- The data: Most People teams struggle to stay on top of market rate changes for employee salaries

- What is a market adjustment raise?

- Why are market adjustments important?

- How often should you make market adjustments?

- How to bring market adjustment raises into your next compensation review: Step-by-step guide

- Frequently Asked Questions

A great team member just resigned. The exit interview reason? They saw an equivalent role paying 15% more elsewhere – the market rate shifted over time, and their salary didn't reflect those changes.

Market adjustment raises consistently come up as one of the most challenging aspects of running a salary review.

Understanding how market benchmarks have changed since your last review, deciding which roles need adjusting, and determining fair increases across the team requires careful planning and reliable data.

And skipping this step creates serious risks. Salary compression when new hires earn more than experienced employees. Retention issues when your team sees higher rates advertised elsewhere. Pay equity problems when performance increases aren't balanced with market realities.

In this guide, we'll cover what market adjustments are, why they matter, and how to build them into your salary review process effectively.

The data: Most People teams struggle to stay on top of market rate changes for employee salaries

Understanding how market data has changed since your last review ranked as one of the most stressful parts of the compensation review process in our recent survey.

It’s not hard to see why.

Keeping on top of market shifts for dozens or hundreds of role, level, and location combinations, distinguishing genuine market shifts from temporary spikes, and keeping up with emerging skills and evolving role expectations – it’s a lot.

The challenge is exacerbated when your salary benchmarking data comes from market-lagging salary surveys. By the time annual survey results are published and analysed, you're working with data that's 6-18 months old. That lag means you're always playing catch-up, unable to spot market rate changes as they happen.

Subscribe to our newsletter for monthly insights from Ravio's compensation dataset and network of Rewards experts 📩

What is a market adjustment raise?

A market adjustment raise is a salary increase made to align an employee's pay with current market rates for their role, level, and location.

Unlike merit increases, which reward individual performance, market adjustments respond to external factors – cost of labour changes caused by increased demand for specific skills, economic conditions, or competitor pay rates.

Why are market adjustments important?

Market adjustments ensure compensation stays aligned with external realities.

Market benchmarks shift over time – sometimes dramatically.

So, even if an employee maintains the same level of performance within the same role and level, their pay can easily become uncompetitive.

Without regular market adjustments, you're essentially paying employees less for the same work over time, creating retention risk and internal pay inequities.

The risks of skipping market adjustments:

- Retention issues due to market lagging salaries. Employees don't need to actively job hunt to realise they're underpaid. They see job ads on LinkedIn, hear from recruiters, or talk to peers in similar roles. When they discover the gap between their salary and current market rates, the temptation to look elsewhere rises. This is particularly important if meeting or leading the market on compensation is a core component of your talent strategy.

- Competitive disadvantage for critical skills. In fast-moving areas (like AI this year, where talent demand is incredibly high and competitive salaries are changing regularly) failing to adjust salaries based on market changes can mean losing out on great new hires to your competitors – as well as losing current talent to new opportunities too.

- Salary compression. New hires are often benchmarked fresh and enter the process with current market salary expectations, so they're brought in at today's rates. If existing employees don't receive market adjustments, experienced team members end up earning less than new joiners doing the same work – causing inconsistencies and inequities that only compound over time.

How often should you make market adjustments?

Market adjustments should be deliberately included in your compensation management process at least once a year – but ideally you should be monitoring market rate changes continuously throughout the year, to catch shifts as they happen.

Our recent pay review survey found that most companies (85%) make market adjustments as part of their compensation review process – and the vast majority of companies run one or two compensation reviews per year.

We’d recommend using your compensation review cycle as the anchor point. These cycles are the natural time to make market adjustment raises: refreshing your underlying benchmarks and ensuring any salary increases account for market changes.

But, don’t neglect market changes in-between cycles – depending on your compensation review cadence, waiting to make market adjustments until your next cycle might be too late.

