Merit increases are one of the most common ways to reward employee performance, granting high-performers a salary increase following a performance or compensation review.

But they're also one of the most contentious elements of compensation strategy.

Some experts argue they're essential for motivating and retaining top talent.

Others believe the model is fundamentally broken, creating compounding pay inequities that undermine the fairness they're meant to support.

In this guide we'll cover everything you need to know to decide whether merit increases are right for your company and, if they are, how to ensure they actually deliver the impact you're aiming for.

What is a merit increase?

A merit increase is a salary raise given to an employee specifically to reward their performance and contributions.

It's a performance-based reward that fits into a pay for performance compensation philosophy, where employees who perform well are rewarded through higher pay.

Typically, higher performers receive a larger percentage increase, with performance ratings determining the final amount.

Merit increases might be the sole form of pay increase granted to employees. Or they might be granted on top of a standard pay rise for cost-of-living or market shifts or tenure recognition. Or everything might be combined into a single merit-informed increase, often calculated using a merit matrix that factors in both performance ratings and salary band position.

Subscribe to our newsletter for a monthly treasure trove of insights from Ravio's compensation dataset and network of Rewards experts 📩

What is the average merit increase?

The industry standard for merit increases is typically seen as a 3-5% salary increase to reward high performance, though this varies significantly by company and performance rating.

According to Ravio's Compensation Trends data, the typical in-role salary increase has held steady at around 5% over the past three years:

- 5.0% in 2025

- 5.0% in 2024

- 5.3% in 2023

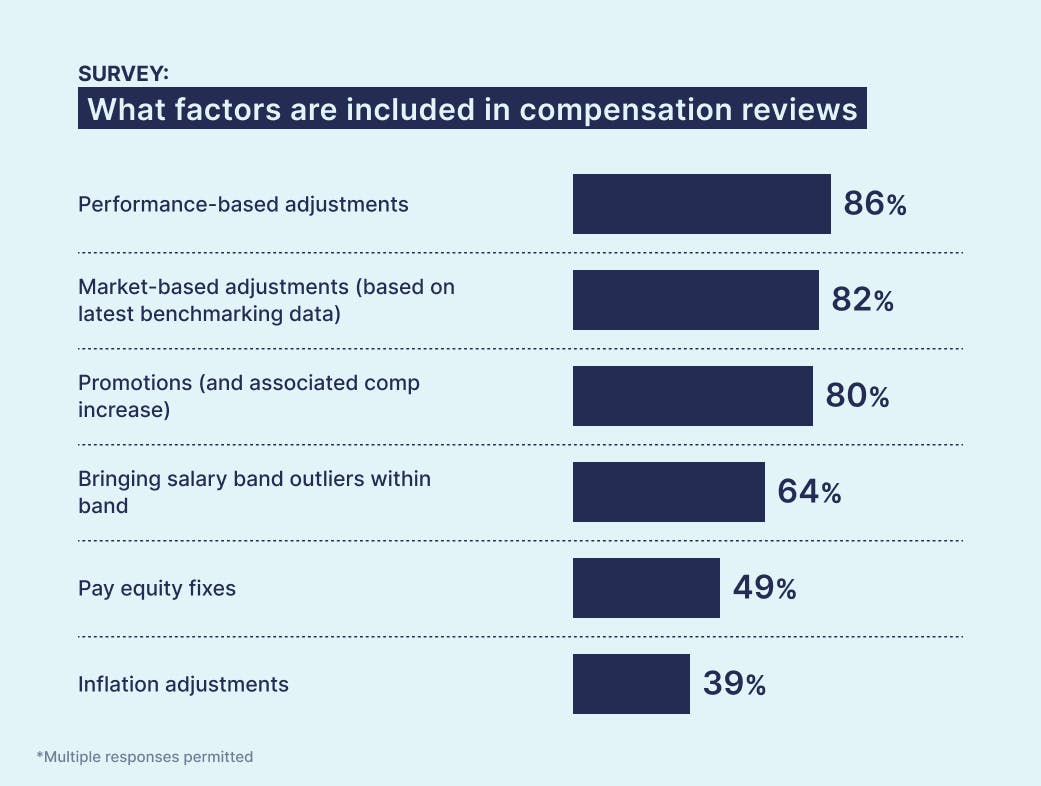

Whilst this figure includes all types of pay adjustments and not exclusively merit increases, we also know from our report: Behind closed doors: Compensation reviews that 86% of companies include performance-based adjustments in their compensation reviews – making the 5% figure broadly representative of typical merit increase percentages.

