When you’re evaluating compensation market data, the first question you’ll ask is usually the most practical one: “Does this provider have the data I need for my role and location?”

It’s the right starting point, but it’s only one part of assessing data quality.

And when compensation decisions go wrong, the cost is immediate – in retention, hiring velocity, and trust from leadership – so that quality is crucial.

To work out whether the salary market data you’re evaluating is trustworthy enough to help you make fair, competitive pay decisions:

- Review the 3Rs of the dataset. Is the data relevant, reliable, and updated in real-time? Or is it outdated, inaccurate, too broad, and doesn't match your job roles?

- Test the benchmarks to instantly understand whether the data is usable and to confirm it works for your organisation in practice, before you buy.

This guide walks you through how to evaluate compensation data, the questions to ask, and how different types of data sources compare to help you quickly assess a dataset’s relevance to your organisation.

Quick recap: What is compensation market data?

Compensation market data is anonymised pay information collected from multiple companies, showing what people are paid for specific roles, levels, and locations.

It helps you understand the market rate for a job so you can:

- Build and adjust salary bands. Set accurate midpoints based on your target percentile.

- Make competitive offers. Use market benchmarks to guide fair starting compensation.

- Run annual compensation reviews. Identify when to adjust employee salaries and salary bands so pay stays competitive as the market evolves.

Keep in mind, compensation data is not the same as compensation benchmarks.

Compensation data is raw, unprocessed data; collected, aggregated, and shared with you.

Compensation benchmarks turn that data into something more powerful. The raw data is mapped and validated with a consistent methodology to produce like-for-like market insights you can use to make pay decisions.

Where to find compensation market data?

You can find compensation data from several sources, each with different strengths and limitations depending on how the data is collected, updated, verified, and delivered.

Here’s a quick overview of the five main sources and what to expect from them:

- User-generated sources (e.g. Glassdoor, Indeed). Crowdsourced or job-ad salary data that’s free and easy to access, but unverified with high variance and unreliable for any meaningful compensation decision.

- LLMs (e.g. ChatGPT, Perplexity). AI tools can synthesise publicly available salary data from sources like Glassdoor and job adverts into a 'benchmark'. Easy to access, but relies on the same unreliable user-generated sources, without transparent methodology or compensation expertise – making them unreliable black boxes for benchmarking decisions.

- Governmental sources (e.g. ONS in the UK). Official labour market data that’s accurate at a broad level but too general to benchmark specific roles, levels, or competitive hiring markets.

- Salary survey providers (e.g. Mercer, Radford). Give-to-get surveys – typically conducted annually, where companies manually submit data to get compensation data. The data can be helpful for large enterprises but prone to human error due to manual submissions, and is outdated by the time it’s published.

- HRIS compensation modules (e.g. HiBob compensation, Workday compensation). Broad HR platforms that surface salary survey data through third-party partnerships with traditional salary survey providers. Access through your HRIS is convenient, but limited to outdated benchmarks with little granularity or filtering.

- Real-time benchmarking platforms (e.g. Ravio, Carta, Pave). These are tools that pull anonymised, up-to-date compensation data directly from HRIS, ATS and cap table systems, giving you highly granular compensation benchmarks that are reflective of today’s market. However, regional strengths, benchmark methodology, and quality vary by provider.

How to evaluate compensation data: A step-by-step guide

When evaluating compensation market data, focus on the 3Rs:

- Relevance: Does the underlying data reflect the roles, levels, locations, industries, and company size you compete for talent in?

- Real-time: How frequently are the benchmarks updated? Do they reflect today’s talent market, or the market as it was 12 months ago?

- Reliability: Is the sample, source, and data collection methodology transparent and robust enough to guide fair, competitive pay decisions?

The questions in the sections below all map to these three principles – helping you work out whether a salary benchmarking market dataset is truly useful for your organisation.

1. How relevant is the compensation data to your pay structure and talent market?

Start by reviewing how closely the salary benchmarking data aligns with your compensation philosophy and the roles and locations you hire for.

For example, you follow a location-based pay model, review the compensation data for its local benchmarks in the countries where you hire to ensure all employees are paid fairly and competitively against their working location.

To further ensure the compensation data aligns with your company's goals, review the following:

- Can you adjust the market data to the percentile your compensation philosophy aims for? For example, if you pay at the market median, you’ll benchmark to P50, but if you want to pay more competitively, you might benchmark to P65.

- Can you filter the compensation data to quickly find data relevant to your peers, industry location, company size, and revenue? (More on this under question 3.)

