What's happening with hiring in the tech industry right now? Are companies expanding their teams, or staying cautious?

For People Leaders and talent teams, understanding hiring trends is essential for workforce planning, budgeting, and staying competitive in the talent market.

So, to help, let's take a look at the latest data on tech hiring rates – and then expert viewpoints on the key hiring trends shaping the tech talent market this year.

Hiring rates in 2026

The hiring rate across European tech is 29% (Ravio data, October 2025).

This refers to the percentage of new hires in the workforce in the last 12 months (October 2024 to October 2025), compared to the average headcount in that time.

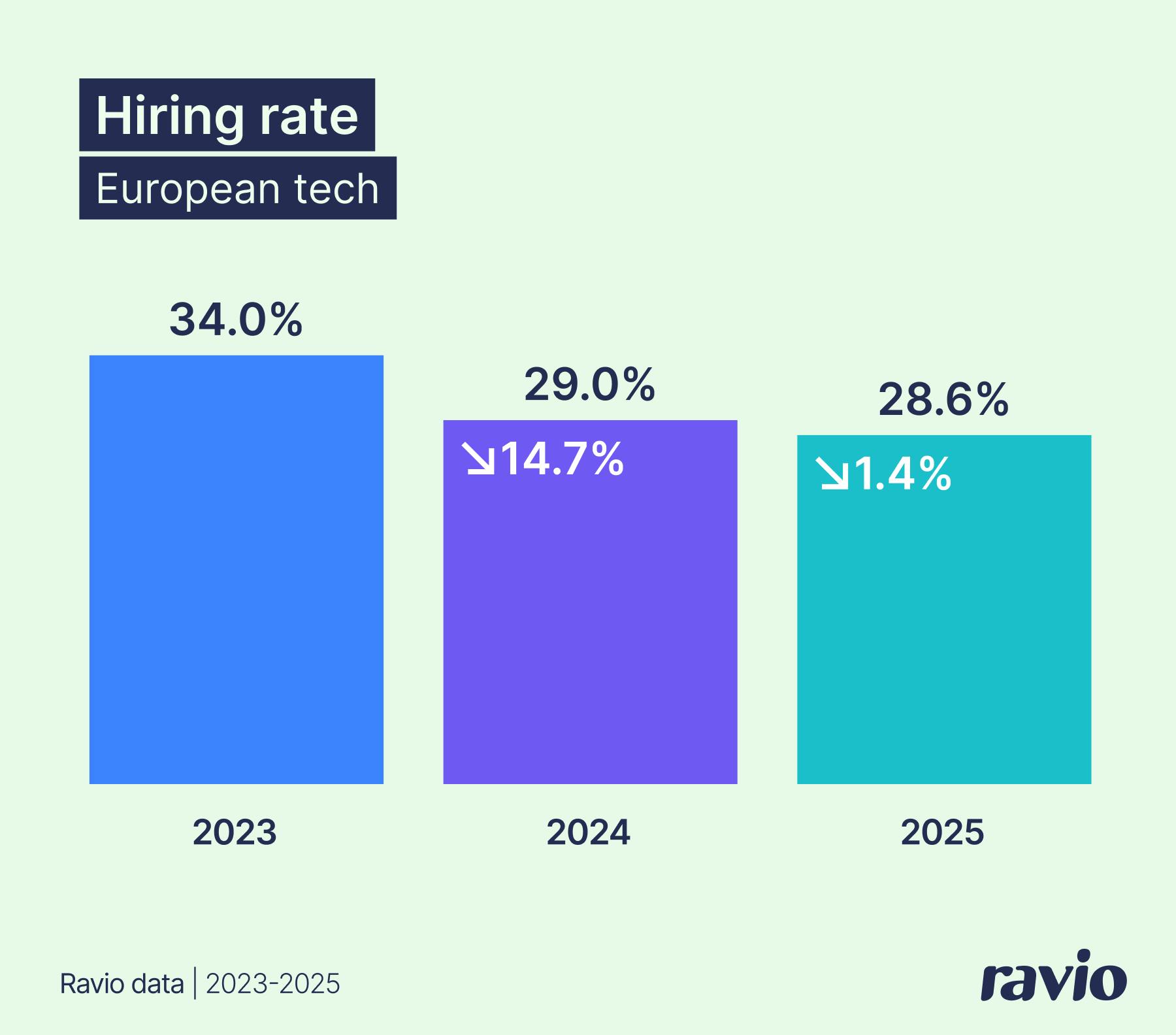

Hiring rate 2025 vs 2024 vs 2023

The 29% hiring rate in 2025 marks a year of hiring stability – the hiring rate in 2024 was also 29%, following a significant 15% decline from 2023's hiring rate of 34%.

This suggests tech companies are maintaining the same steady but cautious approaches to team expansion, avoiding the rapid headcount growth that used to characterise the industry.

"Stable hiring rates suggest tech companies are progressing with caution. This pause in rapid scaling gives them space to strengthen their talent acquisition and rewards strategies – building more sustainable foundations for future growth." – Rob Green, Founder of Darwin Total Rewards