The pros and cons of merit increases

Whilst merit increases remain a popular way to incentivise and reward employee performance, they carry significant risks and downsides.

Here's what the experts say.

Merit increase pros

The case for merit increases centres on employee motivation and retention.

Rob Green, Founder of Darwin Total Rewards, explains: "Merit increases can work extremely well as a way to reward your highest-performing employees as part of a pay for performance model, as well as to give a financial incentive which motivates all employees to work smarter and harder towards business goals. All of which can be great for employee retention and lengthening tenure."

The logic is straightforward: reward high performance to retain your best people, and create a clear incentive for others to elevate their contributions.

Merit increase cons

The problems with merit increases stem from a fundamental tension: when salary increases are led by performance ratings, inequities quickly emerge. And when that approach is repeated every review season, those inequities compound over time.

The main concerns are:

- Inherent bias in performance ratings that damages pay equity

- That inequity compounds over time

- Individual performance rewards can promote the wrong model for modern, collaborative work

- Merit increases can become financially unsustainable for companies too

Let's look at each of these in a little more detail.

Inherent bias in performance ratings that damages pay equity:

Most performance review processes are highly subjective because they rely on feedback from peers and managers.

This opens the door to various forms of bias, from recency bias (overweighting recent events), to leniency bias (managers rating too generously), to similar-to-me bias, where factors like gender, ethnicity, and age influence ratings and contribute to pay equity issues.

Different line managers will also have slightly different interpretations and approaches, even with clear guidelines.

Matt McFarlane, Director at FNDN, also pointed out during his Reward Hour on pay for performance that "often the manager may not be the person closest to the work being performed", and so may be unable to really give a clear view of what performance looks like for a particular employee.

Whilst bias can be reduced through manager training, clear guidelines, and calibration sessions, some level of subjectivity will always remain.

And, as Matt also highlights, if you try to mitigate bias by introducing extensive structure, it can become rigid and resource-intensive. "360 reviews, getting lots of different points of view, feedback write-ups – it can all be a real tax on your ability to perform and focus on doing the job, especially in a fast-moving startup environment.”

That inequity compounds over time:

Perhaps the most serious concern is how merit increases can compound existing pay disparities.

"If two people are doing the same job, and Joe has had a great three years and received the highest rating for performance each year then his salary increases compound,” Matt McFarlane explains. “But maybe we also have Mary who is in the same role with similar experience and has also performed highly this year, but hasn’t had the same previous increases – you start to see real disparity between two comparable employees.”

This problem can start from day one.

A candidate who negotiates hard during hiring might secure a comparatively high starting salary. If they then consistently receive merit increases each review period for high performance, they'll quickly become an outlier, paid well above their band maximum, whilst colleagues doing the same work remain at lower levels.

And given that many of these differences are down to the inherent bias in performance and hiring decisions, it’s a huge contributor towards pay equity issues.

The wrong model for modern, collaborative work:

Matt McFarlane argues that merit increases stem from an outdated view of work: "It's really a hallmark of the industrial era when people were smelting steel.”

In that industrial context, tasks were repetitive and roles were individualised, with individual output quantified, observed, and measured.

Work is fundamentally different for most modern tech companies. "We're looking for collaboration. We're looking for innovation. These sorts of things that are really hard to rate on a scale of one to five," Matt explains.

In fact, rewarding employees based on individual ratings can work against the very behaviours companies want to encourage – driving competitive, individualistic, short-term thinking.

Matt points to research showing how performance-based individual pay "can often be quite detrimental in terms of how it narrows perspective and creates destructive behaviours."

Merit increases can become financially unsustainable for companies too:

Merit increases create permanent additions to payroll, because the employee’s performance is rewarded through salary – which can’t be reversed.

Once granted, they also become an expected annual event, creating ongoing budget pressure that can't be reversed when company finances shift.