So, it’s also important to stay on top of market rate changes year-round, through:

- Access to a reliable, up-to-date salary benchmarking source – a real-time compensation data provider (like Ravio) that keeps benchmarks constantly updated via HRIS and ATS integrations is the best way to stay on top of market shifts and spot trends as they emerge.

- Looking for trends via talent acquisition – if the rates you need to offer to secure candidates for a role are significantly higher than your current range, then it’s a sure-fire sign that your compensation is no longer market competitive.

One word of warning: be cautious about making market adjustments based on every fluctuation you see in the benchmarks, or every piece of candidate feedback.

Give it time to check whether it’s a genuine trend in the market, rather than a short-term spike or one-off anomaly. You can't easily reverse salary increases, so ensure you're responding to sustained market rate changes, not short-term noise.

How to bring market adjustment raises into your next compensation review: Step-by-step guide

So you’re sold on making market adjustments part of your next salary review. How do you actually go about it?

Well, some companies opt for an across-the-board inflation or cost-of-living increase for simplicity – our recent survey found this approach is particularly common at smaller companies, with 54% of companies under 100 employees including inflation raises in their review process.

While straightforward, across-the-board inflation or COL increases don’t capture how different roles, levels, and locations move at different rates in the market. Inflation is just one factor influencing market benchmarks – demand for specific skills, competitor pay rates, and economic shifts all play a role in how salaries change.

A market-based approach using current compensation benchmarking data provides better accuracy and ensures fair, competitive compensation across your team.

Step 1: Re-benchmark with current market data

Before starting your compensation review, always refresh your underlying compensation benchmarking data – this gives you that updated perspective on market rates.

Today, the best option for reliable and up-to-date compensation benchmarks is a real-time provider (like Ravio) that builds benchmarks via live integrations with company HRIS and ATS systems – meaning the benchmarks are continuously updated, reflecting market rate changes as they happen.

If you're relying on annual salary surveys, the refreshed benchmarks could still be 6-18 months old – which means your market adjustment raises will never reflect what the market actually looks like today.

Step 2: Refresh your compensation bands

Once you have current benchmarks, update your compensation bands to reflect the new market rates.

This means adjusting:

- The band midpoint (which should align with your target percentile – e.g. 50th or 75th percentile)

- The band minimum and maximum (to maintain your desired range spread).

For example, let’s say you target the 50th percentile for your tech team for market positioning.

If the 50th percentile salary for a UK P3 Software Engineer was £66,700 last year and has increased to £70,000 this year, your salary band midpoint needs to shift accordingly.

If you maintain a standard 15% range either side of midpoint, your refreshed band range would be £59,500-£80,500 (compared to the previous £56,695-£76,705).

Don't forget other elements of total compensation too. If your compensation band structure reflects total cash, or you have separate bands for variable pay or equity, you'll need to refresh those benchmarks and structures in the same way too.

If you have access to a compensation bands tool like Ravio’s, the process of refreshing your bands in-line with the latest market rates becomes a simple task – you’ll always be able to see how your ranges line up with your target percentiles, and updating the range to align with market changes is just the click of a button.

Step 3: Analyse employee band positions

Now you can compare where each employee sits within their salary band compared to where they were previously, using either:

- Compa ratio: Employee salary divided by band midpoint (e.g. £66,700 / £70,000 = 0.95)

- Salary range penetration: How far through the band the employee is (e.g. 56% of the way from minimum to maximum).

The question you’re looking to answer is: with the refreshed bands based on new market rates, has the employee's band position changed?

If they were previously at 1.0 compa ratio (right at midpoint) but the band has shifted, they might now be at 0.95 – meaning they're now being paid less competitively against today’s market.

With compensation band software like Ravio’s, that compa ratio analysis is automatically done for you, and always visible.

Step 4: Calculate and apply market adjustments

Determine what adjustment is needed to maintain each employee's band position relative to the refreshed market benchmarks.

To keep to the same example:

The employee’s salary is £66,700. This was a 1.0 compa ratio, right at the midpoint of the original band range of £56,695-£76,705.

