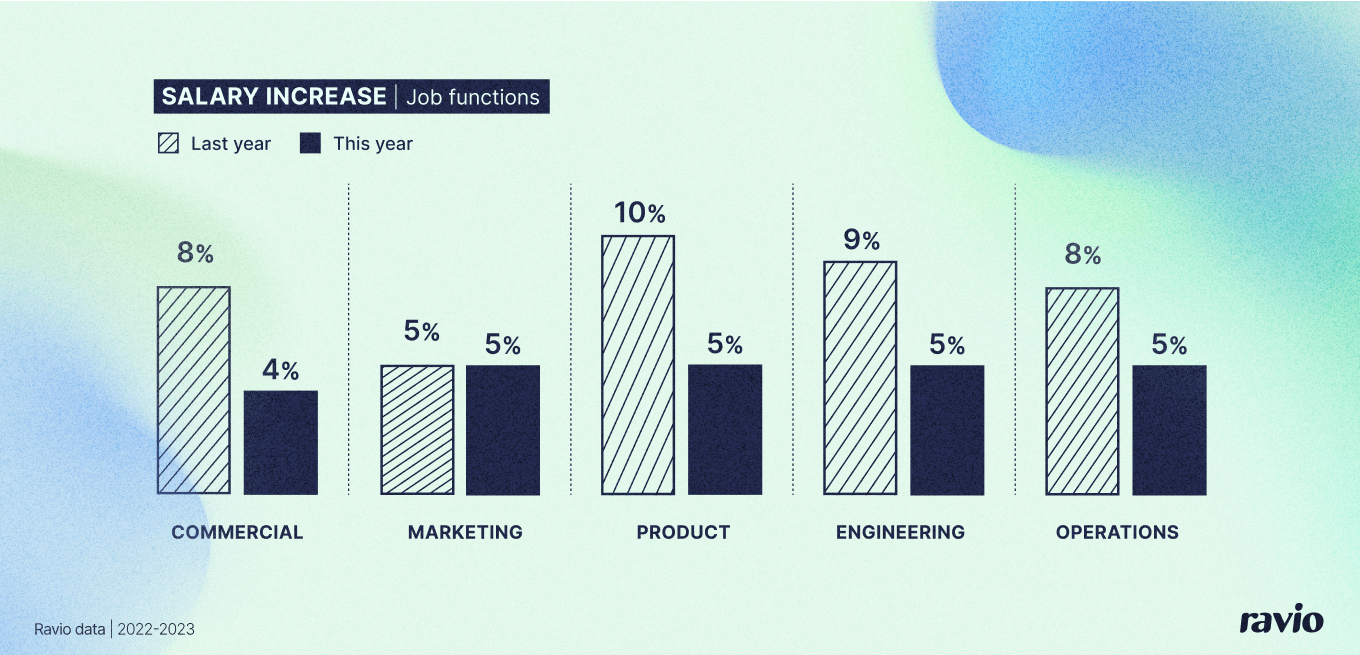

Specifically, last year a typical employee in a tech company in Europe could expect a salary increase of 8%. In 2023, this has dropped to a salary increase of 4.8% – 40% lower year on year.

Extract from Ravio's Compensation Trends 2024 Report

In fact, EY’s 2023 Work Reimagined Report highlights that 35% of employees are planning to find a new job in the near future, with pay as the number one priority in this.

So, if companies want to retain their talent, salary reviews are a must to ensure that pay remains competitive.

But, not all companies realise this.

