- The data: How compensation reviews typically evolve with company size

- How to build a compensation review process that will scale effectively with your company

- Stage 1: Building the right foundations as an early-stage startup (<100 headcount)

- Stage 2: Finding the balance between structure and flexibility as you grow (100-1000 headcount)

- Stage 3: Avoiding a bloated process at scale (1000+ headcount)

- In summary: The art of scaling a compensation review process

As your company scales, so does your compensation review process.

The ad hoc process that worked fine for 20 employees quickly starts to lead to inconsistencies and bottlenecks. And that simple spreadsheet you set up to calculate merit increases at 50 employees? It’s unusable by 200.

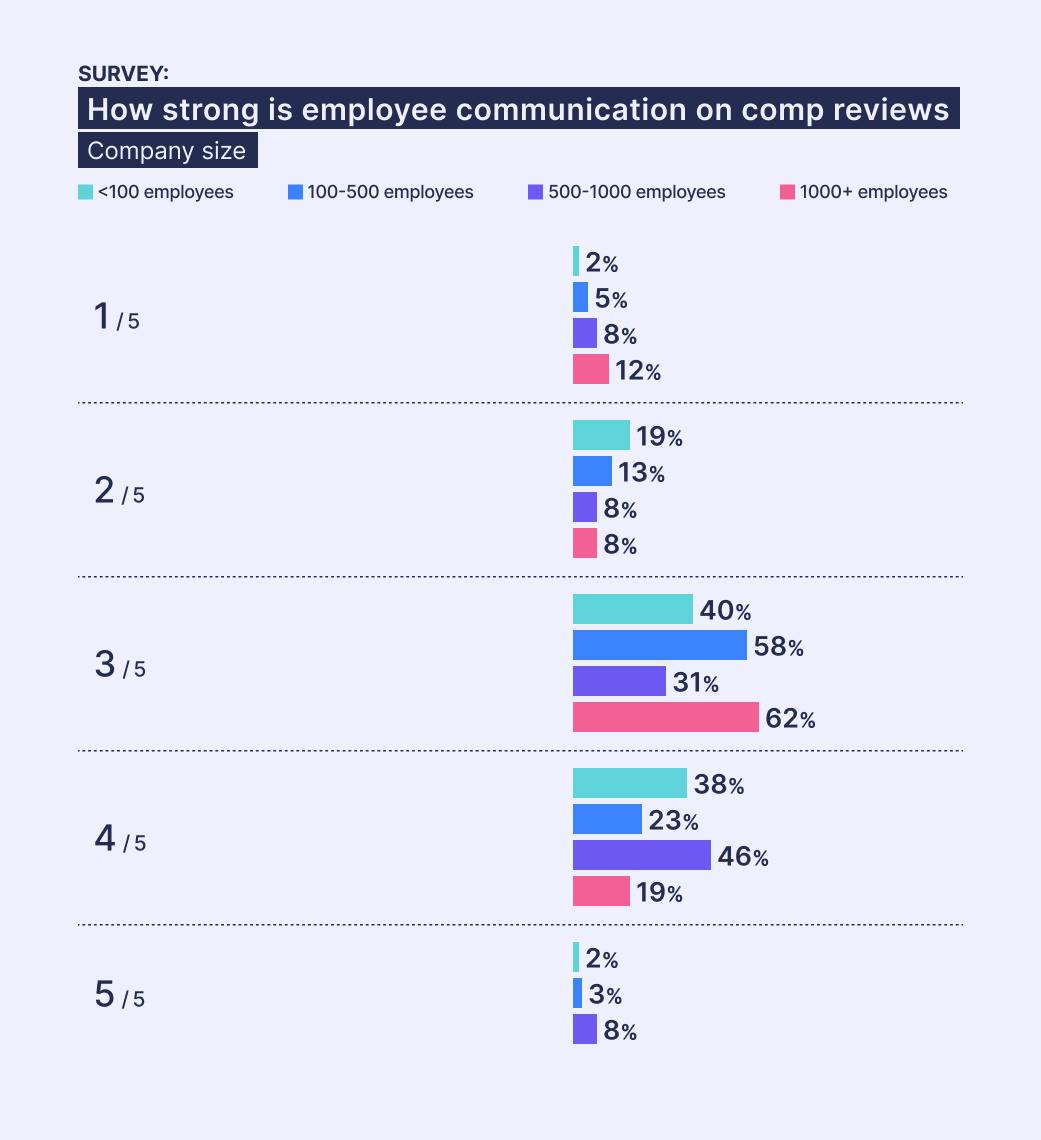

Our recent survey of 140 companies confirms this. Improvised processes transform into formalised structure as headcount increases, with a ‘sweet spot’ emerging at 500-1000 employees where HR and Reward teams report the most successful pay reviews.

