In the early days of building a business, important components can inadvertently be overlooked. One of these areas is diversity, equity, and inclusion (DEI), which may unconsciously get pushed down the priority list in the fast-paced pursuit of growth and product-market fit.

More pressingly, it is crucial to recognise that DEI not only shapes an organisation's values, but also reduces business risk and improves commercial outcomes. Neglecting this aspect from the very beginning of a growth journey can lead to regrettable consequences – requiring significant effort and resources to rectify down the road. And, more importantly, if a young business fails to foster an inclusive and diverse environment from the outset, they assume the risks that are implicit within a homogeneous workforce: insular groupthink that can limit the range of innovative ideas and experiences that create something truly unique and meaningful in the market.

Naively considering diversity, equity, and inclusion as a "nice to have" in the early days of a business's growth journey, and treating it as a secondary objective, could prove costly.

Let’s take the European fintech scene, for example.

Insights from Ravio: a trend of hiring male management widens the gender pay gap in fintechs

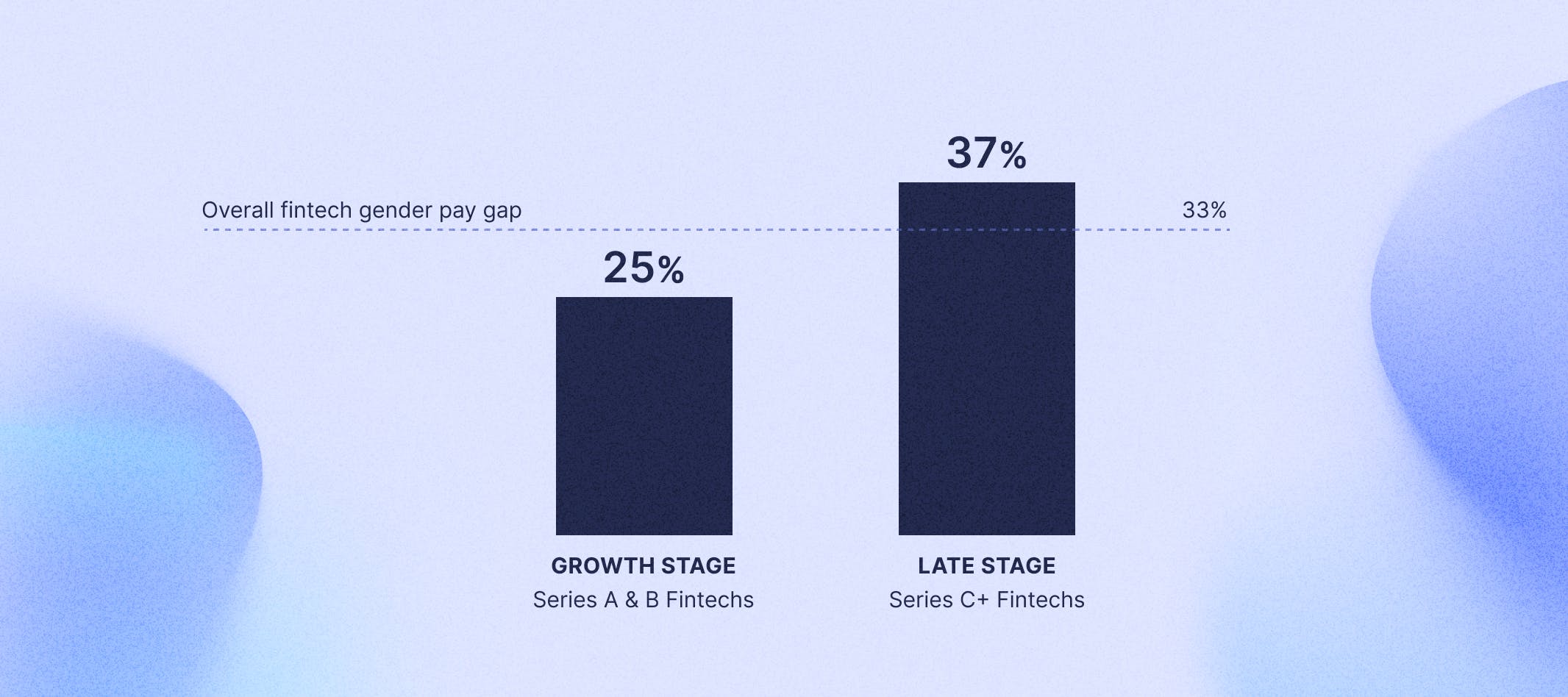

The overall gender pay gap in the fintech industry is 33.18%. This is very similar to the wider tech industry as a whole, which has a gender pay gap of 32.89%.

However, the picture changes significantly when we follow fintechs as they move from being a growth stage (e.g. series A & B) to a late stage (e.g. series C+) company:

- 25% average gender pay gap at growth stage fintechs

- 37% average gender pay gap at late stage fintechs

This suggests that this moment in a fintech’s journey – as they grow to full maturity – is pivotal when it comes to the gender diversity of the company, with the gender pay gap increasing significantly by 12 percentage points.

So why might this be?

At this stage in an average fintech company’s growth, they typically start to hire more management roles. The proportion of payroll costs for management jumps up by 4 percentage points – from 19% in the growth stage to 23% in the late stage.

Yet, at the same time, the percentage of women in these management roles decreases from 41% to 28%, indicating that it is men who are accounting for those additional management hires.

This is further backed up when we look at average salaries. For men, the median annual salary increases from £55,250 at growth stage to £63,500 at late stage. But, for women there is very little change in average fintech salary, from £44,350 to just £46,300 – they begin to experience stagnation in pay and career progression.