With the new refreshed range of £59,500-£80,500 and a midpoint of £70,000, keeping the employee at the same £66,700 salary now gives a compa ratio of 0.95.

To keep them at the same 1.0 compa ratio, their salary needs to be at the midpoint (50th percentile) of £70,000 – meaning a 5% market adjustment raise is needed (£3,300).

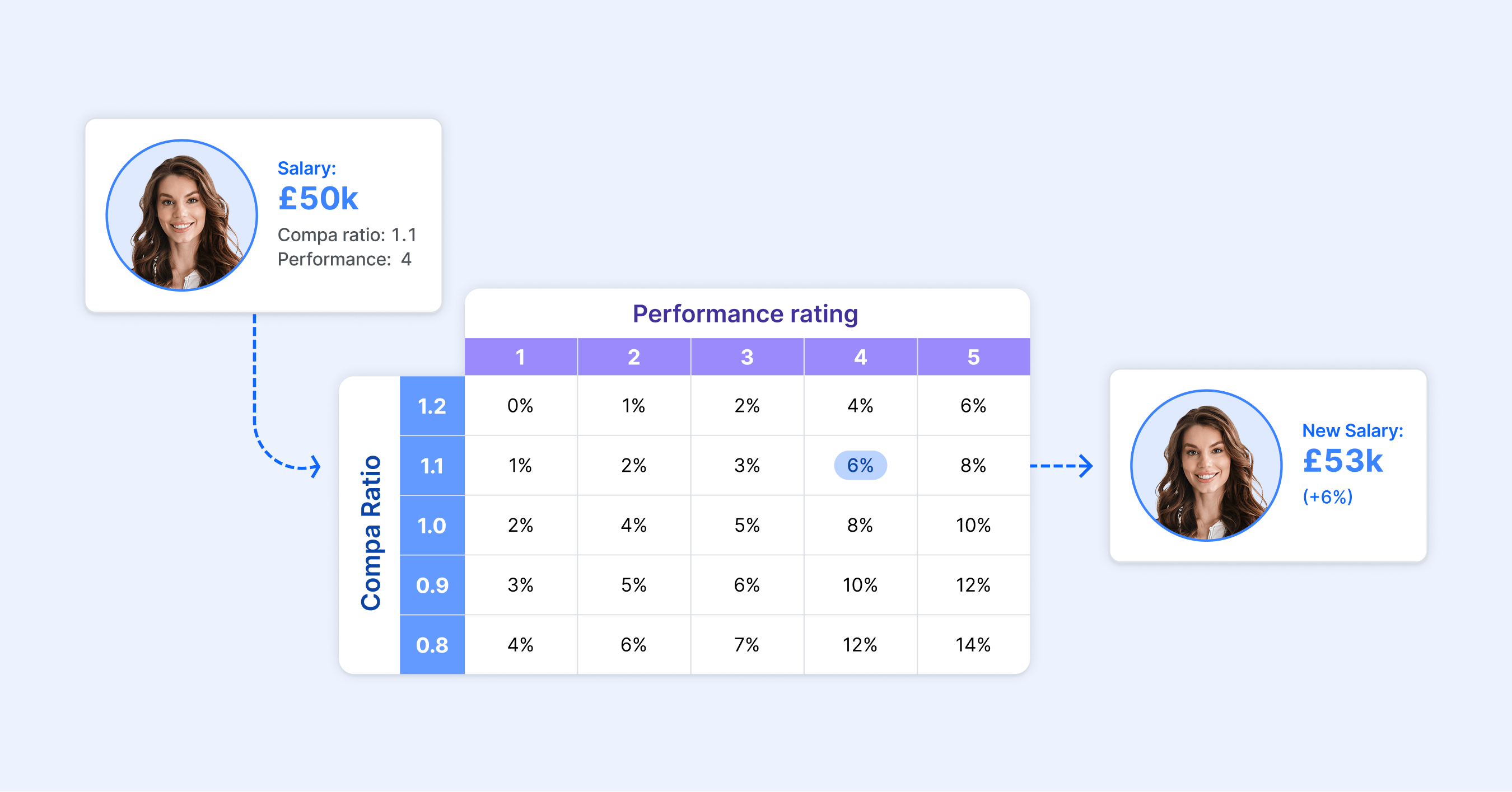

Rather than calculating market adjustments in isolation, many companies find the most effective approach to be using a merit matrix to combine several things that are typically factored into an employee’s pay adjustment during compensation reviews.