But success plummets again once you hit enterprise scale – complexity rises, and it shifts from strategic process to bureaucratic nightmare.

So how do you build salary review processes that actually scale with your company?

Let’s take a closer look at our survey findings on what works at each stage of growth – and we’ve also included advice from the experts Giac Soliman and Rob Green on their learnings from scaling compensation processes at fast-growing startups like Deliveroo, TikTok, Monzo, and Skyscanner.

The data: How compensation reviews typically evolve with company size

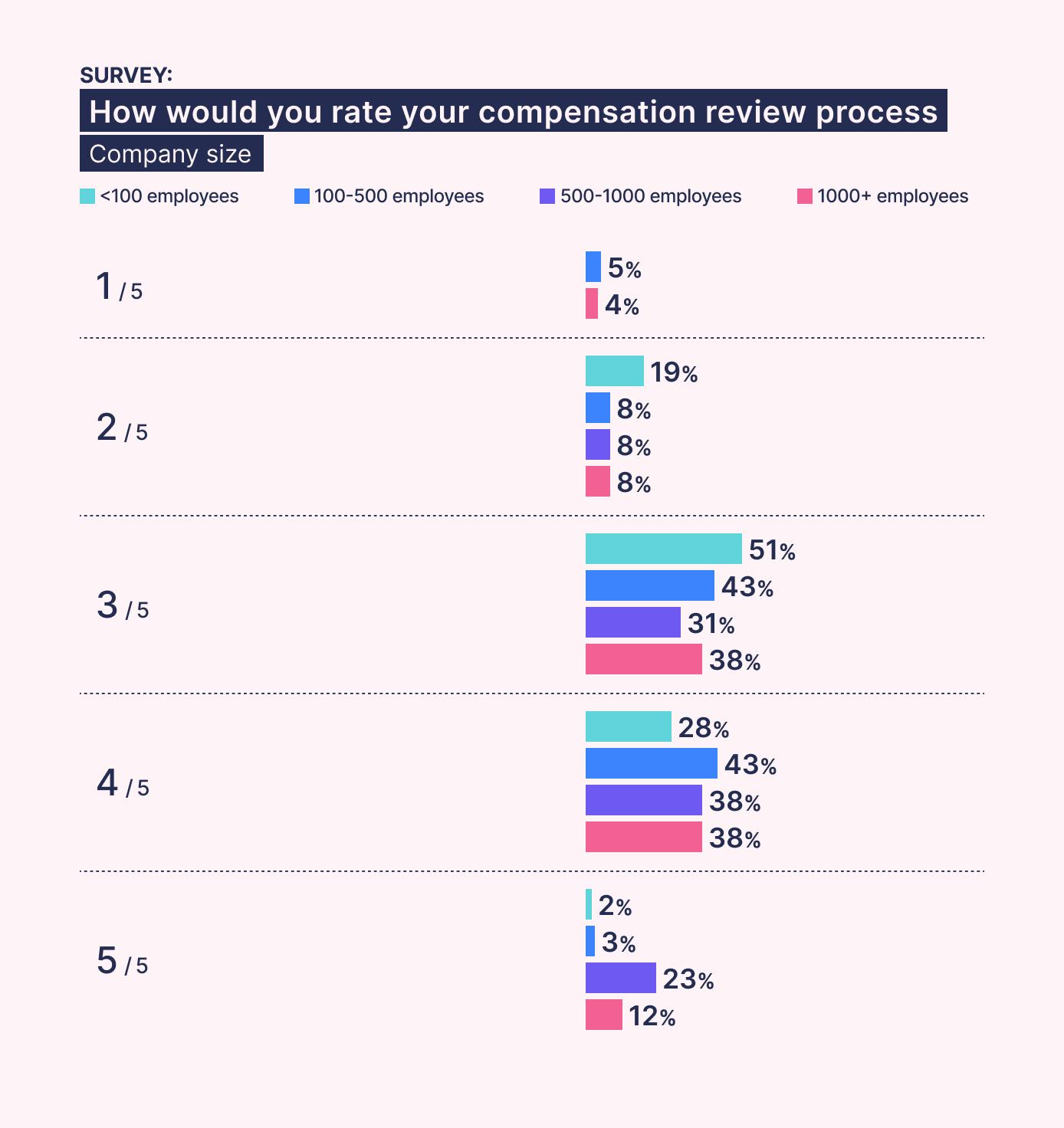

When we asked HR and Reward teams to rate the success of their current compensation review process, a clear pattern emerged: small companies struggle most, success peaks at 500-1000 employees, then declines again at enterprise scale.