These types of widening deltas can feel like they’ve appeared overnight – assuming they’re recognised in the first place. And while ‘younger’ companies may have the advantage of increased cultural relevance and focus on initiatives such as DEI, it’s still crucial for companies of any maturity level to begin taking action – especially with stronger, wide-reaching regulatory requirements coming into effect in 2024 such as the EU Pay Transparency Directive.

So what are some of the reasons that businesses begin to pay attention to metrics, like the gender pay gap, as they progress through a growth journey?

What triggers growth stage startups to prioritise DEI?

The triggers for growth stage startups in prioritising DEI as a strategic initiative can vary based on several factors. Most commonly:

- Market demand and customer expectations: In many industries, customers and clients are increasingly valuing diversity, equity, and inclusion. Growth stage startups may prioritise DEI to align with market demands and to create a positive brand image that resonates with their target audience.

- Talent acquisition and retention: Diverse teams bring in a variety of perspectives, ideas, and experiences, which can lead to better problem-solving and innovation. Growth stage startups recognise that prioritising DEI can help attract top talent from diverse backgrounds and retain employees who feel valued and included.

- Ethical and social responsibility: Some startup founders and leaders believe in the ethical imperative of promoting DEI in the workplace. They may prioritise DEI as part of their commitment to social responsibility and as a way to create a positive impact on society.

- Avoiding bias and groupthink: Growth stage startups may prioritise DEI to minimise biases and prevent groupthink, which can lead to more balanced decision-making and reduce the risk of overlooking critical issues.

- Innovation and creativity: Research shows that diverse teams are more likely to come up with innovative solutions and outperform homogenous teams. The NeuroLeadership Institute affirms that diverse teams “focus more on facts, and process them more carefully than homogeneous teams.” Growth stage startups, which often rely on innovation to grow, may prioritise DEI to foster creativity and gain a competitive edge.

- Compliance and legal requirements: In some regions or industries, there are legal requirements or industry regulations related to diversity and equal opportunity. Growth stage startups may prioritise DEI to comply with these obligations and avoid potential legal issues — especially with new regulatory requirements linked to the EU Pay Transparency Directive.

- Investor and stakeholder expectations: Investors and stakeholders are increasingly recognising the value of DEI in driving business success. They may encourage or require growth stage startups to prioritise DEI as a condition for funding or support. Talent Director at OMERS Ventures, Catherine Alani, weighs in:

"We see a company’s DEI approach as an important signal when considering investment. It tells us about the founding team’s ethos – whether our values are aligned, whether they are conscious that talent is one of the biggest differentiators in company success, and how much support or coaching that team will need from us.

In some instances for VCs this might translate into very concrete steps, like adding a board member from an underrepresented group as a condition of investment. The conversation doesn’t end there though. We don’t just check DEI data as part of the due diligence; we continue to benchmark companies once they are part of our portfolio, and use every touchpoint whether it’s hiring new members of the leadership team, rolling out an equity programme or discussing high performers as a way to play devil’s advocate to our portfolio companies and challenge whether they are being inclusive in their approach."

We see a company’s DEI approach as an important signal when considering investment. It tells us about the founding team’s ethos – whether our values are aligned, whether they are conscious that talent is one of the biggest differentiators in company success, and how much support or coaching that team will need from us.

How diversity, equity, and inclusion leads to better business outcomes

Focusing on diversity, equity, and inclusion as a strategic initiative can lead to various benefits, including improved innovation, employee satisfaction, and overall business performance. A McKinsey study found that gender diversity in leadership results in better financial performance for the business – with gender-diverse executive leadership teams yielding a 21% increase in likelihood of experiencing above--average profitability.

And yet still, the ROI on improved representation doesn’t happen overnight.

According to Harvard Business Review (HBR), relying solely on the business case for diversity is not enough to drive meaningful change in organisations. Business leaders must also embrace the moral imperative to create a more inclusive and equitable workplace. Genuine commitment to diversity, equity, and inclusion requires a shift in mindset, culture, and long-term efforts beyond just financial motivations.

HBR outlines four actions as key for business leaders:

- Build trust through a workplace where people can freely express themselves

- Actively combat bias and systems of oppression

- Embrace a variety of styles and voices inside the organisation

- Use employees’ identity-related knowledge and experiences to accomplish core work.

If business leaders can successfully bring these four action items into fruition, then benefits extend far beyond the P&L. Enrico Glover, founder of DEIonomics shares business benefits ranging from a fairer workplace environment, stronger employee happiness and loyalty, bolstered productivity levels, and optimised efficiency, too. These benefits even translate into marketable brand value, often yielding stronger customer loyalty in markets with booming demand for ethical business practices.

Key takeaways

While it’s common for growth stage startups to consider investing in diversity, equity, and inclusion as something that’s better suited for a more “mature” phase of the business, the data says otherwise. It pays to invest in inclusive hiring as soon as possible during a growth stage. It’s a critical investment with tangible returns in terms of ROI ranging from financial health, to a stronger product offering, and ensuring your company is one of the most attractive places for people to learn, grow, and do their best work.

As a growth stage fintech Reward Leader, you are in a pivotal moment for addressing the gender diversity of your company. However, it’s impossible to improve what you can’t understand. The best first step is to understand your company's DEI metrics in detail and compare them to your peers and the wider market. This will allow you to understand where you're performing and identify exactly what needs to improve.

With the EU Pay Transparency Directive coming into effect, it’s more important than ever to begin tracking your progress and improvements to make sure you’re compliant well before 2024. The first step to improving DEI is to build a detailed understanding of how your company is performing, and how it continues to evolve over time.

Visit the Ravio website to learn more about how Ravio can help you future proof your people strategy and turn inclusive hiring into a key lever for successful growth.