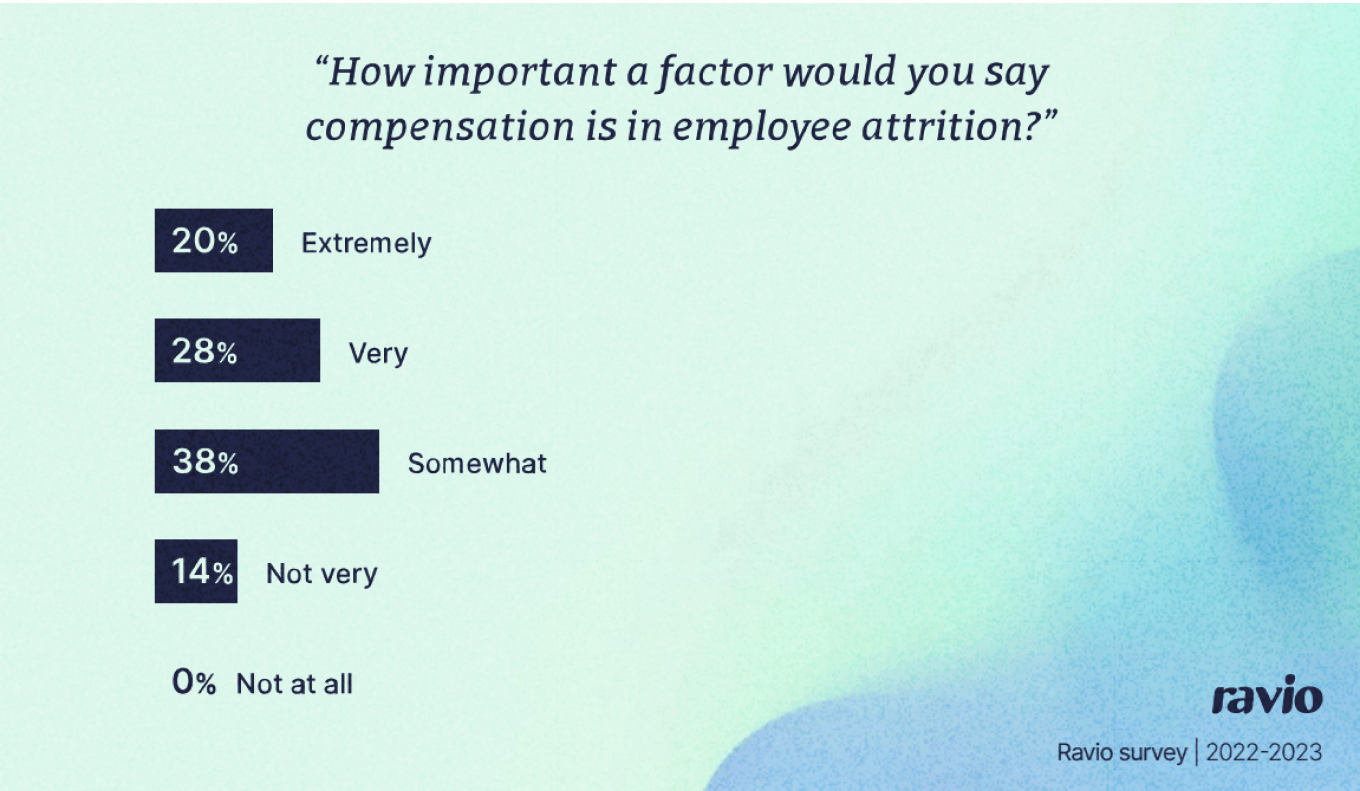

In Ravio’s compensation trends survey 52% of companies said that compensation was ‘not very’ or only ‘somewhat’ important in employee retention.

Extract from Ravio's Compensation Trends 2024 Report

And this is reflected in EY’s research too, finding that 57% of employers actually believe their employees are less likely to quit this year due to the bad market conditions – completely contrary to what their employees are saying.

So the goal to improve employee retention could be at risk for companies that don’t act on this information (keep reading for advice on actions to take).

In fact, this could already be starting to happen.

This year the commercial job family received the lowest overall salary increase at 3.7%. This compares to an average 8% salary increase for commercial roles last year, so a 54% reduction in salary increase.