Founder of Darwin Total Rewards

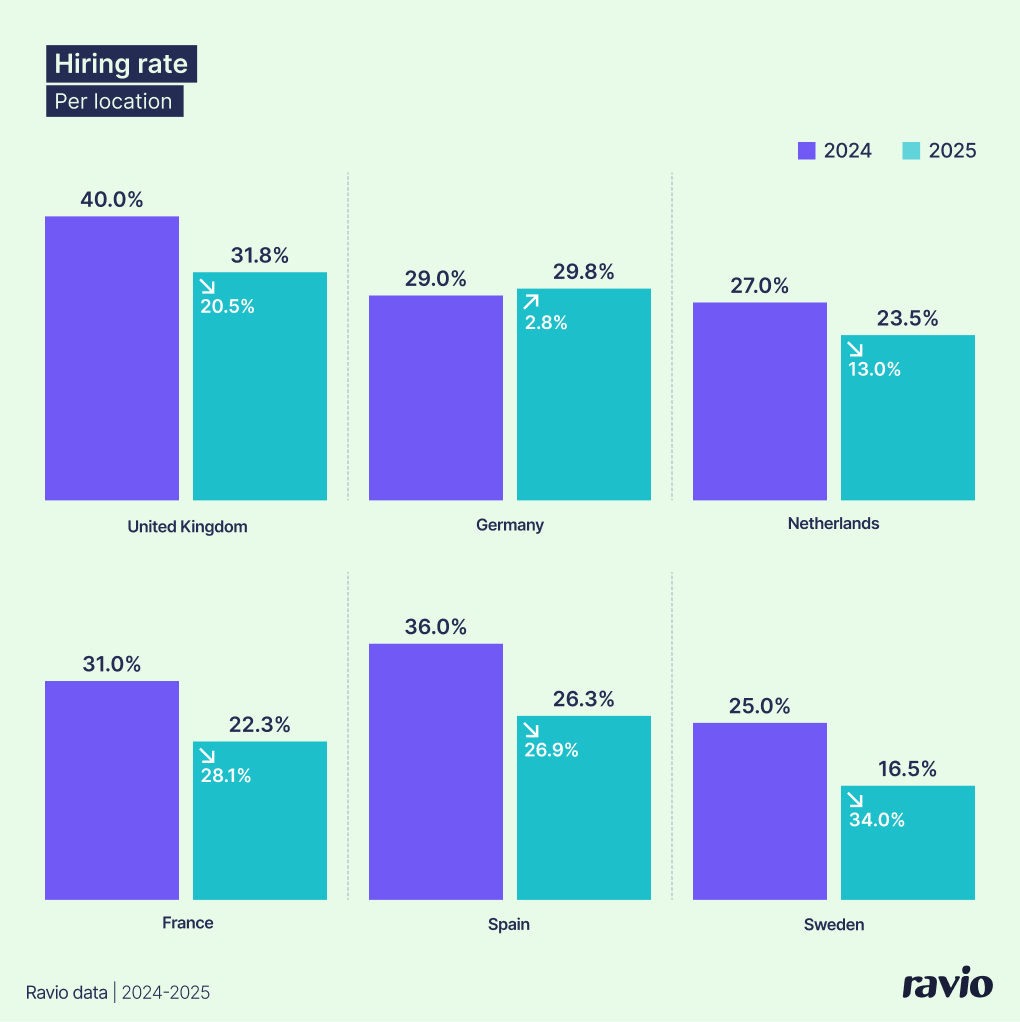

Hiring rates per country

European markets show notably different hiring patterns in 2025:

- UK hiring rate: 32% – the highest rate across all markets, despite seeing a significant 21% decline from last year's very high hiring rate

- Germany hiring rate: 30% – the only market with positive growth, up 3% from 2024

- Netherlands hiring rate: 24% – down 13% from 2024

- France hiring rate: 22% – down 28% from 2024

- Spain hiring rate: 26% – down 27% from 2024

- Sweden hiring rate: 17% – the lowest rate across all markets, down 34% from 2024.

Beyond these geographic differences, four major trends are reshaping how tech companies approach hiring in 2025-6.