Small companies with less than 100 employees were most likely to rate their process poorly, with only 30% achieving 4-5 out of 5. This improves steadily, peaking at 500-1000 employees where 61% rate highly. But success dips again at 1,000+ employees, dropping to 50% of teams rating their process 4-5 out of 5.

So what drives these differences?

So what changes with company size that impacts the success of compensation reviews?

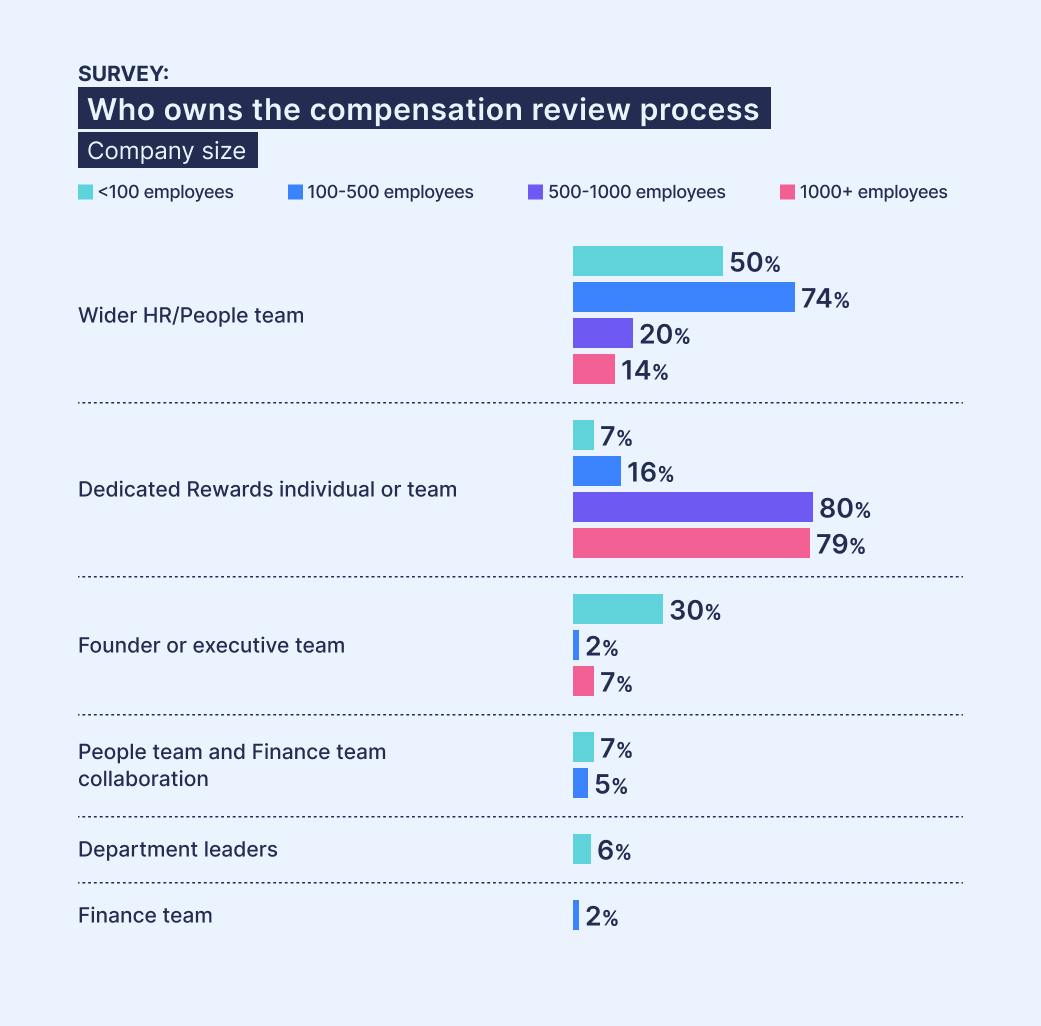

Well, the journey starts with very ad hoc processes – small companies typically operate with minimal structure around their compensation reviews.

In companies with less than 100 employees, founders or executives still lead the process in 30% of cases (compared to just 14% overall), while department leaders make decisions in another 6% (vs 2% overall).

