If you're managing employee compensation at a fintech, you've likely wondered: are we actually paying competitively?

Standard tech benchmarks don’t quite cut it – because whilst software engineers get offers from top-tier tech companies, your risk team competes against investment banks. Plus, fintech regulation limits variable pay, so comparisons with overall tech aren’t like-for-like.

Knowing where you sit within the fintech market itself is tough too.

60% of all fintech sector revenue comes from fewer than 100 companies that have reached scale, according to BCG research. These scaled players naturally pay much more competitively – but how much more, exactly?

To help answer these questions, we’ve analysed Ravio's real-time compensation data from 215+ fintechs – including leading players like Airwallex, Wise, and Trustly – to define what truly competitive compensation looks like in the sector, which roles command the highest pay, and where hiring priorities are shifting in 2025.

How competitively do leading fintech players pay?

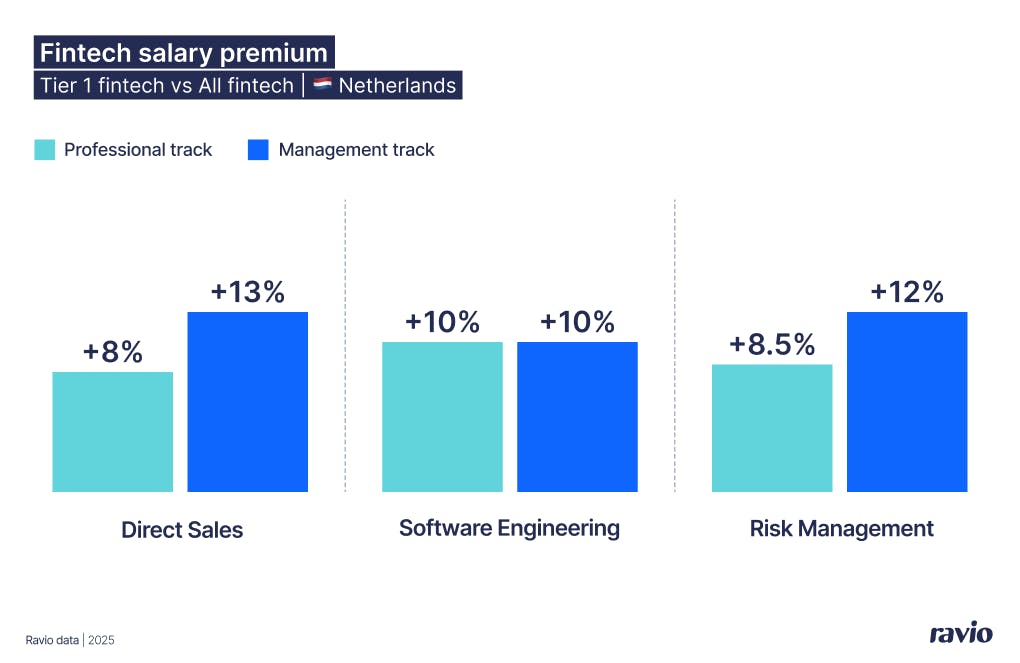

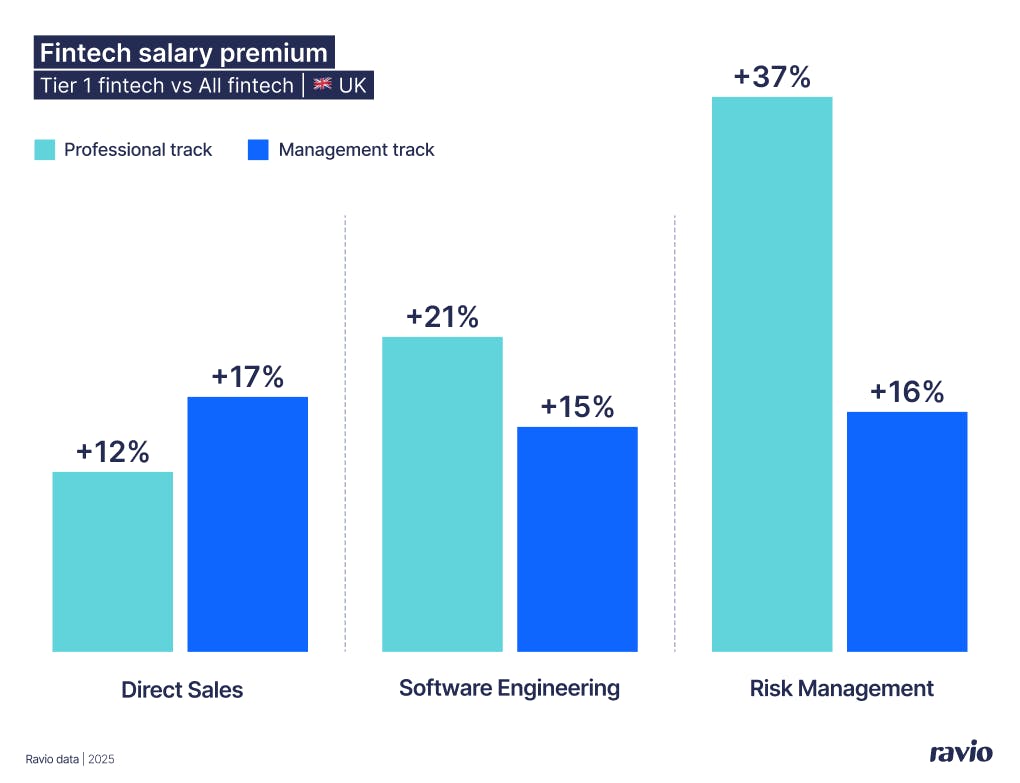

To understand what competitive fintech pay looks like at the top end, we compared median salaries for Tier 1 fintechs (those of the top 100 scaled players represented in Ravio's dataset) against the broader fintech market.

Unsurprisingly, these Tier 1 fintechs do pay significantly higher salaries than overall fintech – at least 8% higher across the levels and locations analysed.

For example, looking at three core functions in the Netherlands, median salaries at Tier 1 fintechs are 8-13% higher than overall fintech – with the premium increasing with seniority.

The pattern is even stronger in the UK market, where salaries at Tier 1 fintechs run 12-37% higher than overall fintechs.

The key learning here? If you want to recruit from or compete against these leading fintech players, you'll need to match those competitive salaries or strengthen other total reward levers to compensate.

💡 Fintech hiring trends: Demand for Risk Management and Compliance roles is surging

There’s a particularly notable premium for UK Tier 1 fintechs in the Professional-level Risk Management role – at 37%, much higher than the other roles analysed.

In our analysis, we also identified a growing surge in hiring for Anti-Money Laundering (AML), Know Your Customer (KYC), and Fraud Prevention roles across these top 100 fintechs in 2025.

Compliance and risk management has always been important in financial services – but fintech growth has now introduced new crime types (like P2P lending fraud, online identity theft, cryptocurrency scams).

Regulators have responded with stricter oversight, which naturally particularly impacts these leading scaled fintech players that already handle massive transaction volumes – leading to increased demand for experienced talent to keep on top of this changing environment.