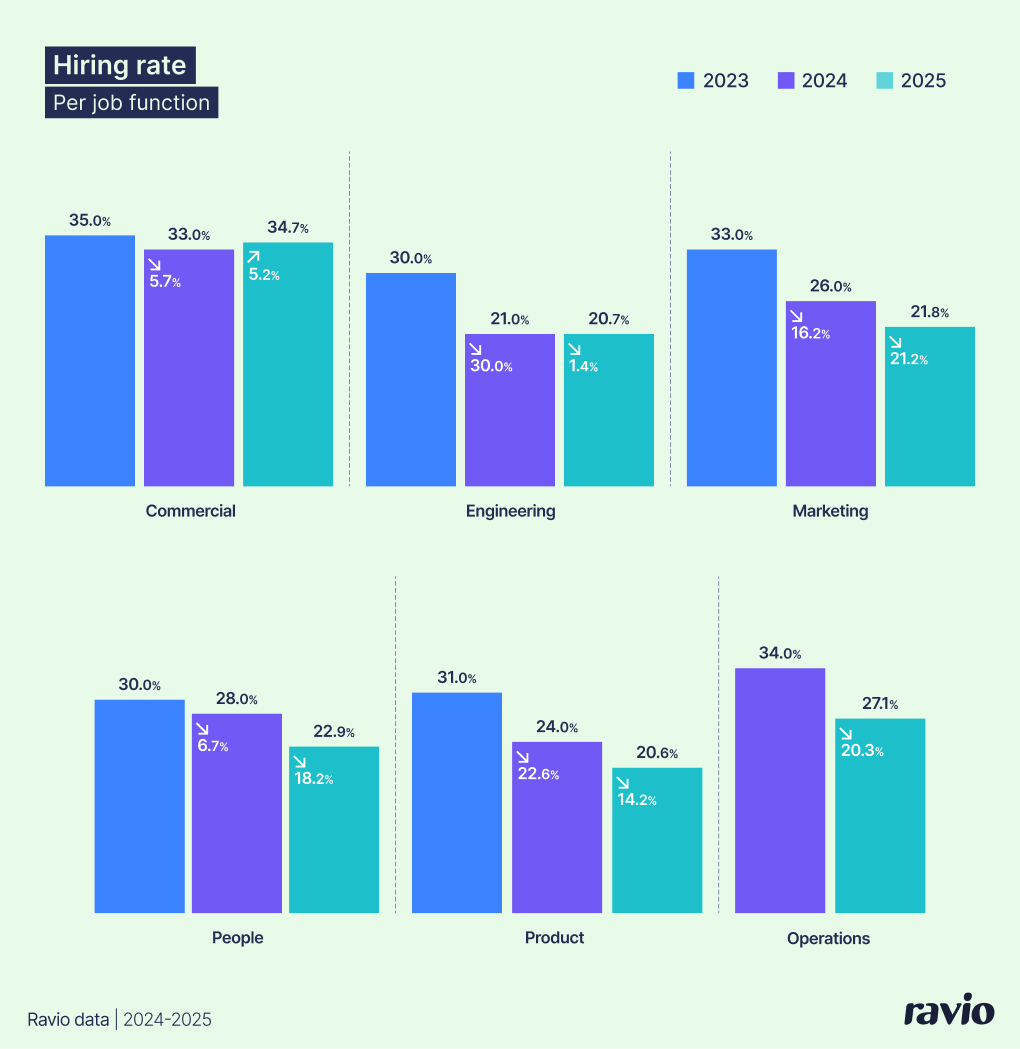

Hiring trend 1: Operations hiring in decline – it’s a function in flux

When we look at hiring rates per job function, we see that most functions have seen declining hiring rates in 2025 – with Commercial being the exception, where hiring rates are up 5% to 34.7% (the highest across all functions).

One of the biggest declines is seen in the Operations job family.

Operations hiring rates declined by 20% in 2025 to 27%. Throughout Ravio's 2026 Compensation Trends report, Operations faces significant compensation pressures in addition to this – with the lowest salary increase eligibility (14% of employees received raises versus 23% overall) and amongst the lowest promotion rates (3.4%).

But, despite these declines, Operations maintains a 27% hiring rate – higher than all other functions except Commercial.

This paradox suggests Operations is a function undergoing fundamental transformation.

The most likely explanation? A bifurcation is happening within Operations roles.

Routine operational tasks previously performed at junior levels are increasingly automated or outsourced. Strategic operations work, on the other hand, is becoming more important as companies explore how to AI-augment the workforce.

"The Operations findings scream 'transformation in action". Our job board still continues to show considerable Operations hiring, perhaps reflecting high replacement demand as companies work to retain and evolve these roles. But obviously, some early adopters are already redesigning their organisations around efficiency gains they hope to get from AI and automation."

VP People at HV Capital

"Companies overestimate how much AI can replace operational and support roles – while some automation exists, real-world implementation rarely justifies such dramatic cuts. In the People function, for instance, People Ops roles always get cut first when budgets tighten, but quickly become understaffed, causing operational problems. We'll see companies rehiring these roles soon, just as we're already seeing with recruiting."

