- Startup salary benchmarks: What to pay across funding stages

- Senior startup salaries (M3) across funding stages

- Startup salary trends: Startup salary growth stabilised across funding stages in 2025

- The total compensation picture: Equity, benefits, and startup culture

- What does this data mean for your startup compensation strategy?

The startup compensation question isn't just "what should we pay?" – it's "what can we afford to pay while still competing for talent?"

Early-stage companies operate with limited cash and uncertain runways, making every salary decision a trade-off between attracting talent and extending survival. Meanwhile, late-stage startups are starting to compete with established tech companies for talent.

Where you sit on that spectrum – seed stage scrappiness or Series C polish – fundamentally shapes your compensation strategy.

This guide breaks down what startup salaries actually look like currently – including how salaries change across funding stages and European markets – with advice on how to use this data to build a strategic approach to employee compensation.

Startup salary benchmarks: What to pay across funding stages

To understand what competitive startup compensation looks like, we analysed our salary benchmarks for three core roles – Software Engineer, Product Manager, Sales Executive – at two levels of seniority – mid-level (P3) and senior (M3) – across early-stage (pre-seed/seed), growth-stage (Series A/B), and late-stage (Series C+/IPO) startups.

All data reflects UK market rates in 2025.

What emerges is a clear pattern: salaries increase steadily as companies mature through funding rounds, and the premium for seniority is even more dramatic at later stages.

Mid-level startup salaries (P3) across funding stages

For mid-level roles, late-stage startups pay 15-18% more than early-stage companies, across all our functions (Ravio 2026 Compensation Trends report).

Software Engineer (P3) salaries per funding stage:

- Early-stage startup salary (pre-seed/seed): £62,900 (up 1.6% from 2024)

- Growth-stage startup salary (Series A/B): £68,500 (up 2.2% from 2024)

- Late-stage startup salary (Series C+): £72,500 (up 2.0% from 2024)

So, late-stage companies pay approximately 15% more than early-stage for mid-level Software Engineers – a £9,600 actual difference in annual salary.

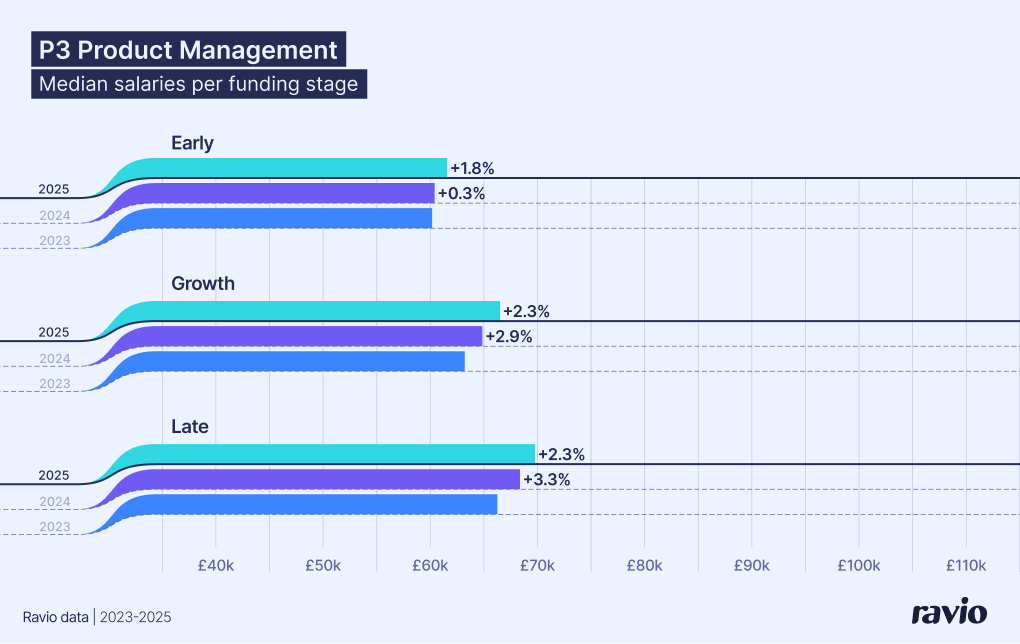

Product Manager (P3) salaries per funding stage:

- Early-stage startup salary (pre-seed/seed): £61,400 (up 1.8% from 2024)

- Growth-stage startup salary (Series A/B): £66,400 (up 2.3% from 2024)

- Late-stage startup salary (Series C+): £69,900 (up 2.3% from 2024)

So, Product Manager salaries are 14% higher at late stage than early stage – an £8,500 actual difference in annual salary.