- Does the data offer total compensation benchmarks such as equity, benefits, and variable pay relevant to your philosophy? (More below under question 4)

- Is the dataset up-to-date? If you have a market-based philosophy, you need real-time benchmarks to keep employee pay competitive (more on this under question 6).

Remember, the key here is to find compensation market benchmarks that support the pay philosophy you already use – not force you into reworking it.

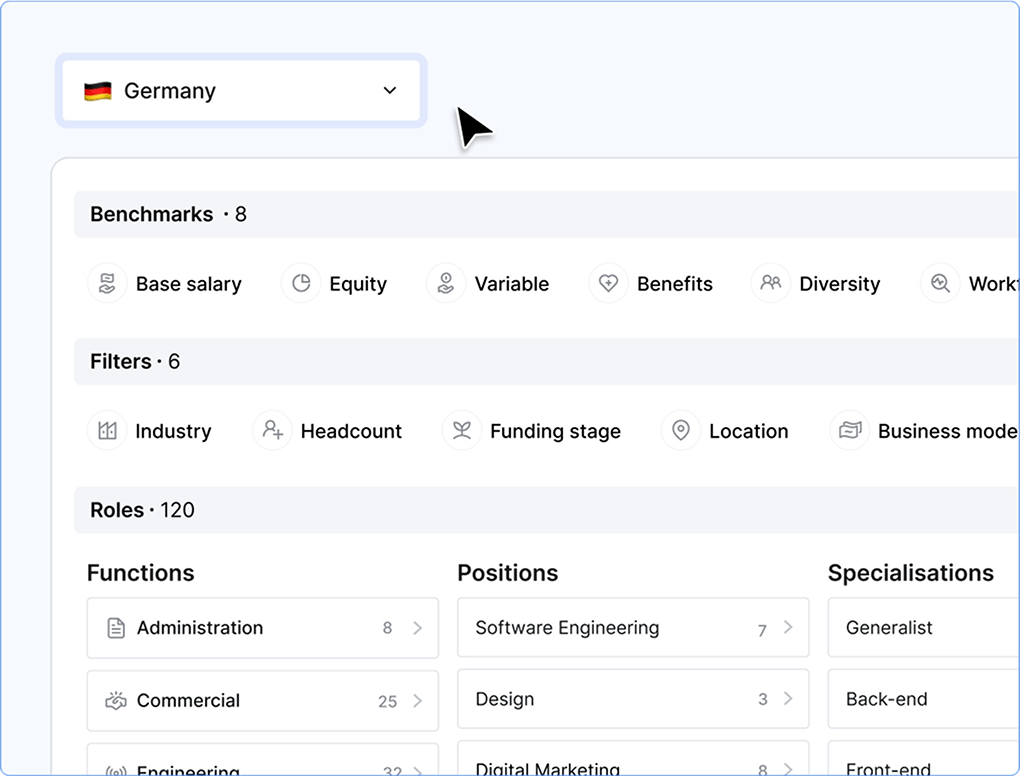

2. How relevant is the compensation data to your job roles?

Review relevance next.

Ask yourself: Are accurate benchmarks available at the level of job role granularity you need (example, front-end, back-end, and full-stack engineers)? Are benchmarks available for niche or emerging roles in your sector (e.g. AI engineers)?

Compensation data relevance often boils down to where benchmarking data providers source their data from and the data volume.

For instance, salary survey providers survey large, legacy enterprises that have complex organisational structures and layered role hierarchies, so the broad dataset reflects that.

Others, including most modern compensation benchmarking providers like Ravio, integrate with organisations’ HRIS and ATS to give you real-time benchmarks from companies with granular tech roles.

3. How relevant is the data to your industry and region?

Different compensation benchmarking market data providers have different regional and industrial strengths.

Traditional salary survey providers, as we’ve seen, survey some of the world’s largest corporations, so the data is helpful for multinational companies in legacy industries like manufacturing and oil and gas.

Data from HRIS compensation modules typically comes from partnerships with these same traditional salary survey providers (for example, HiBob integrates with Mercer). Again, this makes the global data more useful for multinational companies in broad regions like the UK and the US, rather than specialised companies with teams in smaller locations like Estonia, Czechia, and Portugal.

Lastly, data from modern compensation benchmarking platforms depends on the provider itself. Here’s a quick overview of some of the leading names:

- Ravio provides global total compensation data, with especially strong coverage across Europe and tech (or tech-enabled) roles.