A merit matrix assigns salary increases based on the combination of performance rating and salary band position – helping to ensure that compensation review decisions don’t cause inconsistencies and inequities across wider pay structures.

Because you've already refreshed the salary bands in Step 2, factoring in salary band position means you automatically capture how market changes impact band position.

An employee who was previously at 1.0 compa ratio might now be at 0.95 if the market has shifted for their role or location – the merit matrix will naturally allocate them a higher increase to bring them back up, while also factoring in their performance.

This approach prioritises reviewing compensation in the right order:

- Pay equity first – addressing any inconsistencies and inequities

- Maintaining market competitiveness second – at whatever target percentile your compensation philosophy defines

- Then rewarding individual performance – which can also be done through other levers like bonuses, equity refreshes, or recognition programmes to keep base salary decisions consistent across the organisation.

And all within a single, consistent framework that reduces bias and keeps decisions aligned with your compensation philosophy.

Ready to streamline your market adjustments?

Ravio's real-time benchmarks and salary bands tool make it simple to refresh benchmarks in-line with the latest market trends, update bands, analyse band positions, and plan market adjustments to keep pay fair and competitive.

Frequently Asked Questions

What is a market adjustment raise?

A market adjustment raise is a salary increase made to align an employee's pay with current market rates for their role, level, and location. Unlike merit increases that reward performance, market adjustment raises respond to external factors like shifts in supply and demand for skills, economic conditions, or competitor pay rates.

What is market rate salary?

Market rate salary refers to the competitive cost of labour for a specific role, level, and location. Market rates are influenced by factors including supply and demand for skills, economic conditions, competitor pay rates, and cost of living. Companies determine market rates through salary benchmarking data, typically expressed as percentiles (e.g., 50th percentile represents the median salary across the market).

What's the difference between a market adjustment and a merit increase?

A market adjustment aligns an employee's salary with current external market rates. A merit increase rewards an employee's individual performance and contributions. Market adjustments respond to external factors like cost of labour changes, while merit increases are based on internal factors like performance ratings.

How much is a typical market adjustment raise?

A typical market adjustment raise varies depending on how much market rates have shifted for a specific role and location in any given year.

The average salary increase during a pay review is typically 3-5% – in 2025, the average salary increase across European tech is 5% (Ravio data).

However, individual market adjustments will vary by role – for example, AI-related roles have seen premiums of 10% or more in the past year due to high demand, so should expect to see a higher market adjustment.

What is a market correction in salary?

A market correction in salary is another term for a market adjustment raise – a pay increase designed to bring an employee's salary in line with current market rates for their role, level, and location.

How much should a market adjustment raise be in 2025?

Market adjustment raises in 2025 should be based on how much market rates have shifted for specific roles and locations since your last review.

According to Ravio's data, the average salary increase across European tech in 2025 is 5%, though this varies by country and by job function. To determine the appropriate market adjustment, refresh your salary benchmarking data with current market rates and calculate what's needed to maintain employees at their target band position.

How should I communicate market adjustment raises to my team?

Market adjustment raises should be communicated at two levels: overall company communication on the process, and 1:1 discussions between line managers and direct reports.

The overall company communication should cover the whole compensation review process – including what factors go into decisions and the approach to market adjustments – and should come centrally from HR or leadership. This sets the context and ensures consistent messaging across the organisation.

Individual conversations about specific salary adjustments should be handled by line managers in 1:1s. Managers need to be prepared with full context, rationale, and principles behind decisions, and educated on market adjustments and the process, so they're equipped to answer questions and explain how the adjustment reflects current market rates for that employee's role.