Sales Executive (P3) salaries per funding stage:

- Early-stage startup salary (pre-seed/seed): £47,600 (up 2.1% from 2024)

- Growth-stage startup salary (Series A/B): £53,200 (up 2.7% from 2024)

- Late-stage startup salary (Series C+): £56,400 (up 2.5% from 2024)

Sales roles show the highest funding stage premium, with an 18% ( £8,800) jump between median salaries at seed to Series C+ – likely reflecting the increasing complexity of sales operations as companies scale.

Senior startup salaries (M3) across funding stages

For senior roles, the salary premium as startups scale through funding stages becomes even more pronounced.

Late-stage startups pay 31-34% more than early-stage companies for senior talent across all our functions (Ravio 2026 Compensation Trends report) – nearly double the premium seen at mid-level.

"With VCs demanding sustainable growth over rapid scale, early-stage companies must optimise compensation budgets whilst building a relatively new employee experience. Success means thinking strategically across all People initiatives, and spending wisely."

Founder of Darwin Total Rewards

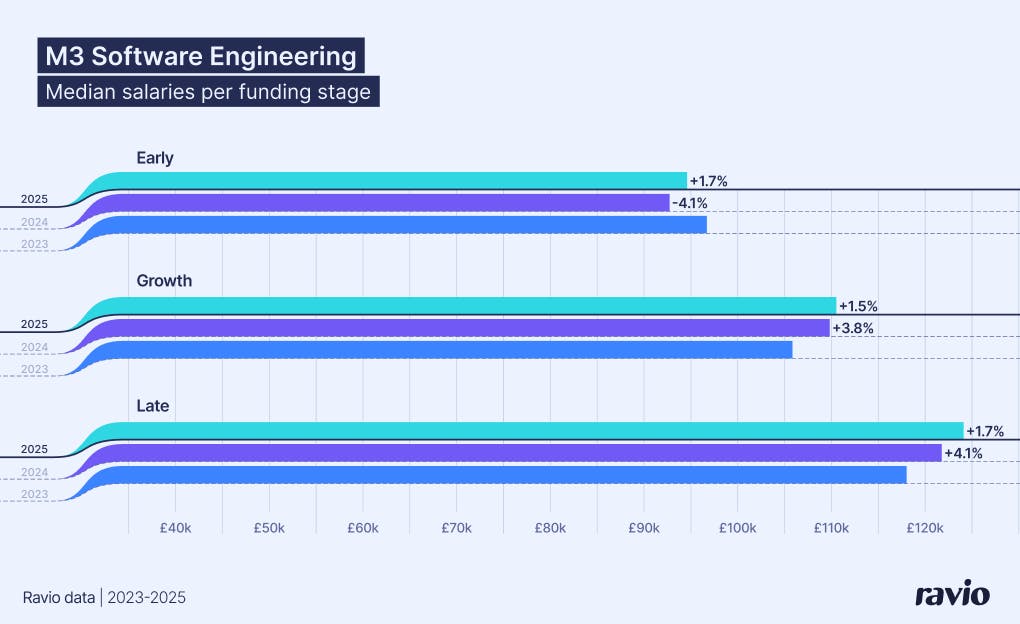

Senior Software Engineer (M3) salaries per funding stage:

- Early-stage startup salary (pre-seed/seed): £94,500 (up 1.7% from 2024)

- Growth-stage startup salary (Series A/B): £111,600 (up 1.5% from 2024)

- Late-stage startup salary (Series C+): £124,000 (up 1.7% from 2024)

So, Senior Software Engineers command a 31% premium at late-stage companies – a £29,500 actual difference in annual salary. This reflects both the financial resources available and the increased complexity of engineering challenges at scale.