- Pave offers benchmarking data in the US and Canada – ideal for tech companies in North America.

- Carta offers compensation benchmarks in India – ideal for India-based startups, mid-market companies, and service firms.

Equally important here is to review for available filters. Does the benchmark provider offer robust filters so you can find relevant data?

Traditional salary survey providers often divide survey participants into predefined peer groups using broad filters like industry, size, or region.

The same is true for HRIS compensation integrating with salary survey providers. But often, the salary benchmarks are available only as a PDF for you to manually parse – without easy-to-use filters or the ability to map that data to your internal job roles or use the data.

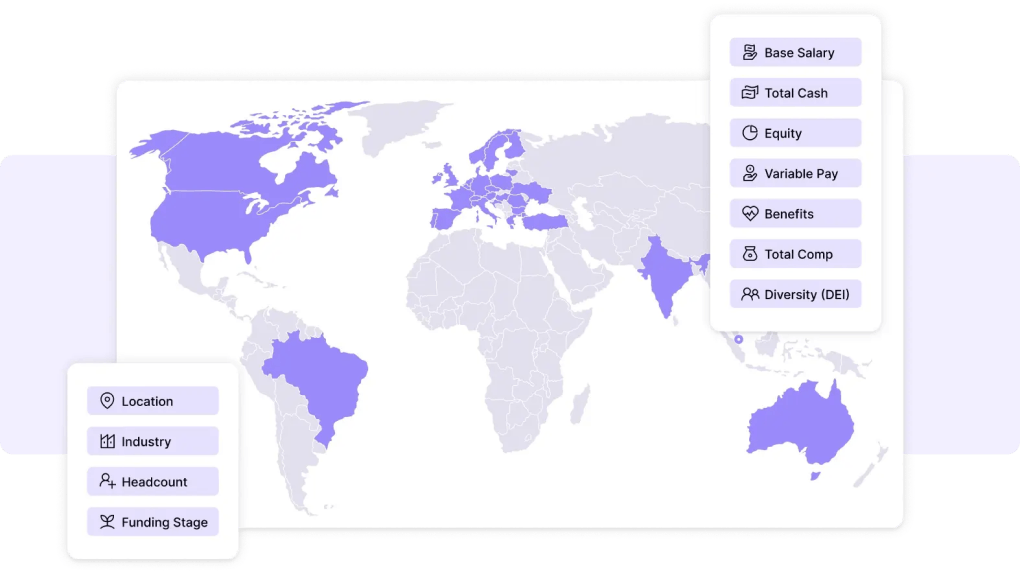

As for real-time compensation benchmarking software, filters vary by providers, for instance:

- Ravio lets you filter data by role, level, location, industry, and company size.

- Pave lets you filter data by job level, location, headcount, industry, and capital raised.

4. What total compensation benchmarks are included in the dataset?

Not all compensation datasets include the same components. At a minimum, review which elements of total compensation the data includes:

- Base salary (fixed pay)

- Variable pay (commissions, bonuses, incentives)

- Equity compensation

- Employee benefits (holiday allowance, health insurance, flexible working, etc)

If your organisation uses equity, a dataset with only base salary won’t give you a full picture of the market, which risks underpaying or overpaying employees compared to your peers.

The coverage of total compensation benchmarks to expect depends on the compensation data provider.

Traditional salary survey providers like Radford, for instance, often offer the full range of base salary, equity, variable pay, and benefit through different surveys.

And depending on the compensation benchmarking software provider you select, you could get base salary, variable pay, and/or total compensation benchmarks.

This guide covers the benchmarks that top compensation benchmarking platforms offer – and three examples:

- Ravio offers global compensation data across total rewards (salary, variable pay, equity, benefits).

- Pave gives you total compensation benchmarks across base salary, equity, and variable pay (coverage outside North America is limited to base salary though).

- Figures HR gives you salary and variable pay data (no equity or benefits benchmarks) across 46 countries in Europe.

5. Is the compensation data relevant enough for like-for-like comparisons?

Equally important here is to review how the data supports like-for-like comparisons.

If the dataset combines roles that aren’t actually comparable (for example, maps Head of Engineering against the wrong benchmark, say, to the CTO data), the benchmarks won’t match your internal reality.

Ideally, you should be able to see how your roles correspond to the dataset’s role and job level definitions – and change the mapping if needed – so that comparisons are always like-for-like.

When you buy salary survey data from an HR consultancy like Radford or Korn Ferry, you have to manually align your job roles and levels to their predefined job catalogue and level framework, which aren’t always intuitive.