"Have they had a great year in 2024 and then a less great year in 2025?" Matt McFarlane asks. The salary increase from 2024 remains, creating a permanent cost and a persistent pay gap based on what might have been temporary circumstances.

If you decide against merit increases, how else can you reward performance?

Companies moving away from performance-based salary increases aren't abandoning the principle of rewarding great work. They're rethinking what base salary should reflect.

Marko Lahtinen, Compensation & Benefits Manager at Finom, advocates for treating compensation reviews primarily as calibration exercises, keeping focus on 'reviewing' rather than 'rewarding'.

"During pay reviews we should be laser-focused on answering the question: does this employee's salary make sense given their tenure and performance, and in comparison to their colleagues and the current market for their role and location?," Marko explains.

In this model, high performers might receive no increase if they're already well-compensated, whilst others get adjustments to ensure the overall picture is fair and competitive.

Matt McFarlane, Director at FNDN, takes a similar view: "For me, employee pay should move with the market so that they continue to be paid based on what you’re choosing to target from a percentile perspective and in-line with their experience and progression in-role."

Then, if rewarding high-performers is still important for retention and motivation purposes, instead of using base salary, companies can use other levers to recognise performance:

- Performance bonuses. One-off or annual bonuses tied to individual or company performance don't permanently increase payroll costs.

- Equity refresh grants. Additional equity grants reward high performers with long-term upside whilst preserving cash.

- Enhanced benefits. More flexibility, additional holiday days, or paid sabbaticals can be powerful rewards for sustained high performance.

- Accelerated development opportunities. Faster promotion pathways through increased learning and development support help high performers progress more quickly through job levels.

- Profit sharing schemes. Company-wide profit sharing schemes reward collective achievement rather than individual ratings. As Matt explains: "If you want to foster collaboration, then reward people through the organisation's achievement and how the collective as a whole has delivered on performance. There tends not to be a better reflection of performance for an organisation than the revenue they've generated or the profit margin."

This is exactly what Pipedrive has done. The sales CRM company made the decision to separate salary increases from performance ratings as their headcount grew past 1,000 employees.

Tanya Krasnova, Senior Reward and Benefits Manager at Pipedrive, explains their approach: "Instead of focusing on past performance, our annual salary review looks ahead, considering skills, experience, and how an employee's pay compares to the market to stay competitive." The focus is on eliminating internal pay equity issues and maintaining company-wide consistency.

But Pipedrive still rewards performance through an annual bonus plan and commission scheme.

High performers are also encouraged to take on additional responsibilities, train on new skills, or test out other roles outside their discipline, helping them reach the next level of promotion more quickly.

The shift has improved employee communication too: "For employees, it means they don't have to rely solely on annual reviews for recognition. They know they can expect fair and consistent salary reviews along with other growth opportunities."

How do you ensure merit increases are actually effective?

Rob Green, Founder of Darwin Total Rewards, believes there's a way to make merit increases work well: "In my opinion, the holy grail to build towards is to make merit increases based on a combination of three things: performance ratings, the 9-box grid, and compa ratio analysis."