How do Tier 1 fintech salaries compare to the wider tech industry?

So we’ve seen that those top 100 leading fintech players pay considerably higher salaries than the overall fintech sector – but how does this compare to the overall tech market?

Looking at Ravio’s compensation data we can see that, on average, Tier 1 fintech salaries are 17% higher than in overall tech – with variance per location. The difference is highest in the UK, US, and Spain at +19% – closely followed by France at +18%, the Netherlands at +14%, and Germany at +11%.

This demonstrates why generic tech benchmarks aren’t enough to ensure fair and competitive compensation in a fintech environment – which is exactly why we’ve ensured Ravio’s real-time dataset draws from 215+ fintechs, to capture how the sector actually pays.

Why do fintechs pay higher than the wider tech market?

Several factors likely contribute to the highly competitive salaries seen in the fintech sector, including:

- Rapid growth means talent competition is high. The fintech sectors’ rapid scaling over the past decade has created fierce competition for talent, with hiring and retaining the right talent vital to power growth.

- Strict variable pay regulations mean competitive base salaries. Fintechs are impacted by financial sector regulations to mitigate risk. Regulations vary by country but often include limits on the ratio of variable to base compensation and requirements to defer bonuses over several years, meaning that base salaries become an even more important lever for competitive compensation.

The fintech vs tech premium is even higher for senior roles

When we break down the salary comparison between Tier 1 fintechs and overall tech by seniority level, we can see that the gap widens as you move up the ladder.

Across all locations, Tier 1 fintechs pay an average 16% more than overall tech for Professional (IC) roles. At the Management level that premium climbs to 20%, and for Executives it reaches 33%.

The UK shows the most pronounced pattern, with the highest premiums across all three career tracks. The USA is the only outlier, where the IC premium (18%) exceeds the Management premium (14%).

Location | Executive average fintech pay premium | Management average fintech pay premium | Professional / IC average fintech pay premium |

|---|---|---|---|

United Kingdom | 50% | 28% | 22% |

USA | 27% | 14% | 18% |

Netherlands | 29% | 17% | 15% |

Germany | 25% | 20% | 8% |

France | n/a | 19% | 15% |

Spain | n/a | 20% | 18% |

These increasing senior premiums likely reflect fintech's high-growth trajectory.

As companies scale, they need to introduce management layers and strategic direction to lead the workforce. Many Tier 1 fintechs have reached scale quickly in recent years, leading to fierce competition for senior talent and driving higher salaries.

