Compensation Trends 2026

The state of hiring and pay in European tech

Discover Ravio’s data on how European tech companies are managing compensation – including salary increases, hiring trends, and pay equity strategies.

Get the report

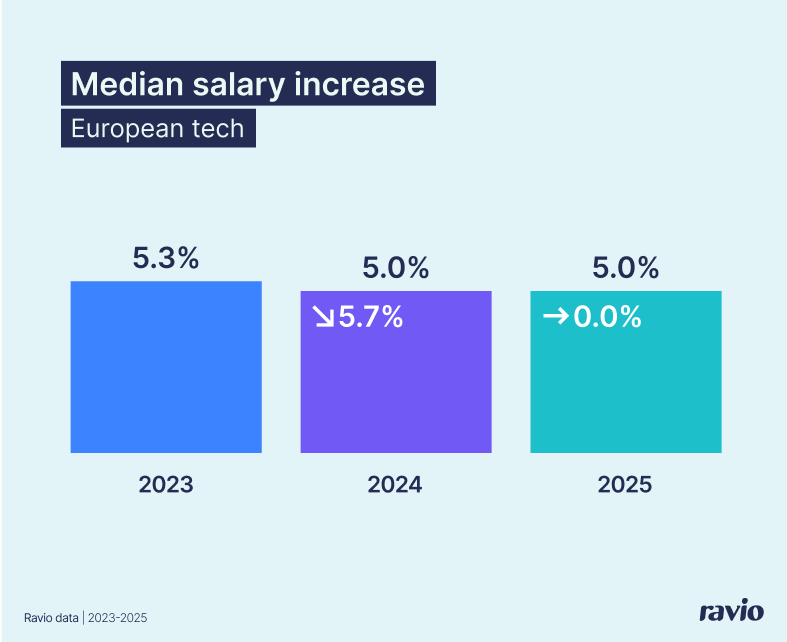

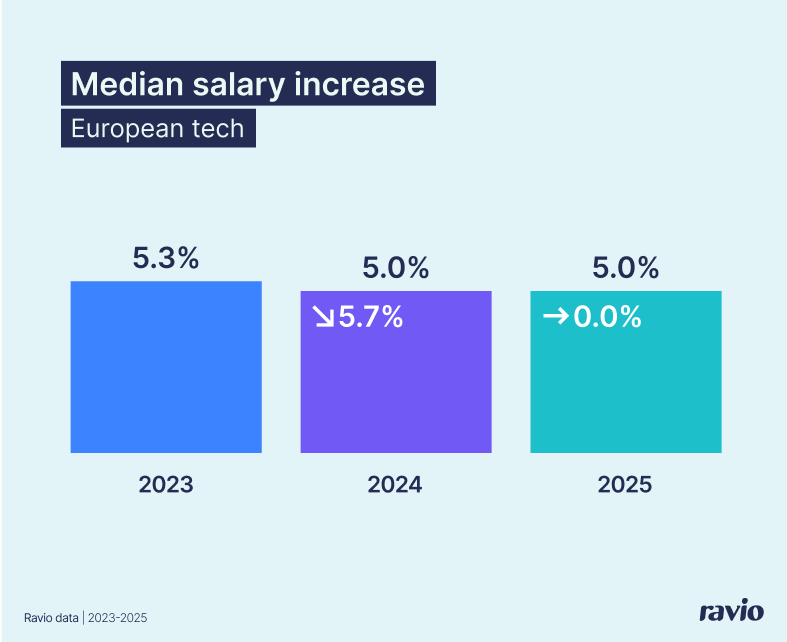

Salary increases hold steady at 5.0% for second consecutive year

After years of volatility, salary increases have stayed consistent, at an overall median of 5.0% across European tech, suggesting a period of economic stability.

However, there’s significant variation per funding stage. Salary increases at early-stage companies are down by 53% as they prioritise extending runway, whilst growth-stage is stable and late-stage sees a slight increase.