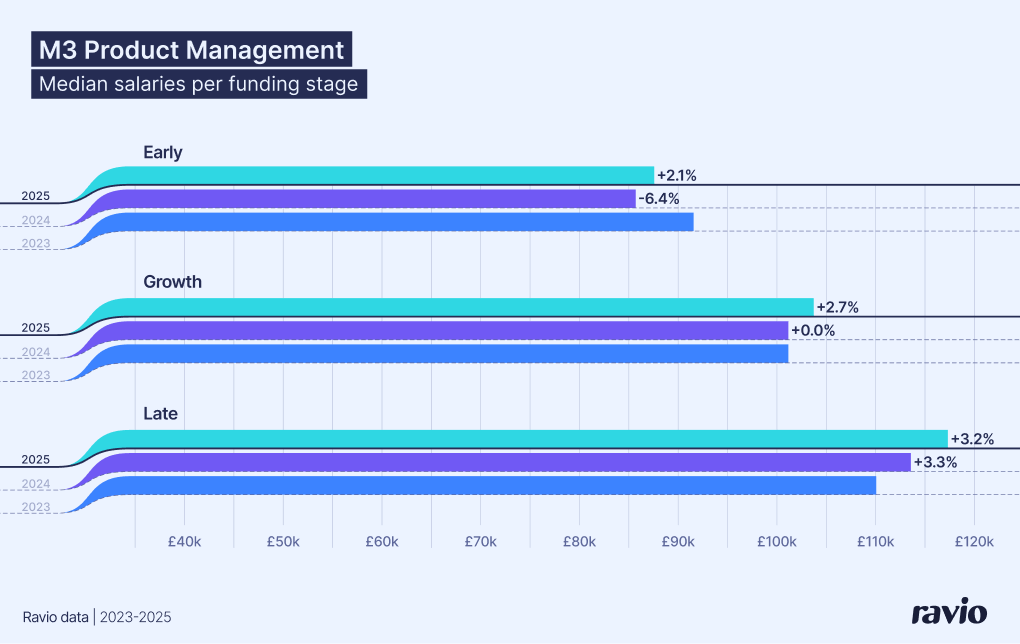

Senior Product Manager (M3) salaries per funding stage:

- Early-stage startup salary (pre-seed/seed): £87,600 (up 2.1% from 2024)

- Growth-stage startup salary (Series A/B): £103,900 (up 2.7% from 2024)

- Late-stage startup salary (Series C+): £117,200 (up 3.2% from 2024)

So, Senior Product Manager salaries are 34% higher at late stage than early stage – a £29,600 actual difference in annual salary. This is the largest premium across all roles analysed, likely reflecting the increasing strategic importance of product leadership as organisations mature.

Senior Sales Manager (M3) salaries per funding stage:

- Early-stage startup salary (pre-seed/seed): £73,600 (up 2.5% from 2024)

- Growth-stage startup salary (Series A/B): £84,900 (up 2.4% from 2024)

- Late-stage startup salary (Series C+): £97,100 (up 2.9% from 2024)

So, Sales leadership shows a 32% premium (£23,500 actual difference in annual salary) at late stage, with late-stage companies paying significantly more for experienced revenue leaders.

Startup salary trends: Startup salary growth stabilised across funding stages in 2025

One of the most significant patterns in the above data on median startup salaries in 2025 is the convergence of salary growth rates across early, growth, and late-stage startups.

In previous years, different funding stages showed dramatically different growth patterns. – late-stage companies often increased salaries much faster than early-stage, or early-stage companies would surge ahead during hot funding periods.

In 2025, that volatility has disappeared.