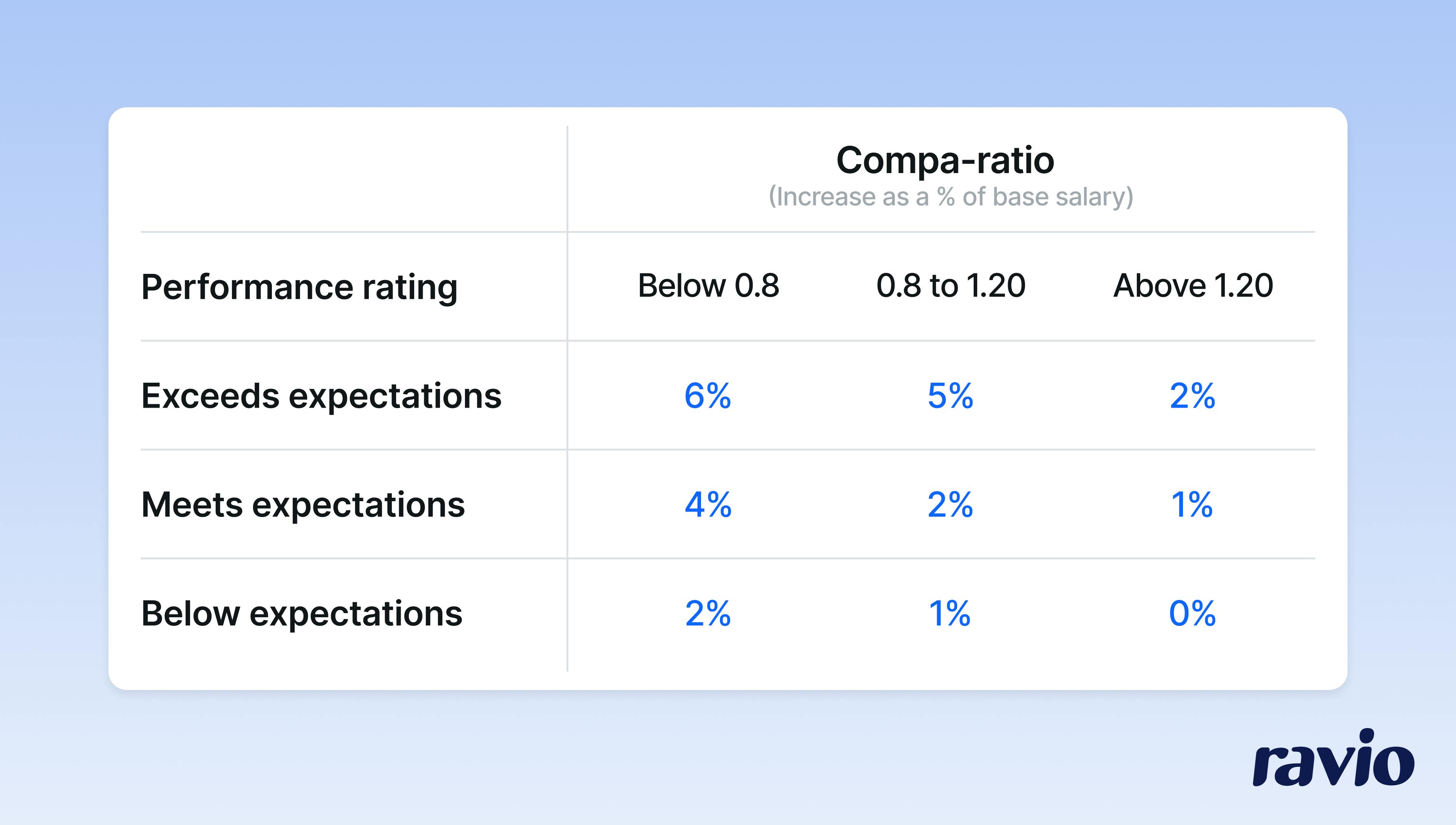

The 9-box grid combines current performance with future potential rather than focusing on a single year's snapshot. Then you overlay this with compa ratio analysis (via a merit matrix or similar) to ensure salary bands and market position are reflected in the merit increase percentage to minimise pay equity impact over time.

But Rob is clear that this sophisticated approach only works if you have comprehensive foundations already in place – and Figen Zaim agrees.

Figen Zaim, Founder of Olivier Reward Consulting, puts it this way: "I do find it's beneficial to link pay and performance for most teams in a more holistic way, but it all starts with having the right job architecture structure in place.”

"The job role and job level sets the foundation through defining the competencies, skills, and level of business impact that an employee should have,” Figen explains.

“Then at the compensation review, it's a case of comparing the employee's actual output and impact to that foundation, with the outcome being a pay increase if they've exceeded expectations."

She recommends incorporating market changes into the final pay increase too. "This way, it all fits together in a logical way for fair and consistent decision making. The clear reasoning also makes it much easier for managers to discuss with employees, which can be a challenge."

So what foundations do you actually need? Rob's checklist includes:

- A guiding compensation philosophy ensuring all compensation decisions align with the company's mission, values, and culture.