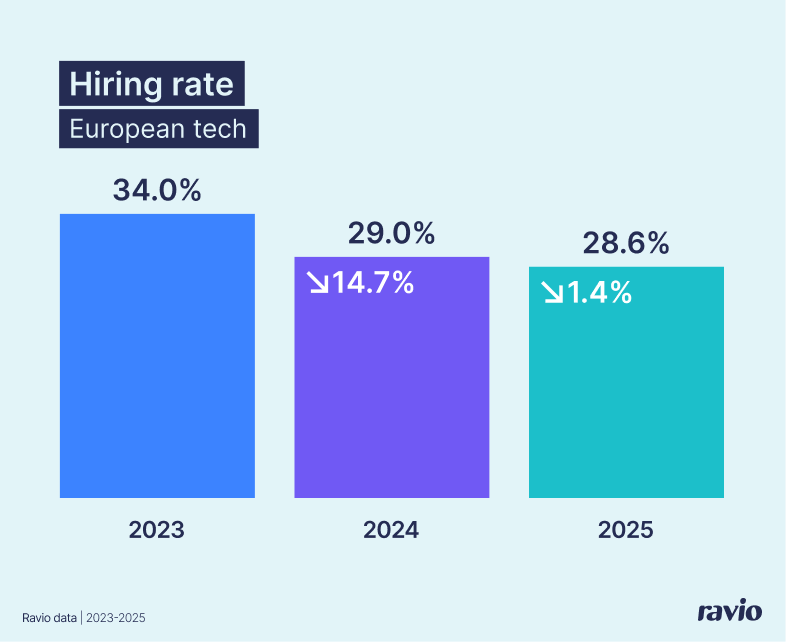

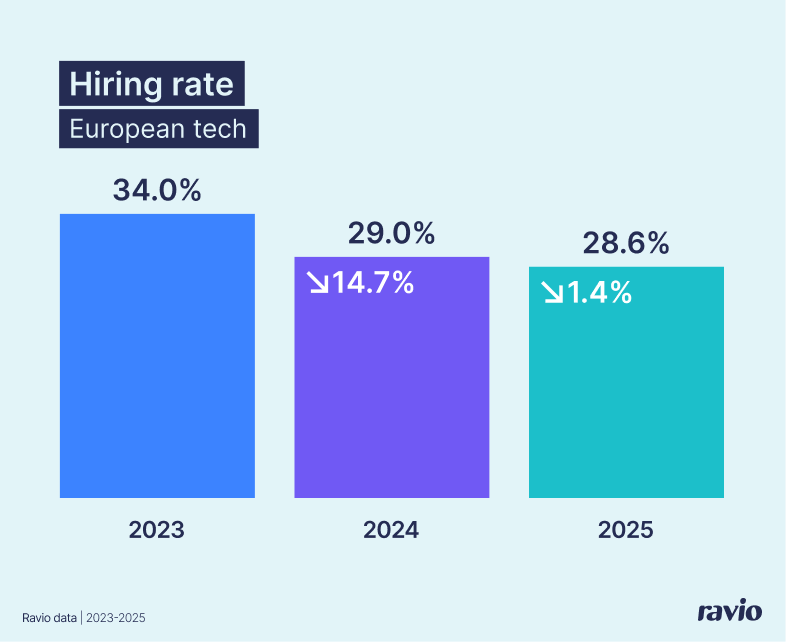

Hiring rates stabilise too, at 28.6% across European markets

Overall, hiring rates are virtually unchanged this year, again suggesting a period of more sustainable growth patterns after the hiring and layoff rollercoaster of recent years.

Yet individual markets tell different stories. Germany stands alone with positive growth (+2.8%), whilst Sweden saw hiring drop by 34% to just 17% – now Europe's lowest. The UK maintains the highest absolute rate at 32% despite declining from last year's peaks.

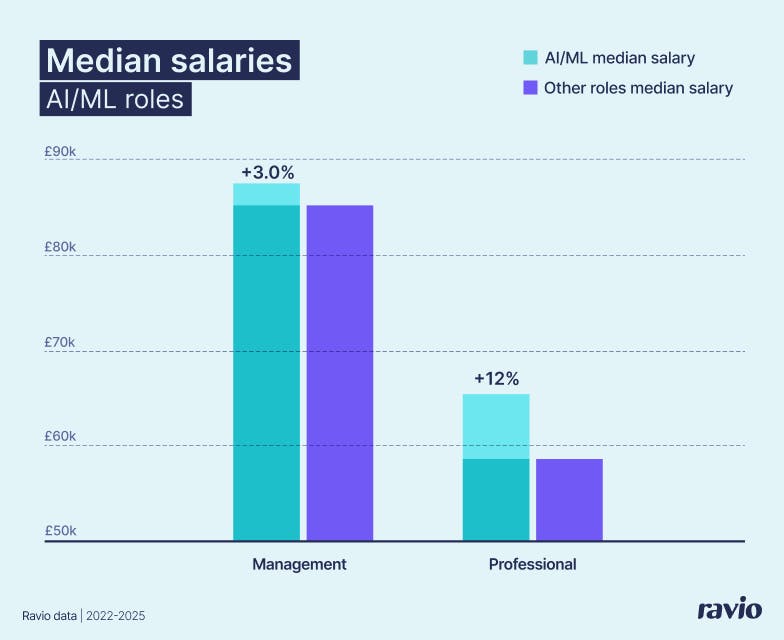

AI surge reshapes compensation strategies

Despite overall stability, AI is transforming the workforce beneath the surface. AI/ML hiring has grown 88% year-on-year, with these roles commanding 12% pay premiums on average – significant, but not the extreme cases reported in media.

Meanwhile, traditional functions face pressure. Operations has the lowest salary increase eligibility (14%) and highest attrition (21.3%). This two-speed market – companies competing fiercely for AI talent whilst automating other roles – will only accelerate into 2026.

Read the full report

For all the compensation trends, download your copy ↓

When downloading the report, you agree to our Terms of Use. Learn how we collect, use and share your data in our Privacy Policy.