HR Consultant and Strategic Advisor

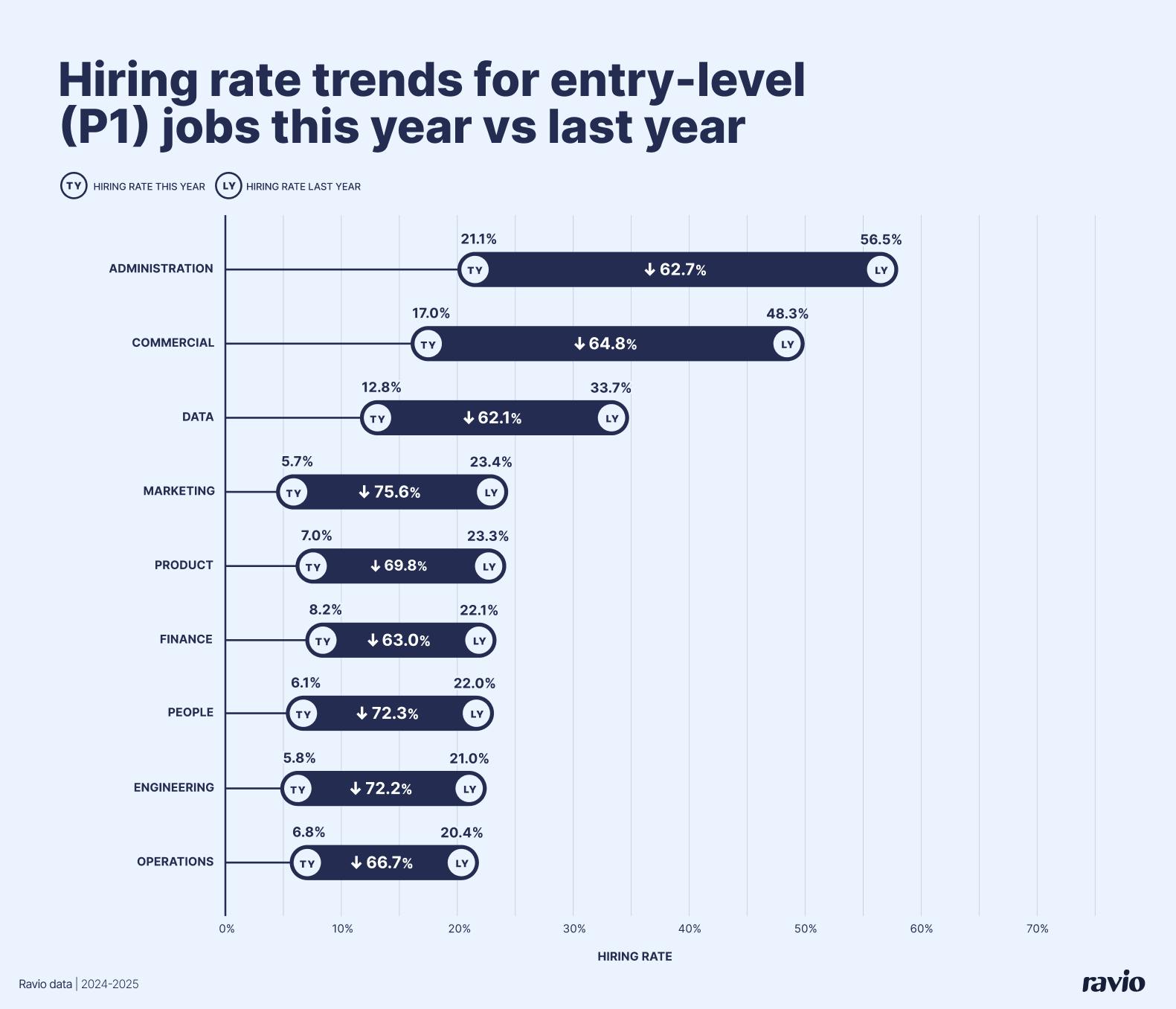

Hiring trend 2: Entry-level hiring has collapsed

Entry-level positions (P1 and P2 job levels) have seen a staggering 73% decrease in hiring rates in the past year, according to Ravio's 2025 Tech Job Market Report – compared to just a 7% decrease in hiring rates across all job levels overall.

Junior roles in People, Marketing, and Engineering are particularly impacted, all showing even steeper drops than the overall entry-level average.

Entry-level roles have traditionally been how companies bring fresh perspectives and develop junior team members into best-fit talent for mid-career positions. Without this pipeline in place, HR and business leaders may need to reconsider career pathways and succession planning.

"If you don't hire and nurture young talent now, what will your mid-level and leadership positions look like in five years? We're heading towards some very difficult and expensive recruitment to fill that gap in a few years time."

Global Talent Acquisition & Employer Branding Leader and Co-founder of Cohorts

AI is certainly playing a role – entry-level positions often focus on relatively routine and repetitive tasks that are ripe for automation.

But there's also wider context: economic uncertainty and companies maintaining lean operations after years of layoffs and restructuring mean employers are more cautious about investing in new hires, particularly at junior levels.

On a broader note, this trend represents a difficult reality for graduates and early career professionals facing an incredibly challenging job market. The human implications, and what this means for the future of work, are challenges only just beginning to be explored.