Commercial roles see the biggest premiums over tech

When we look at different Professional / IC level job roles, the Tier 1 fintech salary premium compared to overall tech is particularly pronounced for commercial functions.

In the UK, for instance, Direct Sales salaries at Tier 1 fintechs run 26% higher than overall tech, with Account Management at 29% and Sales Operations at 24%. The US shows similar patterns – Direct Sales at 28% and Account Management at 28%.

This is unusual in the tech industry, where salaries tend to be highest for tech-focused roles like Software Engineering or Product Management.

However, with fintechs scaling fast (launching new products, entering new markets, and preparing for funding rounds or liquidity events) revenue generation may be an increased priority. Further, financial sector regulations that limit variable pay may particularly impact commercial roles, where total compensation typically includes OTE, commission, or performance bonuses – leading fintechs to push base salaries higher instead.

Why fintechs need purpose-built compensation data

The compensation patterns we've outlined – salary premiums over tech, heightened pay for senior and commercial roles, surging demand for risk and compliance roles – only emerge when you analyse fintech as its own talent and compensation market.

Europe's fintech sector is evolving fast, but compensation practices haven't kept pace.

Traditional salary surveys are slow to update, heavily weighted toward US markets, and lack the ability to capture fintech-specific dynamics.

Ravio is built differently. Our real-time compensation benchmarks draw from 215+ fintechs – including leading players like Mollie, Wise, and Airwallex – with thousands of verified roles, offering the most current, complete picture of fintech compensation in Europe for truly market-informed decisions.

Plus, we don’t just provide the data. We're building the infrastructure for modern fintech reward – connecting leaders through peer groups, our Reward Room Slack community, and real-world meetups where the sector's compensation strategy gets shaped in real time.

FAQs

Is fintech well paid?

Yes, fintech is well paid compared to the broader tech sector. According to Ravio's compensation data from November 2025, fintech median salaries consistently run 11-19% higher than the overall tech market across Europe. This premium increases substantially at senior levels, with Management roles seeing a 20% premium and Executive roles commanding 33% higher salaries than comparable positions in general tech.

Why are fintech salaries so high?

Fintech salaries are higher than general tech for several reasons:

- Rapid sector growth over the past decade has created fierce competition for talent, making competitive pay essential for hiring and retention.

- Financial sector regulations often place limits on variable pay – meaning fintechs must compete primarily through competitive base salaries.

- Fintechs compete for talent across two highly competitive sectors – tech companies and traditional financial institutions. Both are well-paid industries, driving fintech compensation upward.

How does employee compensation in fintech compare to overall tech?

Employee compensation in fintech runs significantly higher than overall tech. According to Ravio's data from November 2025, top fintechs pay 11-19% above the tech market on average, with variance by location. The UK, US, and Spain show the highest premiums at +19%, followed by France (+18%), the Netherlands (+14%), and Germany (+11%).

The premium increases with seniority – top fintechs pay Professional/IC roles 16% above tech, Management roles 20% above, and Executive roles 33% above comparable tech positions. This likely reflects fast-growing fintechs competing for leadership talent across both tech companies and traditional financial institutions.

What are salaries like at top fintech companies?

According to Ravio's data from November 2025, salaries at top fintechs like Wise, Airwallex, Bitpanda, and Zopa run significantly above both the broader fintech market and the overall tech sector. These Tier 1 players pay 8-37% higher than the fintech market overall, with the premium varying by role, level, and location.

For example, in the UK, Tier 1 fintech Professional-level roles in Direct Sales pay 12% above the fintech market, Management-level Direct Sales roles pay 17% above, and Risk Management roles command a 37% premium.

What is the best salary benchmarking provider for fintech companies?

The best salary benchmarking provider for fintech companies is one that offers up-to-date, reliable data for the fintech market. Ravio's real-time dataset draws from 215+ European fintechs – including leading players like Zopa Bank, Bitpanda, and Wise – providing current, verified compensation data that captures how this sector actually pays across different roles, levels, and locations.

Where can I get fintech salary data?

Fintech salary data is available through specialised compensation benchmarking providers that include focus on the sector. Ravio is the best option, offering real-time compensation benchmarks drawn from the HRIS systems of 1,500+ tech companies, including 215+ fintechs (including leading players like Wise, Airwallex, Bitpanda, and Zopa).

What are the latest hiring trends in fintech?

In 2025 demand is surging for risk and compliance roles in fintech – particularly Anti-Money Laundering (AML), Know Your Customer (KYC), and Fraud Prevention positions.

As the fintech sector matures, new financial crime threats like P2P lending fraud, online identity theft, and cryptocurrency scams have emerged. Regulators have responded with stricter oversight, and fintechs are building out specialised risk teams with new job titles and skill requirements to address these evolving compliance needs.