- A job architecture, level framework, and career progression framework setting clear expectations. This is what Figen means by starting with job architecture and levels – the definitions must be clear before you can assess performance against them, and consistent high performance should be leading employees towards promotion.

- Reliable, up-to-date benchmarking data to guide market-informed compensation (informed by the compensation philosophy), determine salary band ranges, and understand market shifts at each review period.

- A robust salary band structure that ensures fair and consistent decisions and aligns with expected career progression for employees – enabling the compa ratio analysis Rob describes.

- Well-defined performance expectations clearly communicated to employees by well-trained managers, supported by a continuous feedback culture.

"If you're confident that all of these elements are firmly in place, then you're going to be able to run a sophisticated merit increase process, rewarding high-performing employees and reducing attrition risk, whilst still maintaining overall fairness in pay structures," Rob explains.

"If not, then my recommendation would be to focus on implementing strong foundational compensation structures first as part of the overall strategy, and then start to gradually scale up the use of compensation as a lever to reward performance.”

“This will enable and maximise the effectiveness of merit increases over time, whilst supporting fairness and a thriving company culture."

FAQs

What’s the difference between a merit increase and a salary raise?

Whereas a merit increase specifically refers to a performance-based reward, a salary raise is a broader term encompassing all kinds of increases to pay that an employer might grant.

This could be related to performance, or progression and promotion, or changes in market rates, or increases in inflation and cost-of-living, or a combination of some or all of these factors.

What’s the difference between a merit increase and a cost-of-living adjustment (COLA)?

Whereas a merit increase rewards performance, a cost-of-living adjustment is an increase made to offset the impact of inflation, which causes increases in the cost of living through higher rent, bills, and goods. COLA ensures employees maintain their purchasing power regardless of their performance.

What’s the difference between a merit increase and a market adjustment?

Whereas a merit increase rewards performance, a market adjustment reflects significant changes in market benchmarks for a specific role or level, keeping the employee's salary fair and competitive to avoid attrition risk. Market adjustments are typically made whenbenchmarking data shows substantial shifts in what companies are paying for similar roles.

How do companies determine merit increase percentages?

The process typically follows these steps:

- Set the merit pool budget. Determine how much is available overall for the organisation, which then informs what percentage increases can be allocated for each performance rating level.

- Conduct performance reviews. Determine each employee's performance rating objectively. Typically this involves gathering feedback, with line managers and department leads making recommendations, followed by calibration sessions run by the HR or Rewards team to ensure consistent decision-making across all teams.

- Factor in additional considerations. The HR or Rewards team considers other factors such as market adjustments for certain roles or teams. This often involves using a merit matrix to account for salary band position and market changes alongside performance.

- Finalise and approve. Merit increase percentages are finalised with HR and the leadership team through a final check to ensure consistency across the organisation and alignment with budget.

How much should a merit salary increase be?

A merit salary increase typically ranges from 3-5% for high performers, though this varies by company and performance rating.

According to Ravio's Compensation Trends report, the average salary increase in 2025 is 5.0%. Whilst this includes all types of adjustments, 86% of companies include performance-based increases in their reviews, making this broadly representative.

Companies using a merit matrix often have a wider range of 2-10%, factoring in both performance rating and current salary band position to maintain pay equity, with employees who receive higher performance ratings receiving a higher merit increase percentage.

What is the average merit increase for 2025?

The average salary increase in 2025 is 5.0%, according to Ravio's Compensation Trends data. This represents the median pay rise employees received within their existing role over the past year. Whilst it includes all types of adjustments (not just merit increases), 86% of companies include performance-based adjustments in their reviews.

For context, the average merit increase has held steady in recent years: 5.0% in 2024 and 5.3% in 2023.

How do you calculate a merit increase?

The merit increase percentage is typically tied to performance ratings, with each rating corresponding to a specific percentage based on the overall budget available. For example:

- Greatly exceeds expectations = 8%

- Exceeds expectations = 6%

- Meets expectations = 4%

- Below expectations = 0%

For example, if an employee earns £50,000 and receives a 6% merit increase: £50,000 × 0.06 = £3,000 increase. So their new salary = £53,000.

Some companies also use a merit matrix to factor in salary band position as an additional factor alongside performance, to reduce the risk of pay equity issues.