"If junior talent can be replaced by AI, we're saying that all they ever offered was a cheap way to get our admin work done, but that's so far from reality. You're missing out on the creative ideas, diversity of thinking, and savviness with new technologies (like AI itself) that new generations bring to the workplace."

Global Talent Acquisition & Employer Branding Leader and Co-founder of Cohorts

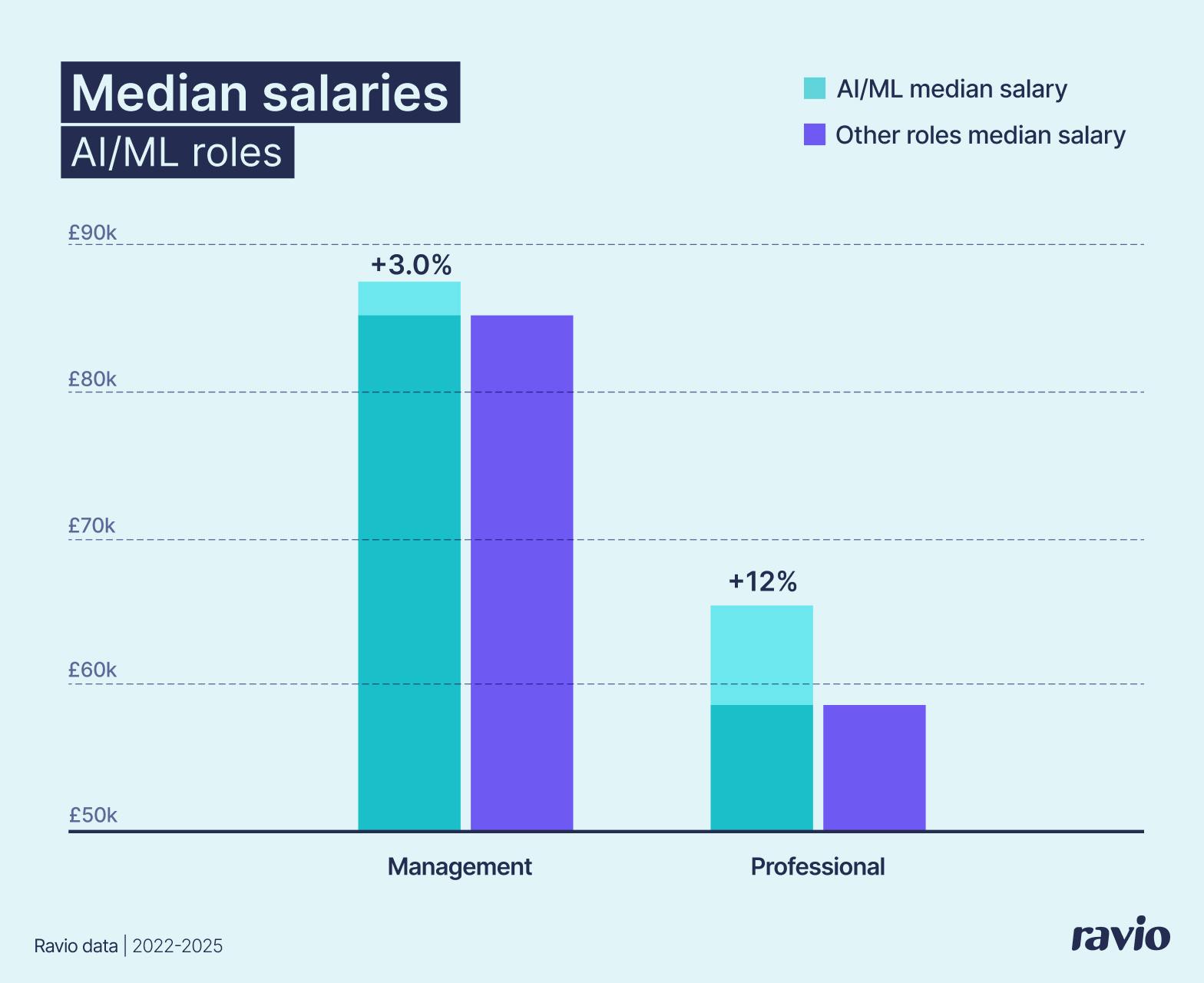

Hiring trend 3: The AI hiring gold rush

The biggest trend in hiring this year is AI talent becoming the new battleground – the proportion of new hires in AI/ML roles grew by 88% in 2025 compared to the previous year.