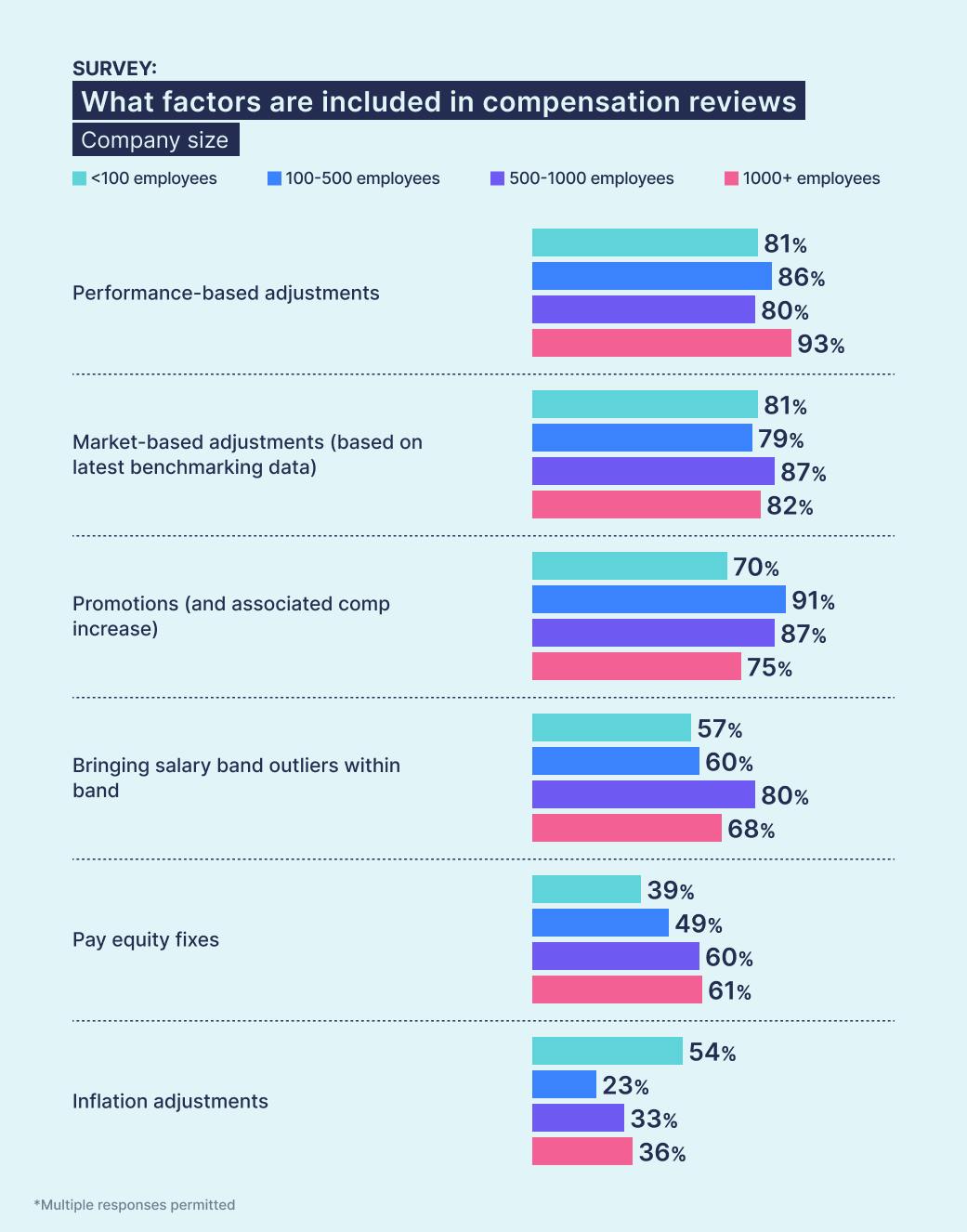

Without dedicated HR or Rewards expertise, these reviews tend to be reactive - while 81% include performance adjustments, only 39% systematically address pay equity issues and just 57% fix salary band outliers.

Then, as companies reach 100-500 employees, HR teams take ownership in 74% of cases, bringing more consistency to the process. The scope of reviews expands significantly – 91% now include promotions, 60% begin addressing band outliers, and 49% pay equity issues.

The 'sweet spot' arrives at 500-1000 employees.

At this size, we can see that 80% of companies have invested in dedicated Rewards teams who own the review process. Reviews become truly comprehensive – 87% include market adjustments, 80% fix salary band outliers, and 60% address pay equity issues.