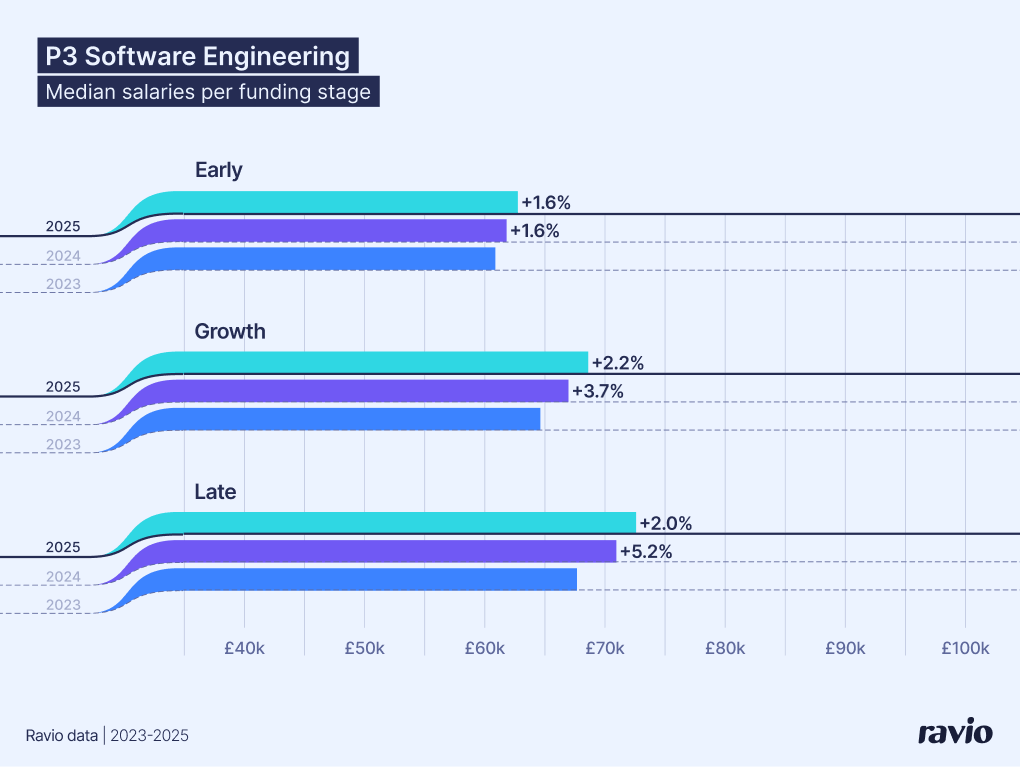

Looking at Software Engineers as the clearest example:

P3 Software Engineer year-on-year salary increases:

- Early-stage: 1.6% (2025) vs 1.6% (2024)

- Growth-stage: 2.2% (2025) vs 3.7% (2024)

- Late-stage: 2.0% (2025) vs 5.2% (2024)

M3 Senior Software Engineer year-on-year salary increases:

- Early-stage: 1.7% (2025) vs -4.1% (2024)

- Growth-stage: 1.5% (2025) vs 3.8% (2024)

- Late-stage: 1.7% (2025) vs 4.1% (2024)

At both levels, 2025 shows convergence.

Late-stage companies that jumped salaries by 5.2% for mid-level engineers in 2024 increased by just 2.0% in 2025 – nearly matching the 1.6% from early-stage companies.

For senior engineers, the pattern is even more striking: all three stages now cluster between 1.5-1.7% growth, compared to the wild swings of 2024 (-4.1% to +4.1%).

This stabilisation suggests the startup salary market has matured, with companies at all stages taking a more measured approach to compensation increases rather than competing aggressively on cash.

What this means for your compensation strategy: The established salary hierarchy across funding stages is holding steady. If you're early-stage, you won't suddenly need to match Series C rates to stay competitive. But if you're late-stage, the premium you pay for talent isn't shrinking either – you're just increasing it more gradually. The game has shifted from salary wars to strategic positioning on total compensation.

The total compensation picture: Equity, benefits, and startup culture

Salary benchmarks tell only part of the compensation story. For startups, the total compensation package (equity, benefits, culture) often matters as much as base pay.

Startup equity compensation

Equity compensation is where startups often genuinely differentiate, offering employees ownership and potential for significant financial upside if the company succeeds.