"Every company is either hiring for AI talent or upskilling existing teams, but success depends on being intentional about it. Some clearly understand what AI capabilities they need; others are just reacting to FOMO. The companies that balance being lean with rewarding high-impact AI talent are the ones attracting both funding and the right people."

Early Stage People Lead at EQT Ventures

The landscape of AI careers is expanding rapidly too.

In the past year, the number of distinct AI/ML job titles that companies are hiring for has increased by 50%. AI/ML job roles are appearing across all functions as companies embed AI tooling to drive efficiency, but by far the most common is Software Engineering – with AI/ML Engineer representing 45% of all AI/ML job titles in Ravio's database, and Senior AI/ML Engineer a further 15%.

"AI has gone from a side project to the core of engineering teams. In our recent pulse survey, founders expect that 20-50% of their engineering org will be AI engineers within 12 months. These AI engineers are not just prompt-tuning – they're owning model evaluation, LLM stack building, and collaborating across product and design. It's no surprise compensation for these roles is commanding higher premiums."

Talent and Portfolio Development Partner at Northzone

With AI capabilities in high demand, AI salaries also now command a market premium across all levels – with a 3% premium on average for the Management career track, and 12% for the Professional career track.

These premiums reflect growing competition for AI skillsets, though they're more moderate than the extreme examples sometimes cited (like multi-million dollar bonuses for top global AI talent at Meta). For the median tech worker, the reality is more measured.

The smaller management premium suggests less competition for bringing AI into leadership roles, with the priority being hands-on contributors who are directly integrating AI into workflows.

"Right now, we see eye-watering salaries for AI talent. The risk is overpaying for skills that may commoditise quickly. Companies need a clear workforce plan: which AI skills are truly differentiating and worth the premium, and where they can reskill existing talent."