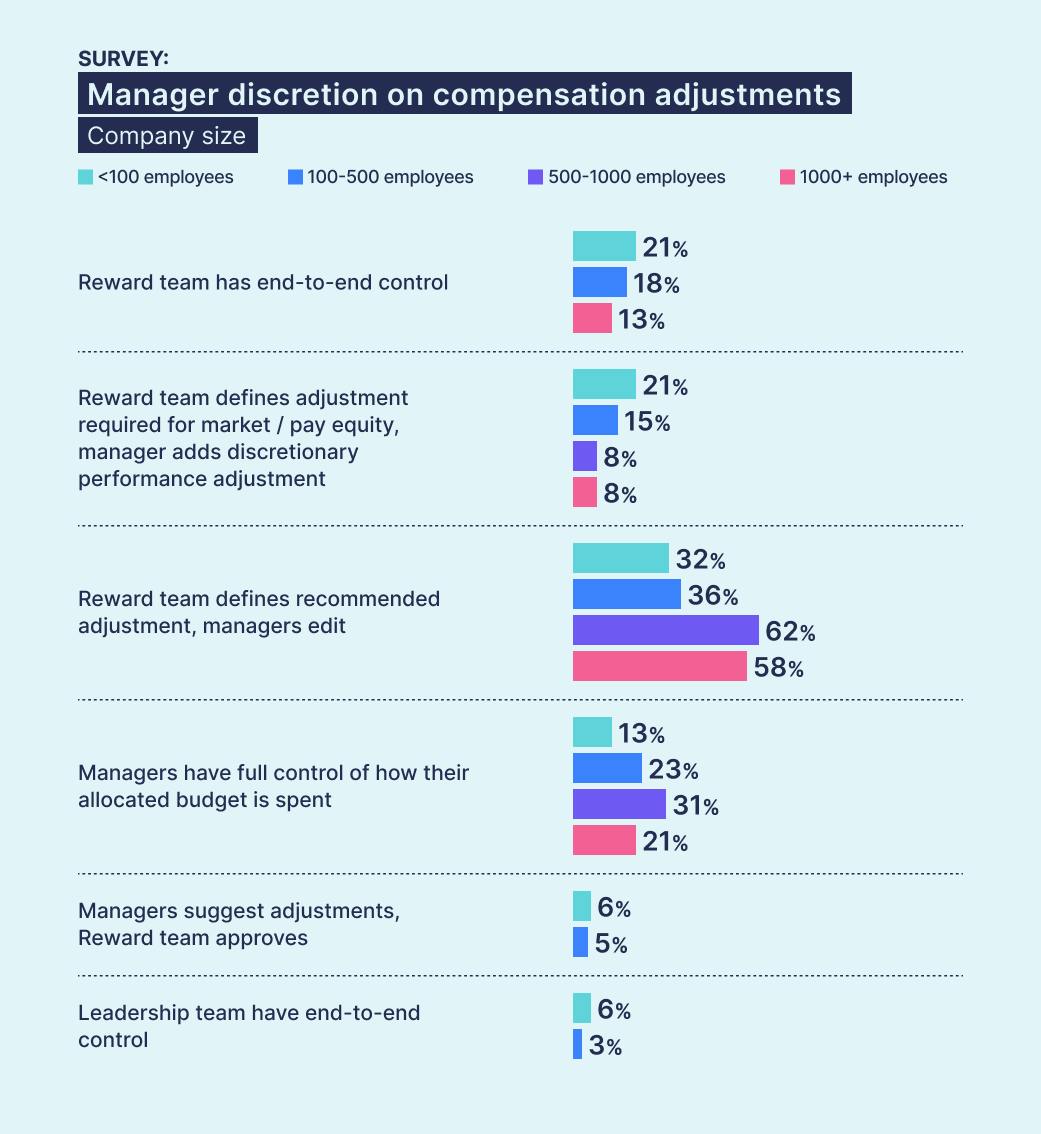

Crucially, these companies balance structure with flexibility.

In terms of compensation adjustment decisions, 62% use a collaborative model where Reward teams provide recommendations based on their expertise, but managers have the discretion to make changes to reflect their day-to-day contextual knowledge.

But as companies reach 1,000+ employees, centralisation creeps back in, likely due to the increased complexity and bureaucracy that comes with enterprise scale teams.

Executive teams become more likely to own the process again (7% vs 0% at 500-1000) and control compensation budgets too (43% vs 31% overall), and Reward teams are more likely to maintain end-to-end control over adjustments with limited manager discretion.

The outcomes suffer – with overall success dipping as we saw earlier, and areas like employee communications particularly affected (0% rate 5/5, and only 19% 4/5 compared to 32% overall).

The pattern is clear: structure helps until it hinders.

And that means scaling a compensation review process successfully involves finding the balance between systematic process and the very personal side of pay reviews.

How to build a compensation review process that will scale effectively with your company

So how do you avoid the pitfalls we've seen in the data – the ad hoc nature of reviews early on, the late-stage bureaucracy?