For early-stage employees especially, equity represents a calculated bet: accepting a high-risk job with a potentially lower salary now, in exchange for shares that could become valuable as the company scales and raises at higher valuations.

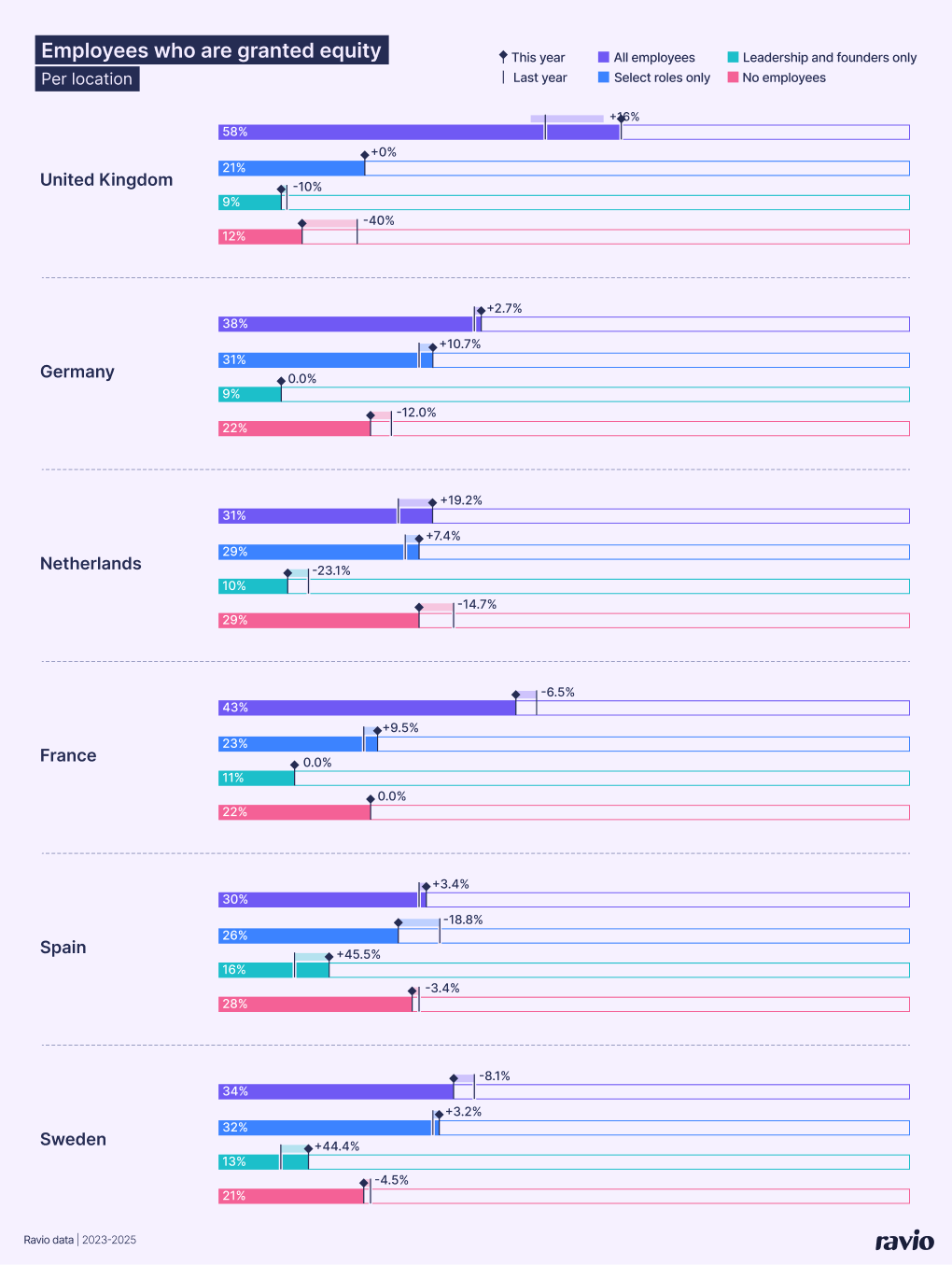

In the UK, 58% of tech startups now offer equity to all employees – the highest rate across all markets and up 16% from last year (Ravio 2026 Compensation Trends report).