Co-founder of Invested

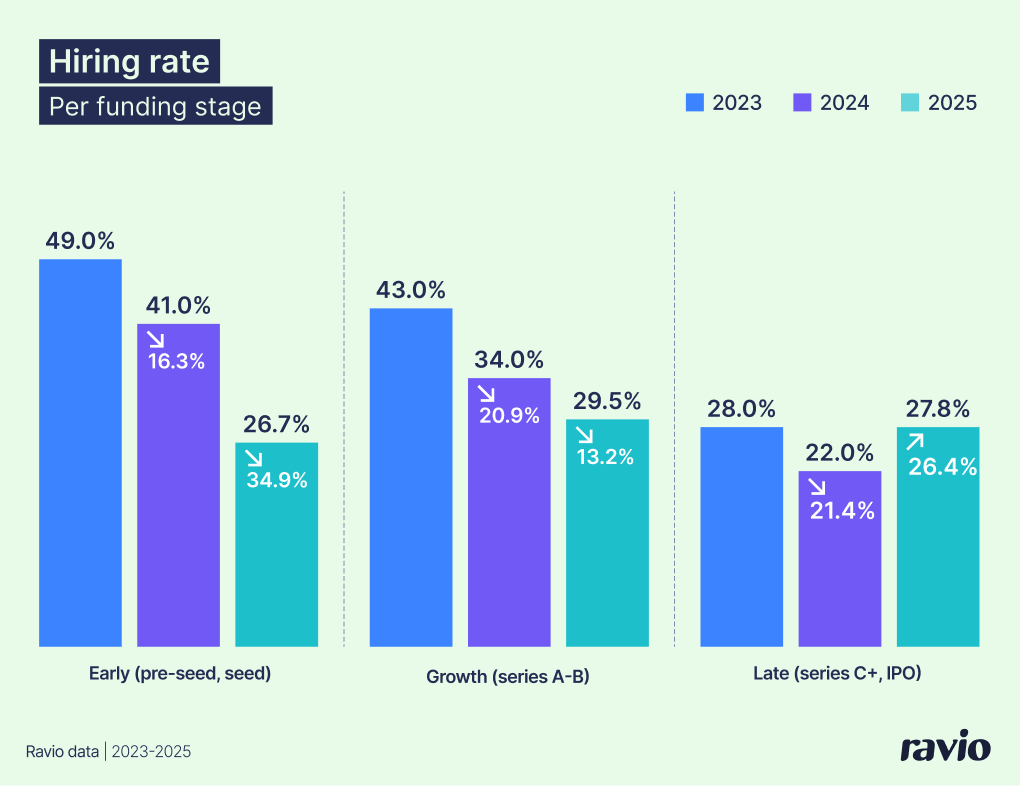

Hiring trend 4: Early-stage startups have slowed hiring significantly

Hiring rates across funding stages have converged significantly in 2025. Where 2022-3 showed dramatic variation (49% for early-stage versus 28% for late-stage), all stages now sit within a narrow band of 27% to 30%.

Early-stage companies saw the steepest decline, down 35% to a 27% hiring rate – bringing them down from the exceptional 49% rate of two years ago to more sustainable levels. Growth-stage companies declined more moderately (down 13% to 30%), whilst late-stage companies actually increased hiring by 26% to reach 28%.

This convergence suggests all company stages are adopting similar, measured approaches to team expansion regardless of their funding position.

At the early-stage, the shift seems to mark a trend of leaner teams – a big change in how startups think about team building and scaling.

Founders are opting for slower headcount growth, but making every hire count, and finding ways to leverage AI tooling and automation to maximise impact even with smaller teams. This is particularly common at AI-native startups, but seems to be becoming a wider trend.

"We're seeing a shift toward leaner, more intentional company building at early-stage. Founders are deploying cash and equity more selectively to attract one or two people who can materially change the company's trajectory. The challenge is role clarity – too many founders hand out inflated titles like 'Head of AI' to brilliant researchers who've never managed teams. Getting that distinction right early prevents organisational and compensation headaches down the line."

Early Stage People Lead at EQT Ventures

"What might look like belt-tightening at early-stage is actually a shift toward more intentional company building. Hiring rates are down and headcount growth is lower than previous years, but it's more strategic – we're seeing our founders target specific capabilities and skillsets needed to bring new products to market, especially AI-native talent and customer-focused roles like Forward Deployed Engineers."