We asked the compensation experts Rob Green (Founder of Darwin Total Rewards and Consultant at MCR Consulting) and Giac Soliman (Compensation Manager at Monzo and Founder of CompTech News Roundup).

Both have substantial experience with building and scaling compensation review processes – like Rob leading Deliveroo’s first compensation review (and then scaling the process from there), and Giac leading the transition from siloed processes to a unique and effective pay review approach at Monzo – so they bring a myriad of insights and lessons learnt.

Stage 1: Building the right foundations as an early-stage startup (<100 headcount)

Tip 1: Define your objectives, ownership, and guiding principles upfront

Before you even think about running your first compensation review, you need to be able answer three fundamental questions:

- What are you trying to achieve? – “I see startups go wrong when they introduce pay reviews because they think they should, Rob says, “but without stepping back and agreeing on what they’re trying to achieve with the review, and how it fits with wider business priorities.”

- What principles will guide the decisions? – “Your compensation philosophy should guide how you structure your reviews,” Giac explains, “for instance, if cultivating a high-performance culture is a core aim, then rewarding performance needs to be factored in from the start.”

- Who's making those decisions? – “It’s equally valid to have C-level ownership on pay adjustment decisions, or to have each line manager suggesting the increases for their team, but whatever the approach there has to be clarity on ownership,” says Rob. “For small startups, it usually makes sense to keep decisions with HR and senior leadership, as it can take time to educate and build up line manager maturity on pay decisions. Ideally you want to expand ownership by one or two levels each review, so that eventually line managers are the decision makers.”

Without clarity on these three questions upfront, you risk running a compensation review that lacks purpose, accountability, and consistency.

“I see startups go wrong when they introduce pay reviews because they think they should, without stepping back and agreeing what they’re trying to achieve with the review and how it fits with business priorities.”

Founder of Darwin Total Rewards

Tip 2: Focus on building the right foundations – but keep it simple

At an early stage of an organisation, the temptation is to either keep ownership firmly with the HR (or leadership) team, or to over-engineer an unnecessarily complex process.

The foundational structures you need in place to run an effective review process are:

- Compensation philosophy: To guide decision-making, as discussed in tip 1.

- Job levels: To assess performance and progression consistently against defined scope and responsibilities.

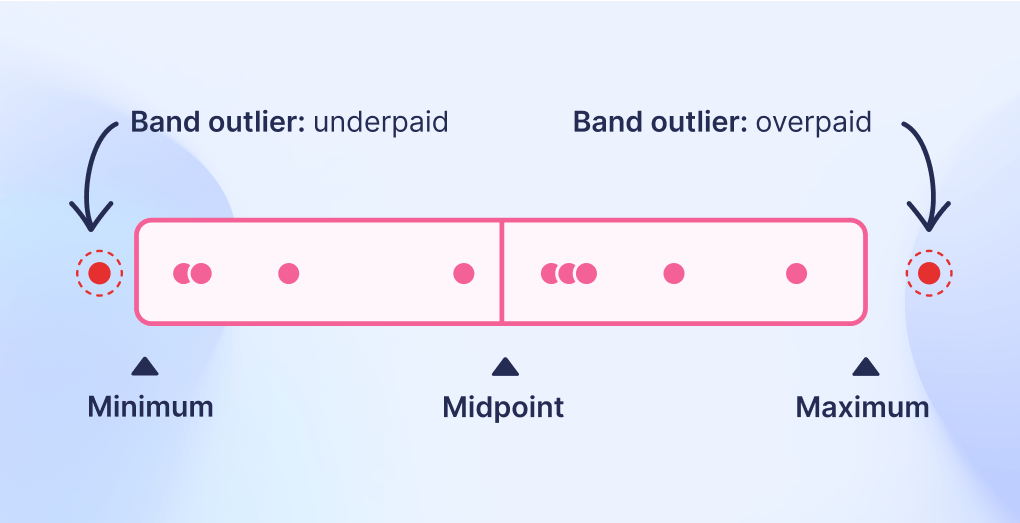

- Salary bands (informed by market benchmarks): To identify who’s underpaid or at risk, inform equitable decisions, and guide where budget should go.

"Getting those building blocks in the right order is essential”, Rob notes, because without them you can't make consistent decisions.

These structures also help manage what Giac calls "peer relativity" – ensuring people doing similar work are paid fairly. Startups often make exceptions at the offer stage or ad hoc increases to win talent, but without structure this creates inequities. Your compensation reviews need "a plan that gradually brings these people back within the band," Giac explains.