Extract from Ravio's Compensation Trends 2024 Report

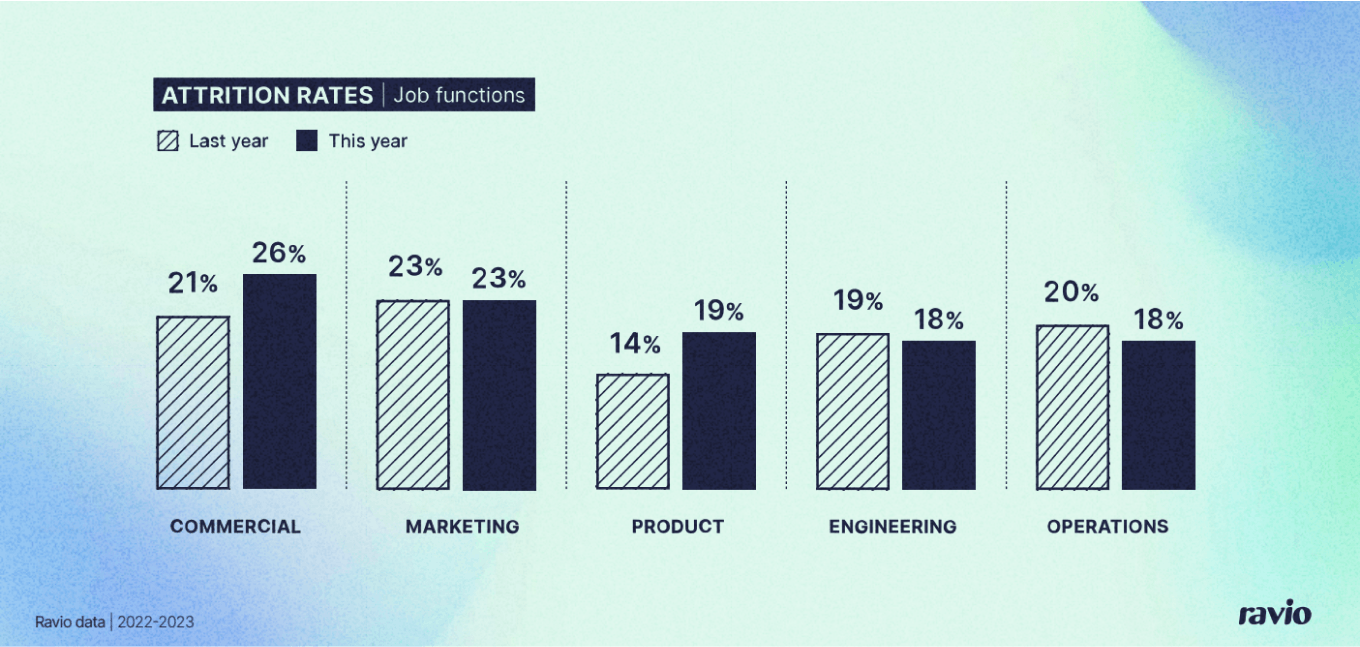

And, alongside this, the commercial job family also has the highest attrition rate this year at 26%, up from 21% last year.

Extract from Ravio's Compensation Trends 2024 Report

Of course, we can’t say for certain that the lack of pay increase is causing higher attrition rates – but it’s highly likely to be a contributor.

So what does this mean for your start up?

Well, it means that if you make it a priority to review the competitiveness of your compensation package for existing employees (especially those top performers you can’t risk losing), then you can win on employee retention – keeping your top performers in post to achieve that stability and slow and steady growth that start ups are looking for, and saving time and money on hiring their replacements.

Tips for retaining top performers in 2024

As we’ve seen, retaining great employees in 2024 will require business leaders to prioritise (and budget for):

- Salary reviews. Salary matters for retention: that’s clear. So, salary benchmarking to understand how your employees’ salaries stack up overall against the changing market is important to stop them looking elsewhere – as well as considering inflation increases given the economic environment.

- Career progression opportunities. Salary stagnation and career stagnation are closely linked. So alongside an overall review of salaries, it’s also important to understand what career and pay progression has looked like for existing employees (especially your top performers) over the last few years. If you don’t have budgetary scope for promotions, you could look at other factors like improving L&D opportunities, secondments for those considering lateral moves, and building a culture of recognition and appreciation.

Alongside this, other important factors in employee retention during a time of recession include:

- Total compensation. Salary matters, but it isn’t everything. Start ups can also leverage factors like equity options or meaningful benefits as incentives to retain great employees where cash compensation falls short.

- Great communication and empathetic leadership. In a time of economic uncertainty, when employees are likely struggling with concerns about cost of living, job security, and career progression, understanding and communication are more important than ever.