VP Talent at Creandum

FAQs

What is the meaning of 'hiring rate'?

Hiring rate refers to the percentage of new hires in the workforce in a given period, compared to the average headcount in that time. For example, a 29% hiring rate means that new hires represented 29% of the average headcount during that period. According to Ravio's 2026 Compensation Trends report, the hiring rate across European tech is 29%.

What is the formula for calculating hiring rates?

The formula for calculating hiring rate is: (Number of new hires / Average headcount) × 100. This gives you the hiring rate as a percentage, showing what proportion of new hires there were compared to the average workforce size during that timeframe.

How do you stay up to date with hiring trends?

Staying up to date with hiring trends requires access to real-time market data and reliable industry insights. Compensation tools like Ravio provide live compensation benchmarks and talent market insights from hundreds of thousands of employees across European tech companies, enabling People teams to track hiring rates, salary trends, and talent market shifts as they happen. Regular industry reports, talent acquisition data, and networking with other People Leaders also help maintain a current view of the hiring landscape.

How can startups stay ahead of tech hiring trends?

Startups can stay ahead of tech hiring trends by leveraging real-time compensation benchmarking data from trusted providers like Ravio. Ravio's platform provides live market insights on hiring rates across different funding stages, job functions, industry types, and locations – helping startups make informed decisions about when to hire, which roles to prioritise, and how to structure competitive compensation packages.