For example, Radford’s tech compensation survey includes 899 unique job titles – leaving plenty of room for misinterpretation and subsequent error in the resulting dataset.

Compensation data from specialised software providers, however, is typically mapped for you – either using human experts, AI and automation, or a mix of both.

Compensation benchmarking software, Ravio, for instance, has a dedicated Benchmarking Operations team to map each of your employees to our Ravio job role library and job level framework upon onboarding.

If you already have a level framework set up, the team matches up the levels that you use internally to the corresponding level within the Ravio level framework, ensuring consistency between how each level is defined.

This works for niche or hybrid titles like Growth Designer or Founding Engineer you have in your organisation too, as the team maps them against the best fit in Ravio’s role library.

And you can always see a correlation table within Ravio showing you exactly how the levels you use internally match with the corresponding level within the Ravio level framework.

The correlation table showing how job roles are mapped in your Ravio account under the ‘manage my data’ tab.

In short, relevant compensation data should reflect the roles you actually hire, the locations you operate in, and the level and scope of work inside your organisation.

Try three Ravio benchmarks for free – no credit card required, just a quick way to review how relevant our market benchmarks are to you.

6. How fresh is the compensation market data?

Real-time compensation market data helps you understand current salary expectations (not last year’s) and spot market shifts early (example, increasing demand for AI engineers) – so that you can always make competitive pay decisions, without overpaying.

It’s especially important if you operate in fast-changing talent markets like the tech industry, where roles, compensation expectations, and hiring competition shift regularly.

Frequent data refreshes also unlock the ability to track market trends – with some providers (like Ravio) surfacing live insights on which roles are in-demand or how salaries are shifting month-on-month, so you can spot compensation pressures before they become critical.

But not all salary benchmarking companies build their benchmarks from real-time data – depending on the benchmark provider’s sourcing methodology and subsequently, data update frequency.

Traditional salary surveys from HR consultancies like Radford and Willis Towers Watson, for instance, collect data by surveying large corporates. Given the large-scale nature of the surveys, these salary surveys are typically conducted only once or twice a year, with data aggregated and released months after collection.

By the time results reach you, they’re historical snapshots – already out of date and hardly reflective of the current market. It’s also not for another 6 or 12 months before new benchmarks become available.

Given that HRIS compensation providers also rely on third-party salary survey providers to give you salary benchmarks, the data isn’t updated in real-time.

As for modern compensation benchmarking software, most pull real-time data via live HRIS integrations and refresh continuously – though their methodology for building benchmarks from that data varies (more on this in 7). Some modern providers also layer in traditional survey data alongside their real-time feeds. Figures, for example, refreshes HRIS-sourced benchmarks monthly but updates Mercer-sourced data quarterly.

7. How reliable is the compensation market data?

The final piece to evaluate is how trustworthy the salary data is. You can do this by reviewing:

- How the compensation data is sourced

- How large and representative the sample for each benchmark is

- How the data is validated and maintained.

The goal here is simple: you want to determine how accurate and relevant the numbers you’ll use to guide pay decisions are.

7a. Review the data source

Different providers collect compensation data in very different ways, which directly impacts accuracy:

- Company review sites like Glassdoor give you unverified, inaccurate data. Data is crowdsourced without verification, and since users must submit salaries to access the site, there's a direct incentive for false submissions. The figures you see mix all submissions ever made, with no filtering for outliers or stale entries, leading to unreliable averages.

- Job adverts like Indeed give you high-variance data with no context. Salary ranges vary widely, and there’s no context on each company’s compensation philosophy, target percentile, or verification – again resulting in inaccurate insights.

- Traditional salary surveys like Radford give you outdated, error-prone data. Data comes from a “give-to-get” model where HR and People teams manually submit pay data. The process is time-consuming and prone to human error, which impacts data quality – and by the time it’s published (data is usually aggregated and released months after collection), it’s often already outdated.

- Real-time benchmarking platforms like Ravio give you up-to-date, accurate insights. Data is pulled live from HRIS or ATS integrations, giving you current benchmarks. Accuracy still depends on how each provider verifies and validates the data (more on this below).

7b. Check sample size, data confidence, and relevance

Reliable benchmarks depend on having enough data points for the role, level, and location you need data for.

So make sure to review the compensation market data for sample size and data confidence level. These indicators reflect how robust the underlying data is, based on:

- Number of contributing companies

- Number of employees per role/level

- Variability across those data points.