But keep it simple. You don't need a sophisticated performance management system or fully-fledged job architecture before your first review. "I love the fact that startups can do what they need to do quickly," Rob says. "The agility and flexibility is a massive strength."

Put minimum structures in place to make consistent decisions, and refine them as you grow.

Tip 3: Communicate the 'why' from day one – to both managers and employees

From your first compensation review, establish clear communication plans with both managers and employees about the process and the principles underpinning it – how decisions are made, why, and who’s involved.

Line managers will become a critical stakeholder within the compensation review process in the future, so investing in their understanding early will set you up for success as you scale.

"If managers don't understand how merit cycles add value to them and their team, or feel ownership over pay adjustments, they won't engage like you need them to," Giac explains.

"Building up managers' capability to make fair, consistent decisions and communicate them effectively is a long-term investment," Rob notes. "It's something that evolves over years of multiple cycles in the same organisation.”

Employees need clarity too. At small companies, you have two advantages: direct access to leadership, and a clean slate. You can educate people on principles and processes from the beginning rather than retrofitting transparency later. When people understand the process, they're more likely to trust the outcomes.

"If managers don't understand how merit cycles add value to them and their team, or feel ownership over pay adjustments, they won't engage like you need them to."

Compensation Manager at Monzo and Founder of CompTech News Roundup

Stage 2: Finding the balance between structure and flexibility as you grow (100-1000 headcount)

Tip 1: Introduce structure thoughtfully – don't force transformation

You're likely bringing in dedicated Rewards expertise for the first time, with inconsistency to address from the ad hoc approach that worked at smaller scale.

The temptation is to dive straight into fixing everything. But Giac has seen this go wrong repeatedly. "A new Reward leader will come in, spot the discrepancies within the first month, put together a large-scale plan, present it to departmental leaders, get pushback... and quit the job – all in the space of under a year."

"Don't muscle in immediately and try to force change," Giac warns, "or you'll be seen as an opponent."

Department leaders have been making compensation decisions their own way, often for years. Structural changes feel like an attack – especially if they mean relinquishing control.

The better approach is to observe first. "Let the problems play out first by living through a merit cycle," Giac recommends. "By observing you'll gather concrete evidence of the issues and quantify the impact – crucial for making your case for change later."

This observation period serves multiple purposes: renewed clarity on principles and objectives, understanding the business impact of inconsistencies, seeing which processes are salvageable, and building relationships with department leaders.

"The departmental leads need to see you as a partner who is there to listen and make informed improvements," Giac explains.

Once you have evidence and relationships, present the case using business language – retention risk, budget efficiency, compliance.

Structure is essential at this stage. But how you introduce it matters as much as what you introduce.

Tip 2: Connect compensation reviews to your broader People strategy

Your compensation review needs to integrate with wider compensation decisions made throughout the year.

Giac highlights a common mistake: "Many people think about the big annual merit cycle in isolation, and forget that salary increases and promotions might happen across the entire year."

Companies make compensation decisions constantly – ad hoc increases, new hires, mid-year promotions, internal moves. If you don't consider how your merit cycle interacts with these, you create inconsistencies.

To give one example, Giac spoke with many former Meta employees during the time TikTok was hyperscaling and hiring aggressively from big tech: "It was common knowledge that if you got promoted mid-year instead of during the main Spring cycle, you could get a larger increase."

Aligning with performance management is equally critical. "At this size and scale, you need performance management working in partnership with Rewards," Rob notes. "There should be a year-long message on performance and feedback, but if there's a dedicated performance review process with ratings then it needs to come before the compensation review so that it can inform pay changes."

Your compensation review is one component of broader strategy. Design it to work in harmony with everything else.

Tip 3: Master project and stakeholder management as complexity grows

"Now that your cycle has become big, it's going to involve thousands of people," Giac observes.

What felt like a manageable process as a team of 40 will quickly become chaos at this scale – missed feedback deadlines cascade into delays, inconsistent communication creates confusion, and what should be a strategic process becomes a fire-fighting exercise.

Proper project management is a must, including:

- Clear timelines. "Going out with a very clear timeline is pivotal if you really want the cycle to run smoothly," Giac notes. Create "different versions depending on the stakeholder" – granular for managers involved in calibrations, simpler for executives, clear key dates for employees.

- Objectives as your anchor. With multiple voices in the room – department heads wanting bigger increases, finance focused on budget, executives concerned about retention – you need an anchor point. "Keep going back to what you're trying to achieve from the cycle," Rob emphasises.

- In-the-moment guidance for managers. You can't rely on managers remembering training from weeks ago, Giac explains, " providing guidance and reinforcing principles at the point when decisions are being made enables consistency.”