"Boards and VCs remain firmly focused on dilution, amid a tighter global startup funding environment. So whilst equity-for-all is increasingly common, grant sizes may be under even greater scrutiny."

Founder of Darwin Total Rewards

Germany (38%), France (43%), Netherlands (31%), Spain (30%), and Sweden (34%) all trail behind the UK in employee equity participation.

Interestingly, France and Sweden have actually seen decreases in all-employee equity participation (-6.5% and -8.1% respectively).

"I’m starting to see cracks in the startup equity compensation promise. With IPOs happening later, liquidity drying up, and even success stories like Klarna disappointing employees' expectations, people are questioning whether the equity gamble is worth sacrificing cash compensation. The next generation of talent may demand very different trade-offs."

Senior Compensation Manager at Bolt and Co-founder of Cohorts

Startup benefits and flexible working culture

Beyond equity, employee benefits and workplace flexibility are areas where startups can compete effectively – again, often without massive budget implications.

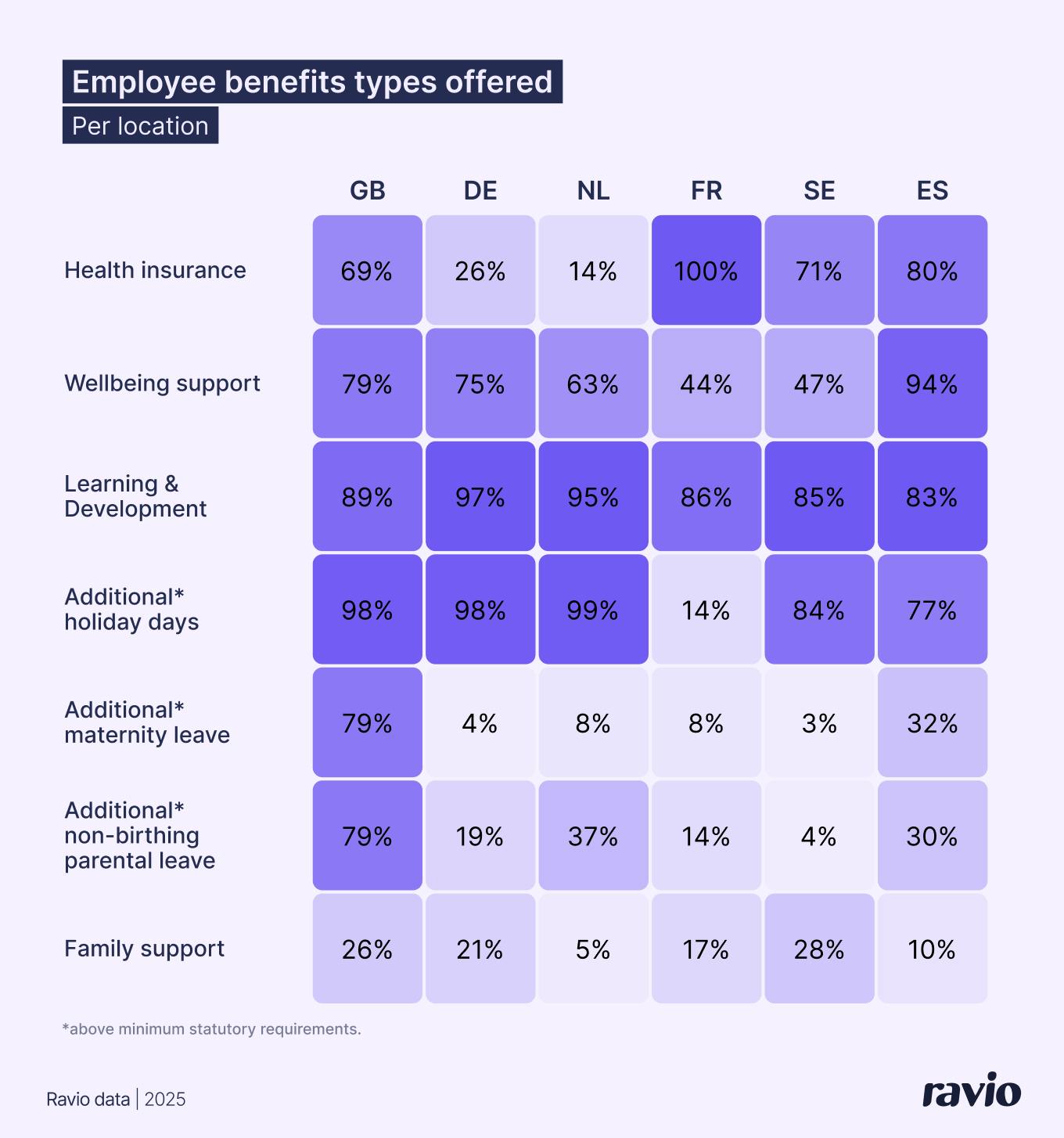

When we look at Ravio's benefits benchmarking data across European tech, it becomes clear that employees value benefits that offer autonomy, growth, and wellbeing over purely financial perks.

Learning & Development emerges as the universal benefit, with 83-97% of companies offering L&D support (depending on location) This consistency suggests investing in employee growth is a fundamental expectation.

Wellbeing support is increasingly common, with 63-94% of companies offering some form of wellness benefit. Sweden leads at 94%, reflecting the Nordic emphasis on work-life balance.

Additional holiday days (above statutory minimum) are offered by 77-99% of companies across markets – a simple but effective benefit for improving work-life balance.