If the sample isn’t large enough to hit required thresholds, some providers may model the range based on neighbouring roles, levels, and market patterns – rather than publish benchmarks with weak statistical confidence.

Ravio, for instance, has a high threshold for releasing new benchmarks, but offers Ravio IQ for benchmarks where we have enough data to model a reliable benchmark, but not enough to meet our rigorous sample size requirements.

The best providers also adjust thresholds based on role volatility. Salary data for junior administrative roles, for instance, tend to be consistent across companies – meaning fewer data points are needed for a credible benchmark. On the other hand, emerging roles like AI Engineer vary wildly, requiring more data to create a benchmark, to account for market uncertainty. Blanket thresholds can't distinguish between these scenarios, leading some providers to either over-index on stable roles or release volatile benchmarks prematurely.

Ravio, for instance, adjusts sample size requirements by role volatility and discloses data confidence in buckets of 'very strong,' 'strong,' 'good,' and 'moderate' – sharing the number of companies and employees that contribute to the benchmark, whilst accounting for variance in the underlying data, rather than just stating volume.

It’s also worth reminding here that sample size alone doesn't tell the full story – source and verification matter just as much as volume. 1,000 unverified Glassdoor salary submissions aren't equivalent to 1,000 HRIS-validated salaries. Sample size is useful for comparing roles within the same provider, but comparing across providers requires understanding where the data comes from (see 7a) and how it's validated (7c).

7c. Review how the data is validated and maintained

Even with strong data sources and sample sizes, reliable compensation data requires expert validation.

So you’ll want to ask about:

- Automated checks to detect outliers or stale datapoints

- Human review from compensation analysts and data scientists

- Clear criteria for when a benchmark is released or updated

- Visibility into when data was last refreshed.

As discussed above, employee-generated compensation data sources don’t have a verification process in place. And since consultancies conducting salary surveys are based on a high volume of manual submissions, they also don’t individually verify their data quality.

In comparison, compensation benchmarks have stronger data validation and maintenance checks in place.

Ravio, for example, has a team of data scientists and benchmarking experts that validates every piece of data we collect, checking for outliers, filling gaps, and smoothing for accuracy.

Similarly, benchmarks are only released once we have a high level of confidence for each role and location.

To wrap up: Evaluating compensation data providers with confidence

To recap, as you evaluate your compensation data options, review how well the data reflects your roles and locations, how often it’s refreshed, and how transparent the provider is about their methodology for creating benchmarks.

Testing a few benchmarks is the quickest way to see whether the data holds up in practice for your organisation’s needs and compensation philosophy.

We recommend trying three Ravio benchmarks for free – no commitment, just a quick way to see how relevant the market benchmarks are to you.

FAQs

Does compensation data include total compensation (base, bonus, and equity) or only base salary?

Compensation data may include total rewards (salary, bonus, equity, benefits) or only base salary, depending on the provider. Traditional surveys usually include all components. Modern platforms vary: Ravio, for example, offers full global total rewards data, while others like Figures provide salary and variable pay only. (no equity or benefits benchmarks). Always check coverage before relying on benchmarks.

Are Mercer or Radford surveys still relevant for fast-growing startups?

Mercer and Radford salary surveys are more relevant for enterprises than for fast-growing startups. For fast-growing startups, salary survey data is often too old, too broad, and not reflective of tech roles in fast-moving markets. It’s why, depending on their funding stage and hiring locations, most teams pair salary surveys with real-time benchmarks to make fair, competitive pay decisions.

Which tool is most transparent about sample size and methodology?

Ravio is one of the most transparent providers on sample size and methodology. Every benchmark shows a data-confidence rating (from moderate to very strong) with the underlying number of companies and employees, plus clear detail on data sources, validation steps, and how benchmarks are modelled when sample sizes are smaller.

How many data points support Ravio’s benchmarks?

Ravio’s benchmarks are built on a large, high-quality dataset – 1,500+ companies and over 400,000 compensation datapoints (as of December 2025). Data comes directly from HRIS integrations (not error-prone surveys or unverified user submissions), and every datapoint is validated for accuracy by Ravio’s data science team before release. You can also see sample size/data-confidence levels for each role, level, and location.

Can I see how often each data point is refreshed?

Depending on the compensation data provider, you can see how often the data is refreshed. Typically, traditional salary surveys usually refresh annually or biannually, and HRIS compensation tools that integrate with them to give you benchmarks inherit that slow cycle. Modern benchmarking platforms like Ravio are typically more transparent – most showing when each benchmark was last updated.