- Proper tools. "There's a tipping point where you won't be able to run a compensation review in thousands of spreadsheets," Giac warns. Version control becomes impossible and human error becomes substantial risk. The time to explore compensation review software has arrived.

Tip 4: Create one unified voice across multiple communicators

As you grow, compensation review communication becomes complex. Department heads, country leaders, and line managers all communicate with their teams.

"It's common to see each department leader owning communications for their own department," Giac observes. "The message inevitably becomes different, and even the fact that communications is happening separately gives employees a feeling that we aren't aligned as one company."

The solution isn't to centralise all communication. Instead, ensure "one unified voice."

“Start with a central message that establishes the core narrative and non-negotiables,” says Rob – the process, timelines, principles.

Then ensure departmental leads reinforce that message. Giac suggests the ideal: "instead of starting their own thread, all they need to do is forward the central message, and add any additional localised context if needed."

Different contexts might be needed for different locations, but everyone should understand they're part of the same process guided by the same principles.

Stage 3: Avoiding a bloated process at scale (1000+ headcount)

Tip 1: Find ways to preserve agility, even with more regimented processes

"By this stage, businesses will be in a rhythm," Rob observes. "Everyone knows that annual reviews are coming, what to expect."

But within that predictable structure, you need room to address unique challenges. Rob describes this as maintaining "standard process for standard needs, but finding ways to preserve agility for special cases."

This might mean:

- Fast-track approval processes for critical retention cases

- Mid-cycle review windows for critical talent and or roles facing market pressure

- Department-specific adjustments when business context requires it

- Budget reserves for unexpected needs.

"The agility needs that startups have don't disappear as scale increases," Rob emphasises, "data will support being able to still move fast where the business needs to."

Instead of ad-hoc increases whenever someone threatens to leave, create structured data driven talent and retention review processes that allow leadership to make business-informed decisions. Instead of random promotion timing, create clear windows whilst allowing exceptions for critical cases.

"The agility needs that startups have don't disappear as scale increases. Maintain standard process for standard needs, but find ways to preserve agility for special cases."

Founder of Darwin Total Rewards

Tip 2: Take every opportunity to simplify and adjust

At enterprise scale, processes tend to pile on top of processes. More approval layers, more checkpoints, more documentation. It's overwhelming – and process without purpose doesn't serve anyone.

"Make sure you take space away from the treadmill to reset," recommends Rob. "It's easy at scale to fall into the 'it's just the way we do it' trap, so take the time to reevaluate and make sure things are adjusted or rebuilt for where you are."

Look for opportunities to streamline: consolidate approval flows, automate manual work, remove unused reporting requirements, simplify convoluted communication flows.

Tip 3: Provide strong central guidance for decentralised execution

At enterprise scale, you can't have the Rewards team making every compensation decision.

With thousands of employees across multiple departments, countries, and business units, execution has to be decentralised – managers and local HR teams need autonomy to make decisions for their areas.

But without strong central guidance, that decentralisation quickly becomes chaos.

Different departments develop their own approaches, consistency disappears, and you're back to the problems you solved at earlier stages.

“Rewards has to maintain ownership over the frameworks and principles, but also continue to distribute the execution as the business grows, in partnership with HR, line managers, and leadership,” says Rob.

This means establishing clear guardrails:

- Non-negotiable principles that apply everywhere (e.g. performance criteria, market positioning philosophy)

- Structured processes that departments follow (e.g. calibration requirements, approval flows)

- Decision-making frameworks that guide local choices (e.g. when exceptions are appropriate, how to handle edge cases)

- Check-ins and guardrails to ensure consistency in final outcomes.

As Giac emphasises, decision-makers need "guidance at the point it's needed" to ensure confident and consistent execution – which is also why it’s so crucial that compensation software factors in the manager experience, providing that structure and guidance throughout the process to support HR and Reward leaders.

“In my experience, many CompTech tools fail to create positive experiences for line managers – which is often a core metric for Reward leaders, who want to improve the NPS score for each cycle.”

Compensation Manager at Monzo and Founder of CompTech News Roundup

In summary: The art of scaling a compensation review process

Your compensation review will change as you scale – it's inevitable, the process that works at 100 people won't work at 1,000.

Success means anticipating these breaking points and evolving proactively.

As Rob puts it, it's about "getting those building blocks in the right order" and then regularly "taking time to reset and make sure things are built for where you are." Structure is essential, but how you build it – and how you maintain it – matters as much as what you build.

The overarching lesson: scaling a compensation review is about intentional evolution. Build thoughtfully, simplify regularly, and maintain the discipline to reset for each new phase.