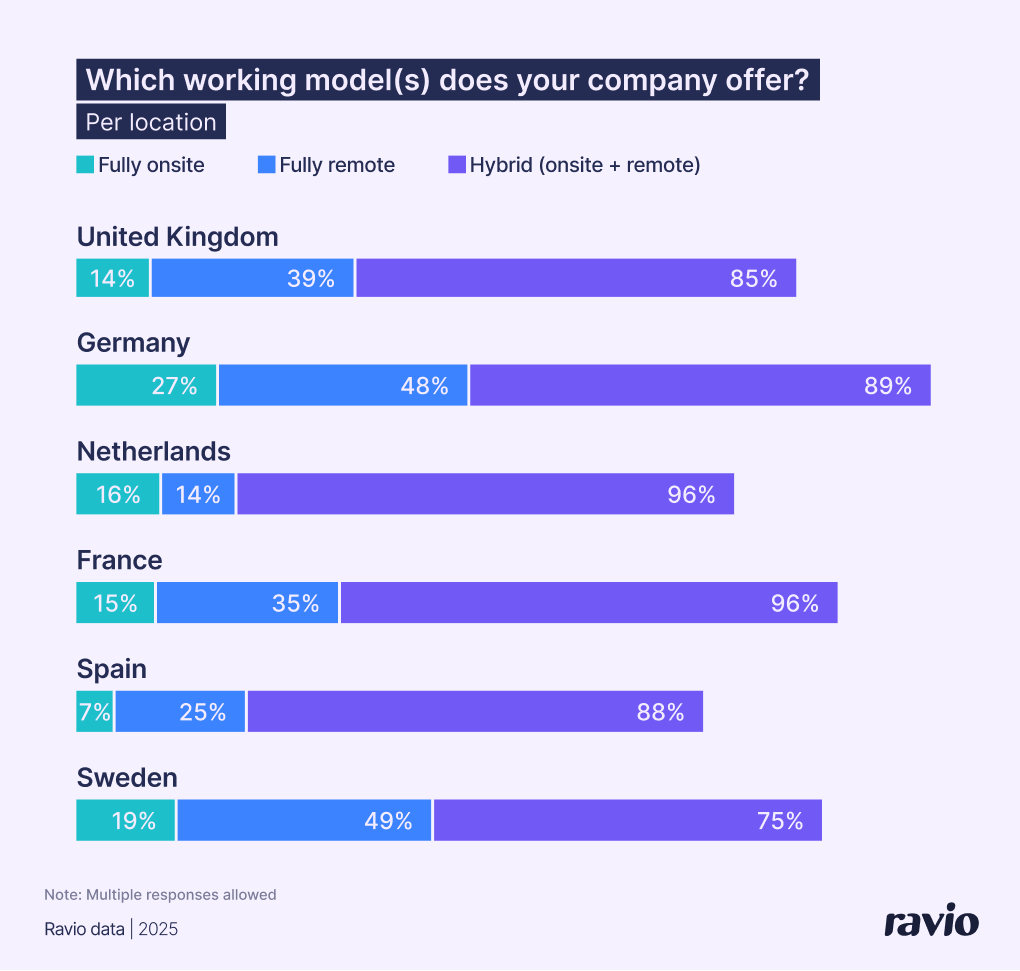

Flexible working also remains critical. Hybrid working is firmly the dominant model across Europe’s tech startup scene – for instance, 85% of UK companies offer some form of hybrid arrangement and 39% offer fully remote working options.

"After the cultural resets of 2022, most companies are now finding a middle ground between office mandates, employee autonomy, and performance expectations. It's no longer about choosing one over the others."

Founder of Darwin Total Rewards

What does this data mean for your startup compensation strategy?

We’ve seen some clear patterns in the data: typical salaries increase substantially from seed to Series C (especially for senior roles), more and more startups are offering employees equity, and personalised benefits matter as much as cash for many candidates.

Here's how to use these insights to make better decisions for your startup.

Choose your target percentile strategically

The default "pay everyone at 50th percentile" rarely makes sense for startups. Your compensation positioning should reflect your constraints and what you're competing on – which likely means changing your target percentile as you grow.

If you're early-stage with limited cash, you might position base salaries at 25th-40th percentile, then compete aggressively on equity and growth opportunity.

If you're Series C approaching scale-up territory, you're competing with established tech – consider 60th-75th percentile for business-critical roles.

→ Read: How to create a compensation philosophy

→ Read: Complete guide to salary benchmarking

→ Read: Market-driven vs market-informed compensation

"Every company should identify their own business-critical roles and pay them at P60 or P75. The days of paying everyone at median are over – that's a recipe for losing your key talent."

Senior Compensation Manager at Bolt and Co-founder of Cohorts

Compete on total compensation, not just salary

Equity structures, genuine flexibility, and meaningful benefits are all incredibly important for startup compensation.

For startups competing on culture rather than cash, these benefits align naturally with what makes startup environments attractive – a focus on autonomy, growth, and impact.

→ Read: Complete guide to employee benefits

→ Read: How to decide on flexible working policies

Find the balance of cash and equity

You likely can't match corporate cash as a seed stage startup, and equity can bridge the gap for the talent you want to bring into your company.

But, be realistic about what equity can actually do for your hiring and retention strategies – it isn’t a magic wand, and with more and more startups offering equity to all employees, it isn’t always a clear differentiator either.

"I'm starting to see cracks in the startup equity compensation promise. With IPOs happening later and liquidity drying up, people are questioning whether the equity gamble is worth sacrificing cash compensation."

Senior Compensation Manager at Bolt and Co-founder of Cohorts

Budget realistically for your funding stage

Startup funding isn’t as easy as it once was, and employee costs will always make up a big chunk of your overall budget – especially for tech startups.

Therefore, hiring has to be strategic and intentional.

We’re seeing this most with AI-native startups who are deliberately keeping their teams lean – fewer employees, but top talent powered by AI tooling – but there are learnings for all startups to consider.

→ Read: How to set annual compensation budgets

→ Read: What every startup can learn from AI-native hiring

"Early-stage funding is still available, but mid to later stage funding is drying up. This means startups need to show profitability much earlier. The money they're getting now needs to last much longer than it used to."

Director at FNDN

Use reliable data to make defensible decisions

"Finger in the air" salary decisions create problems that compound as you scale. Inconsistencies become inequities. Overpaying strains budgets. Underpaying drives attrition.

Access to reliable, relevant, real-time benchmarking data is foundational. It enables you to set offers confidently, plan budgets accurately, maintain internal equity, and refresh strategy as markets shift.